My fishing pal Sam Rines has spent a lot of this yr pushing a thesis of “Worth over Quantity”; I discovered it a compelling narrative, one that matches in properly with an apsect of inflation that I had initially underestimated: “Greedflation.”

The Worth over Quantity thesis is each compelling and underappreciated. I hope you discover his take thought scary… -Barry

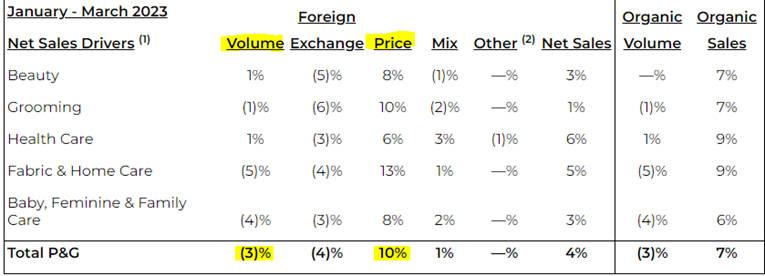

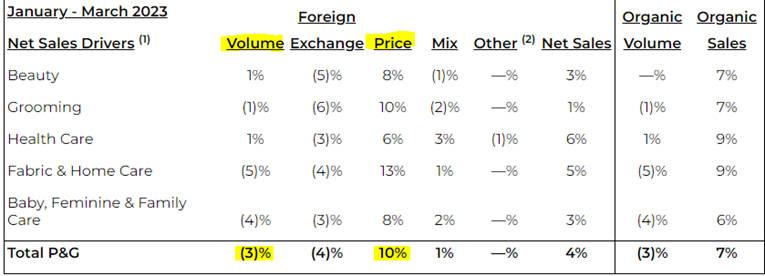

Worth over Quantity stays a key theme this earnings season with PG’s earnings report the tip of the iceberg. As a reminder, this has been one among PolyMacro’s themes for the previous yr.

It stays early within the present earnings season. However the persistence of the PoV narrative is turning into virtually comical. The quantity of value flowing by way of the system to customers is quite obscene. Pushing 10% value at P&G with comparatively little pushback on volumes (-3%??) makes for a troublesome argument that there’s a disincentive to proceed discovering that elasticity breaking level. And P&G doesn’t seem to have discovered it but.

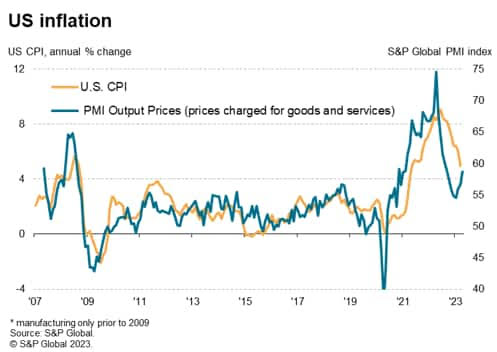

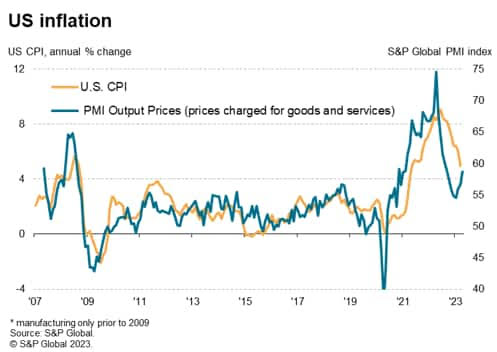

And the present S&P World PMI numbers serve to strengthen the PoV narrative. Manufacturing corporations? Pushing value. Companies corporations? Pushing value.

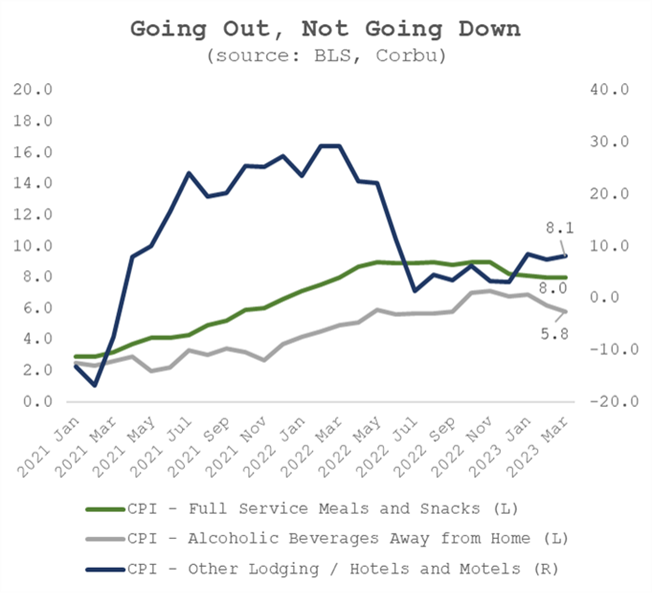

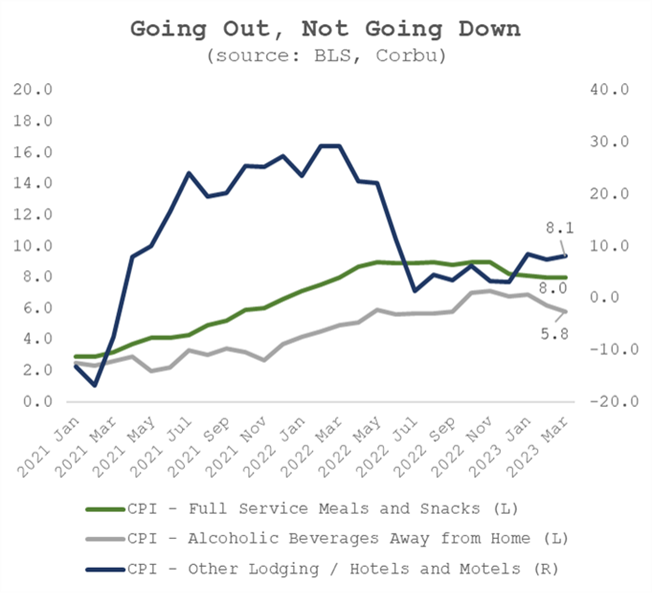

And taking all of it collectively – the uptick in demand is inflicting pricing pressures to re-emerge that can not be ignored. If the S&P PMI report proves to be right (inflation reaccelerating) that’s going to be extremely problematic for threat property which have turn out to be extra comfy with a “hike to pause” narrative.

Firms are saying costs are going larger, and the surveys are confirming it. It must also not be ignored that this survey is following the banking scare.

Once you mix the narrative from P&G (“we’ve value energy and we all know it now”) with the FOMC’s biggest worry (companies inflation), it isn’t troublesome to parse out what occurs subsequent. There may be little in the best way of aid coming within the pipeline for the patron.

This isn’t the identical financial system because the pre-Covid period. That is the financial system of “pushing value” and discovering that marginal greenback.

There was – was – a rational argument for a much less aggressive PoV coming by way of the system. Following the SIVB debacle and the next funding pressures seen by some regional banks, the soundness of the monetary sector was in danger. That was presupposed to be a headwind to the US financial system and inflationary pressures.

However because it seems that’s merely not what is going on.

There’s a sense that the banking scare solved the inflation downside. And – whereas there are theoretical causes to consider it to be the case – it has not confirmed to be true to this point in earnings. United Airways referred to as it out as a “two week” headwind, and there have been scarce others that face customers even acknowledging it.

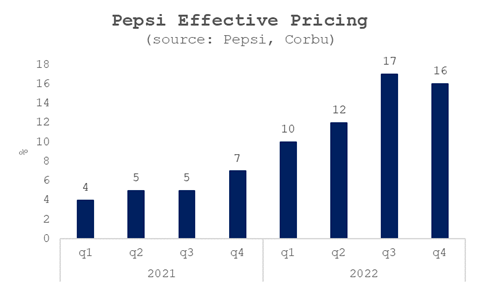

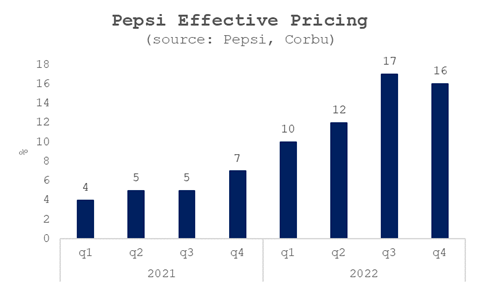

And Pepsi – the one firm that was not supposed to have the ability to increase costs due to the direct competitors from KO – is without doubt one of the most blatant PoV culprits.

The acceleration in pricing throughout – however significantly at Pepsi and the like – is astonishing. It’s indicative of the present company mentality. There are only a few possibilities to search out the elasticity of demand. And – in the interim – there are ample excuses to determine it out.

There’s a conflict. There’s a labor scarcity. These are good excuses to lift pricing and never care about quantity. And that’s the world we live in. Quantity doesn’t matter. Worth does.

~~~

Samuel Rines is the managing director at Corbu, Samuel Rines is an analyst of all issues financial with a deal with how “the micro meets the the macro”. Sam is the creator of “After Regular” and writes continuously on the cross-section of the financial system and markets.

Samuel Rines | Managing Director

CORBŪ

samuel.rines@corbu.co