- BTC’s value has rallied by 40% since 1 January.

- Traders have recorded important features, and now, a value reversal would possibly observe.

Exchanging palms on the $23,200 value mark at press time, the main coin Bitcoin [BTC], at the moment trades at ranges final seen in August 2022. On a year-to-date foundation, BTC’s value has rallied by 40%, per information from CoinMarketCap.

Sharing a statistically important optimistic correlation with a number of different belongings available in the market, the expansion in BTC’s value has resulted within the progress within the worth of a number of different crypto belongings within the final month.

In keeping with information from CoinGecko, world cryptocurrency market capitalization has elevated by 21% within the final month.

How a lot are 1,10,100 BTCs value in the present day?

Holders are in revenue, however for a way lengthy?

BTC’s rally to a five-month excessive within the final month has led a lot of its holders to log earnings on their BTC holdings. An evaluation of the fee foundation for short-term and long-term holders revealed this.

The fee foundation for any BTC holder is the typical buy value of the BTC they possess. This considers any variations in BTC’s value on the time of buy. This price foundation determines capital features or losses when the BTC is bought.

In keeping with Twitter analyst Will Clemente, the fee foundation for short-term and long-term BTC holders have been $18,900 and $22,300, respectively.

Nevertheless, since BTC’s value has rallied past these factors, these cohorts of traders have been “not underwater,” Clemente stated.

Bitcoin has now reclaimed its long-term holder price foundation ($22.3k) along with its short-term holder price foundation ($18.9k) and the aggregated price foundation. Behavioral shift as holders in mixture are not underwater.

The final thrice this has occurred are proven under: pic.twitter.com/8fCSyU5sqk

— Will Clemente (@WClementeIII) January 29, 2023

Additional, CryptoQuant analyst Phi Deltalytics assessed BTC’s short-term Spent Output Revenue Ratio (SOPR) and located that “sentiment from Bitcoin short-term on-chain individuals has reached the greediest stage since January 2021.” In keeping with the analyst, the SOPR was positioned properly above the bullish threshold of 1, indicating a very stretched market.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Deltalytics famous additional that the bullish development may very well be short-lived with out a rise in stablecoin reserves on spot exchanges.

Supply: CryptoQuant

A have a look at Crypto Worry & Greed Index confirmed the analyst’s place. At press time, the index confirmed that greed permeated the cryptocurrency markets.

When the index is within the “greed” vary, it signifies that traders have change into more and more assured and optimistic in regards to the market and could also be extra keen to tackle threat.

This additionally means that costs have gotten overvalued and {that a} market correction could also be imminent.

Supply: Various.me

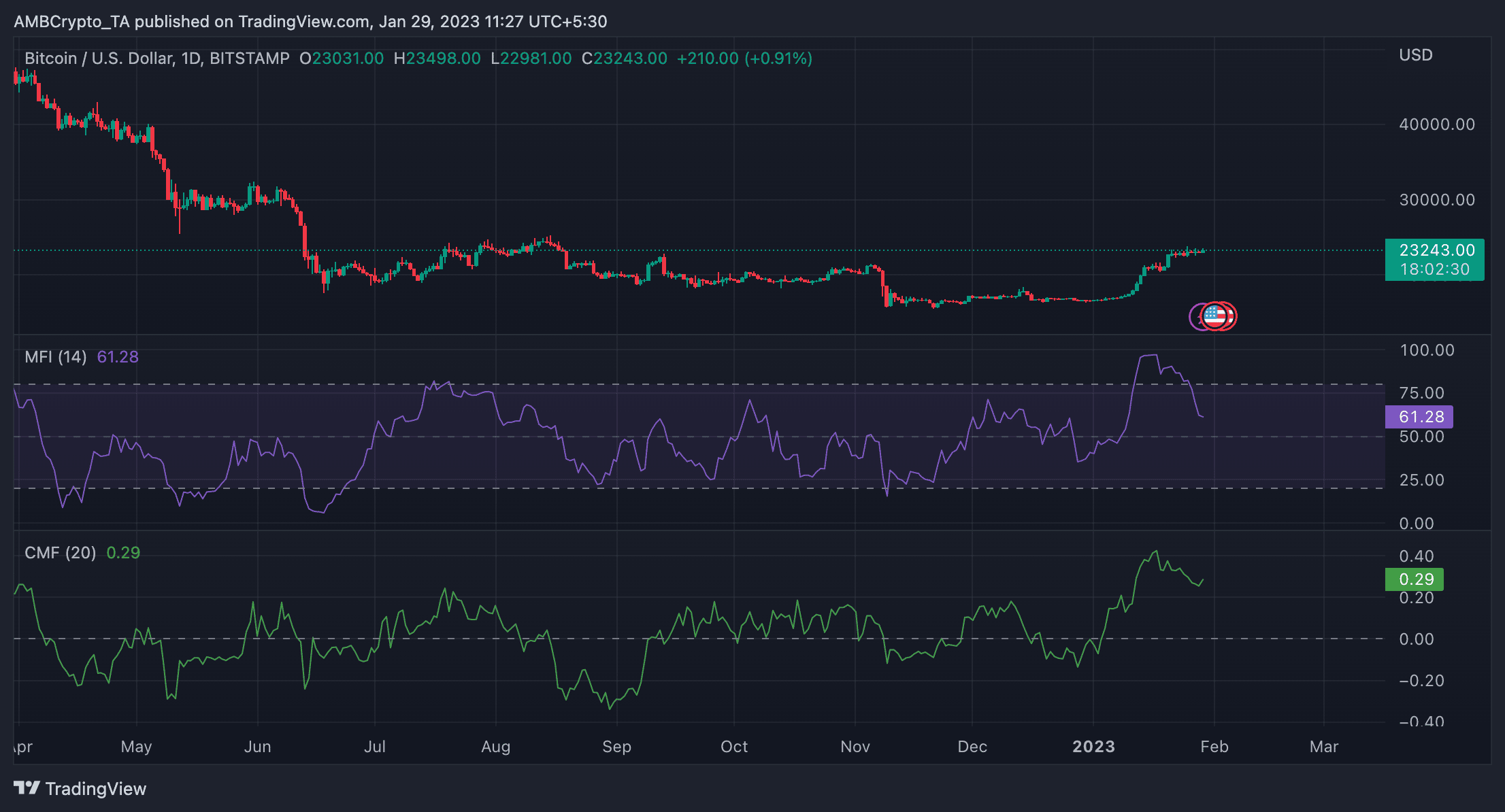

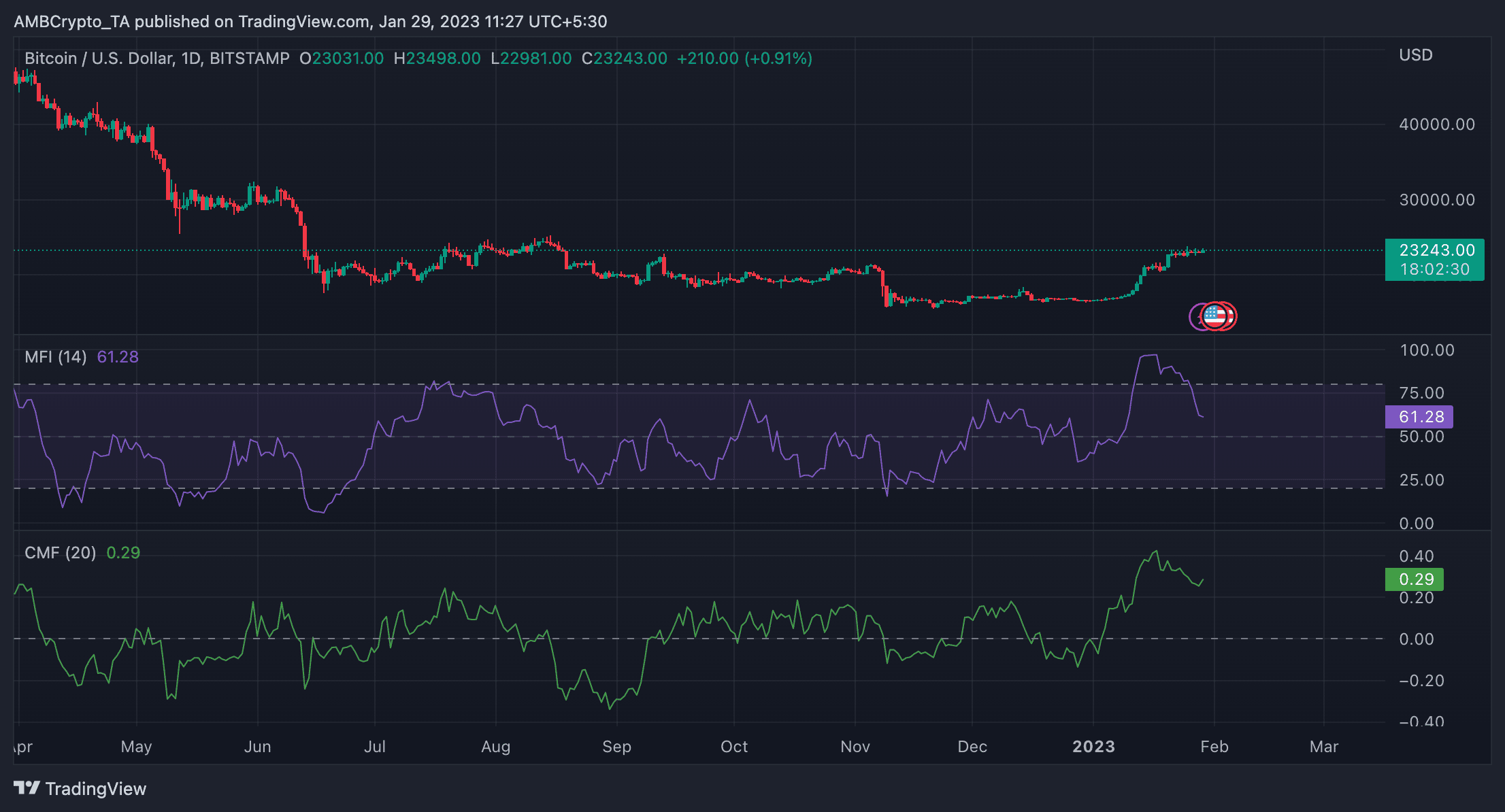

An evaluation of BTC’s motion on the every day chart confirmed the opportunity of a value correction. Since 21 January, the king coin has traded in a decent vary.

When BTC’s value oscillates inside a decent vary, it signifies that the value is just not making important strikes in both route and is staying inside a comparatively slim band.

An evaluation of BTC’s Cash Move Index (MFI) and Chaikin Cash Move (CMF) indicators raised extra considerations as these technical indicators have been trending downwards since 21 January.

The tight vary of BTC’s value mixed with downtrends within the MFI and CMF steered an absence of shopping for momentum and potential for elevated promoting stress.

This additionally confirmed that the market was more likely to break down from the tight vary to the draw back.

Supply: BTC/USDT on TradingView