After Bitcoin has staged a considerable rally of 29% for the reason that starting of the yr, buyers are speculating about whether or not this can be a bull lure or truly the start of a brand new bull market. At present, there’s nonetheless a variety of skepticism amongst analysts about whether or not Bitcoin has actually discovered its backside.

To reply this query, the famend on-chain evaluation firm Gassnode printed at this time a listing of 10 indicators to reply essentially the most urgent query of all. As the corporate notes, there’s “no single silver bullet to perform this process.”

Nonetheless, the 10 indicators can present a clue as as to if Bitcoin is nearing the top of its bear market. In response to Glassnode’s evaluation, 4 indicators already verify the top, whereas two indicators are “in progress,” and 4 indicators in flip haven’t but been triggered.

Bullish Indicators For Bitcoin

The primary indicator, which has already been triggered, is Realized Cap HODL Waves (LTH). The indicator states that traditionally, an intersection between the Realized Worth * 0.7 and the 200D SMA * 0.6 worth mannequin happens in the course of the lowest phases of bear markets.

A second indicator that the bear market is ending is a wholesome improve in miner revenues, signaling a aggressive payment market. In response to Glassnode, the 90-day SMA of miner payment income has exceeded the 365-day SMA. This implies that there’s a “constructive uptick in blockspace congestion.”

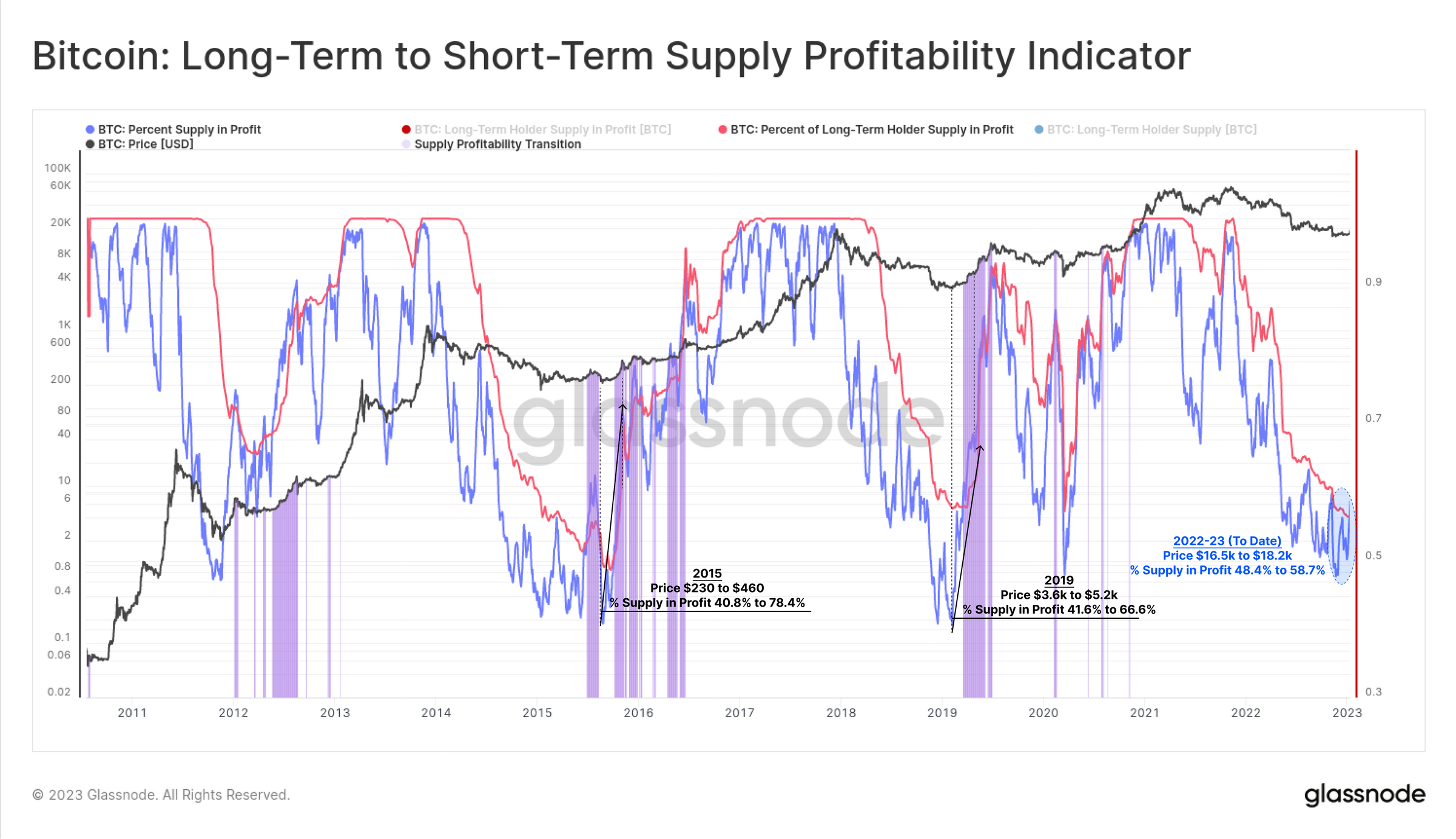

Additionally totally confirmed is the Lengthy-Time period To Brief-Time period Profitability Indicator. The metric indicators that a lot of cash have modified fingers at low costs. This creates a “stable basis” for bull cycles as this creates a realignment of the typical market value base to cheaper and decrease costs.

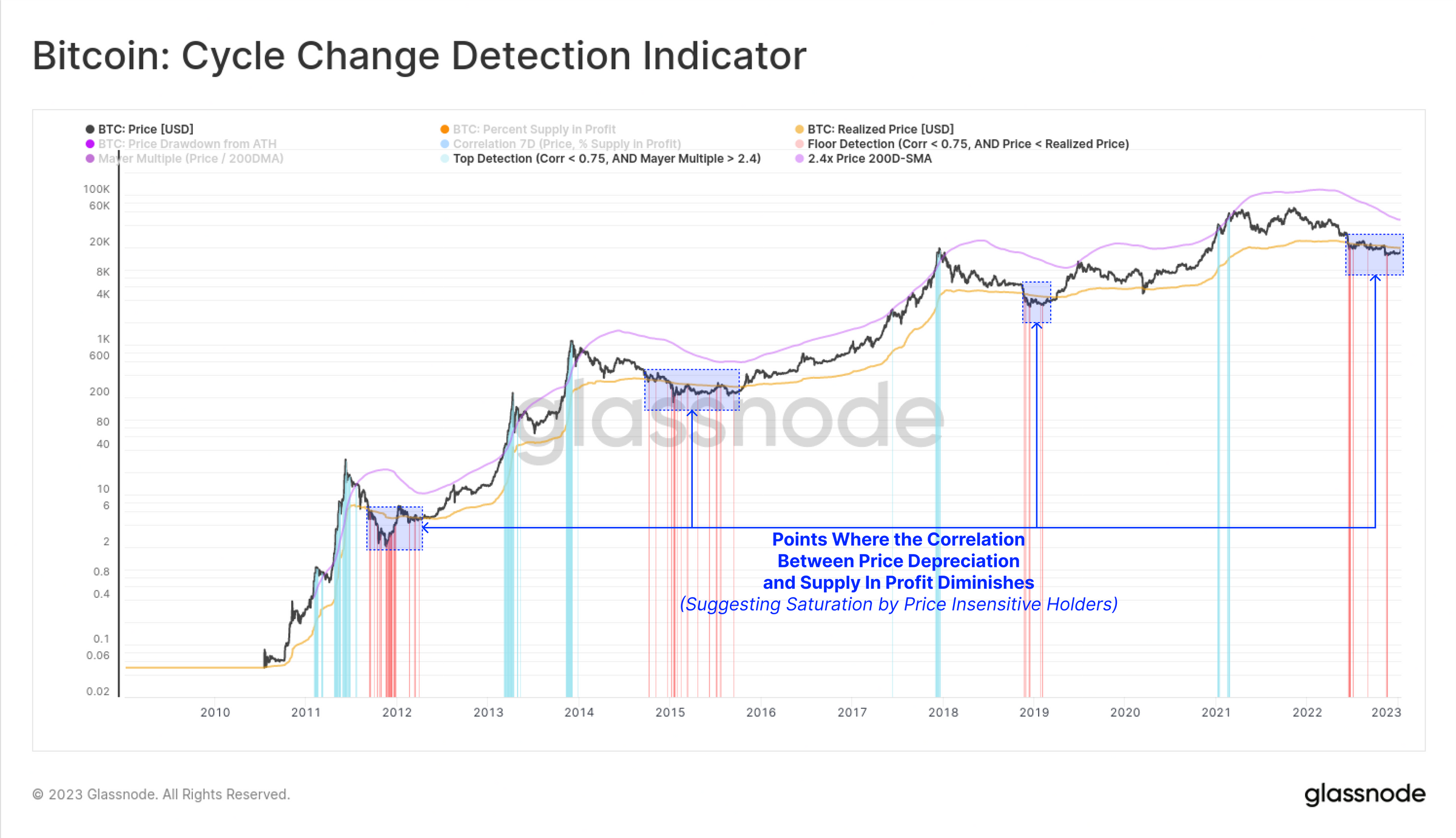

Final however not least, the “Bitcoin Cycle Change Detection Indicator” has additionally been totally triggered. The metric exhibits that the purpose has been reached the place the correlation between worth depreciation and provide in revenue is diminishing, indicating saturation by price-insensitive holders.

Within the strategy of being confirmed is the New Tackle Momentum indicator, which exhibits a sustainable market restoration as a result of improve in community exercise. In response to Glassnode, this happens when the 30-day SMA of recent addresses exceeds the 365-day SMA and holds for no less than 60 days.

“An preliminary burst of constructive momentum occurred in early November 2022. Nonetheless, this has been sustained for just one month up to now,” says Glassnode.

Additionally not but confirmed is the Provide Stress Ratio Indicator. In deep bear market phases, this metric reaches a drastic drop beneath 1.0, reflecting that the “weak fingers” are being flushed out of the market.

The “ratio is at the moment throughout the peak market stress regime that has traditionally been enough to shake out a majority of buyers,” in response to the analysis agency.

Indicators For A Bearish State of affairs

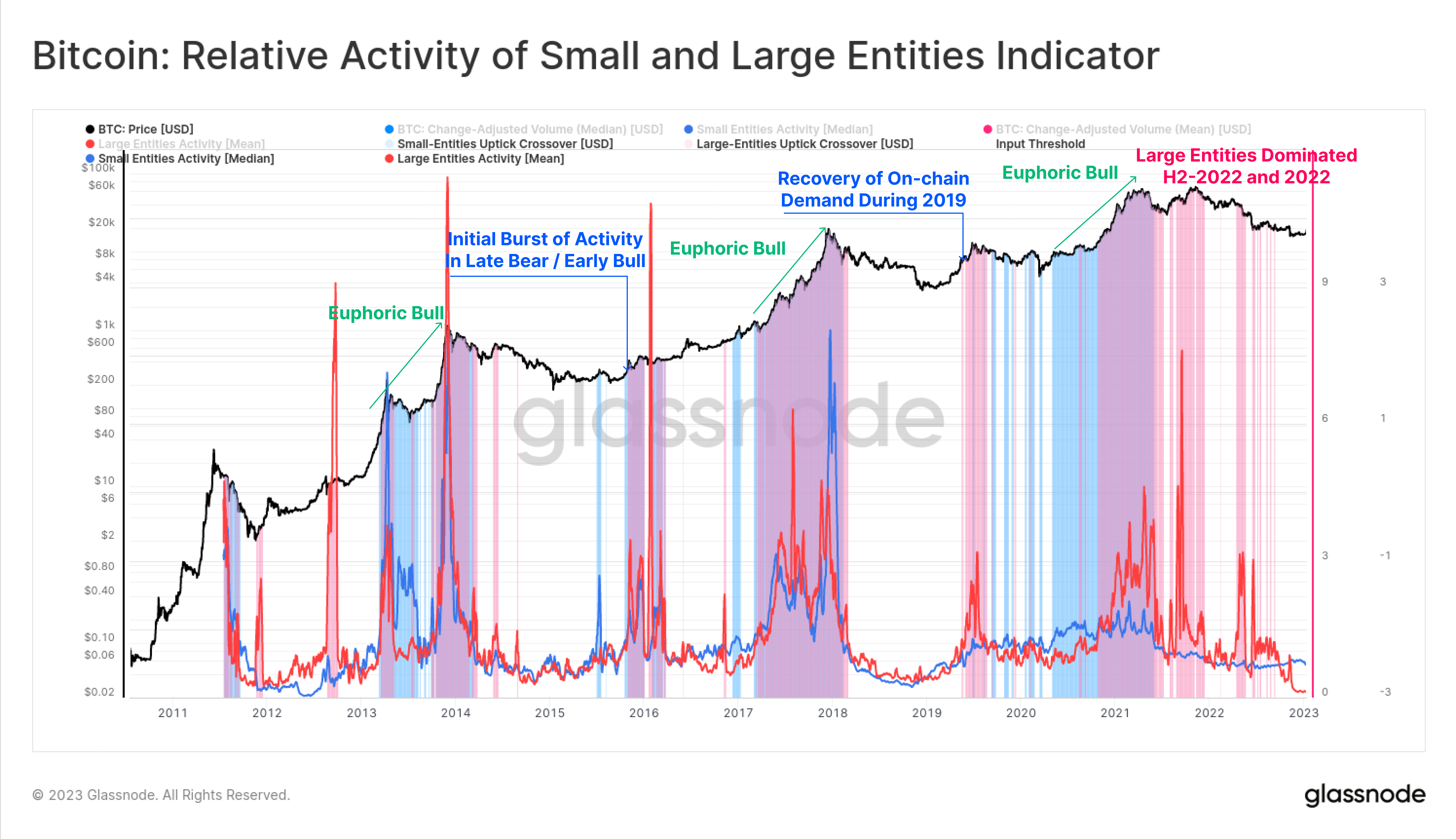

Towards an imminent finish of the bear market speaks the broader restoration of exercise by smaller and bigger entities. As typical for a bear market, the Relative Exercise Of Giant And Small Entities indicator nonetheless exhibits a major decline in on-chain exercise by entities of all sizes (threshold 1.2).

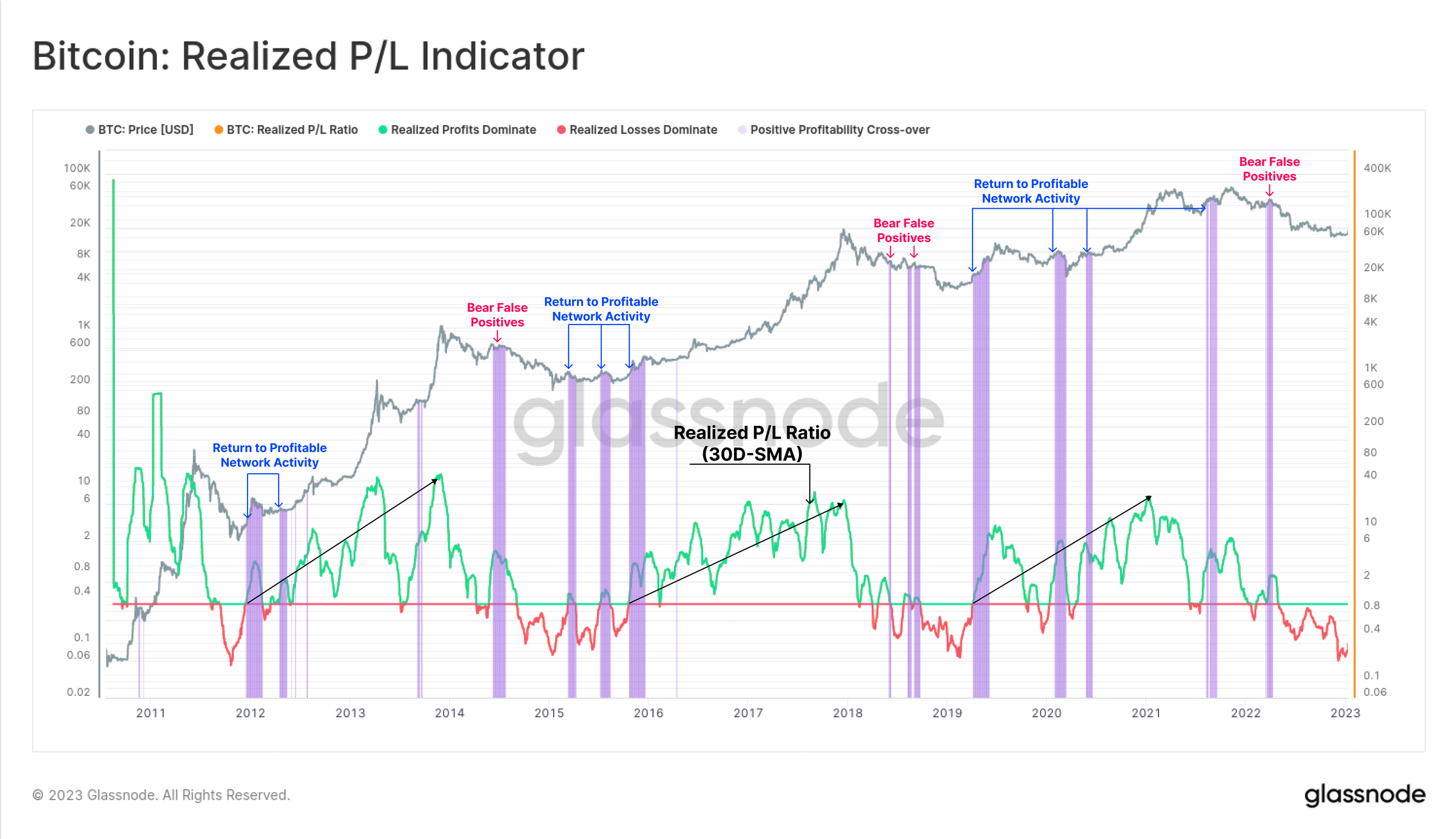

Additionally, the analysis of the realized revenue and loss exhibits the nonetheless bearish stage of the market. Because the 30-day SMA of the realized P/L ratio has not but recovered above 1.0, this means that demand will not be but in a position to soak up the income taken.

The same image is painted by the aSOPR, which screens profitability primarily based on output spent and indicators that there was no development shift but.

Final however not least, in response to Glassnode, confidence in a development reversal on the chain has not but been noticed. That is mirrored in spending patterns.

One approach to measure that is to check the quantity of unrealized revenue held inside newly acquired (and HODLed) cash to that being realized by spent cash. The indicator has not but been triggered however is near a constructive breakthrough.

At press time, the BTC worth traded just under the essential resistance at $21,500.

Featured picture from Kanchara / Unsplash, Chart from TradingView.com