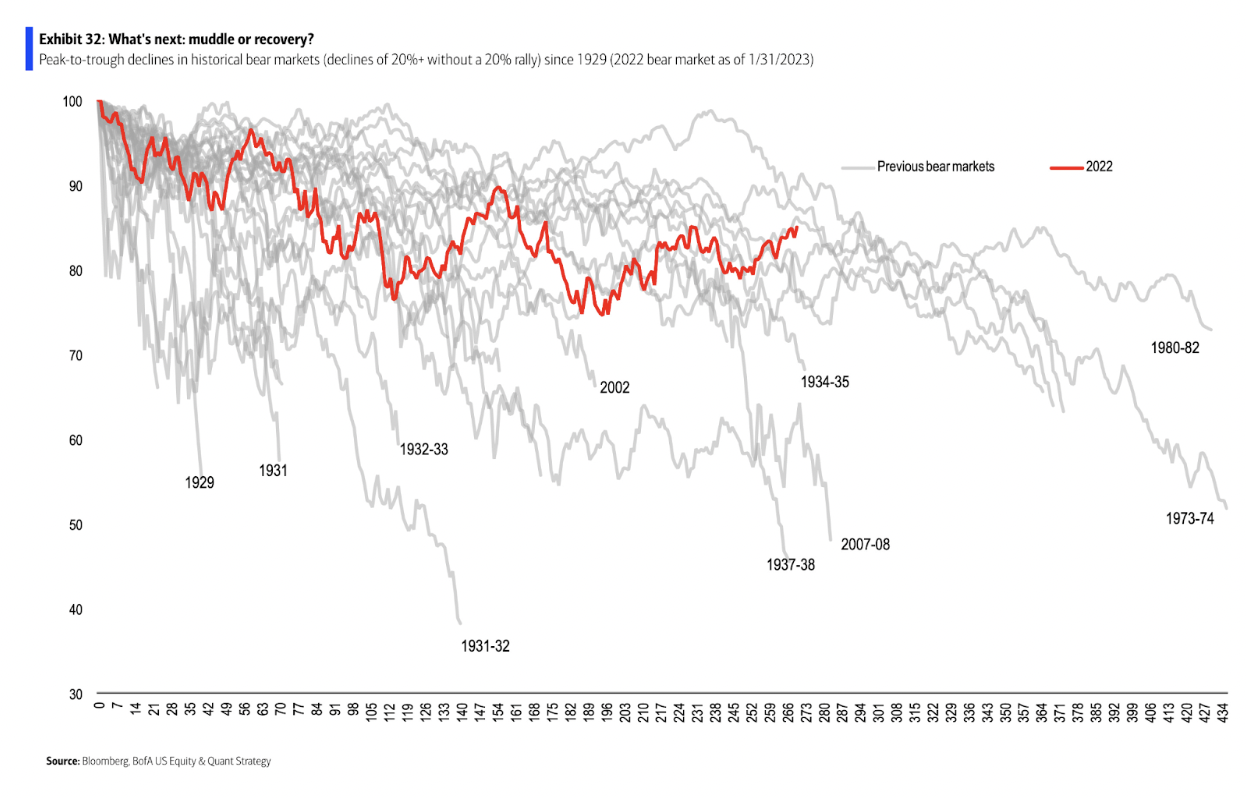

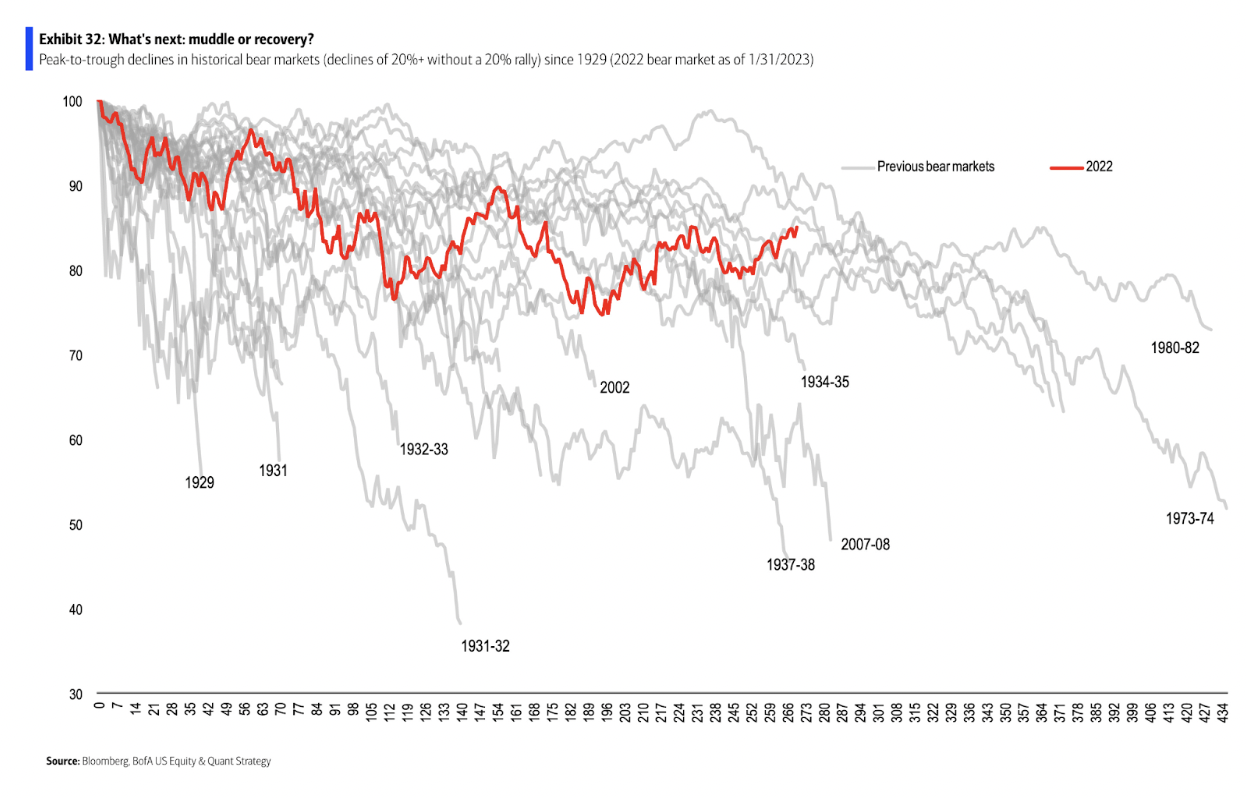

Take a look on the BAML chart above.1 It’s one in every of my favorites, however for causes that may not be readily obvious at first look.

The chart exhibits the peak-to-trough declines of all of the bear markets with the favored definition of a 20% decline, measured up till the beginning of the primary 20% rally.2 The present transfer from 2021 highs is proven in pink.

As Batnick factors out, all of those horrendous intervals of market ache are already factored into long-term returns of equities. Which means, you don’t get the 8-10% long-term positive aspects with out residing via a big variety of market occasions, starting from cyclical drawdowns to longer secular bear markets, and full-on crashes. It’s all a part of the dynamics of danger markets that by definition go up and down.

To state the apparent: “If you wish to be there for the nice occasions, you will need to additionally undergo via the dangerous occasions.” It’s a too usually forgotten cliché.

As I considered this, I had an perception from my very own experiences:

The Bear Markets that mattered the least felt like they mattered probably the most (and vice versa).

Enable me to unpack how I reached this conclusion.

Since I started on a desk within the mid-1990s, I’ve lived via a number of cyclical (20%) and secular (long-term) bear markets:

1990: Graduating right into a recession, and the markets quickly fell ~20%

1998: Russian Ruble markets fell 15% in August, on the best way to ~20%

2000-03: Dotcom implosion, 81% crash

2007-09: GFC noticed SPX fall 56%; terror as credit score markets froze.

2000-13: Secular bear market didn’t make new highs till March 2013

2018: ~20% pullback because the economic system slowed, FOMC hiked.

2020: Pandemic crash of 34%, quickest high fall (however quickest restoration)

2022: Shares & bonds each down double digits since 1981

All of those meet the unofficial definition of a bear of a 20% transfer off of the height.

I graduated regulation college into an oncoming recession; information suggests this negatively impacts your lifetime earnings. I had zero {dollars} available in the market and was deep in scholar mortgage debt. The primary bear I skilled was completely meaningless economically however nonetheless felt dangerous. By the mid-to-late-1990s, I used to be switching careers from regulation to finance. My financial future was unsure, however I felt assured I may make a go of it. My portfolio was tiny; I had no 401ok, and my spouse’s 403(b), with lower than a decade’s price of contributions, was barely 5-figures. The 2000 crash was the worst of all of those: The Nasdaq plummeted 81% from peak to trough.

From a purely financial perspective, these first few crashes have been meaningless. I had so little precise capital at stake, and a lot time to contribute to my financial savings and permit them to compound, if something, any significant worth lower created real shopping for alternatives (not that I used to be sensible sufficient to reap the benefits of them).

However that was under no circumstances the way it felt on the time; in a brand new job the place market ranges affected wage, bonuses, financial stability, and even monetary survival for a lot of, it didn’t really feel good. In truth, it felt horrible. Folks throughout me freaked out, stress ranges have been via the roof.

Every of those Bear Markets mattered little or no financially, however that was not the way it felt on the time.

The place issues start to get fascinating is in the direction of the again half of these 30+ years, from the GFC ahead. By then, we started to have significant property in our financial savings/retirement accounts and the bear markets had an even bigger financial affect on these funds. The GFC and the pandemic have been world phenomena; the 2022 market was the worst since 1981 for a 60/40 portfolio. Not solely is my portfolio considerably bigger, however my complete enterprise relies on how markets do. My 401ok, my wage, and the worth of the agency are all tied up in how markets are doing. Downturns actually value hundreds of thousands and will damage loads . . . however they don’t, and in reality, they’d the precise reverse impact.

These current Bear Markets mattered an awesome deal to me economically however didn’t really feel that manner.

This was curious, however the extra you consider it, the extra it is smart. Let’s reframe the concept of bear markets; the place I land is placing them into the broader context of life experiences. You become old, you reside via these items earlier than; you understand the whole lot is cyclical. “This too shall go” is attributed to King Solomon, an adage to remind the sovereign to be humble within the face of fine occasions and optimistic in intervals of despair.

Markets are the identical manner: They go up, they go down, and it’s out of your management. The way you reply to challenges and alternatives they current issues an awesome deal.

I’ve a suspicion that the largest single issue that determines your success or failure when these occasions happen is solely the best way you psychologically contextualize what is happening. And because it seems, that’s (considerably) in your management…

Beforehand:

What if Dunning Kruger Explains The whole lot? (February 27, 2023)

Trying on the Very Very Lengthy Time period (November 6, 2003)

Bull & Bear Markets

Behavioral Finance

____________

1. Because of Josh and Mike for chatting this up on this week’s What Are Your Ideas?

2. You most likely know I hate the 20% definition however let’s work with it for now; observe mid-year 2022 bounce by no means obtained over 20%.