Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion

- SOL may witness a fall within the days to return if the bears acquire an higher hand out there

- Investor confidence in SOL dwindled to some extent after witnessing an upside over the previous few weeks

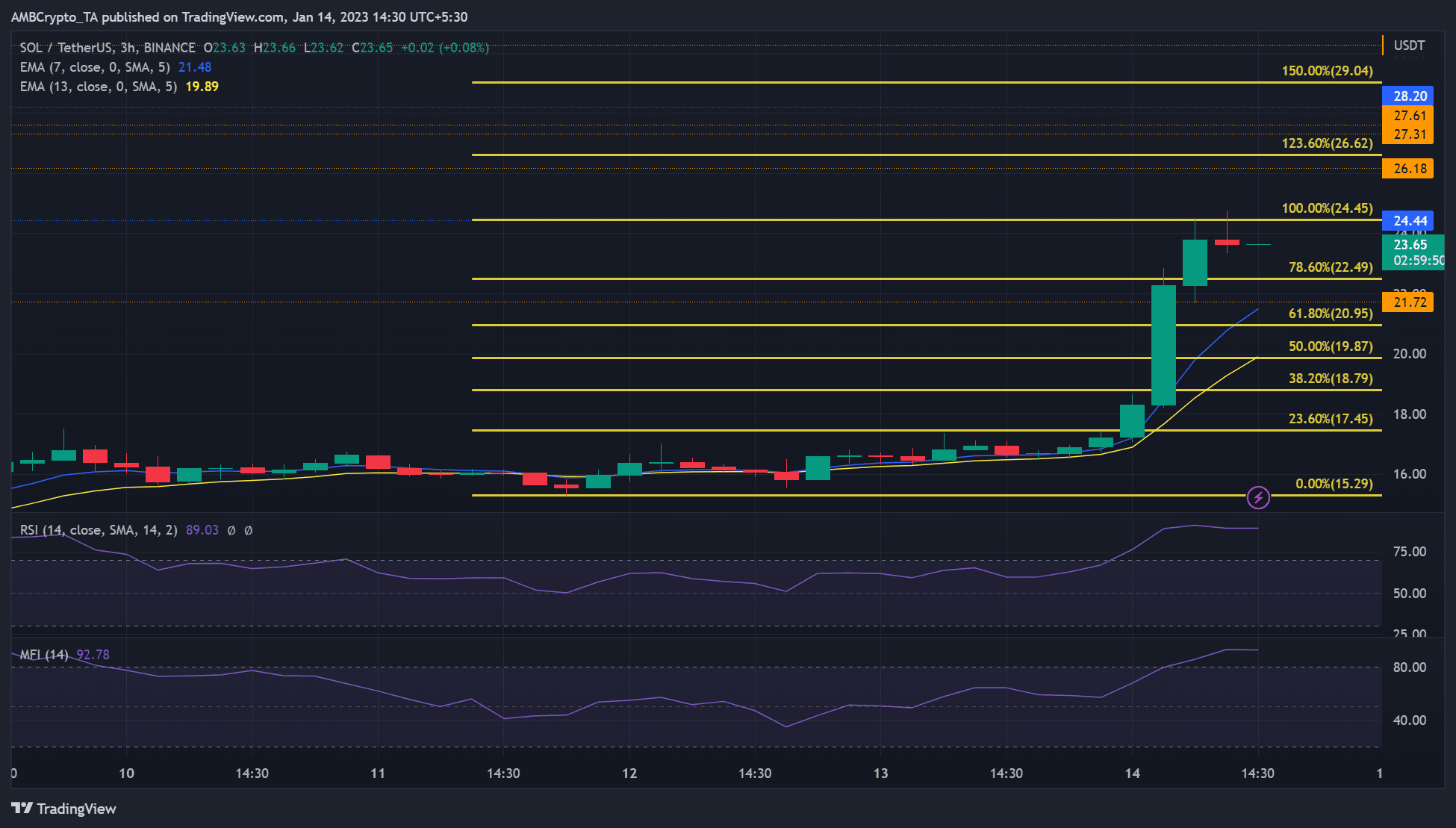

Solana [SOL] broke above its current buying and selling vary of $15.29 – $17.45. Nevertheless, at press time, it was going through a hurdle at $24.45. It was buying and selling at $23.65 and flickered pink, indicating that bears had been on web site on the time of writing.

Bitcoin [BTC] additionally confronted a short-term value rejection at $20,995 throughout the identical interval. Subsequently, SOL may oscillate in a brand new buying and selling vary and try a retest on the $23.45 degree.

Learn Solana’s [SOL] Value Prediction 2023-24

SOL’s subsequent short-term buying and selling vary

Supply: SOL/USDT on TradingView

At press time, SOL’s Relative Energy Index (RSI) and Cash Stream Index (MFI) had been flat on the three-hour chart. It implies that purchasing stress stagnated and will face a reversal if bears gained extra affect.

On the identical time, the RSI and MFI had been within the overbought zone, indicating that the bullish momentum was nonetheless comparatively sturdy at press time. Subsequently, SOL may retest the $24.45 degree and oscillate between $21.72 – $24.45 within the subsequent few hours.

SOL bulls could solely try a break above this vary if BTC overcomes the $20,995 short-term resistance.

Is your portfolio inexperienced? Try the SOL Revenue Calculator

Alternatively, bears may push SOL under $21.72 if promoting stress intensifies. Nevertheless, such a downtrend may discover regular help on the 61.8% Fib degree of $20.95 and invalidate the bullish bias described above.

SOL’s buying and selling quantity surged, however sentiment and growth exercise declined

Supply: Santiment

In line with Santiment, SOL’s growth exercise declined barely after witnessing huge progress over the previous few days. Equally, its whole weighted sentiment retreated from the constructive facet and was hanging under the impartial line, the detrimental facet.

This confirmed that buyers’ confidence within the asset dropped barely after the decline in growth exercise.

Nevertheless, SOL’s buying and selling quantity and costs surged alongside an rising demand within the derivatives market, as evidenced by Binance Funding Charge shifting into the constructive zone.

These two constructive metrics present a doable uptrend momentum, whereas a decline in growth exercise and sentiment may cancel out the momentum. Thus, BTC efficiency may provide a way more correct path for SOL’s subsequent value motion.