Should you spend any time with FinTV – even when it’s muted within the background – you’d have been handled to a debate as to “Are we in a brand new bull market?” or not. Generally it’s phrased as “Is the bear market over?”

I imagine that is the flawed method to consider bull and bear markets.

We’ve beforehand mentioned why the 20% bull/bear body of reference is solely noisy nonsense.1 It’s a meaningless, media-creation fiction, a rule of thumb with no proof displaying it to be vital (past the actual fact we now have that many fingers and toes).

However there are numerous different good causes to keep away from the “Purchase Now, No, Promote Now” debate: First, few are any good at selecting bottoms and tops; Second, nobody ought to run “actual” cash2 that method as the prices for being flawed are just too nice. Third, it’s an strategy that typically lacks the form of course of important to good investing.

Good buyers perceive that bear markets and volatility are a part of the place returns come from; these long-term buyers have discovered that using them out is their highest likelihood strategy.3

You may discover it helpful to suppose as a substitute of Bull/Bear discussions when it comes to broader context: When, The place, and for How Lengthy.

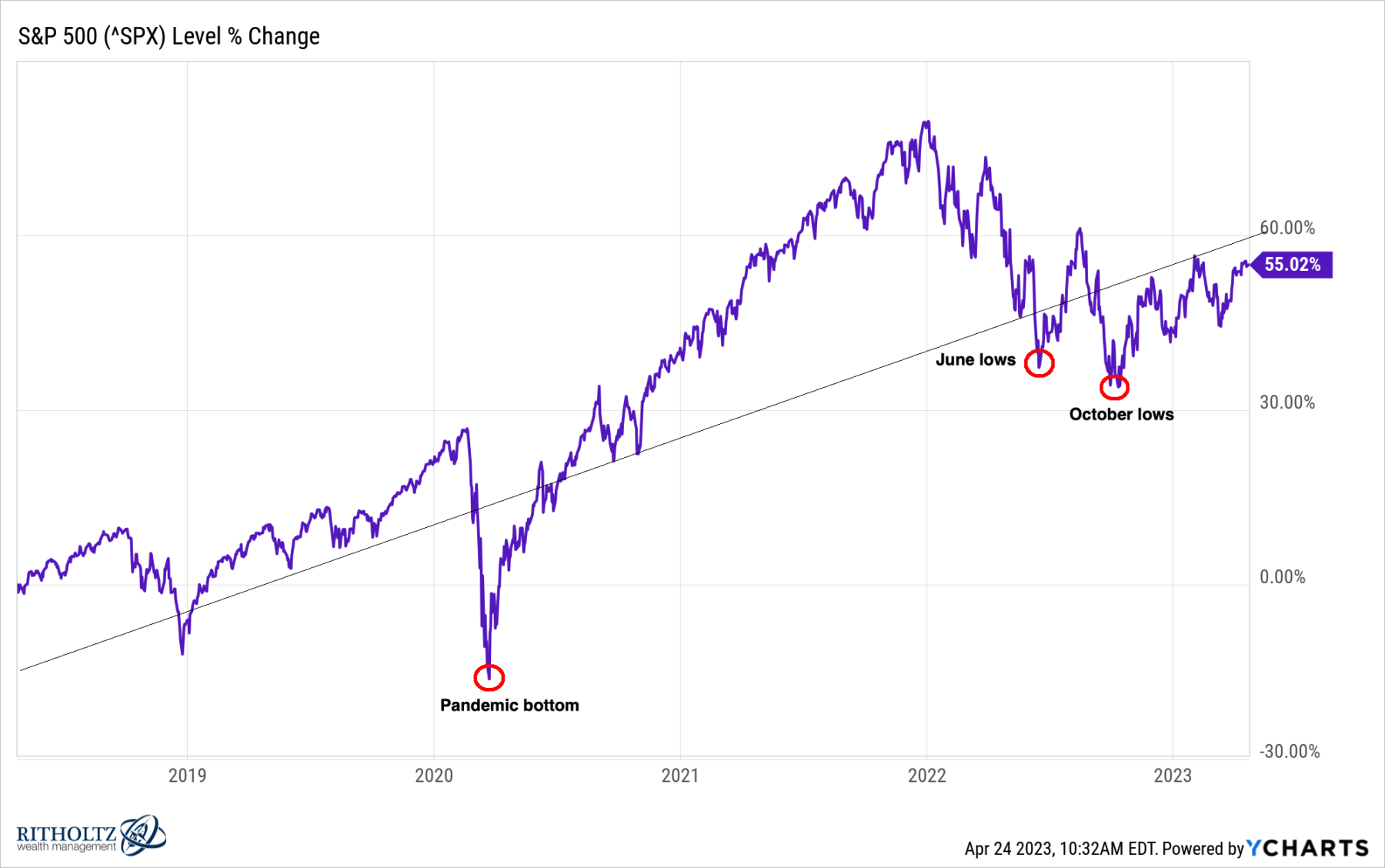

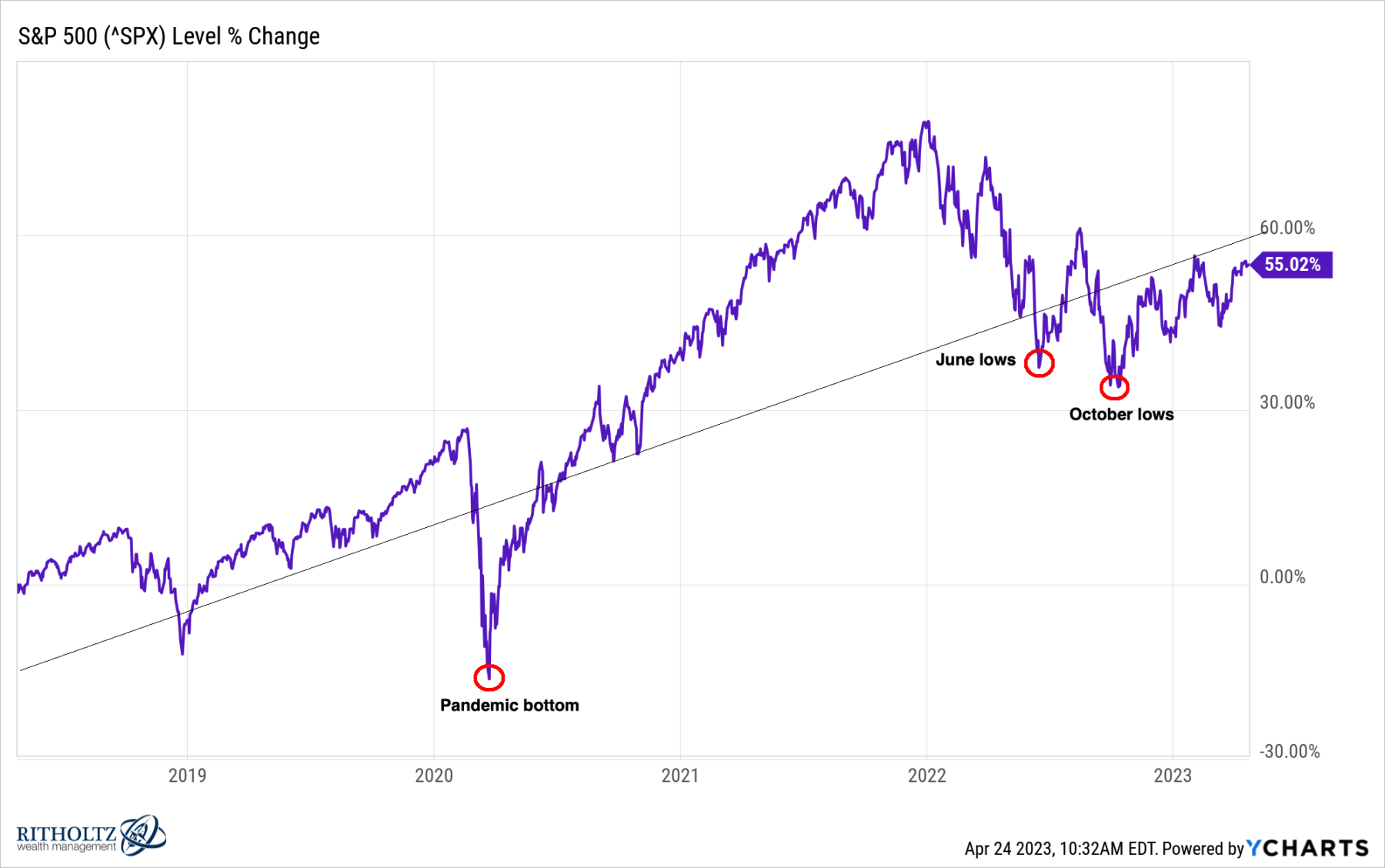

When: Framing the query of “when” is solely asking what’s the bigger timeframe round any specific market transfer. Is that this a pullback happening inside the context of a bigger up transfer? Is that this a bounce within the midst of a relentless grind decrease? Understanding the broader context of when any transfer is happening is beneficial in understanding the percentages of it persevering with.

Markets are like fractals, and what you see is usually dependent upon the time-frame you’re utilizing. You can see very completely different conclusions in the event you deal with minutes, days, weeks, months, quarters, years, or many years.Should you spend a lot time on social media you’ll notice {that a} substantial chunk of market debates appears to be folks with very completely different time horizons speaking previous one another.

The time intervals I discover helpful are secular market strikes that may final many years and cyclical strikes that final months; YMMV.

The place: On this morning’s reads, I referenced J.C. Paret’s dialogue of abroad features. When folks complain they’re in a bear market, we should always acknowledge that they’re typically exhibiting “dwelling nation bias.” Simply because their native bourse is in a drawdown doesn’t imply that all the fairness markets on this planet are in additionally in a drawdown. As JC famous: “It’s not the bull market’s fault that your nation is underperforming.”

Certainly, diversification geographically typically signifies that varied fairness holdings are behaving in another way. Think about Four geographic areas: The US, the Developed world Ex US, Rising markets, and Frontier. All of them have completely different sensitivities to financial components like commerce, inflation, commodities, and development. Throughout the fairness portion of your portfolios, they will present some measure of diversification.

How Lengthy: My favourite context for occupied with markets is the longer-term bull and bear markets is the phrase “secular.”

A Secular Bull Market is an prolonged time period (10-20 years) pushed by broad financial shifts that create an setting conducive to growing company income and earnings. Its most dominant characteristic is the growing willingness of buyers to pay increasingly for a greenback of earnings. Secular bear markets aren’t as lengthy lasting, are extra violent, however in any other case are the flipside of a bull.

However understanding once we are in a secular bull market may permit you higher context to consider danger, and about the way to handle your individual conduct relative to turmoil.

One of many subtexts of the above is that for the overwhelming majority of buyers, Martin Gabel‘s admonition of “Don’t simply do one thing, sit there” is most frequently their greatest strategy.

Markets are advanced mechanisms. Oversimplifying them into narratives or counting on context-free myths won’t serve your portfolio nicely.

Beforehand:

Observations to Begin 2023 (January 3, 2023)

Bottoming? (December 1, 2022)

Secular vs. Cyclical Markets, 2022 (Could 16, 2022)

Bull Market Bull (March 31, 2021)

Redefining Bull and Bear Markets (August 14, 2017)

Are We in A Secular Bull Market? (November 4, 2016)

Bull & Bear Markets

__________

1. If you wish to learn extra on why 20% isn’t vital, see this, this, this, and this.

2. Actual when it comes to each significance to buyers and dimension. No one needs to be swinging round billions of {dollars} primarily based on intestine intuition, and positively not retirement accounts or different crucial capital.

3. Be aware we now have not even referencing the valuation debate.