There’s an previous joke a few hypochondriac who is consistently complaining to his physician about his many quite a few, mysterious illnesses. The Doc runs a full battery of exams, and delivers the unhealthy information to the affected person:

“Sadly, every part is okay…”

And that appears to be the identical method lots of in the present day’s glass half-empty traders are digesting details about the markets. They’re in search of out a catastrophic, weeks left-to-live analysis for what – a minimum of thus far – has been an unusual quantity of market tumult.

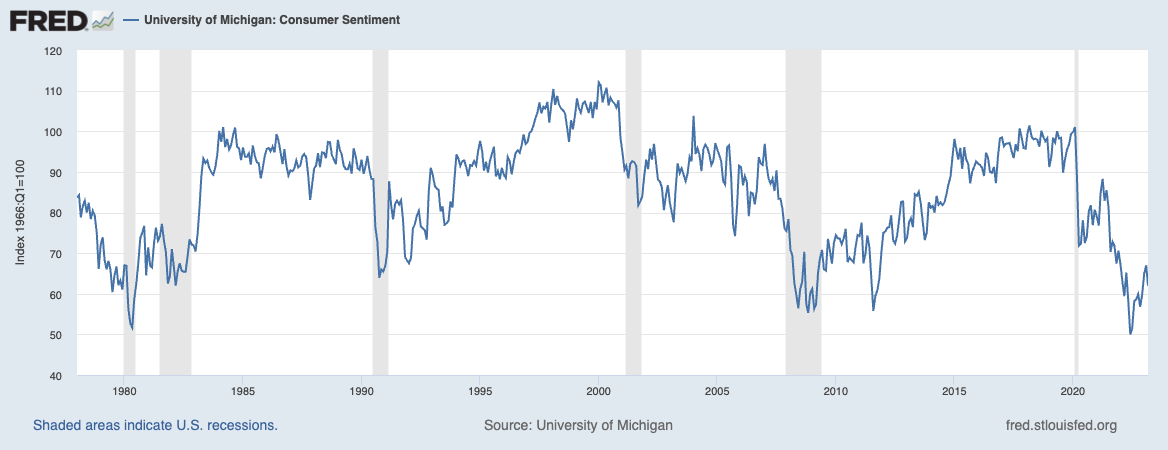

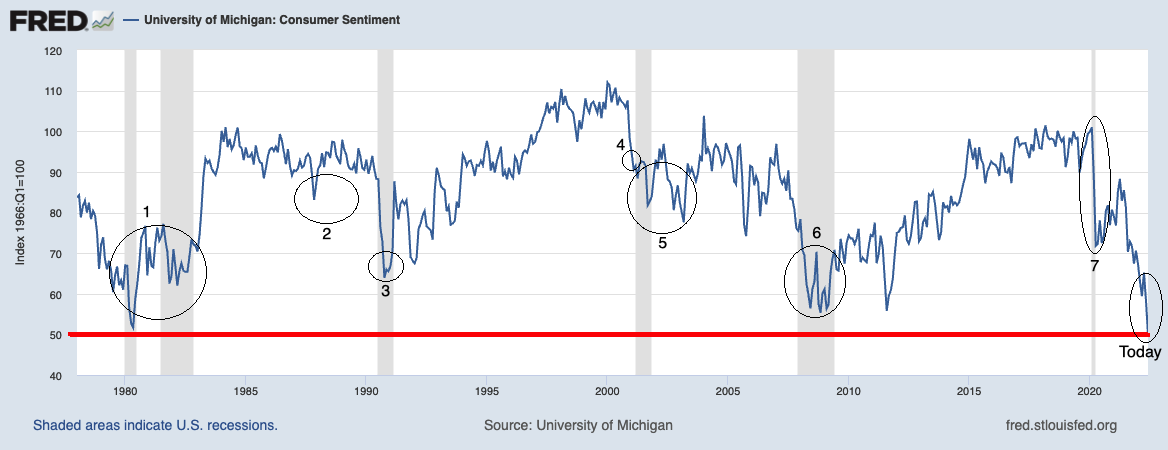

Is it honest to name in the present day’s traders hypochondriacs? Properly, given their near-hysterical ranges of sentiment – worse than the 1987 crash, the dotcom implosion, 9/11, and the GFC – I don’t imagine that’s an unfair comparability.

Contemplate:

– Unemployment at 3.4% is at 50-year lows;

– Pandemic induced Inflation appears to have peaked a few 12 months in the past;

– Earnings proceed to come back in at close to document ranges;

– Trillions in fiscal stimulus are nonetheless stimulating the financial system;

– Client spending close to recoird excessive ranges;

– The main cash heart banks are wholesome;

– The FOMC has knowledgeable us that they’re hitting pause on future charge hikes.

What in regards to the negatives?

– Regional banks proceed to lose belongings;

– Companies inflation stays sticky;

– 2 extra small banks blew up over the weekend;

– Concetrated Markets led by a small variety of large cap tech names;

– Market members expect a recession;

– Russia’s battle in Ukraine continues to tug on;

– Debt ceiling brinksmanship continues to threaten stability;

– Markets are basically flat over the previous 2 years.

Is the glass empty or half full?

Here’s a fast psychological train to assist you to function with out your hindsight bias getting in the way in which:

On the finish of 2022, an all-knowing market deity visits to tell you that just about midway by way of the 12 months, 1) Charges might be appreciably increased; 2) Three of the largest financial institution failures in U.S. historical past will happen; 3) The U.S. might be on the verge of defaulting on its debt; 4) A number of high-flying shares will disappoint on earnings and see a considerable decline in value.

Given all that, is your fairness stance bullish or bearish on January 1?

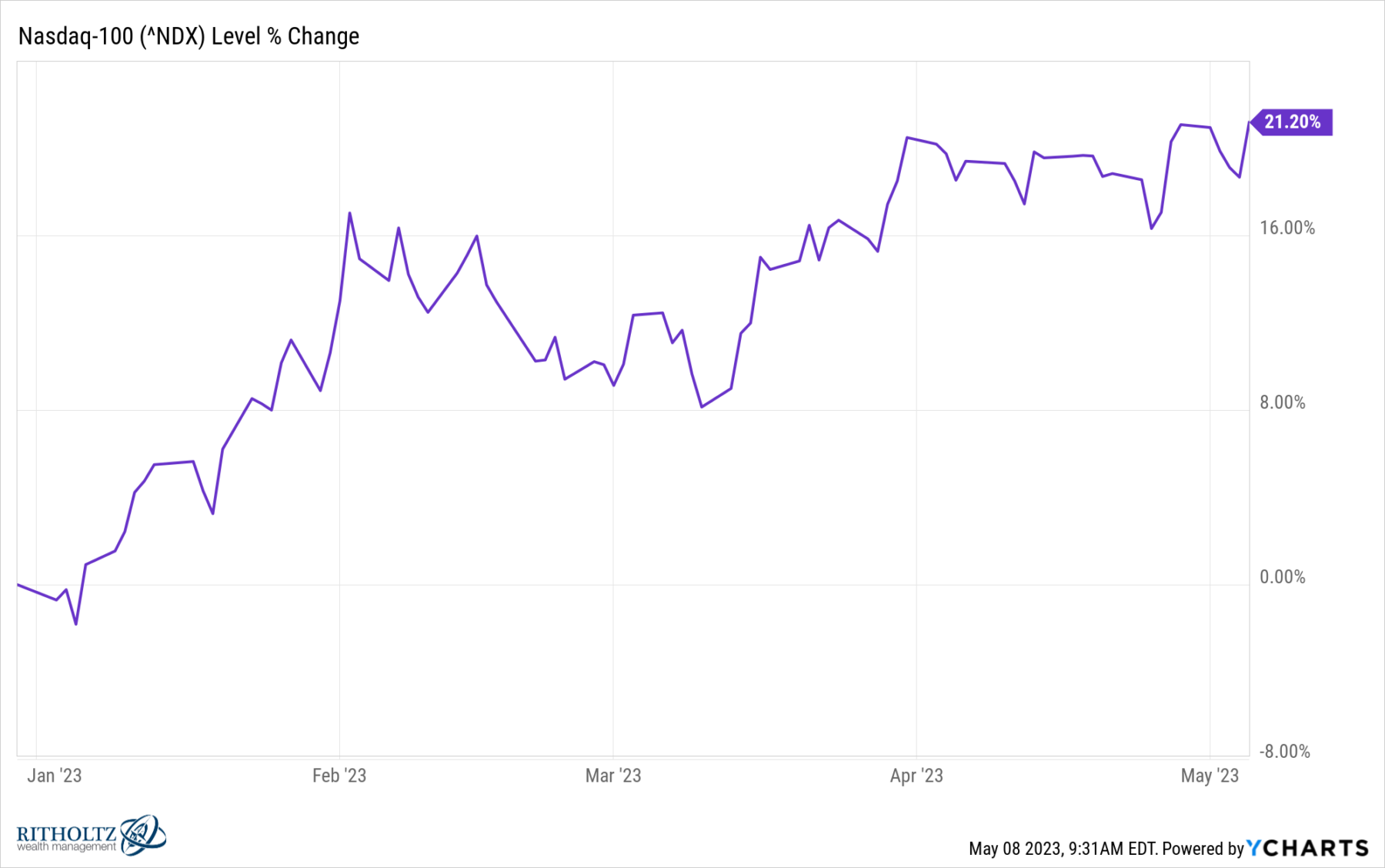

In the event you say bullish, get the hearth extinguisher, as a result of your pants are possible in flames. As of this writing, the S&P 500 is up 7.73% YTD, whereas the Nasdaq 100 is up 21.2% over the identical time interval. That’s damned good given the parade of horrible laid out above. I don’t ascribe to the Panglossian view that shares all the time go up over the long term and due to this fact you must ignore any and all considerations, together with those above. As I’m keen on mentioning, someday this rally will finish, the market cycle will flip and the following actually damaging period will start.

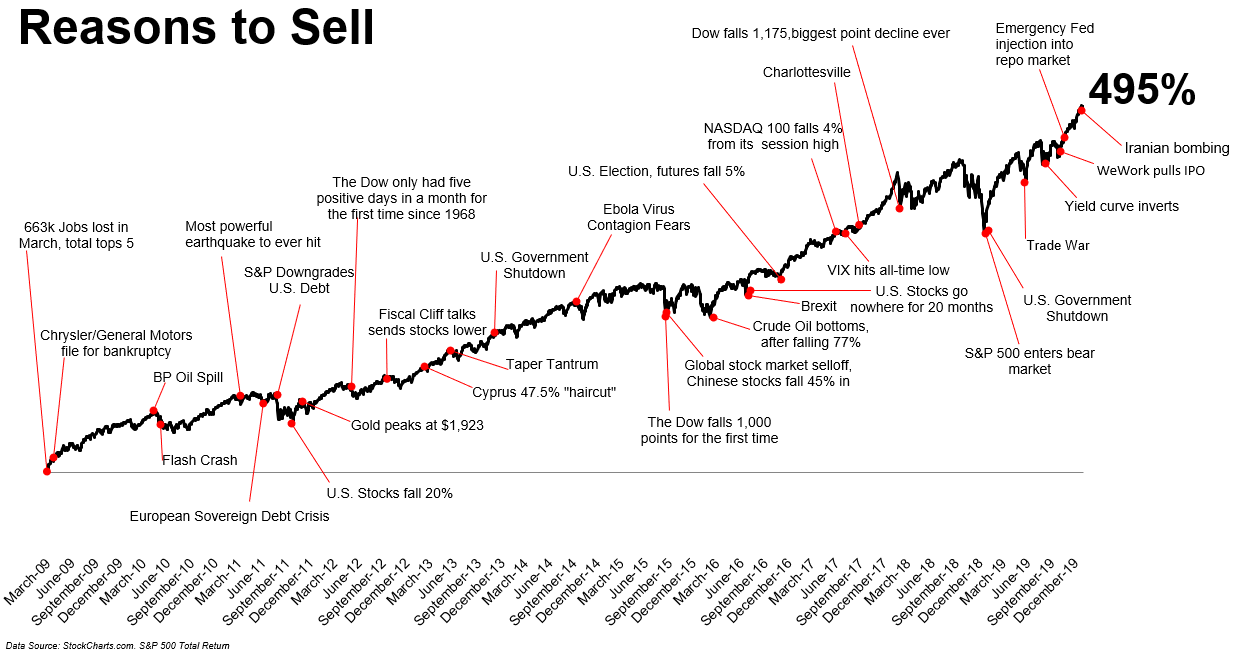

However one thing is all the time breaking, and there are all the time issues to fret about, because it appears that there’s all the time some challenge on the sting of catastrophe. Even excellent news may be problematic: When every part goes nice, stability can beget complacency, extra hypothesis, and finally, instability.

I believe it’s an uncommon mixture of modern-era components — social media, partisanship, and even frustration with the accelerating tempo of change– which can be what is generally driving this damaging sentiment. Numerous individuals say they’re damaging on equities, and but equities proceed to do fairly effectively regardless of — or is it due to — the entire unhealthy information.

Maybe too many traders are specializing in the improper query: As a substitute of asking your self “What’s the unhealthy information?” it’s extra helpful to ask “How a lot of the unhealthy information is already mirrored in market costs?”

As we’ve got identified over time, there are all the time causes to promote shares. The issue is that more often than not, these are unhealthy causes…

Supply: Irrelevant Investor

Beforehand:

One-Sided Markets (September 29, 2021)

Is Partisanship Driving Client Sentiment? (August 9, 2022)

Sentiment LOL (Could 17, 2022)

How Information Seems to be When Its Previous (October 29, 2021)