Disclaimer: The datasets shared within the following article have been compiled from a set of on-line sources and don’t mirror AMBCrypto’s personal analysis on the topic

Binance Coin (BNB) has had a moderately good begin to the brand new 12 months, gaining greater than 127% throughout the first Three weeks of 2023. The rise within the token’s value has brought about its market capitalization to increase by over 52%, making it the 4th largest crypto by market cap. The large change in BNB’s value has prompted merchants to commerce this token, driving its buying and selling quantity up by a whopping 170% because the starting of the 12 months.

Learn Value Prediction for Binance Coin [BNB] 2023-24

BNB has seen vital development in worth since its launch. Within the first 12 months, the worth of BNB elevated by over 100 occasions, and it has continued to extend in worth over time. This has made BNB a well-liked funding possibility for a lot of buyers. The token noticed its all-time excessive in Could 2021 when it reached $676.3.

BNB’s main utility comes into play on the Binance trade, the place merchants use it to pay for buying and selling charges, staking, participation in IEOs, and so forth. The vast utility helps preserve the token’s demand. Whereas the affiliation with the Binance trade has confirmed helpful for BNB, it comes with its personal disadvantages. Any controversy surrounding the trade, or its founder Changpeng Zhao, has a direct impression on the token’s value.

One motive for BNB’s comparatively sturdy efficiency could also be its sturdy fundamentals. Binance is a well-established and revered trade, and BNB is a key element of its ecosystem. BNB can be backed by quite a lot of high-profile partnerships and collaborations, which provides to its credibility and attraction.

Nicely, the exploit on BNB chain-based Ankr protocol on 1 December despatched BNB’s value down by virtually 5% inside a matter of hours. So far as value motion is anxious, the bulls tried to interrupt the important thing resistance zone at $300 again on 5 December. Nevertheless, the bulls held their floor. $281 has emerged as a short-term help zone.

BNB has been within the information not too long ago because of its involvement within the hack that was carried out on the bankrupt crypto trade FTX. The perpetrator has swapped hundreds of BNB tokens for different cryptos however nonetheless holds an estimated $41 million price of BNB.

The immense volatility in BNB prompted some strategic selections from Binance CEO Changpeng Zhao, one in all them being the top-up of the trade’s Secure Asset Funds for Customers or SAFU. The trade introduced that it will likely be replenishing this insurance coverage fund, bringing its holdings as much as $1 billion

June 2022 had a yearly low of $183 on account of this decline. Nevertheless, it is very important observe that on the every day chart, the RSI indicator has not but risen past 50.

The closest long-term resistance degree, at $427, could be reached if the present pattern continues.

Late in January 2021, Binance Coin joined the upswing within the cryptocurrency market, rising from $40 to $330 in a single month. BNB’s value dropped in March, buying and selling for some time within the $250 to $300 area, however in April it began to rise once more shortly, reaching an all-time excessive of $690.93 on Could 10.

Think about this – In January 2021, the value of Binance Coin (BNB) was $40. Nevertheless, 2021 additionally noticed a major incline in BNB’s value, one which allowed it to hit $690 on the value charts. In truth, this was its highest value degree in 2021.

Price noting, nonetheless, that quickly after, the latter few months of 2021 noticed the broader market fall throughout the board. Evidently, the identical had a ripple impact on BNB’s value charts as effectively, with the trade token hitting new lows.

Up to now, Binance Coin (BNB) rose subtly and progressively to rank among the many most beneficial cryptocurrencies by market cap. Above all, the expansion of Binance, the most important cryptocurrency buying and selling platform, has brought about the worth of the BNB to rise considerably in recent times.

In current months, the bear market has brought about Binance Coin (BNB) to expertise extra extreme losses. BNB surpassed its all-time excessive of $690 through the Could 2021 bull market. Nevertheless, the bear market quickly started in November and the value plummeted.

When customers use the BNB on the platform, Binance reimburses them for a big portion of the transaction bills. BNB has grown in significance as a element of the platform over the previous few years. The demand for Binance Coin rises as Binance expands and positive aspects extra customers, which boosts the coin’s value and forecast.

Binance makes certain that the availability of BNB is routinely lowered as demand rises. Each three months, a particular portion of BNB is destroyed, making Binance Coin deflationary and enhancing the outlook for BNB going ahead.

BNB additionally capabilities as a cost methodology and opens up extra alternatives on the Binance platform, together with financial savings, DeFi staking, and liquidity mining through the BNB vault.

It was initially used as an ERC-20 token on the Ethereum (ETH) community earlier than being moved to the Binance community and altering its identify to BEP-20.

Because the Ethereum Merge has taken place, Binance has been in a position to handle the transition for its customers in an environment friendly method.

Binance Coin was initially created in 2017 as a utility token for discounted buying and selling charges. In the present day, nonetheless, its use instances have grown on a number of cryptocurrency exchanges. BNB can be utilized to pay transaction charges on many Binance platforms corresponding to Binance.com, Binance DEX, and Binance Chain, moreover crypto.com and HTC. Lodge reserving websites (e.g. TravelbyBit), SAAS platforms (e.g. Canva), DeFi apps (Moeda) and numerous platforms settle for BNB as a mode of cost.

BNB’s value has fallen on account of the cryptocurrency market’s sharp bearish shift. One may argue that the SEC’s points with Binance took a heavy toll on the value of the altcoin. Even so, expectations stay excessive.

Finder.com surveyed 54 individuals not too long ago, with the panel believing that the coin has promising long-term potential. The crypto’s value is anticipated to hit $781 in 2023. And, though BNB might not be receiving as a lot consideration proper now, it routinely ranks among the many best-performing currencies by way of ROI. It’s also the fifth-largest crypto on the planet.

Late in January 2021, Binance Coin joined the upswing within the cryptocurrency market, rising from $40 to $330 in a single month. BNB’s value dropped in March, buying and selling for some time within the $250 to $300 area, however in April it began to rise once more shortly, reaching an all-time excessive of $690.93 on Could 10.

Binance Coin’s value fell as the complete cryptocurrency market collapsed in late Could 2021. At about $200, it recovered and rose to about $430, however this upturn was fleeting. BNB fell to about $250 in late June after which fell as soon as extra in the midst of July. Nevertheless, the market started to point out indicators of restoration later that month, and Binance Coin wasn’t an exception. BNB’s value elevated dramatically as soon as extra, surpassing $350 within the first half of August.

Nevertheless, like most cryptos available in the market, 2022 wasn’t a very good 12 months for the trade token, with BNB falling on the charts.

Given all the pieces, shopping for BNB have to be a clever determination in the long term, proper? Most analysts have optimistic predictions for BNB. Moreover, the majority of long-term BNB value projections are upbeat.

Why do these projections matter?

BNB is a cryptocurrency that’s native to the world’s greatest cryptocurrency trade. It’s also essential to the Binance Good Chain ecosystem. The latter, in reality, is one in all Ethereum’s rivals, and it presents considerably larger scalability and decrease transaction prices.

The regular improve within the variety of merchants on Binance additionally has a optimistic impression on the value of BNB. The price of this altcoin had elevated, rising from $526.94 in October 2021 to $555.34 in the beginning of January 2022. It’s anticipated to maintain increasing as commerce exercise on the trade rises as Binance establishes itself as a market chief within the cryptocurrency buying and selling {industry}.

Its worth reached a excessive level, partly because of the quantity of BNB used for decentralized functions (DApps), DeFi, and good contracts after the launch of Binance Good Chain. With 44 thrilling tasks, BSC is the second-largest DeFi platform in the intervening time. Over 620,000% have been added to the worth of Binance Coin between its 2017 introduction and its 2021 peak.

The truth that the trade has maintained a burning program because the coin’s introduction is simply another excuse to belief BNB. On April 15, 2021, Binance burned greater than 1,099,888 BNB, equal to $595,314,380 price of tokens. That is Binance’s 15th quarterly BNB burn, and by way of money, it was the most important one but.

On this article, we’ll shortly assessment the present exercise of the cryptocurrency with a deal with market cap and quantity. In conclusion, predictions from essentially the most well-known analysts and platforms can be summarized along with an evaluation of the Concern & Greed Index to find out market temper.

BNB’s value, quantity, and all the pieces in between

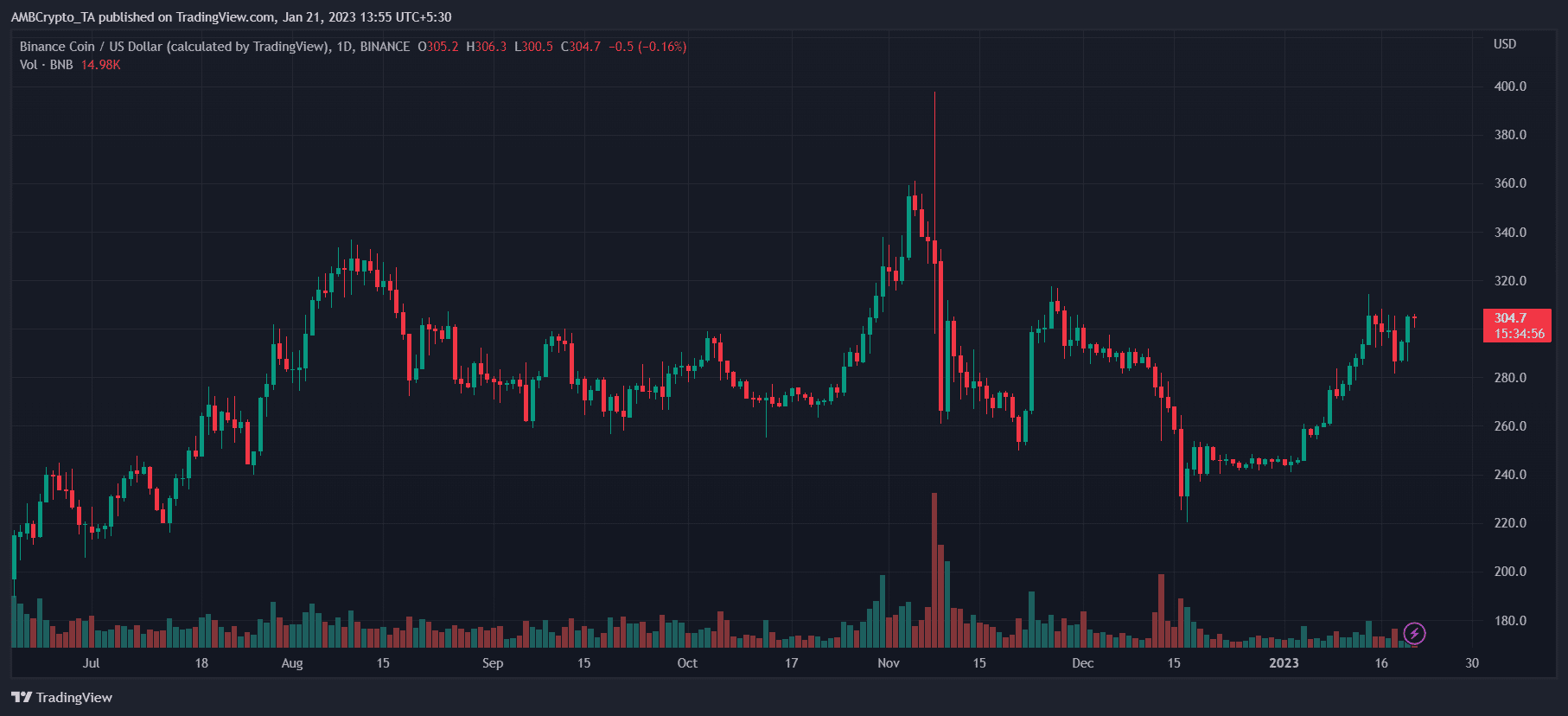

On the time of writing, BNB was buying and selling at about $304.

Supply: TradingView

And because the numbers slowly go up, buyers and specialists have gone bullish on the token. The managing director of Digital Capital Administration, Ben Ritchie, is optimistic about BNB and predicts that by the tip of the 12 months, the crypto can be price $300. Ritchie additionally admitted that the viability of Binance’s trade will decide the future of BNB. Happening to say that the asset has the potential to be a deflationary one, he added,

“The value of BNB additionally follows the demand and provide. BNB launched a burn mechanism in each transaction payment and performed quarterly burns, making it a deflationary asset. For the reason that BNB chain ecosystem continues to develop, the value could attain as excessive as $3,000 in 2030.”

On the time of writing, the value of Binance Coin was under the 200-day easy shifting common (SMA). Since 20 January 2022, the 200-day SMA has been indicating SELL for the earlier 212 days. Since 16 July 2022, when Binance Coin’s value fell under the 50-day SMA, this indicator has been indicating a SELL sign for the final 55 days.

On Three February 2022, 197 days in the past, the Bitcoin market noticed its most up-to-date Demise Cross. A Golden Cross hasn’t occurred in 353 days since 31 August 2021. Technical indicators predict that Binance Coin’s 200-day SMA will decline over the approaching month and hit $ 327.19 by 19 September 2022. By 19 September 2022, Binance Coin’s 50-Day SMA is anticipated to achieve a worth of $327.18.

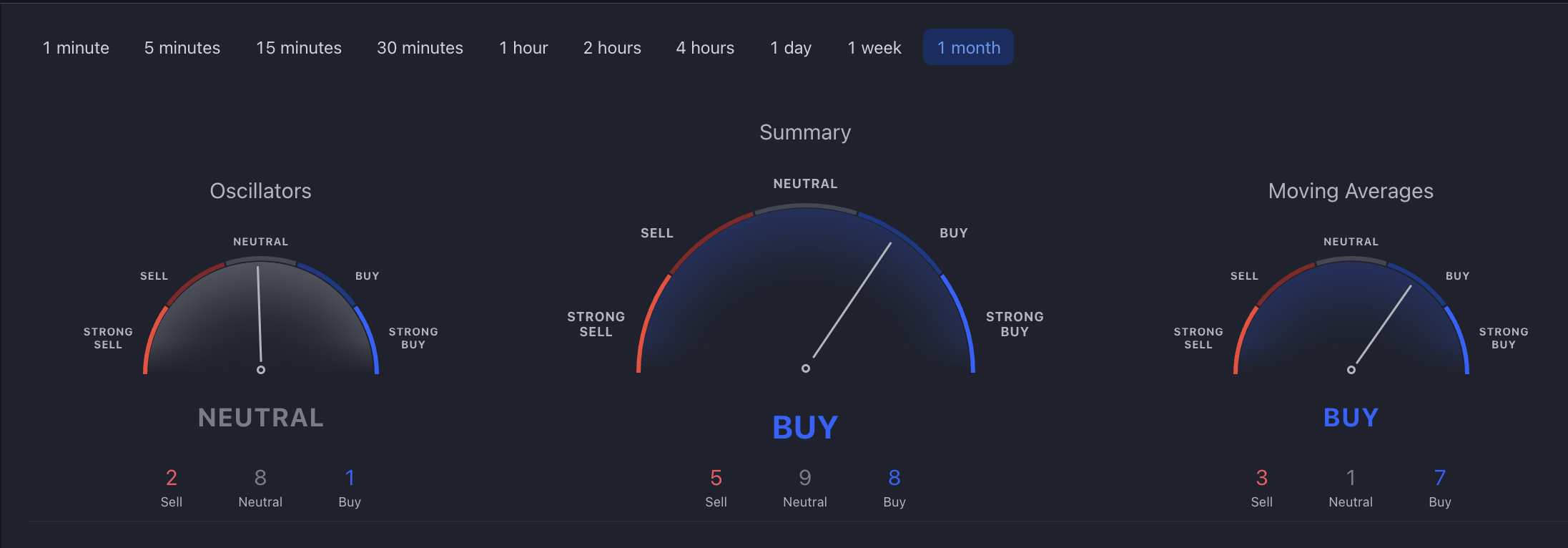

On the time this text was written, the opposite view was held by TradingView, with the platform flashing a “Purchase” sign for BNB.

Supply: TradingView

Let’s now take a look at what well-known platforms and analysts need to say about the place they imagine BNB can be in 2025 and 2030.

BNB Coin Value Prediction 2025

Changelly, for its half, could be very optimistic in regards to the fortunes of Binance Coin. It predicted that the bottom BNB value in 2025 can be $1,122.96, whereas its highest value can be $1,270.31.

Technologist and futurist Joseph Raczynski too has a bullish outlook. He believes Binance to be the highest worldwide trade. He stated,

“Whereas BNB isn’t decentralized, it nonetheless can serve a function for quick and low cost transactions. That has a value although. Binance might change parameters on the token with out consensus and they’re way more more likely to be a single level of failure.”

Crypto-exchange CoinDCX predicts that if the tip of the earlier 12 months was bullish, the start of 2025 would possibly likewise be optimistic. Thus, the value might initially reclaim its place above $2000 and proceed to keep up a robust advance. Consequently, one would possibly attempt to attain $2500 by the tip of 2025.

So, with all these optimistic predictions, is there a motive to not root for BNB? Nicely, do not forget that 2025 continues to be greater than three years from now and Binance has quite a bit occurring with the SEC. The SEC is after Binance, accusing it of issuing BNB as an unregistered safety.

Nevertheless, regardless of this, the market is sort of optimistic. The Co-founder and Vice President of MetaTope, Walker Holmes, doesn’t imagine that the SEC will considerably hurt the way forward for BNB. He stated,

“We now have seen this play out with XRP, ETH, and others. CZ can current a really compelling case. I believe it is a query of potential financial penalties. Nevertheless, on the time of writing, I don’t suppose Binance is at main danger of being taken down.”

BNB Coin Value Prediction 2030

CEO of Balthazar, John Stefanidis, expressed nice optimism about BNB in a research. A BNB worth of $3,000 by 2030, in his opinion, is fully doable. On account of its cutting-edge know-how and adherence to worldwide guidelines, BNB is well-positioned for long-term success. He additionally emphasised that Binance’s nice UX, a robust enterprise workforce, and a fantastic model are all elements in BNB’s success.

Though BNB is extra reasonably priced for a lot of buyers, Desmond Marshall, the Director of Rouge Ventures and Rouge Worldwide, thinks Binance Coin would possibly overtake Ethereum. In accordance with him, the implementation of the bounds may have the best impression on the efficiency of the crypto. Moreover, the belief that the neighbourhood has in BNB is an important think about figuring out future development.

Now, all these predictions are optimistic, however one must be cautious. We’re speaking about eight years from now and it’s price considering the present standing of the crypto-industry. The costs of BNB and Bitcoin are intently correlated. Luckily, BNB will be burned on the Binance market, which reduces the variety of tokens in circulation and will elevate the value of the coin.

The profitability of BNB can be considerably influenced by technological developments. To reinforce the performance of the blockchain, Binance has a number of plans to put money into cutting-edge applied sciences.

Conclusion

Now, it’s not that the prediction of BNB coin is at all times optimistic. In mild of the coin’s volatility and the truth that it “primarily follows the value gyrations of Bitcoin and has no real-world use,” John Hawkins, a senior lecturer on the College of Canberra, has predicted that BNB’s value will fall to $180 by the tip of 2022.

It’s important to remember that cryptocurrency markets are extremely unpredictable, making it difficult to supply long-term projections. Price noting, nonetheless, that the F&G Index was within the impartial zone, at press time. Ergo, higher occasions might not be forward.

Supply: various.me