First, the excellent news: Client Worth Index (CPI) got here in modest at 0.4%, with a year-over-year print of 4.9%. I really like the Four deal with (!) and I count on CPI will proceed to fall over the subsequent few months. We’re prone to see a Three deal with earlier than Christmas, possibly even round Halloween.

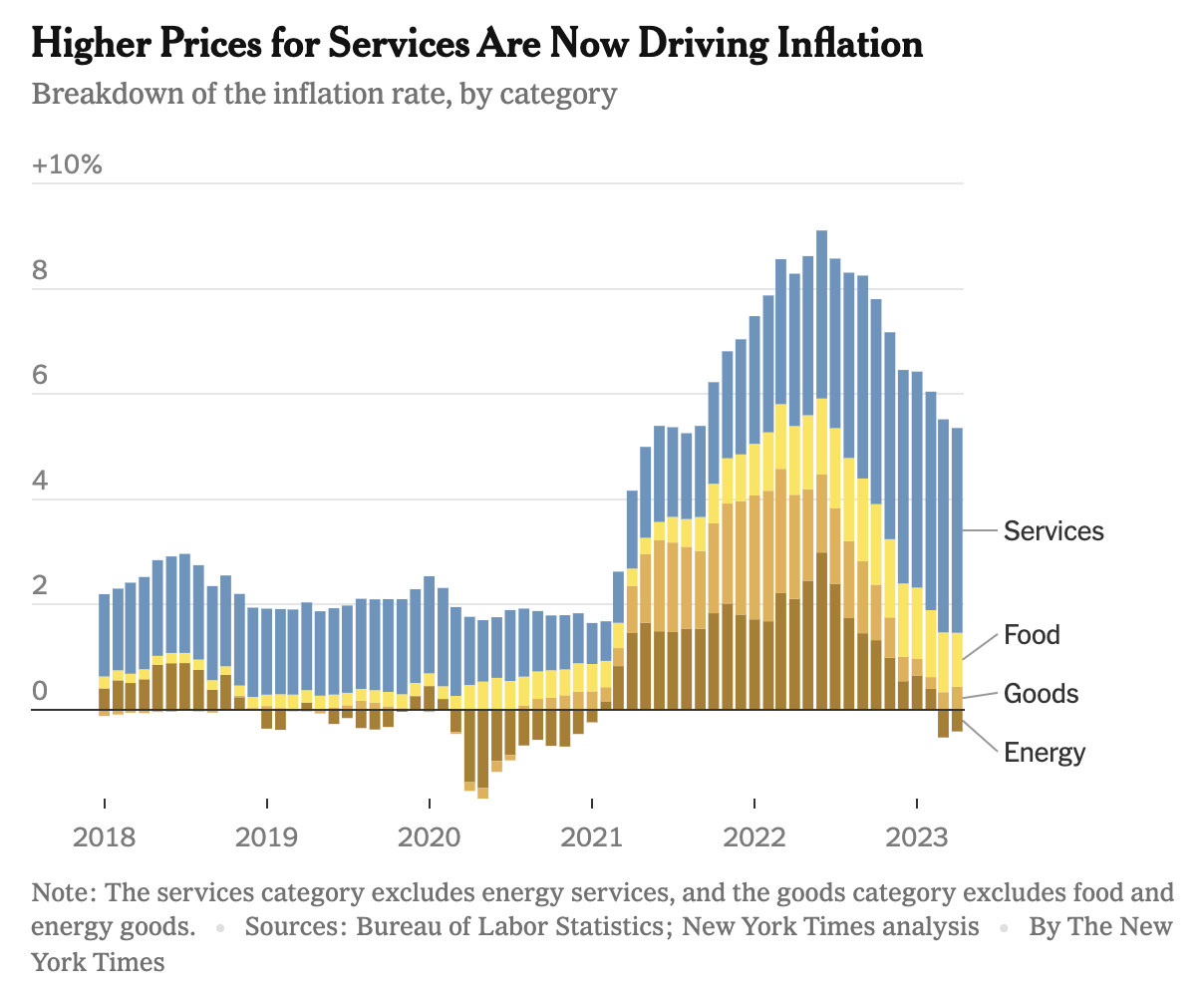

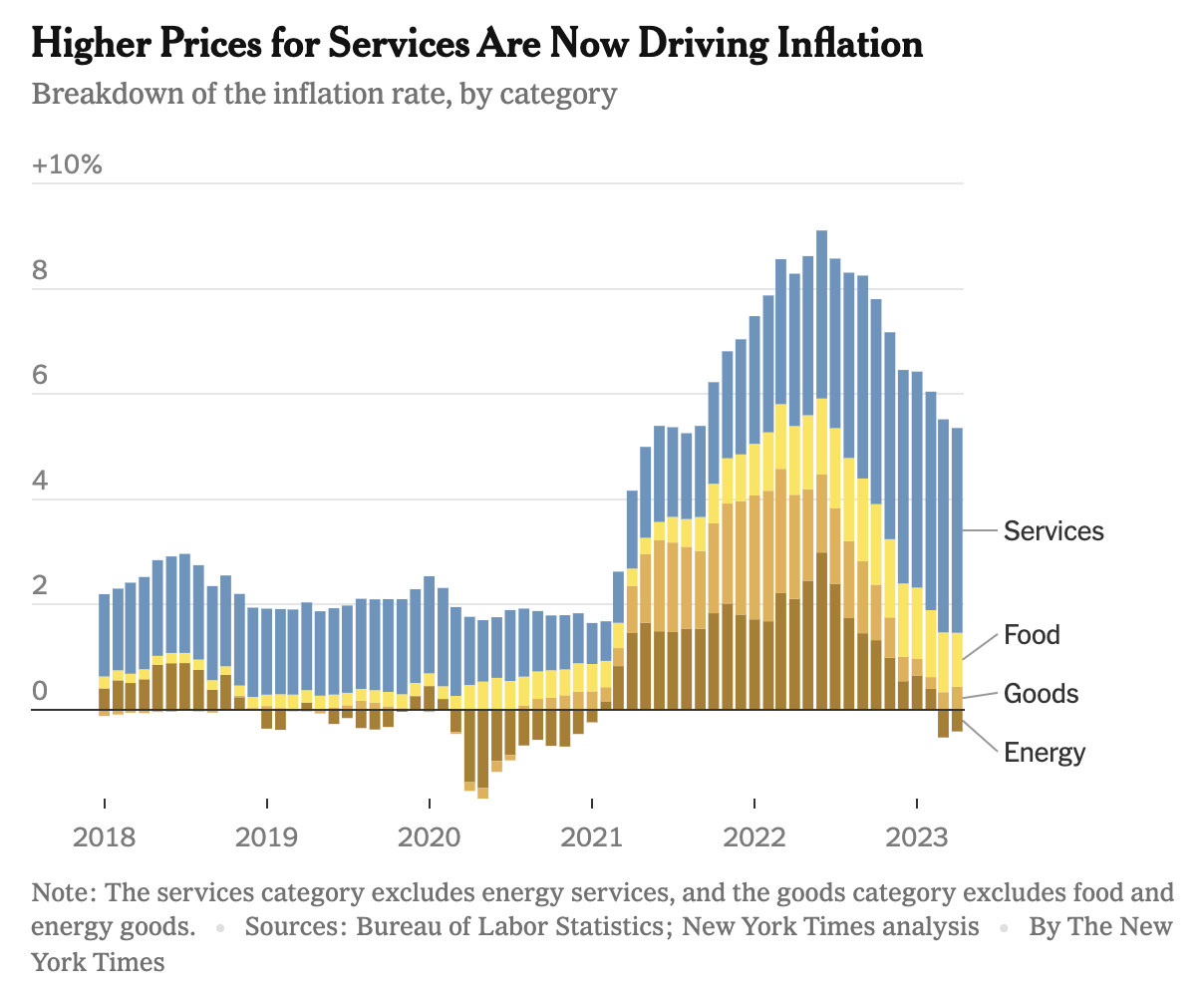

The inflation that appeared so pernicious in 2021 and into 2022 was pushed by the mixture of three issues:

– Distinctive pandemic elements

– Large financial stimulus (CARES ACT I, II & III)

– Structural (long-term) shortages in labor and single-family houses

The distinctive atmosphere of the COVID-19 lockdown for 18 months and the pent-up calls for that adopted its finish haven’t any comparables in historical past. No the present type of inflation is nothing just like the 1970s, neither is it just like what passed off within the mid-2000s.

This has been a novel and (dare I say it) unprecedented set of things which have despatched costs greater regardless of the intentions of the Federal authorities and the FOMC.

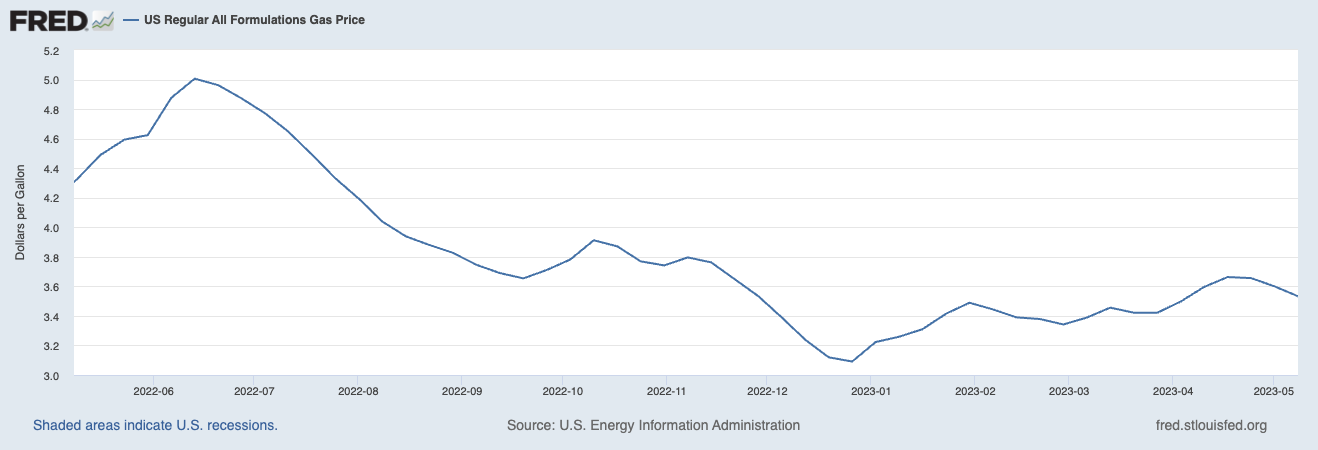

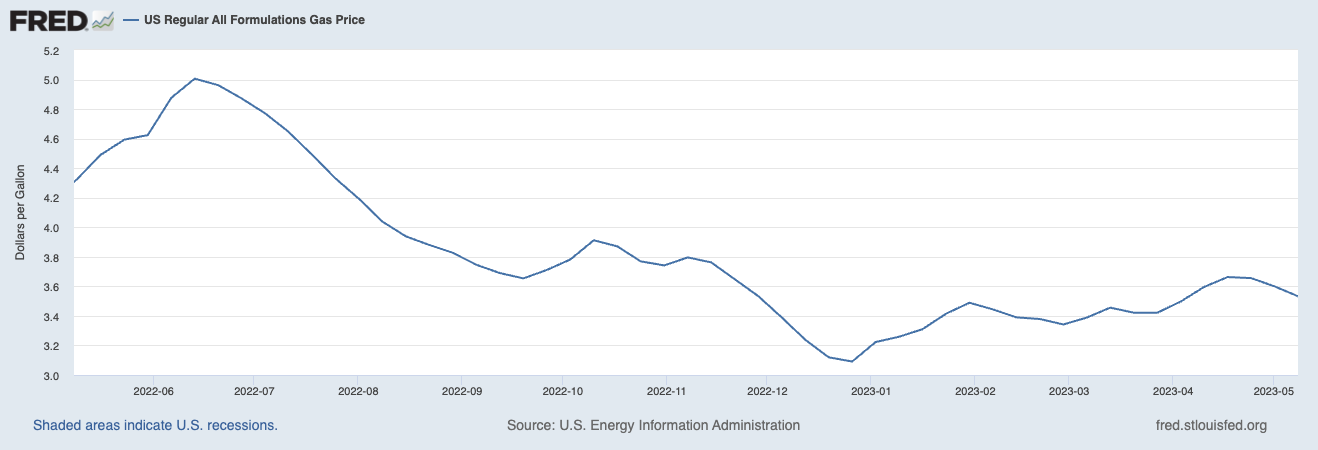

However CPI information is at all times lagging and backward-looking: Think about the massive risers in April have been shelter, used vehicles and vans, and gasoline.

Gasoline costs in April are far behind the curve, as oil costs fell under $70 this week. You’ll be able to see the general pattern in gasoline is decrease, with some volatility because the summer season driving season approaches.

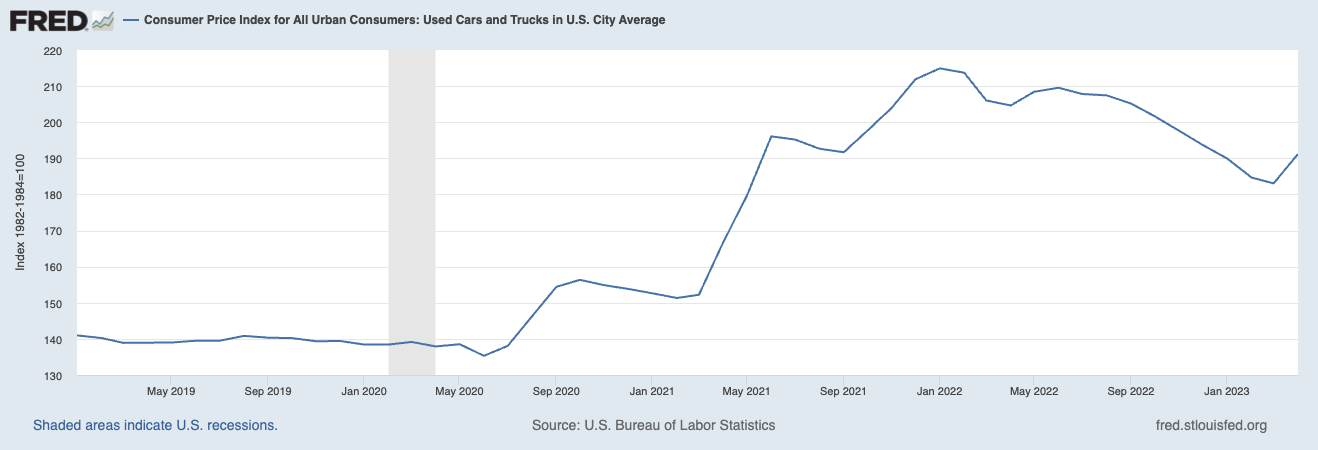

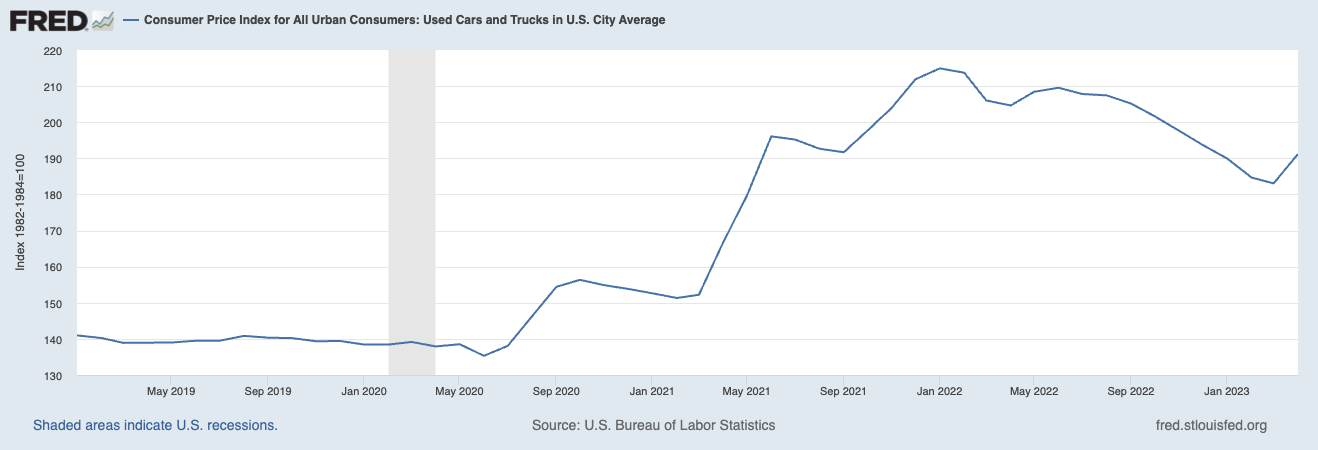

The identical is true for Used Vehicles and Vans, they’re nonetheless elevated because of the scarcity of latest vehicles which traces itself to the slowly easing provide shortages of semiconductors. However greater charges are sending them in the proper course.

Final, Shelter: It’s being pushed greater by the Fed itself, as they’ve despatched mortgage charges a lot greater thereby making rental charges greater.

The FOMC’s 2% inflation goal was a post-GFC, ZIRP/QE pushed creature throughout a interval of sluggish progress, no wage positive aspects, and 0 fiscal stimulus. Publish-lockdown, pent-up demand met huge fiscal stimulus — $Four trillion in three CARES acts, an infrastructure and an inflation invoice — to create a large surge of shopper spending. The post-pandemic financial system differs considerably from the 2010s.

The outdated regime of a 2% inflation goal is lifeless.

I might transfer the goalposts in the direction of a extra rational 3% over the subsequent 12 months. To get again to 2% inflation goal, the financial system would want some mixture of ZIRP, or greater unemployment, or greater than a gentle recession.

The Fed’s new motto must be: 3% or Bust…

Beforehand:

For Decrease Inflation, Cease Elevating Charges (January 18, 2023)

Press Pause (Could 3, 2023)

Transitory Is Taking Longer than Anticipated (February 10, 2022)

Who Is to Blame for Inflation, 1-15 (June 28, 2022)

How the Fed Causes (Mannequin) Inflation (October 25, 2022)