Within the endless battle of market narratives, new concepts get launched and previous concepts are resurrected as crucial. Some of the persistent criticisms of US equities has been how slim the beneficial properties have been, pushed primarily by mega-cap tech shares.

You most likely know variations of this argument as “FAANMG!”

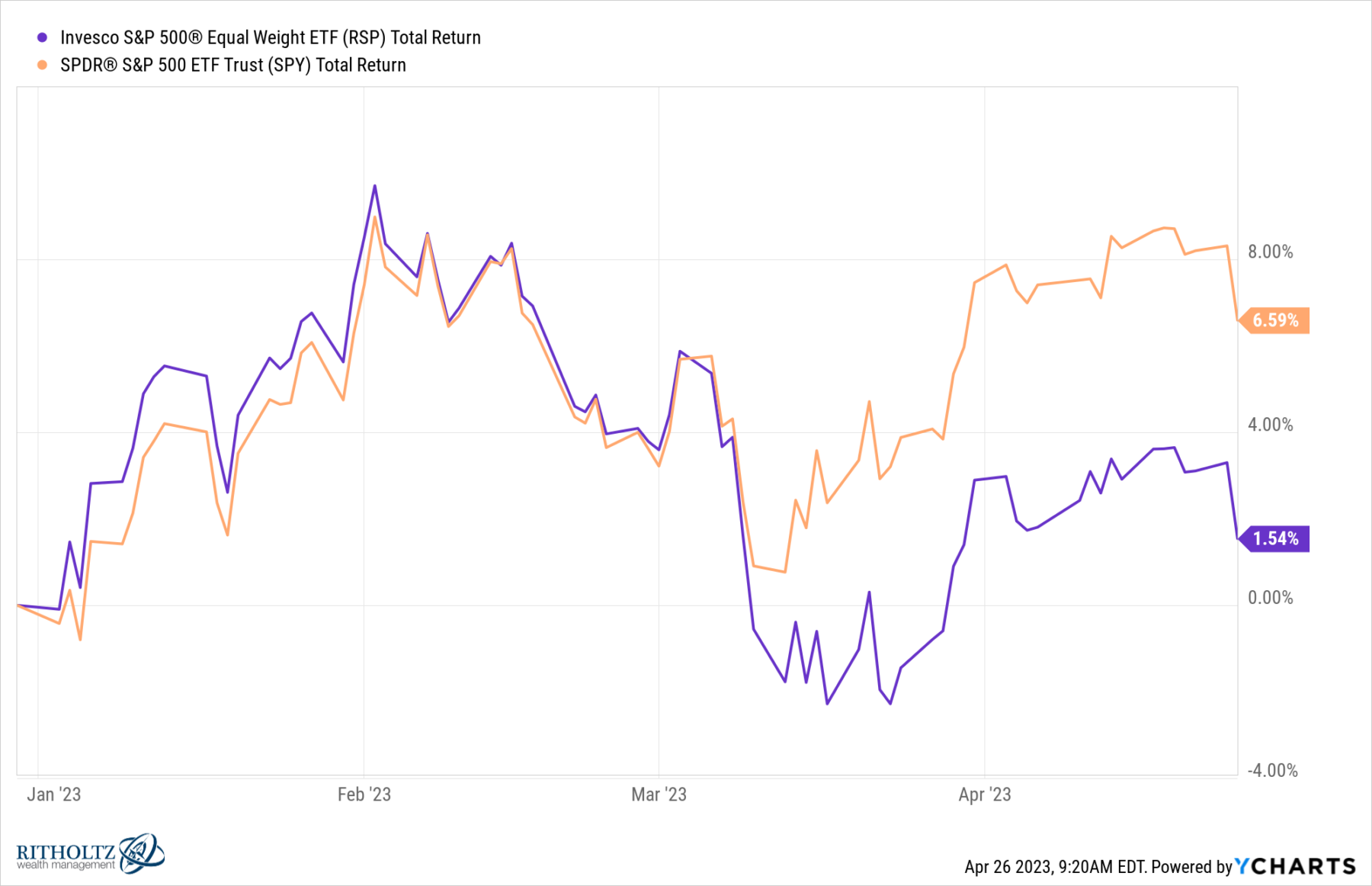

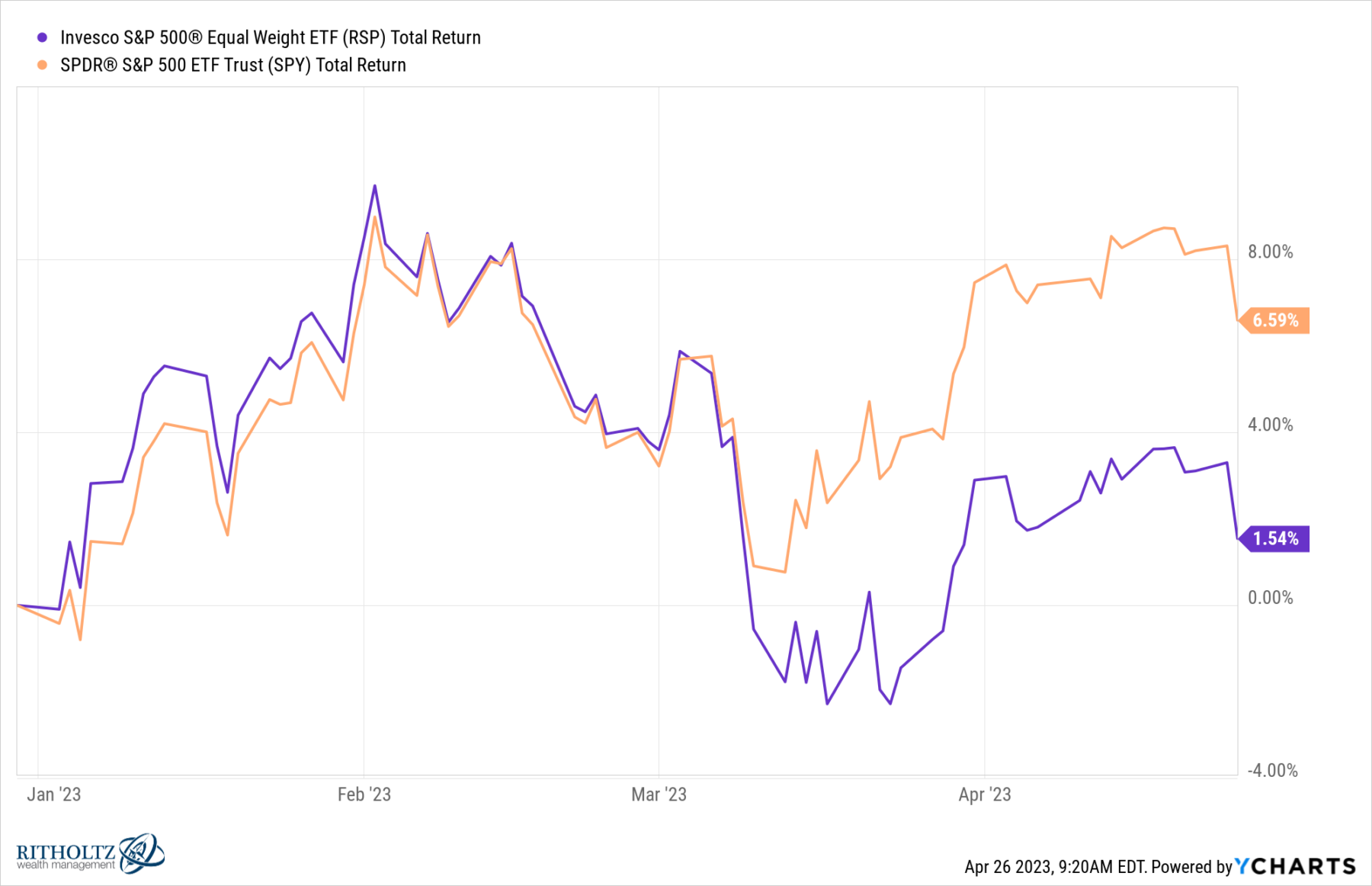

There’s some reality to the declare that the most important corporations have been pulling markets alongside; YTD cap-weighted indices are considerably outperforming equal weight. The extra fascinating query is what does the relative performances of equal weight and market cap weight S&P500 really imply? I discover it extra ambiguous and topic to interpretation than is extensively believed.

Maybe some historic information can add some context to the talk.

Some of the influential our bodies of analysis about “How Market Tops Get Made” got here from Paul Desmond of Lowry Analysis. He famous that markets get more and more slim by cap measurement (capitalization) as longer secular bull markets strategy their ends. Particularly, we see smaller caps roll over, then mid-caps, then massive caps; the final to fall are the mega-caps.

Desmond beloved to ask skilled portfolio managers “What proportion of shares would you count on can be making new highs on the prime day of the bull market when the Dow Jones was making its absolute excessive?” The standard solutions had been within the 60, 70, 80% vary.

The precise reply was lower than 6%. In line with Demond, of the 14 main market tops between 1929 and 2000 inclusive, when the DJIA reached its absolute peak, the common proportion of shares additionally making new highs on that day was 5.98%.

However this doesn’t clarify all the pieces about whether or not markets are too slim or not. We will clarify – or rationalize, in case you choose – a number of contributors to the substantial beneficial properties FAANMG has loved. Growing world market share added to revenues, as new applied sciences and merchandise added to profitability. The 2-decades-long slide in vital anti-trust enforcement has helped every of those giants to dominate their particular sectors.

Which brings us again to the weighting of indices.

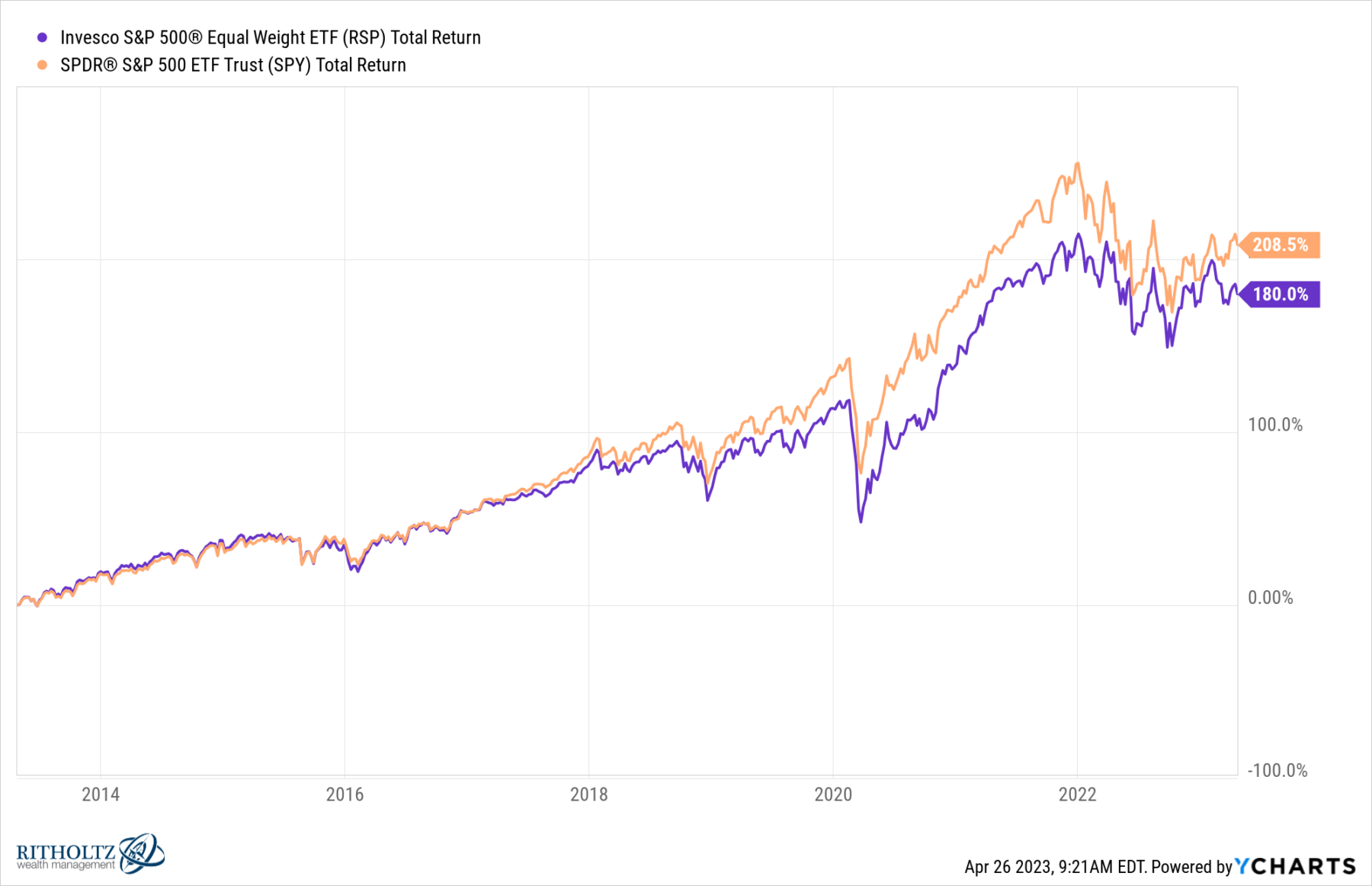

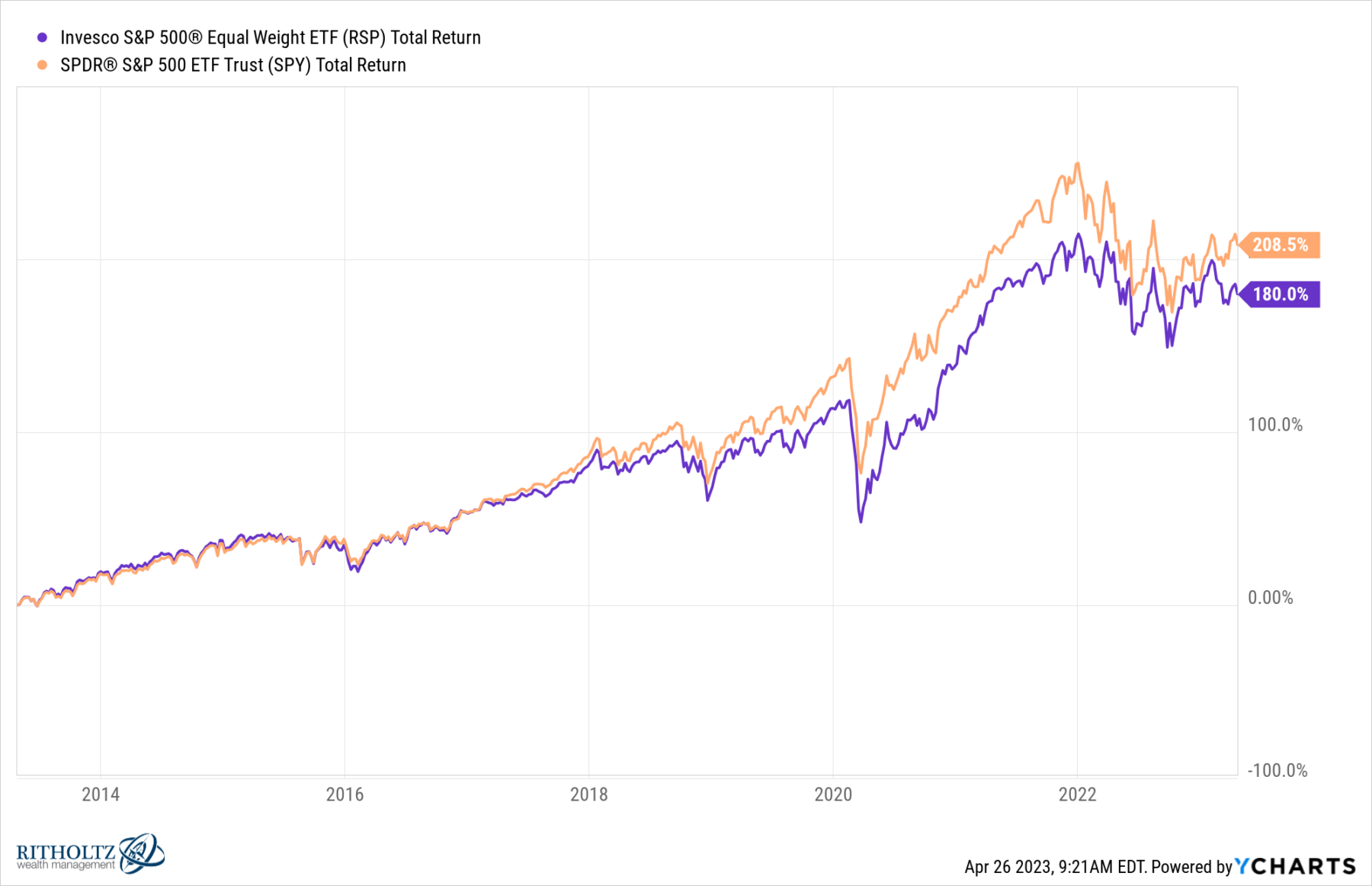

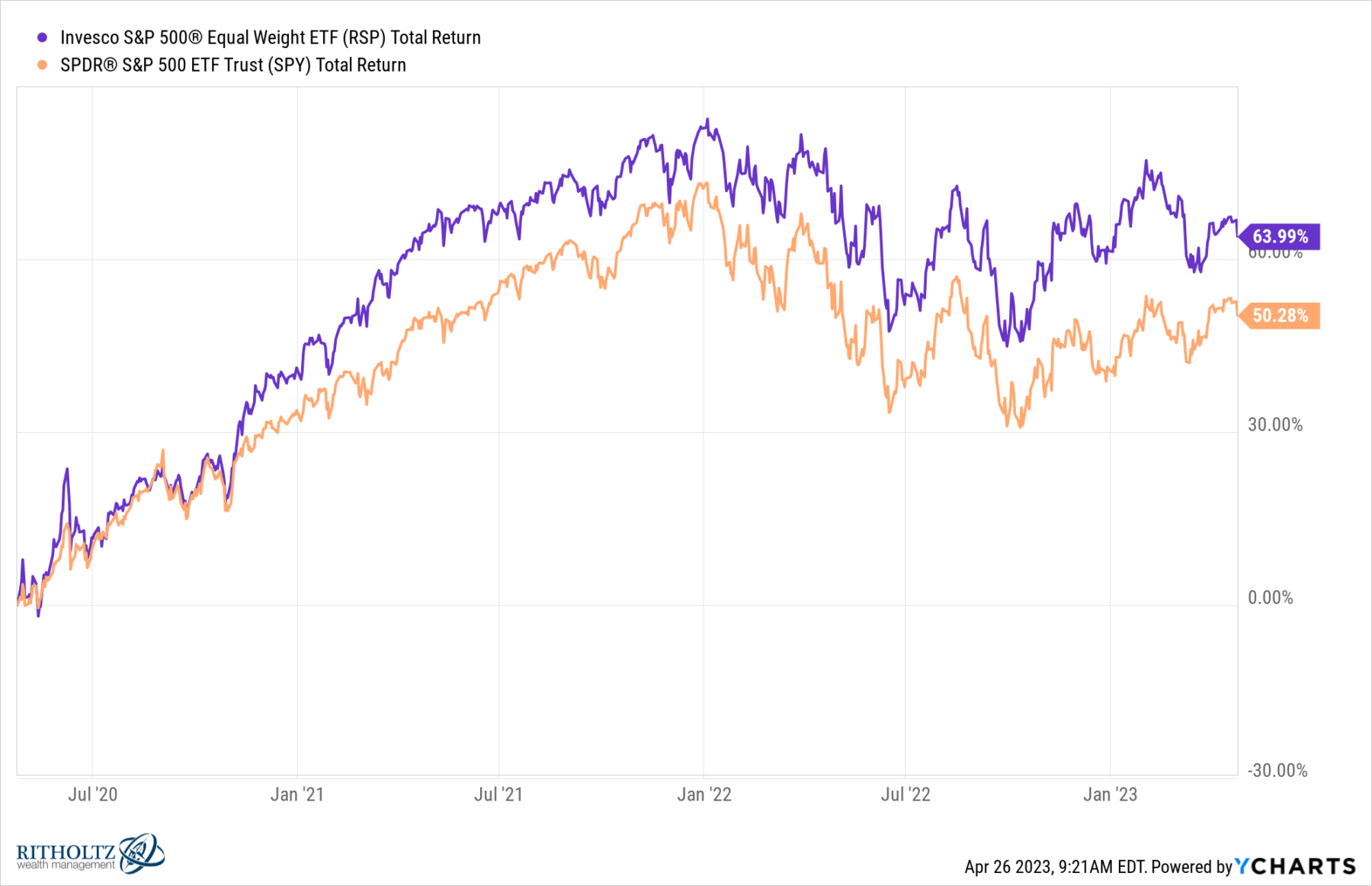

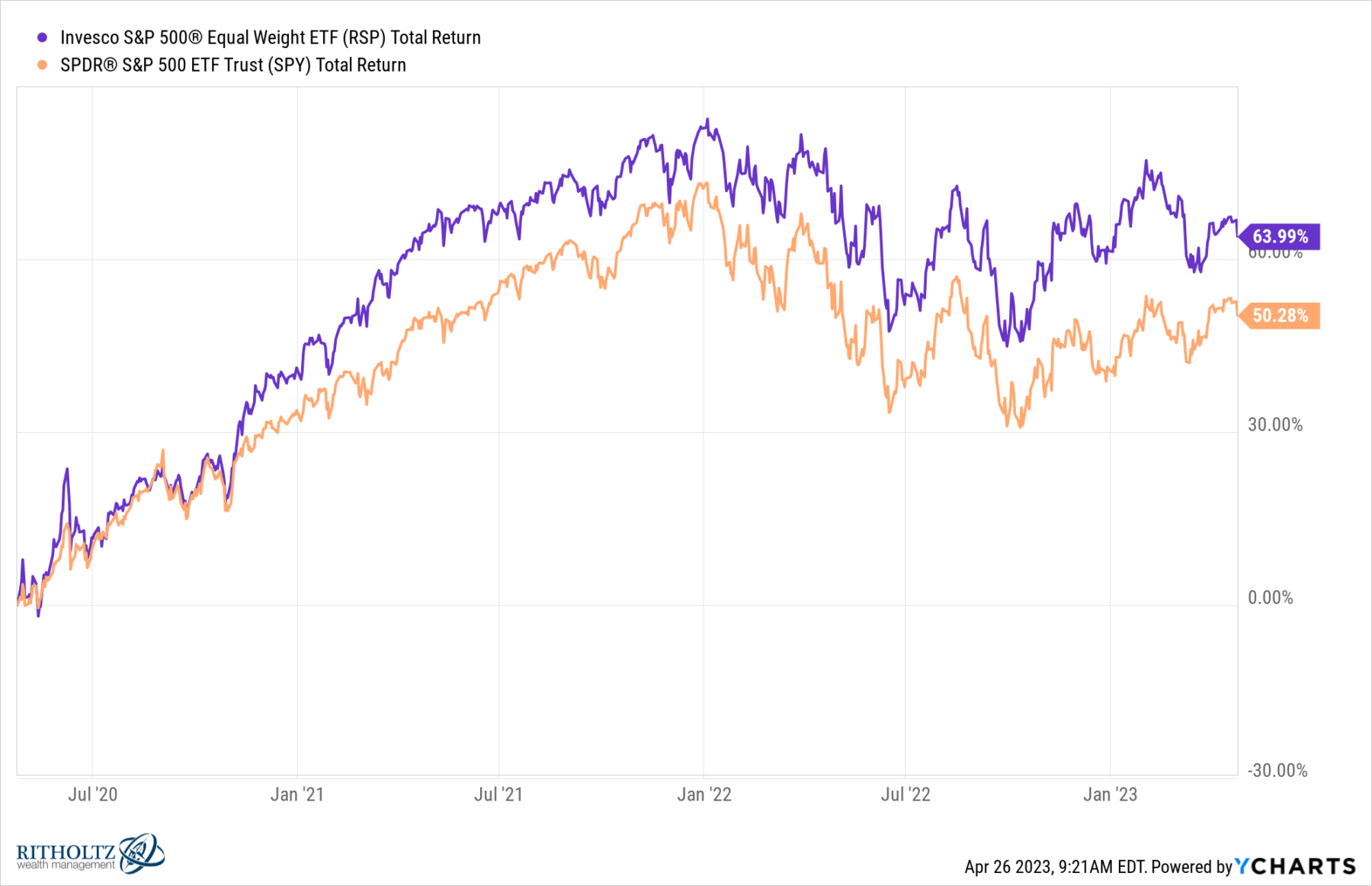

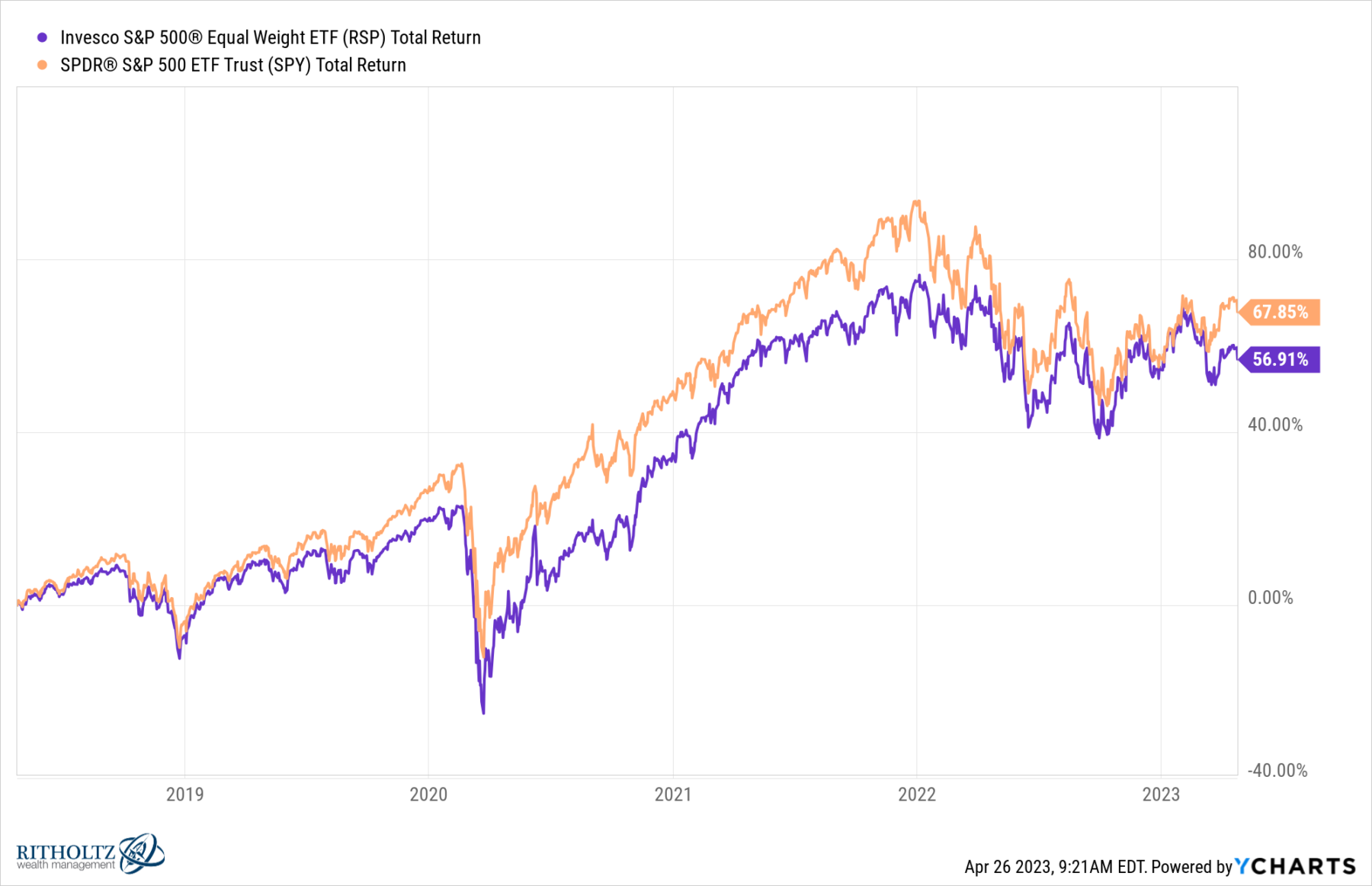

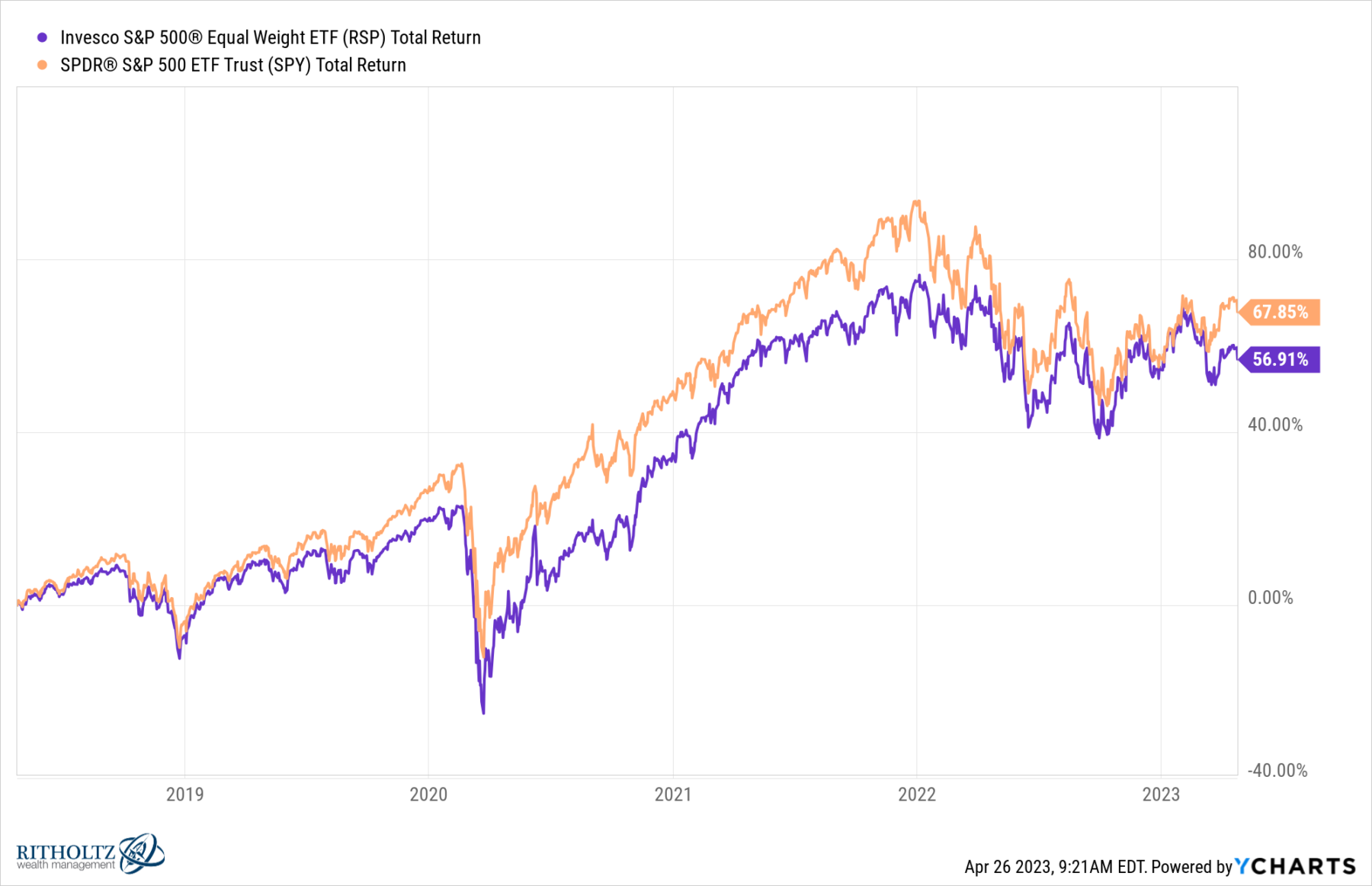

Let’s use 2 ETFs for our efficiency comparisons: SPY and RSP.1 Yr-to-date, cap-weighted is forward by 500 bps – 6.6% to 1.5%. However after we look again three years, the equal weight has practically tripled that benefit: 64% to 50%. It’s noteworthy that this era consists of practically the entire enormous big-cap run-up following the pandemic backside in March 2020 and the 30% crash tech shares suffered in 2022. If we glance long run, the cap-weighted return to dominance: greater than 10% for five years (67.9% vs 56.9%) and even larger 28% over 10 years (280.5% vs 180.0%). See charts right here.

There’s all the time a great cause to note when markets get too slim on the finish of an extended bull market, particularly as main indices make all-time highs. However which may be a special set of circumstances than what we’re witnessing in current mega-cap efficiency right this moment.

Beforehand:

How Market Tops Get Made (March 12, 2014)

2021: Small, Medium & Giant Cap Returns (January 4, 2022)

Prime 5 Shares: What Does This Imply? (December 16, 2021)

The best way to Mislead with Information, Giant Firm Version (November 12, 2021)

See additionally:

This awfully fragile slim no-good rally (FT, April 25, 2023)

MiB: Paul Desmond of Lowry’s Analysis (October 24, 2015)

Q&A: Paul Desmond of Lowry’s Stories & Half II (February 18-19, 2011)

___________

1. SPDR® S&P 500 ETF Belief (SPY) for market cap, and Invesco S&P 500 Equal Weight (RSP) for no cap-weighted.

Yr-to-Date S&P 500: Market cap weight (SPY) versus Equal Weight (RSP)

5 Years S&P 500

10 Years S&P 500