Some encouraging information about individuals saving for retirement:

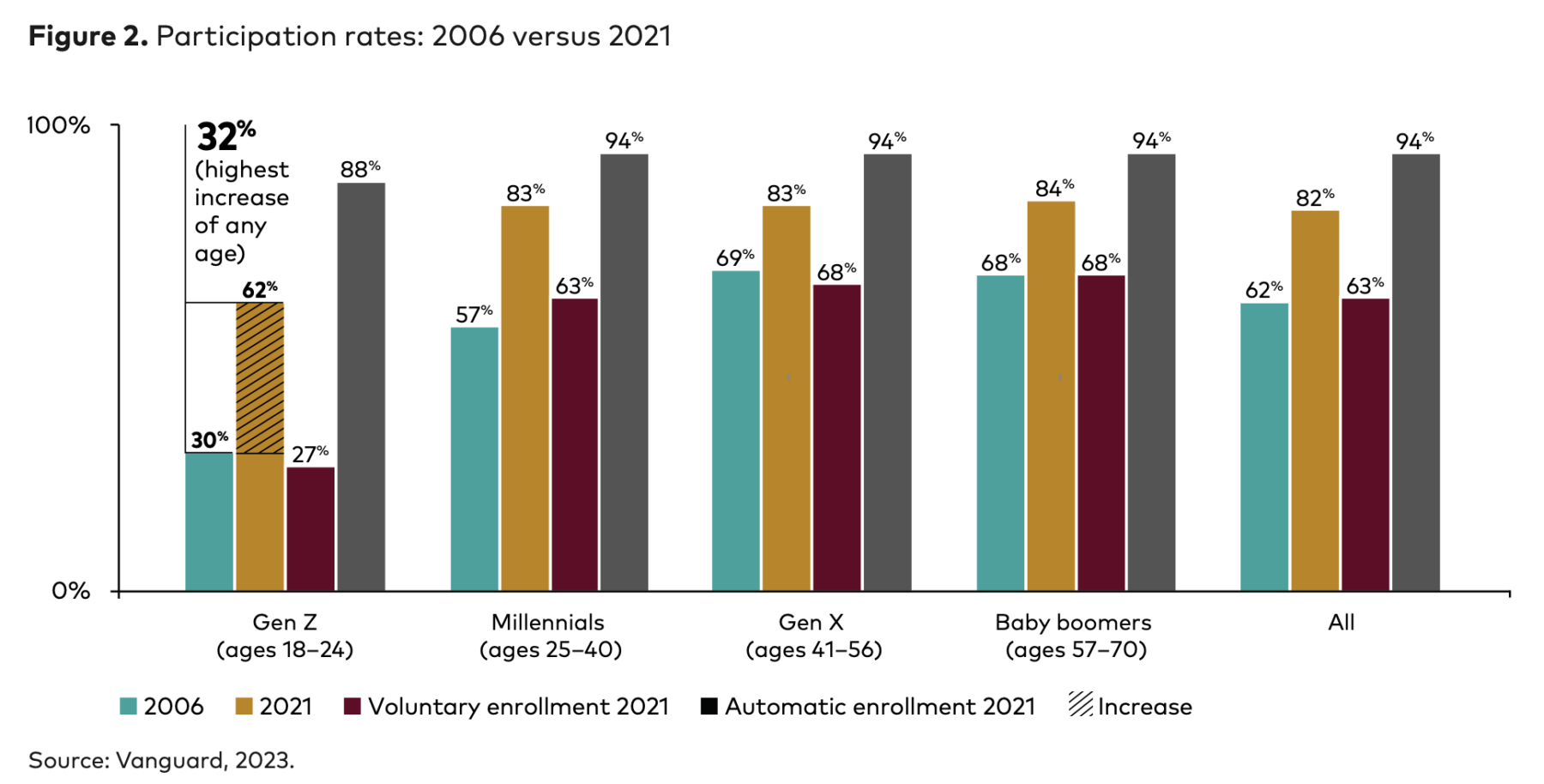

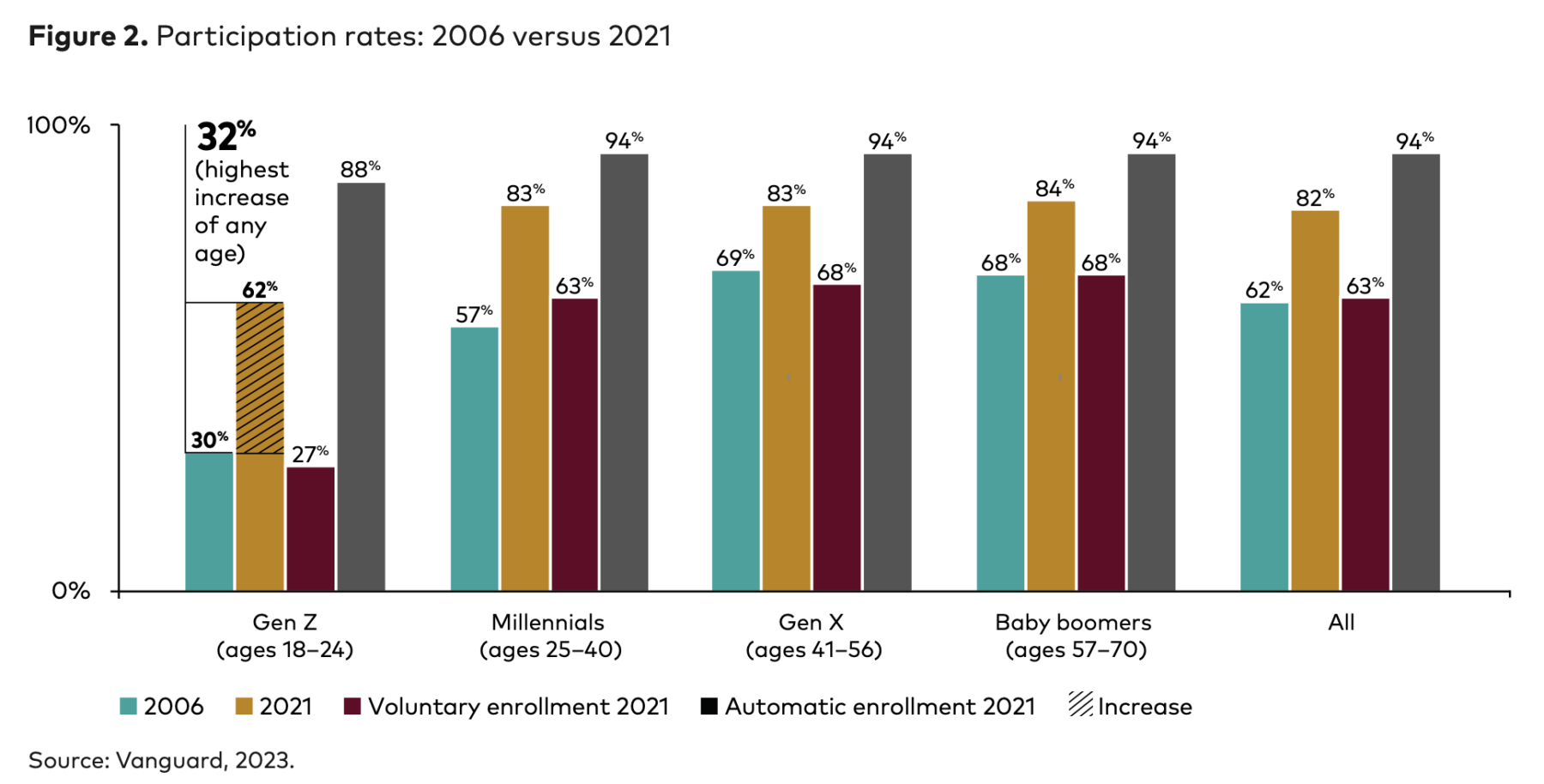

A examine by Vanguard Group discovered that “Automated enrollment and the rise of target-date funds” are having a considerable and optimistic affect on retirement savers, specifically, on Millennials and Era Z traders. They’ve seen a major uptick in total participation charge, which has elevated from 62% in 2006 to 82% in 2021.

Extra employer plans are adopting automated enrollment, a small nudge typically credited to Nobel prize-winning economist Richard Thaler.

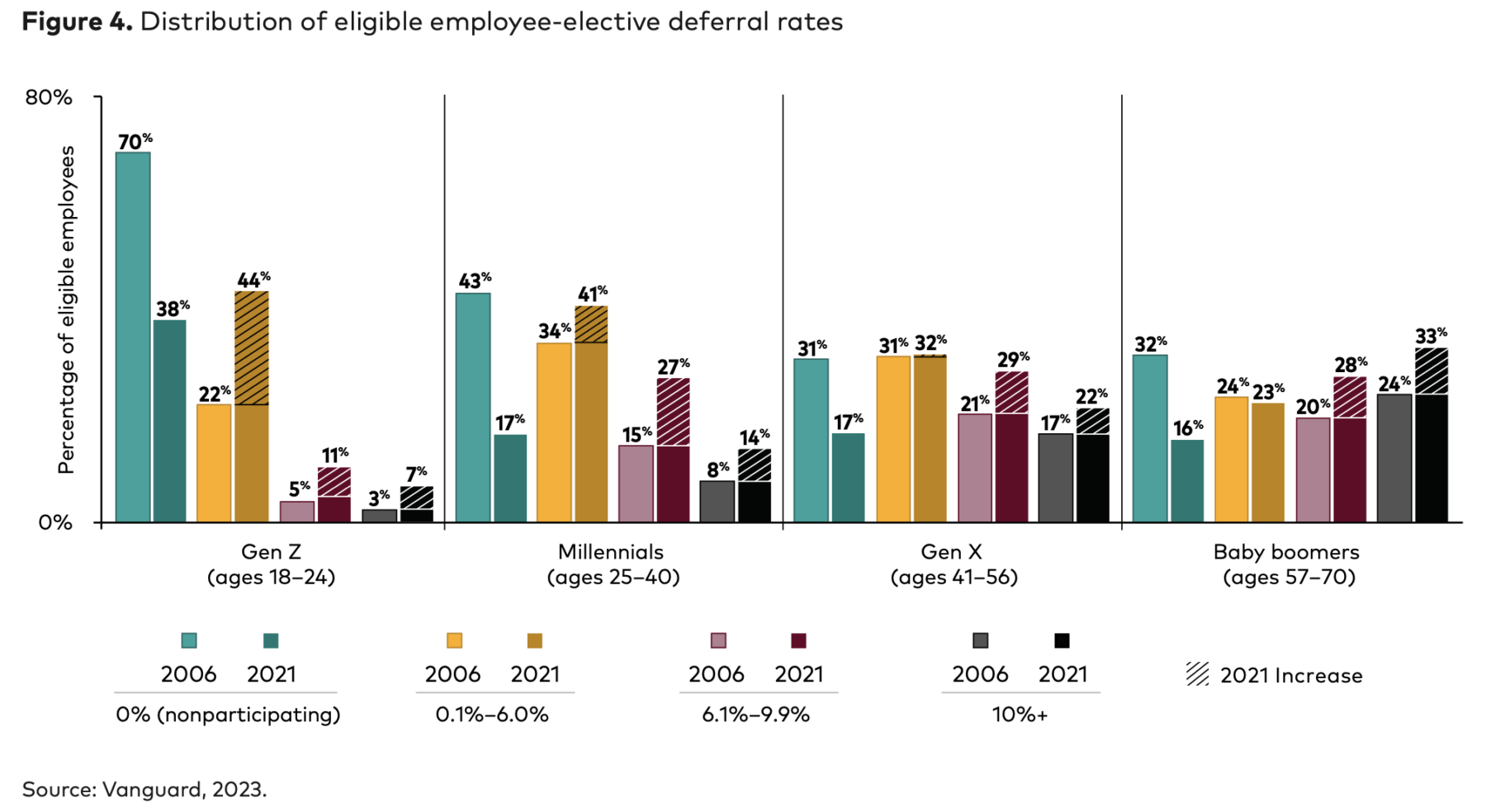

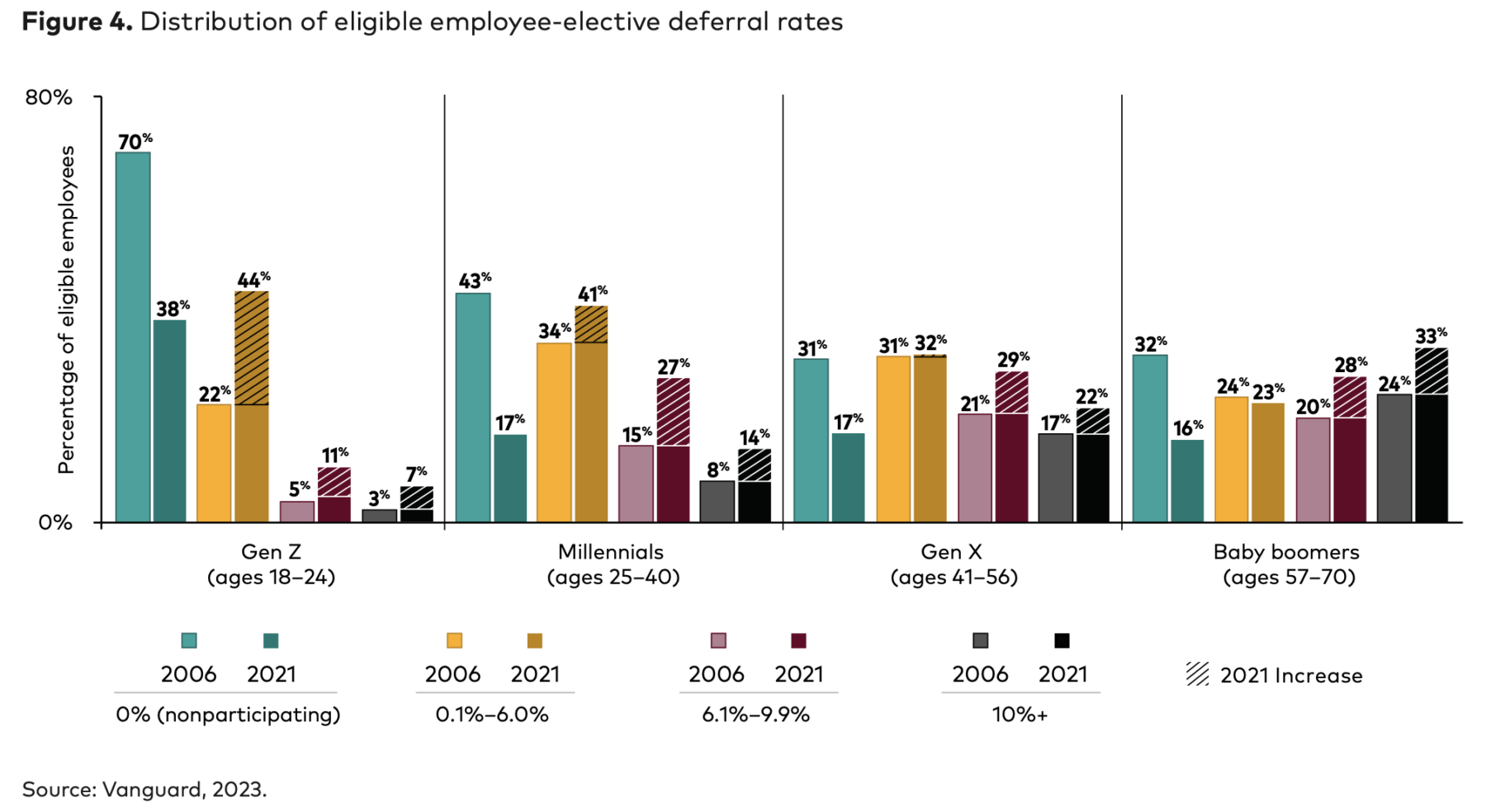

As of 2021, Era Z’s participation charge was greater than twice as excessive as equally aged workers in 2006. Eligible workers deferred almost 40% extra in 2021 than in 2006.

In 2006, ~25% of contributors ages 18 to 24 had zero fairness publicity! By 2021, 97% of robotically enrolled Era Z contributors had an fairness allocation between 41% and 99%.

Goal-date funds in 401okay plans are enhancing age-appropriate fairness allocations throughout for all generations, however because the charts close by present, it’s having the largest affect on the youngest traders.

Supply:

Generational modifications in 401(okay) behaviors

By Jeffrey W. Clark and Kevin D. Kukulka

Vanguard Group, April 2023