The Fed held its benchmark Federal-Funds charge regular yesterday at 5.25% – 5.5%, leaving the opportunity of cuts sooner or later. Jerome Powell repeated his “Information Dependent” mantra. “Persuasive proof” that increased rates of interest had been not essential to carry down inflation is what the FOMC desires, and right this moment I wish to share just a few items of that proof.

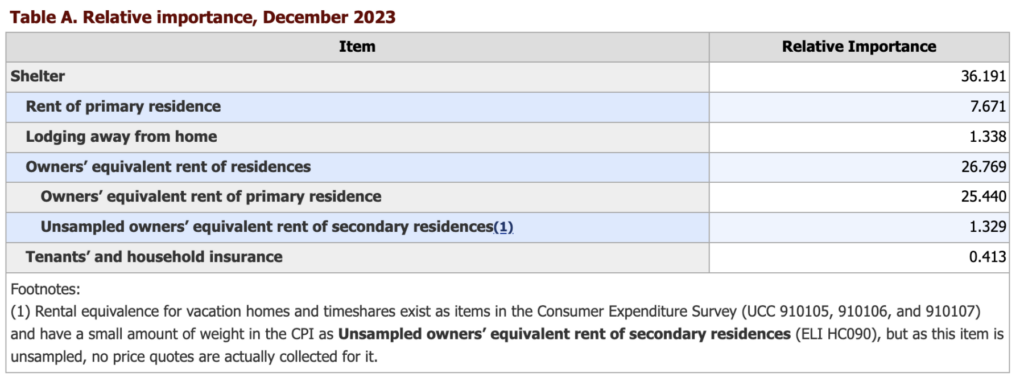

Our place to begin is the shelter element of the Shopper Worth Index. At about 40%, Shelter is the most important portion of the CPI. Because the Bureau of Labor Statistics (BLS) explains:

“The information used as inputs within the building of the index for shelter, in addition to the indexes for lease and OER, are collected in two surveys. The Shopper Expenditure (CE) Survey asks households the share of their price range which fits in the direction of completely different classes of products and providers, and is subsequently utilized by the CPI program to create weights for index estimation. The Housing Survey collects worth observations of rental housing models throughout the US.”

Right here is the BLS desk displaying the weighting:

Let’s maintain the issues with survey information for an additional put up, and as a substitute zoom in on precise measures of rents.

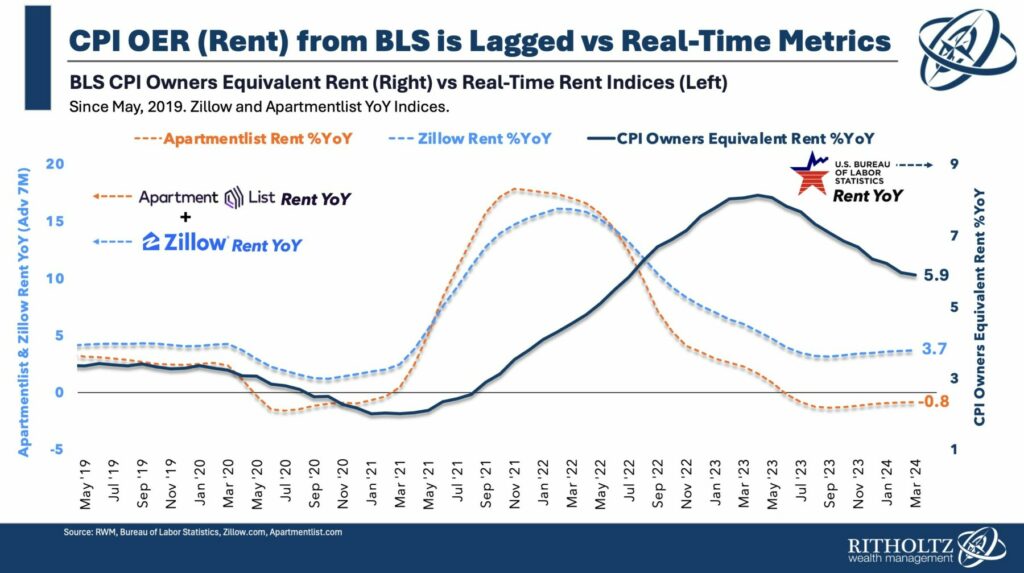

As our chart (prime) exhibits, the CPI mannequin that measures lease 12 months over 12 months seems to lag different real-time measures by 18 months. The House Lease Index peaked in November 2021 at ~17% 12 months over 12 months; as of April 2024 its down -0.8% 12 months over 12 months. The Zillow Noticed Lease Index, with a unique mixture of rental flats and homes, peaked round March 2022 at about 15%; it’s now at about +3.8% 12 months over 12 months.

BLS measures of Shelter peaked a lot later, round Could 2023 — a lag of 14-18 months. There are a number of technical the explanation why OER lags a lot within the BLS measure of shelter inflation — among the lag is in how the BLS information is collected and assembled, however maintain that apart for a second. I wish to give attention to an important side that makes the BLS measure of shelter inflation information so completely different from the noticed rents just like the House Index and Zillow.

In a phrase, Renewals.

Virtually two-thirds of all present leases for flats or home leases get renewed. Almost all of those renewals had been signed one or two years in the past. Leases are contracts, and so they lay out the particular phrases for renewals throughout the doc.

What charges do you suppose landlords constructed into their lease renewals 12-24 months in the past after they had been drafting and negotiating these 2022 and ’23 leases? They clearly mirrored the inflation charges then — which had been peaking.

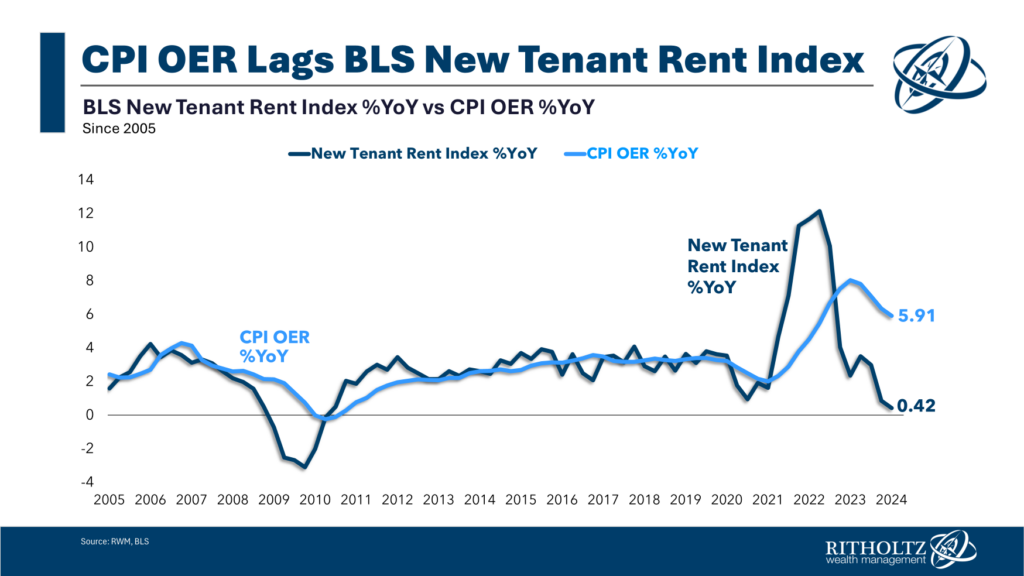

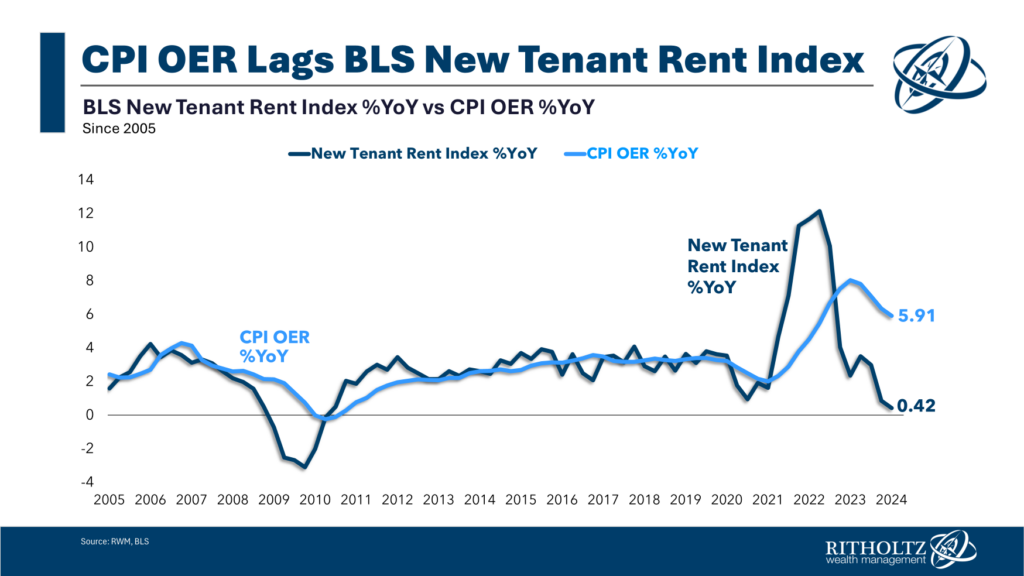

What do contracts negotiated and executed two years in the past must do with the speed of inflation right this moment? You would possibly assume “nothing,” however as we see within the BLS information, it has an outsized influence. It is vitally seen in BLS’ New Tenant Lease Index — that information, in contrast to OER, doesn’t embody renewals.

No shock, it too peaked in 2022, and is now at +0.42% 12 months over 12 months:

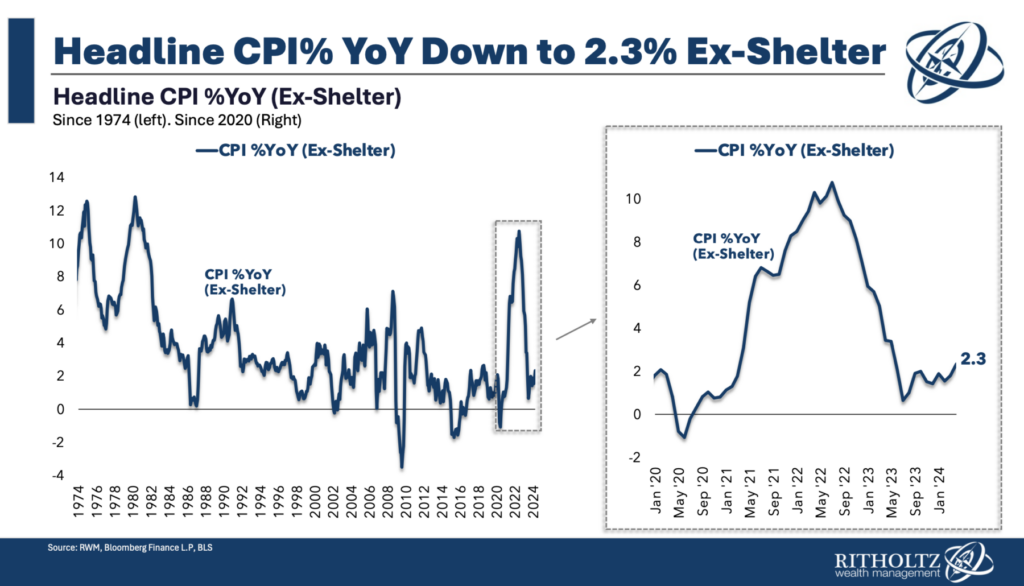

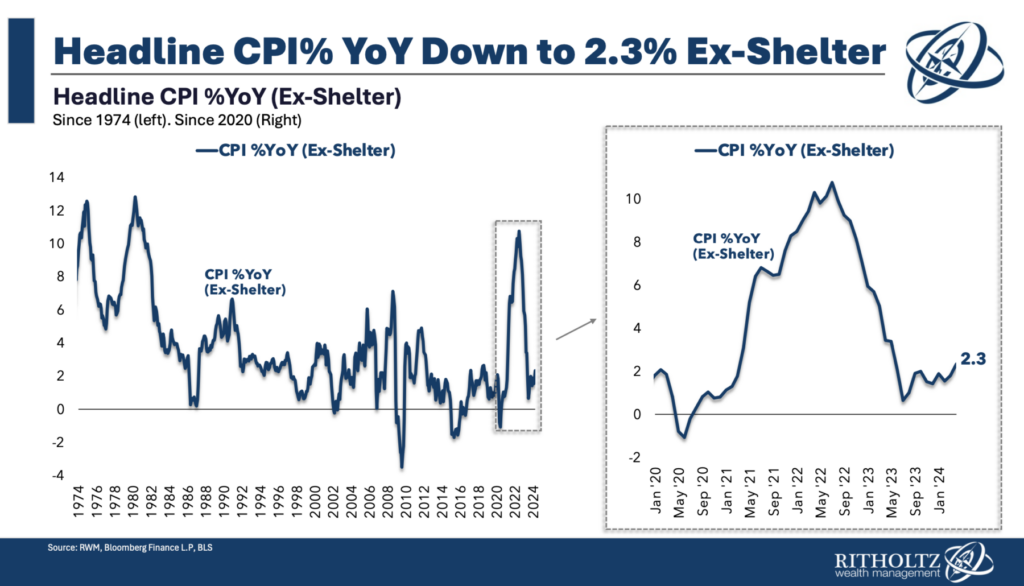

Again out shelter, which is overweighted by renewals, and the CPI is at 2.3%:

The place the rubber meets the highway is in mortgage charges: 61% of all owners have a mortgage; of these owners with mortgages, 78.7% have charges at or beneath 5%. Take into account additionally 59.4% are at or beneath 4%. It ought to be nicely understood by now that these charges have change into golden handcuffs, locking individuals in place who would possibly wish to transfer (commerce up, new location, and so on.).

Going from a 3.75% mortgage charge to present charges of seven.5% will enhance your month-to-month funds by about 50% — for the same-priced home! Think about shifting as much as a costlier home — one which is likely to be bigger or in a nicer neighborhood; it could double or occasion triple your mortgage bills even for a modest enhance in worth.

For this reason single-family home stock is down 75% from its peak of Four million yearly to about 1 million right this moment. That lack of provide has saved costs elevated. Increased charges not solely are affecting present house provides, it’s limiting new house building, and making that costlier as nicely.

I stated this just a few years in the past, however it bears repeating right here: If the Fed desires decrease inflation, they need to be decreasing charges now.

UPDATE: Could 2 2024 2pm

Torsten Slok of Apollo Group factors us to this March 2024 FHFA paper (PDF); “Lock-In Impact of Rising Mortgage Charges:”

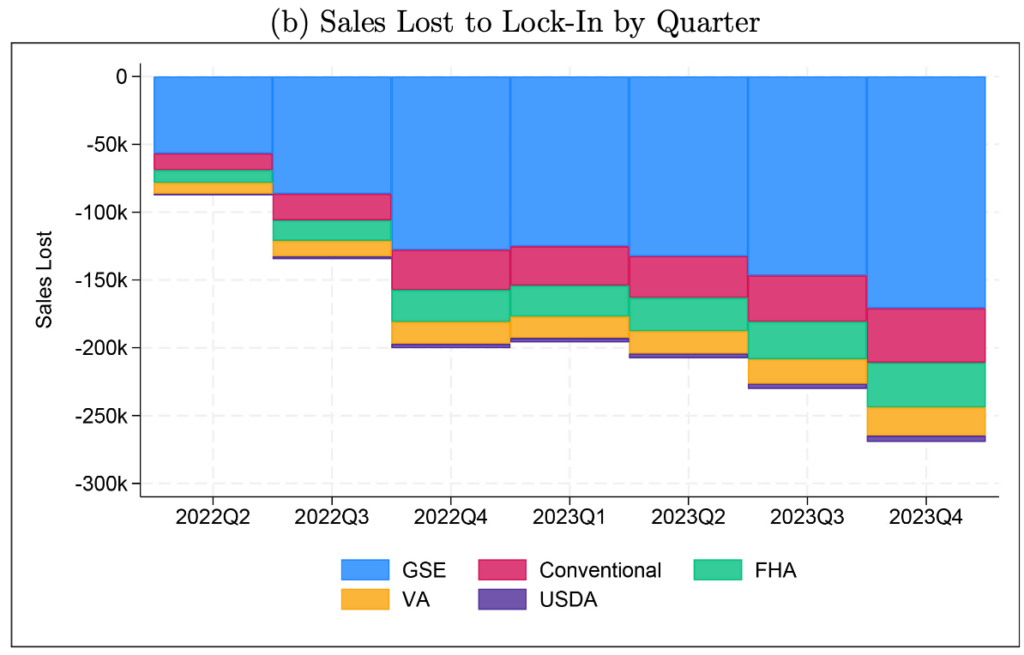

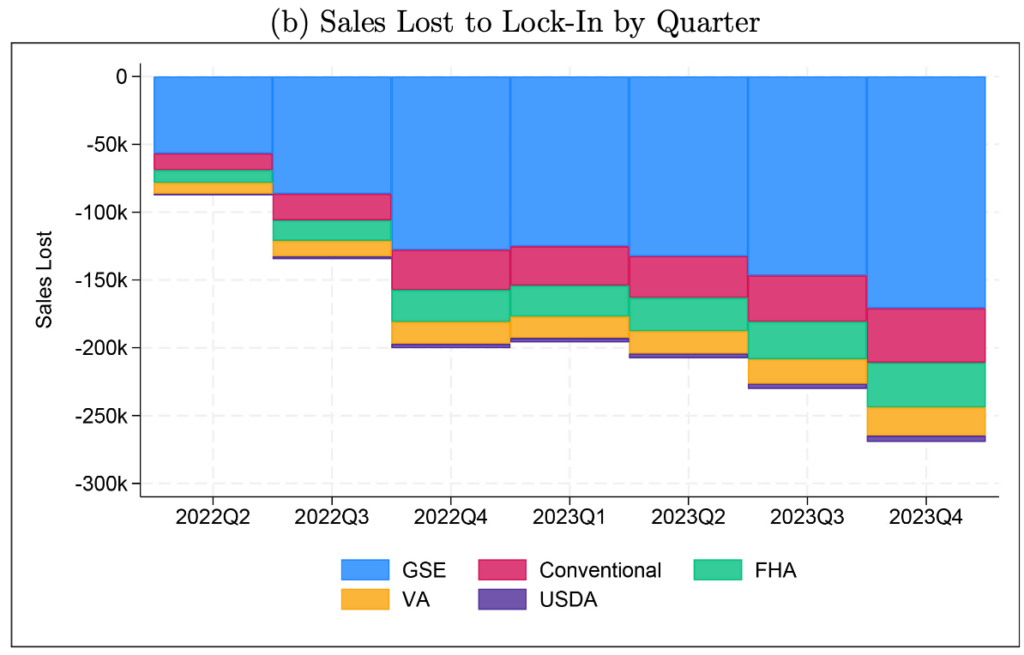

“This paper finds that for each proportion level that market mortgage charges exceed the origination rate of interest, the chance of sale is decreased by 18.1%. This mortgage charge lock-in led to a 57% discount in house gross sales with fixed-rate mortgages in 2023 This fall and prevented 1.33 million gross sales between 2022 Q2 and 2023 This fall. The provision discount elevated house costs by 5.7%, outweighing the direct influence of elevated charges, which decreased costs by 3.3%. These findings underscore how mortgage charge lock-in restricts mobility, leads to individuals not residing in houses they would like, inflates costs, and worsens affordability.”

Beforehand:

How the Fed Causes (Mannequin) Inflation (October 25, 2022)

2% Inflation Goal is Foolish (July 26, 2023)

For Decrease Inflation, Cease Elevating Charges (January 18, 2023)

CPI Improve is Based mostly on Dangerous Shelter Information (January 11, 2024)

How All people Miscalculated Housing Demand (July 29, 2021)

See additionally:

WSJ: Fed Says Inflation Progress Has Stalled and Extends Wait-and-See Price Stance.

Stalled Inflation Vexes the Fed. Is It Noise or a New Development? by Greg Ip, WSJ

The Lock-In Impact of Rising Mortgage Charges, by Ross M. Batzer Jonah R. Coste William M. Doerner Michael J. Seiler; Federal Housing Finance Company, March 2024 Working Paper 24-03