Let’s see if I can discover one thing to counter and/or undercut every of those 10 objects listed on this morning’s tweet above:

Then why are Equal-weighted indices doing so properly?

Equal-weighted Nasdaq100 up 17% because the June lows for the market as a result of “it’s solely 5 shares”? How dangerous at math do it is advisable be to suppose that it’s solely 5 shares driving this market?

by way of @allstarcharts https://t.co/xHid2ZuqMf pic.twitter.com/8r3eAIlmsN— Barry Ritholtz (@ritholtz) Could 16, 2023

2. Recession is inevitable?

If you happen to interpret that actually, then sure, in the future there shall be a recession. However individuals have been forecasting an imminent recession for 18 months — and we nonetheless have but to have one.

This tweet by Steve Rattner — who I think about a better-than-average, rational market analyst — was precisely a yr in the past at this time:

— Barry Ritholtz (@ritholtz) Could 19, 2023

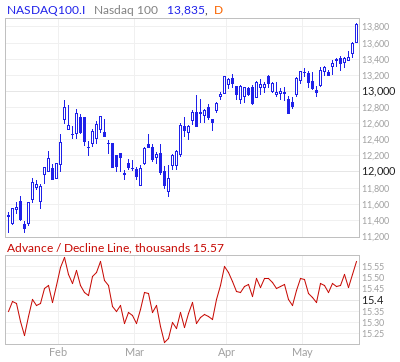

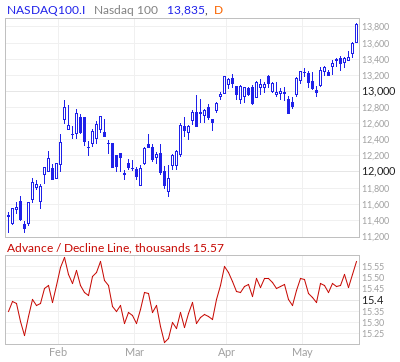

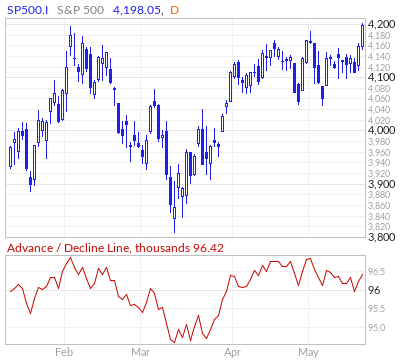

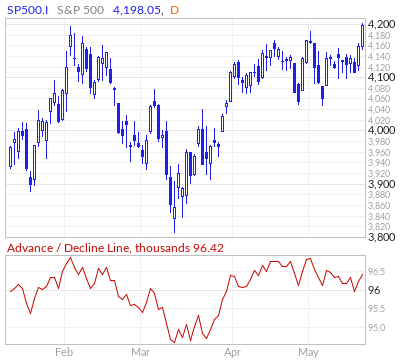

3. Breadth is horrible

There are numerous methods to depict how broad market participation is, however the easiest is the ADVANCE/DECLINE line. It measures what number of shares are going up versus down.

Listed below are the NDX & SPX (Redlines at backside). Each appear to be doing high quality

4. AI is a bubble!

The highest Three AI firms?

Microsoft $MSFT PE is 33, about its 10-year avg

$GOOG PE 27, under its 10-year avg

And Fb? $META is making a gift of their AI, making it open-source.

None of that sounds bubblicious…

5. Debt ceiling = catastrophe

I like Jim Bianco’s feedback that the media appears to suppose it’s a 50/50 proposition, however the implied likelihood of default in keeping with market costs is 3%.

[embedded content]

[embedded content]

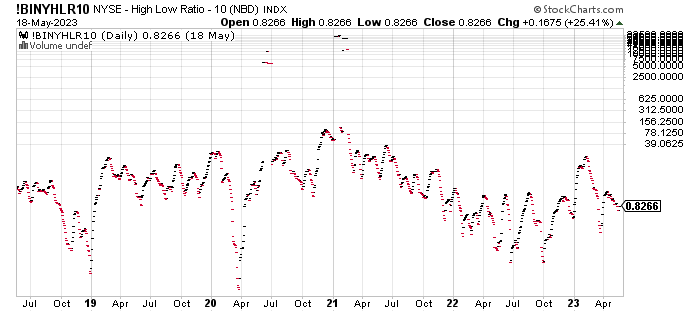

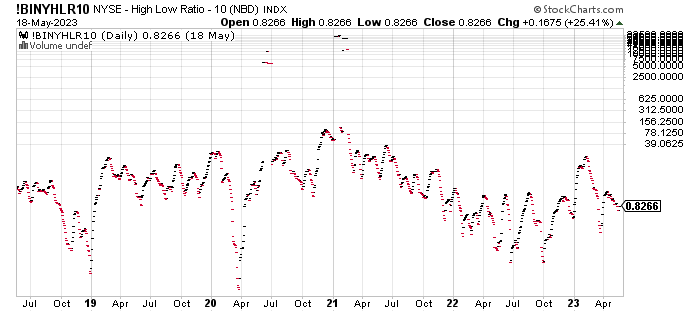

6. New lows are problematic

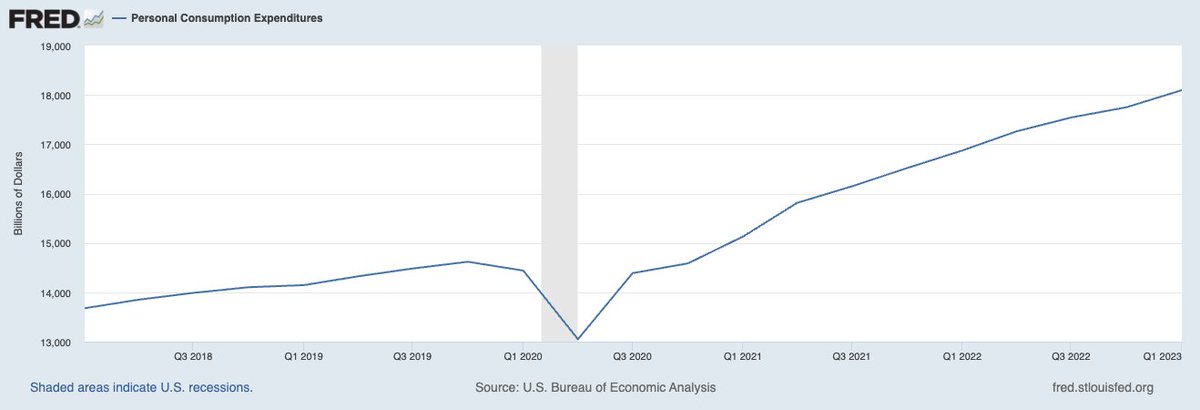

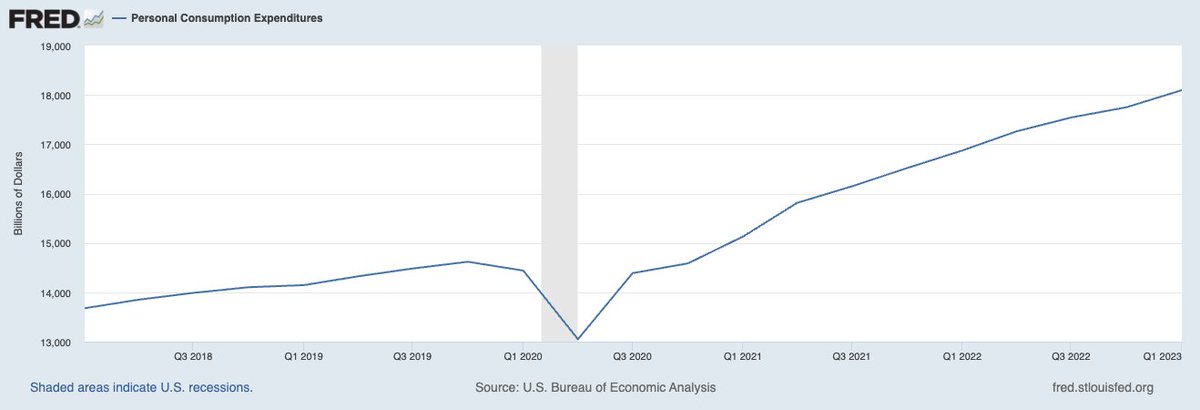

6. Customers are working out of cash (until we have a look at their spending)

Private Consumption Expenditures ( (Seasonally Adjusted Annual Fee)

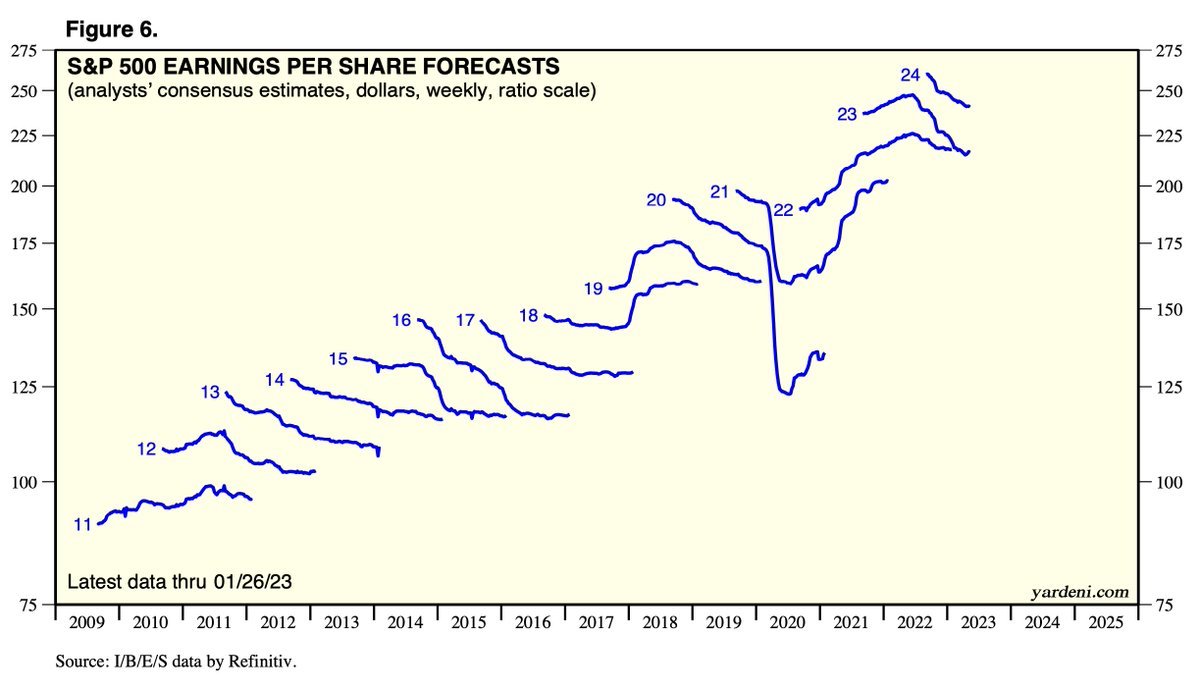

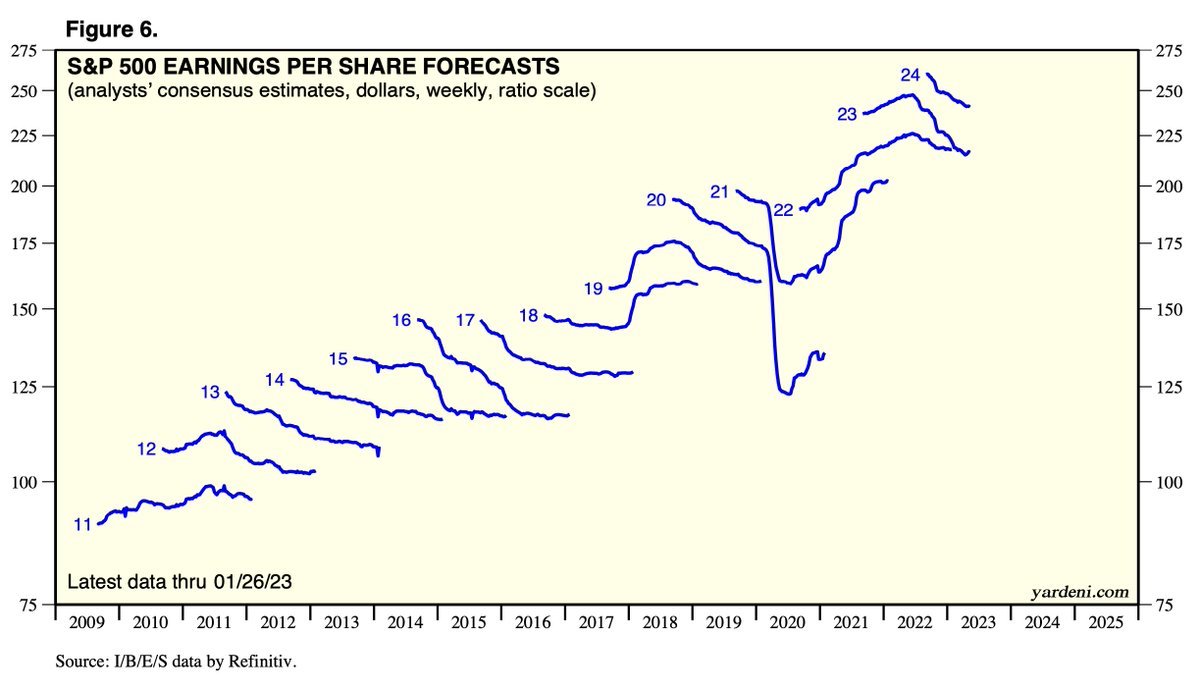

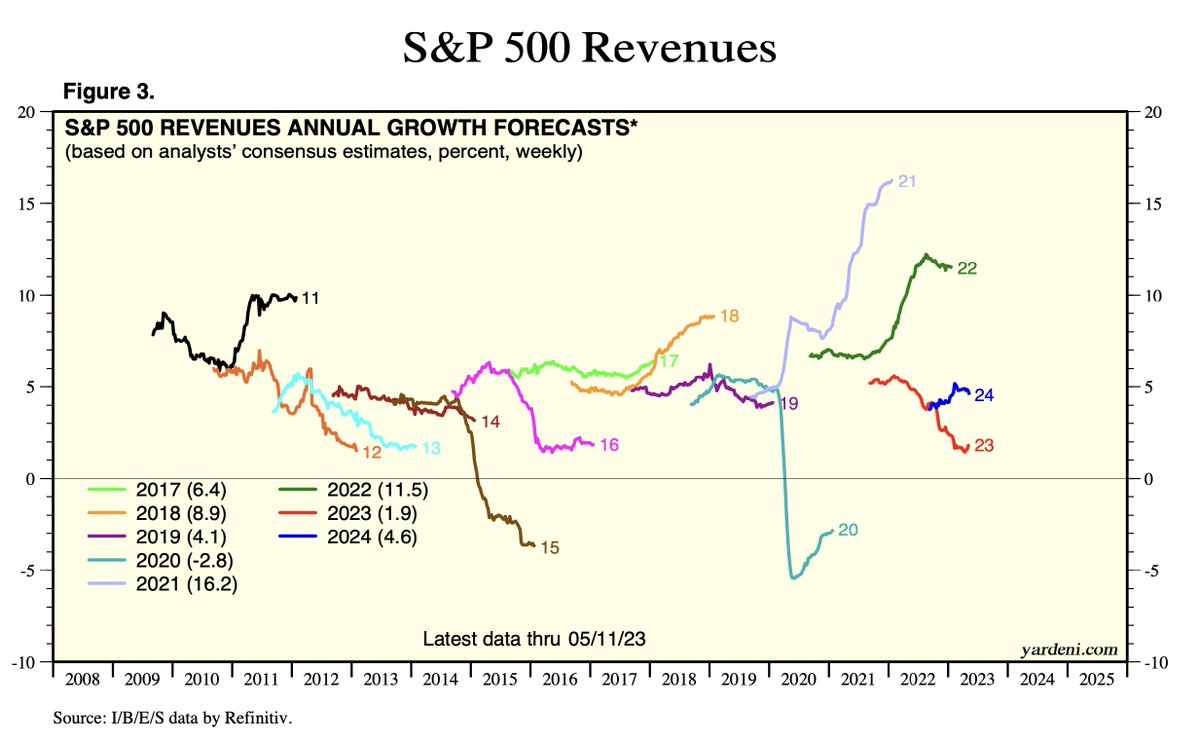

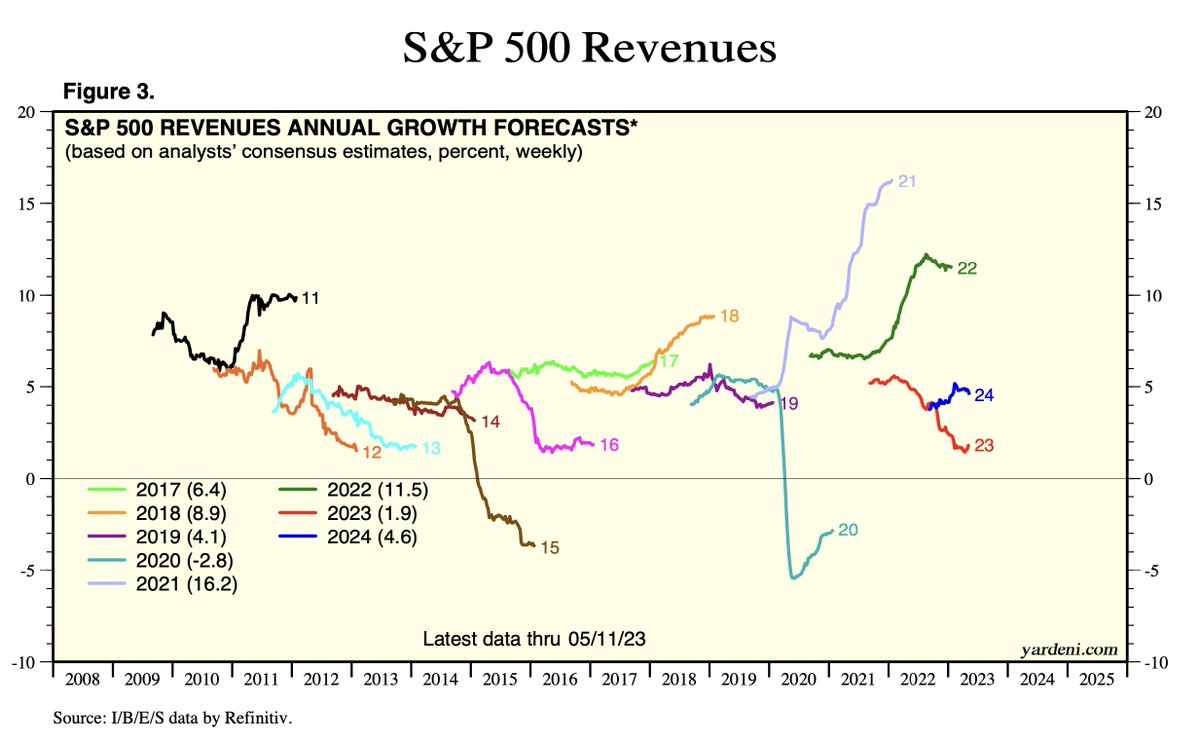

7. Earnings will fail THIS Q

Earnings forecasts are hilariously unsuitable more often than not, as are income forecasts…

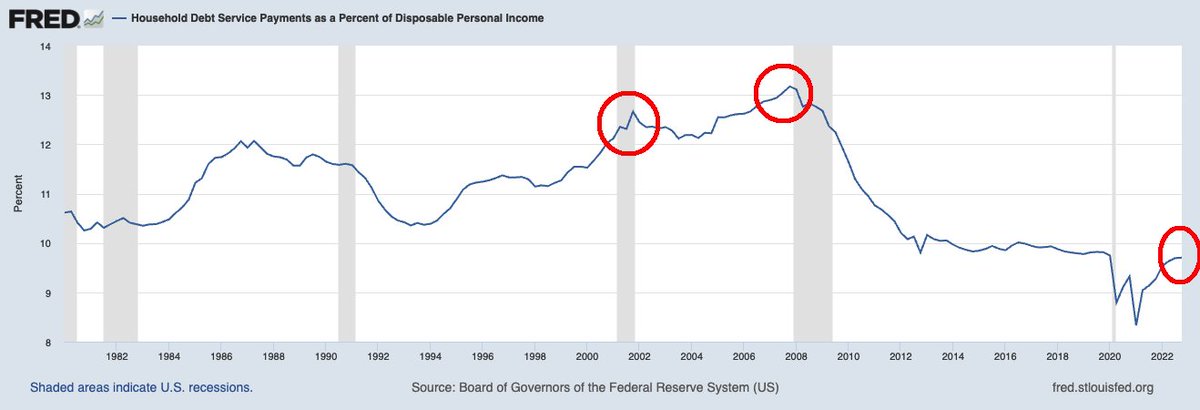

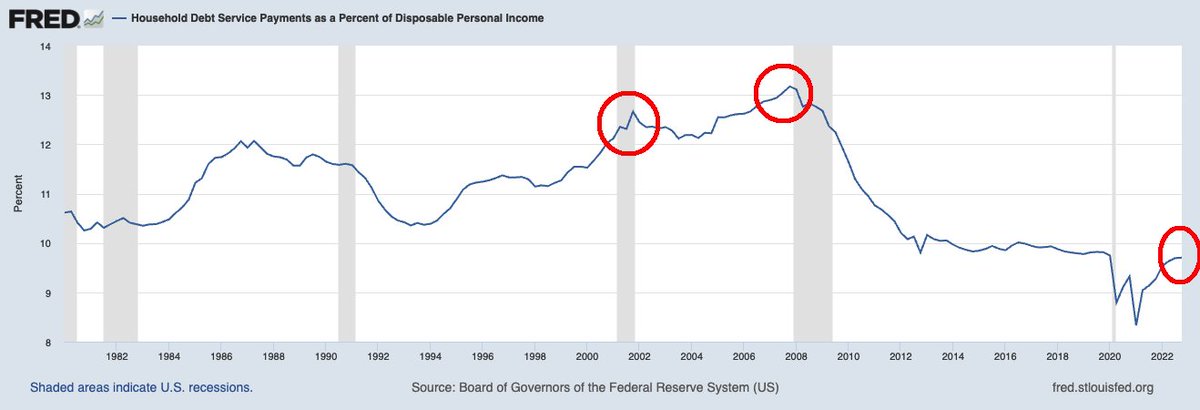

8. HH Debt!

American family debt could also be at document highs, however so too are Property and Incomes + the ratio between debt + revenue is close to document lows.

It’s not the overall debt however fairly the power to service these money owed that issues most…

As I hold saying, in the future, this cycle will finish, a recession to worse will happen, and the secular bull market that started in 2013 will finish. That day is just not right here but…

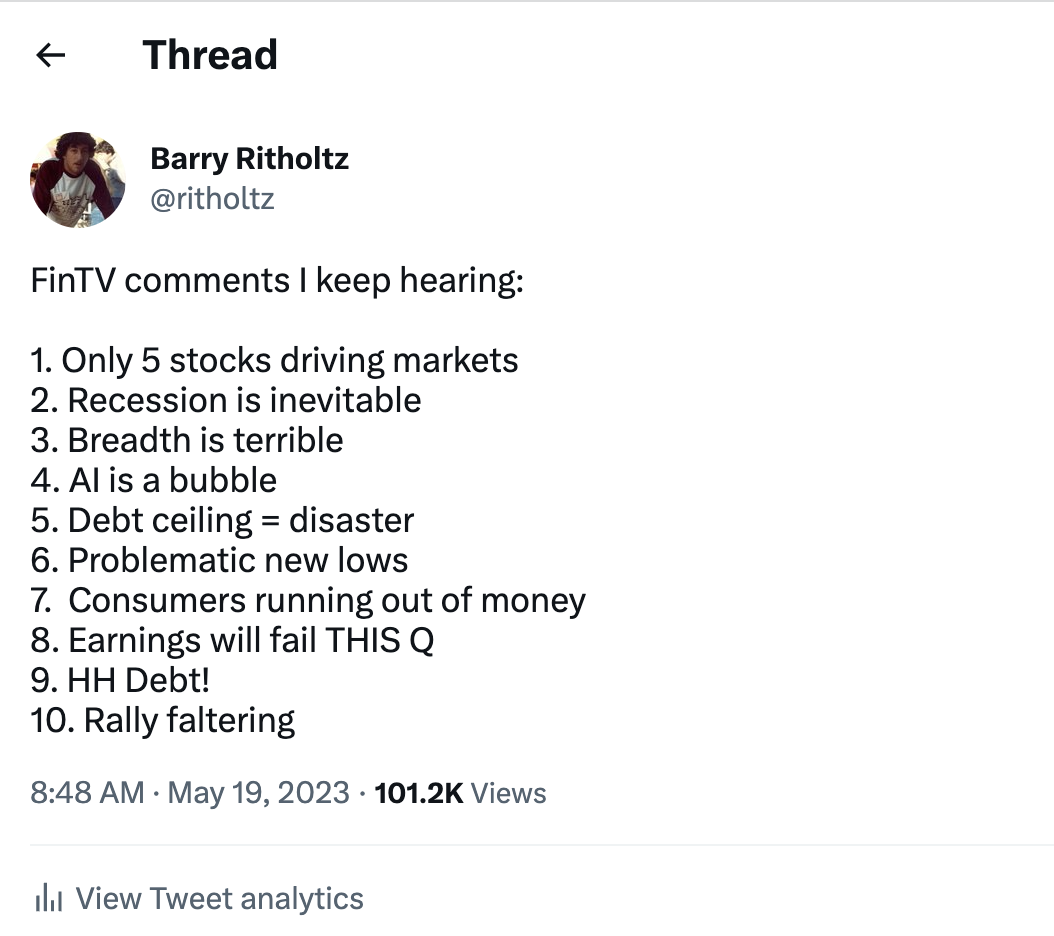

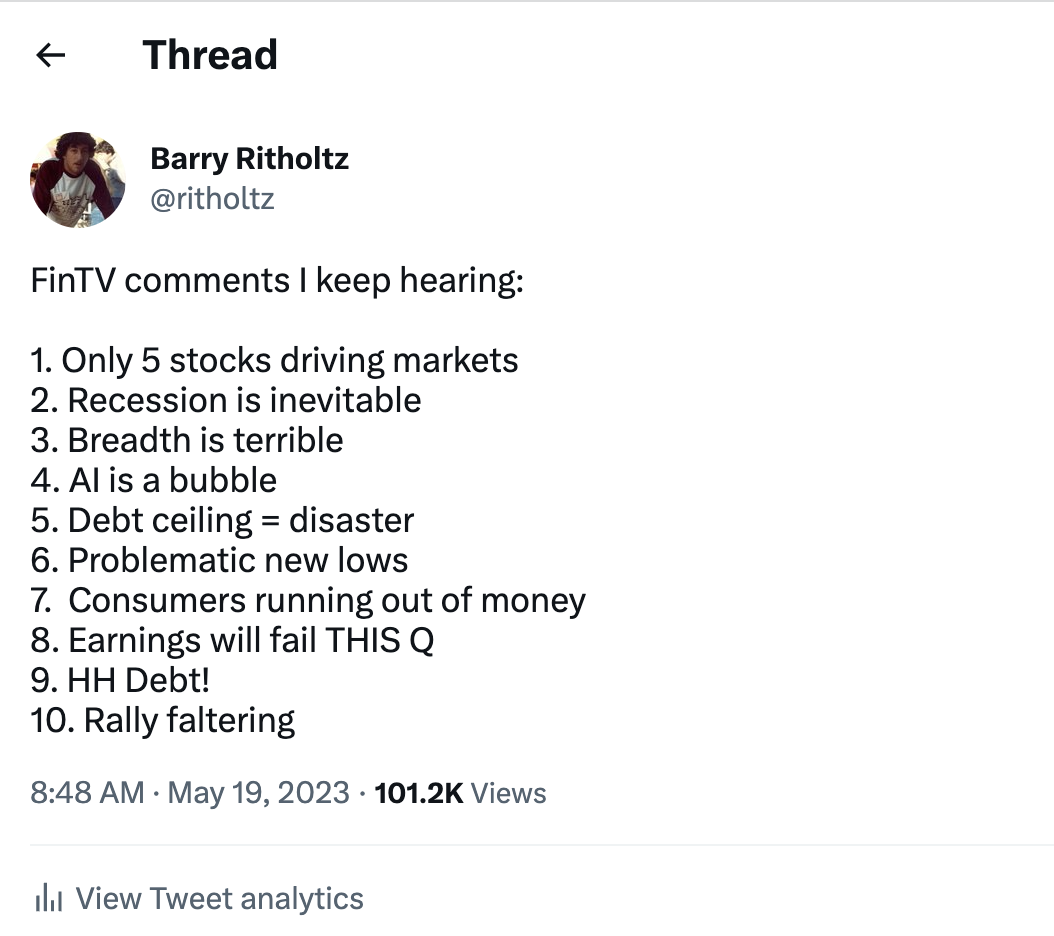

FinTV feedback I hold listening to:

1. Solely 5 shares driving markets

2. Recession is inevitable

3. Breadth is horrible

4. AI is a bubble

5. Debt ceiling = catastrophe

6. Problematic new lows

7. Customers working out of cash

8. Earnings will fail THIS Q

9. HH Debt!

10. Rally faltering— Barry Ritholtz (@ritholtz) Could 19, 2023