One of many core philosophical beliefs I maintain pricey is that the longer term is inherently unknown and unknowable. This tends to be true for the overwhelming majority of individuals practically the entire time.

The world is filled with infinite, random, often-invisible elements we’re unfamiliar with that significantly influence outcomes.

Our personal psychology works towards our understanding this: Our hindsight bias permits us to see these unknowable outcomes with excellent after-the-fact readability; that fools us into believing our prior expectations turned out to be right once they had been nothing of the kind. We selectively recall our brilliance relating to market calls and inventory picks whereas conveniently forgetting the failures. The occasional correct forecast – no matter whether or not the results of talent or luck – fools us into confidently believing that we can also predict the longer term.

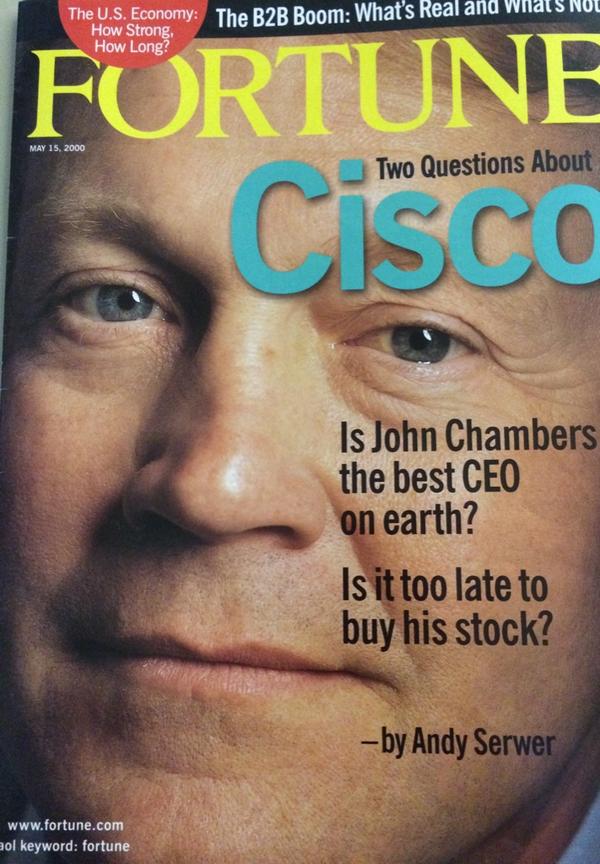

Which leads us to at the moment’s pleasant cowl story: Cisco Programs and its sensible CEO, John Chambers.

23 years in the past at the moment, Fortune journal’s cowl story about networking gear maker Cisco was revealed. The duvet asks two questions on Cisco:

1.”Is John Chambers the Greatest CEO On Earth?” and

2. “Is it too late to purchase his inventory?”

Somewhat than cherry-picking essentially the most egregious quote from the article, enable me to share the opening paras:

“Suppose you had been stranded on a abandoned island and will personal only one single inventory. What wouldn’t it be? Give it some thought for a minute. Would it not be a inventory that’s been battered this spring and is down 20% from its excessive? A inventory that trades at greater than 100 instances earnings? A inventory that’s already climbed round 100,000% since going public ten years in the past, that’s already loved one of many best rides in inventory market historical past? The inventory of an organization that now faces unprecedented challenges in robust new markets dominated by the likes of Lucent and Nortel, plus a posse of red-hot upstarts?

Yup, that might be the inventory. Irrespective of how you narrow it, you’ve bought to personal Cisco.” (emphasis added)

I’m hard-pressed to discover a main journal cowl story that was each extra correct in its evaluation of a supervisor — Chambers was an excellent CEO — and fewer correct in regards to the prospects for the corporate’s inventory. A number of charts from that period reveal simply how misguided this story was.

Contemplate why Cisco was the duvet story — it was one of the vital profitable firms on earth: The 1990s had been good for the networking gear firm, whose routers and different {hardware} had been snapped up by web suppliers. By the point this landed on the duvet of Fortune on Might 15, 2000, the worth of $CSCO was making all-time highs, and it was predicted the corporate would turn out to be the primary trillion-dollar market-cap agency in historical past.

Alas, it was not meant to be.

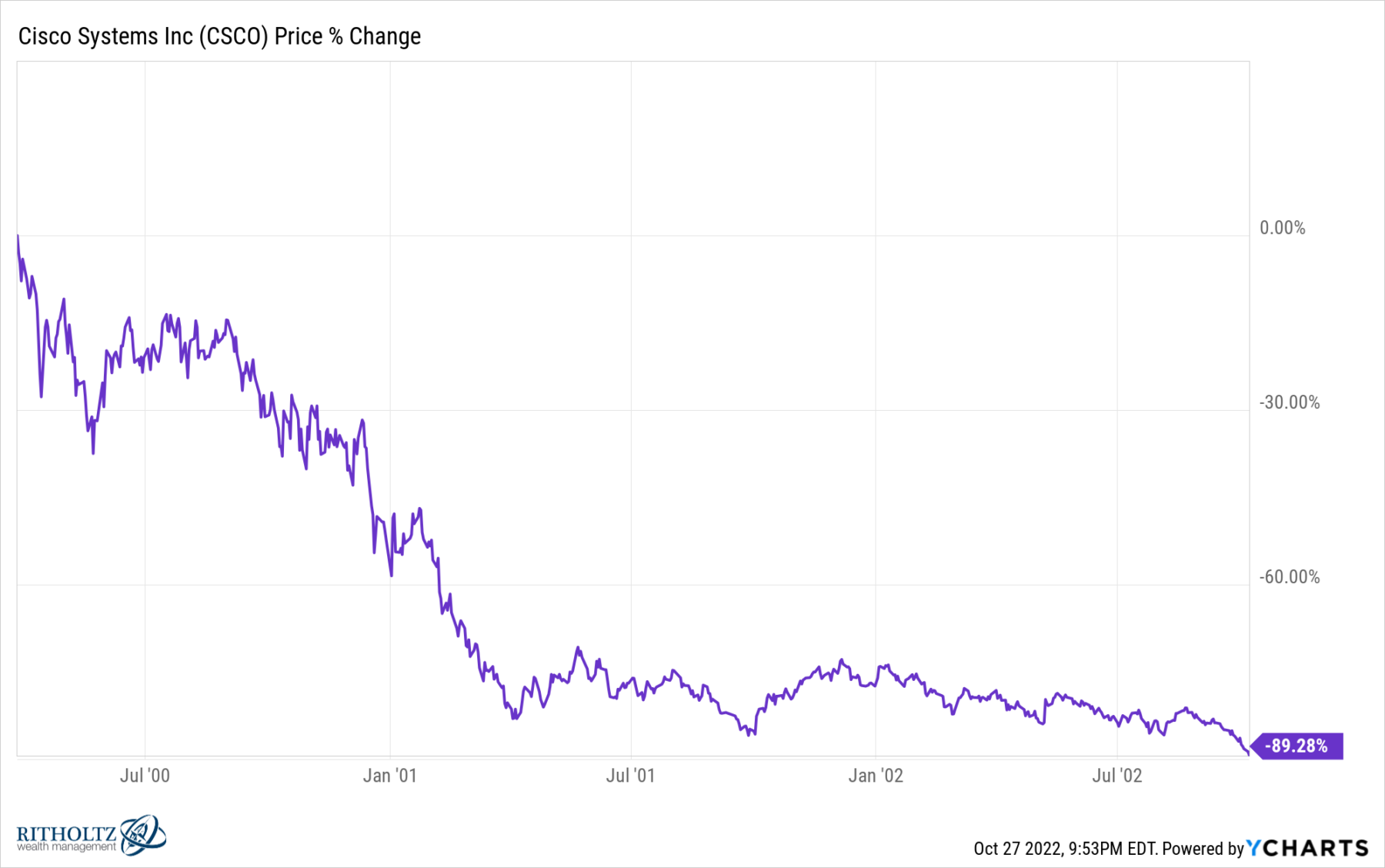

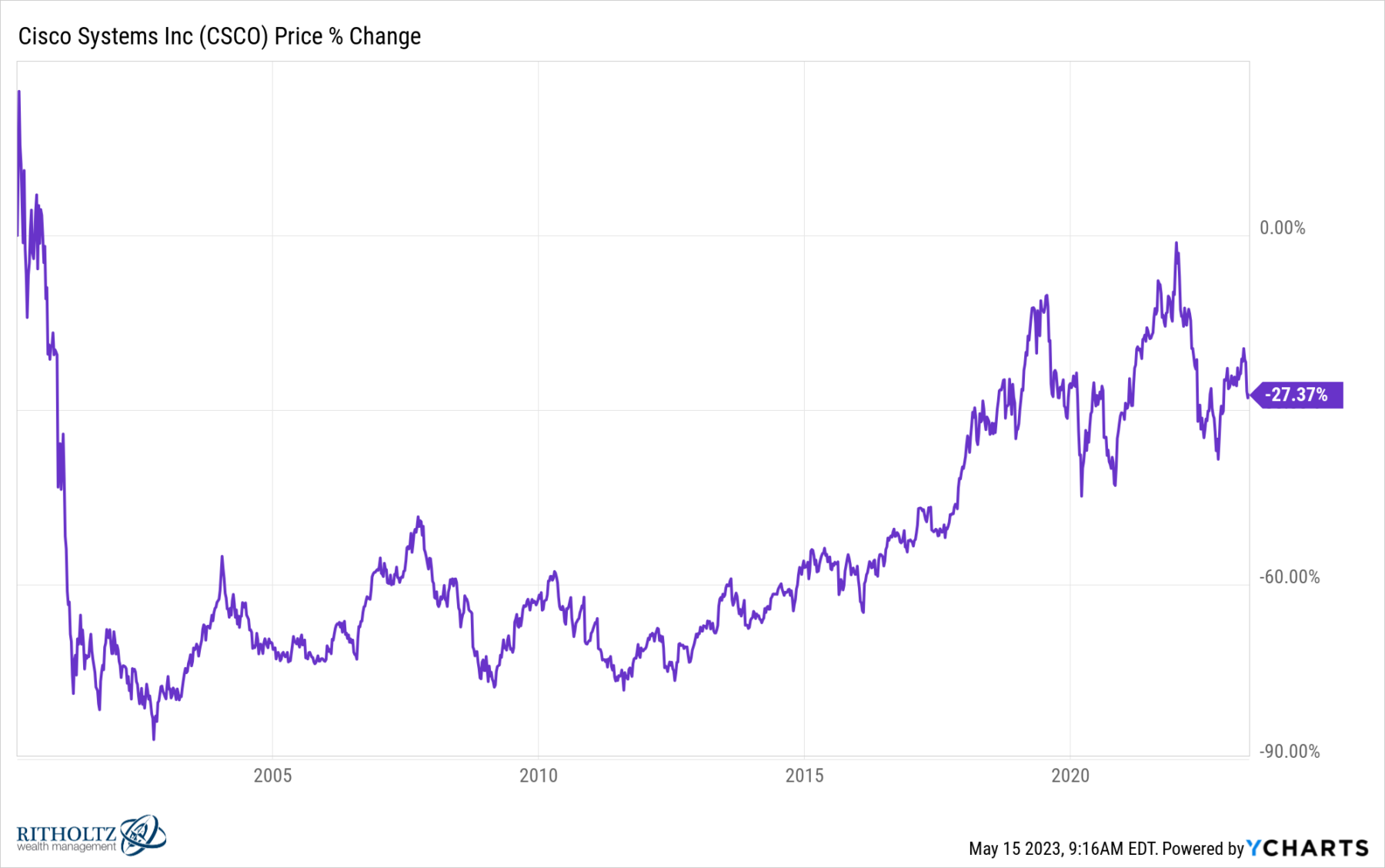

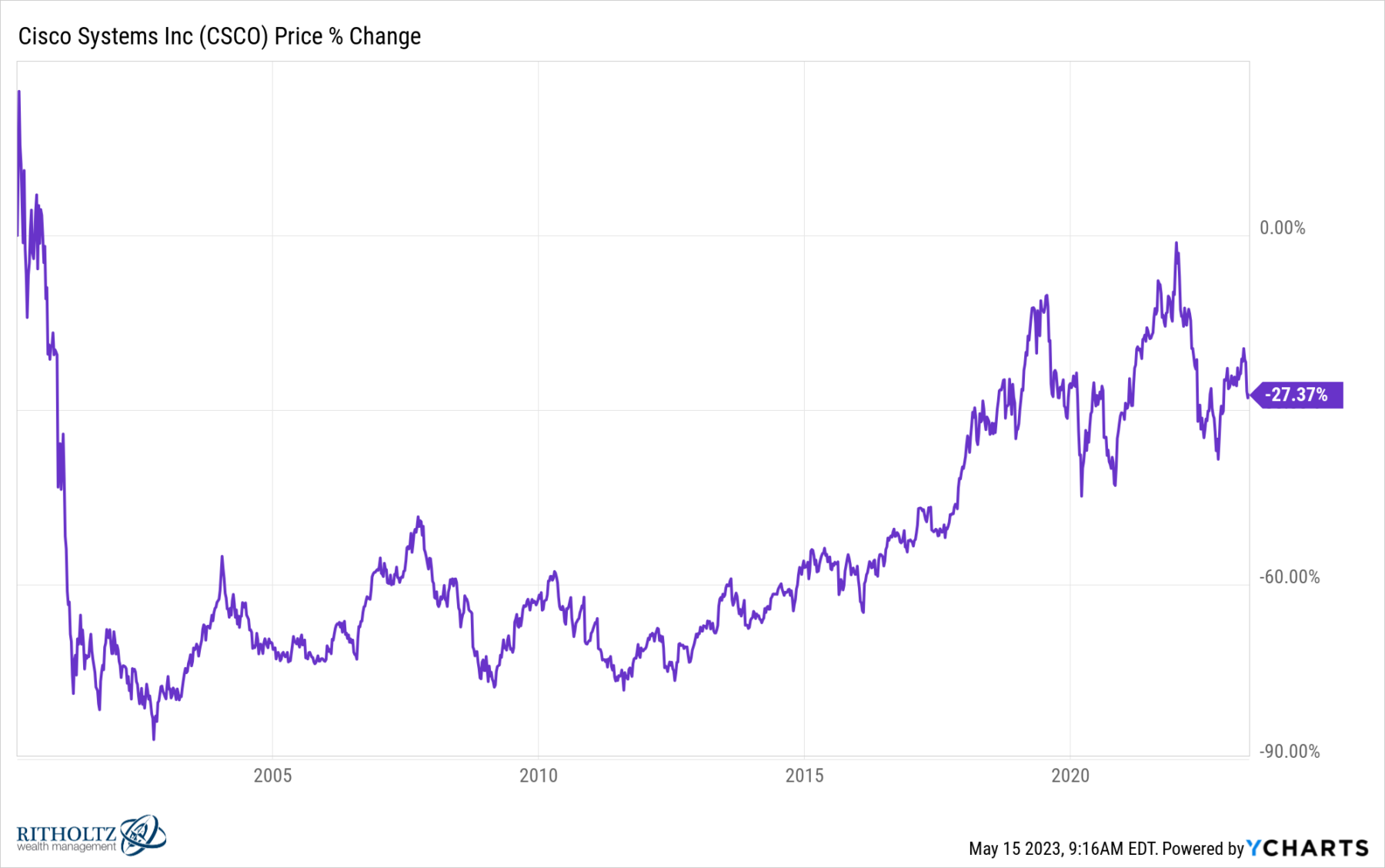

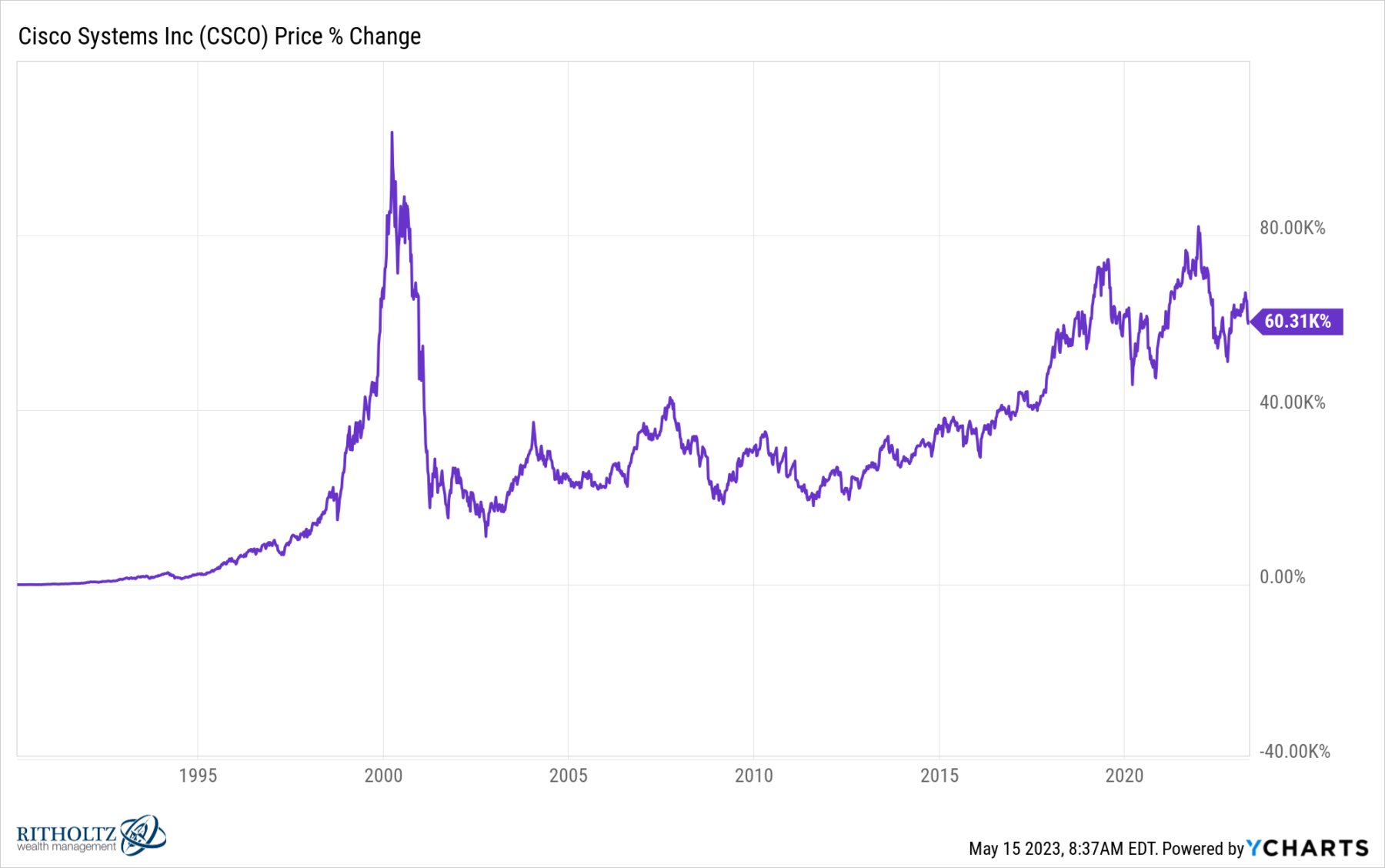

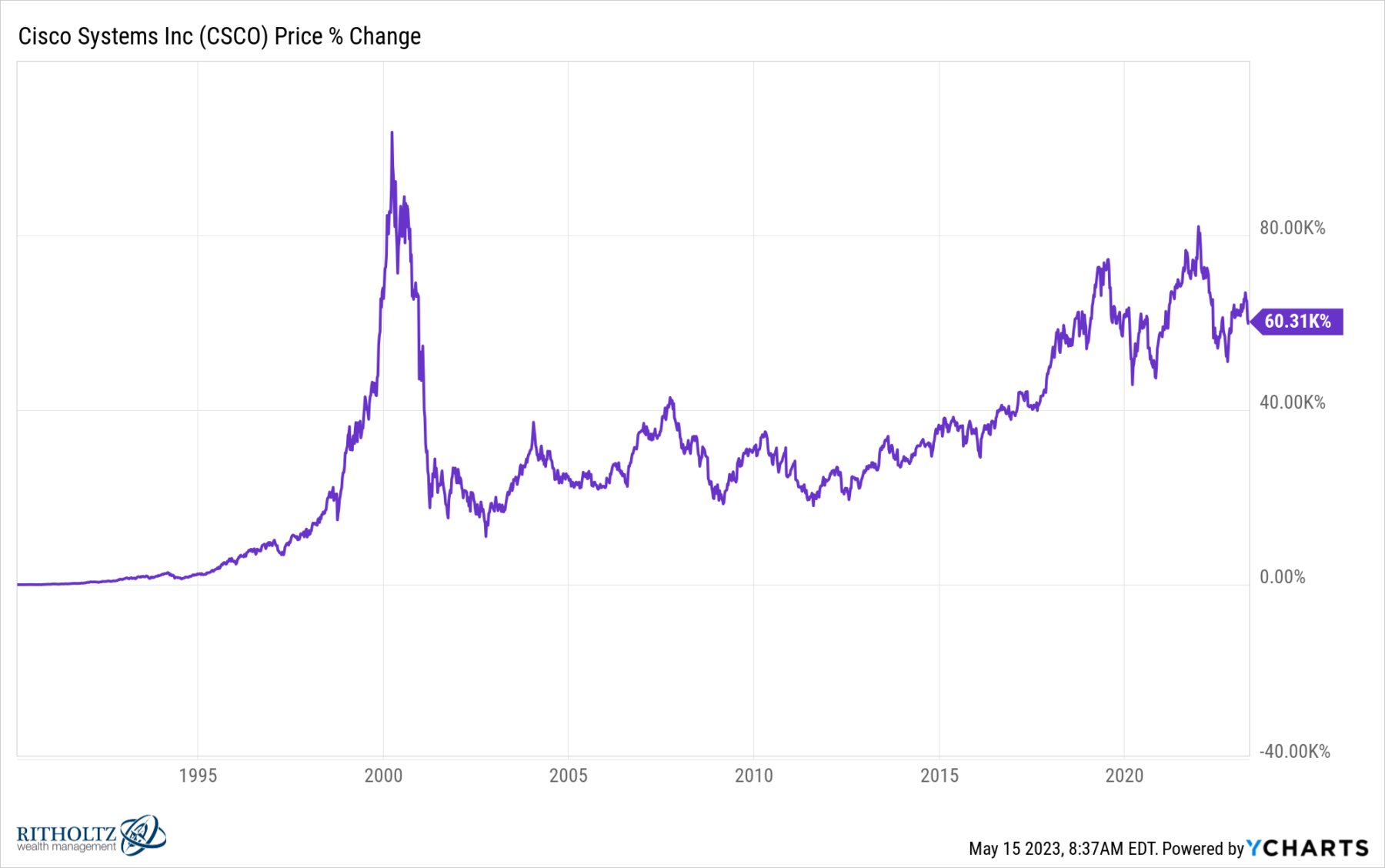

On March 27th, 2000, a mere 2 weeks after this story was revealed, the inventory peaked. It has been one of many poorest performers on the Nasdaq ever since. By the point the (then tech-focused) index made its low in October 2002, CSCO had plummeted 85.7% (89.3% from its ATH)

It didn’t fairly get to a trillion both, peaking a little bit greater than midway there, at $556.74B.

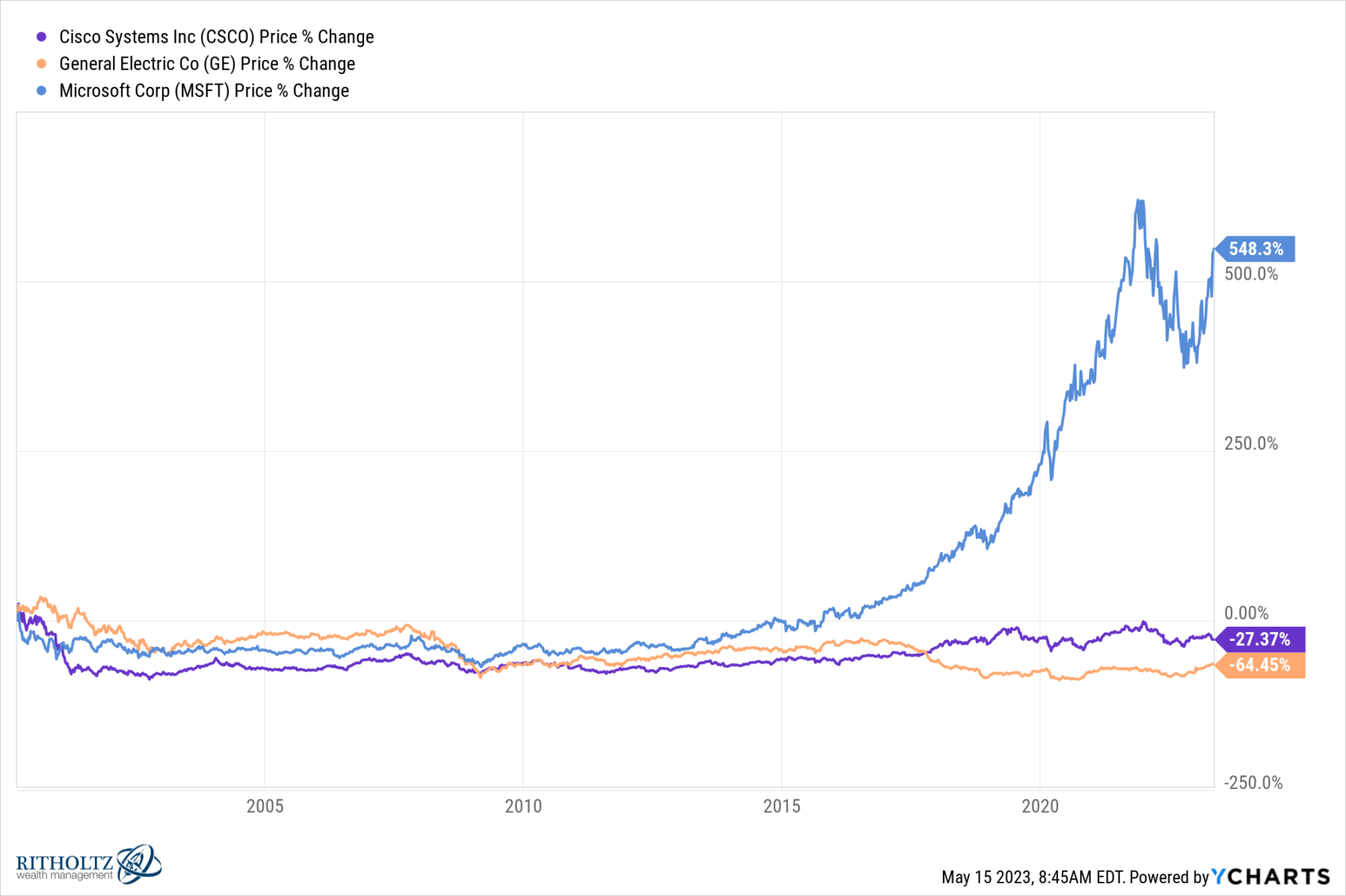

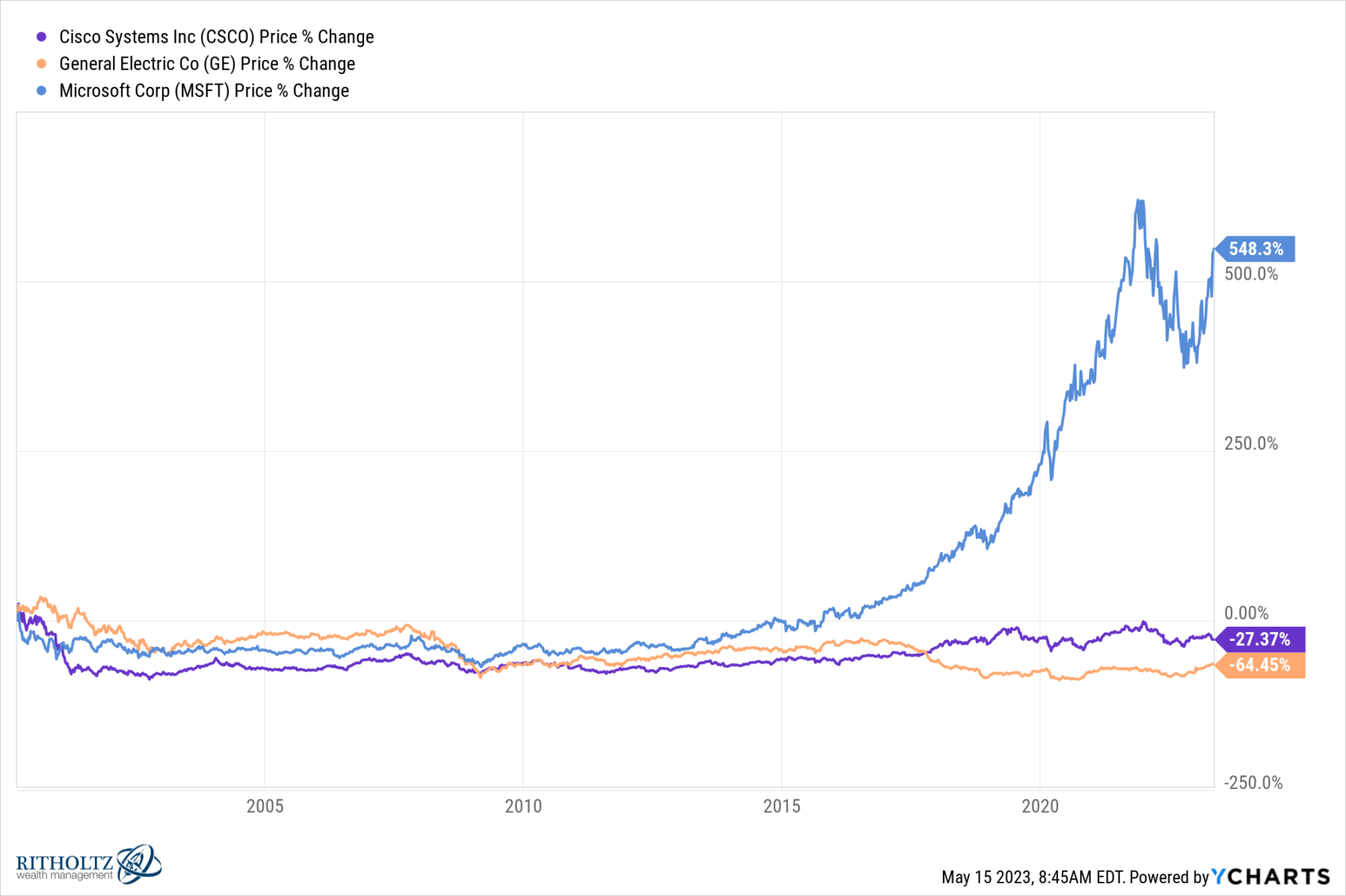

The article picks CSCO over MSFT and GE. Of the three, it did the poorest; this was extra dart-throwing contest dressed up as inventory evaluation. Microsoft has demolished CSCO since then, whereas GE did considerably worse over the following 23 years, however…

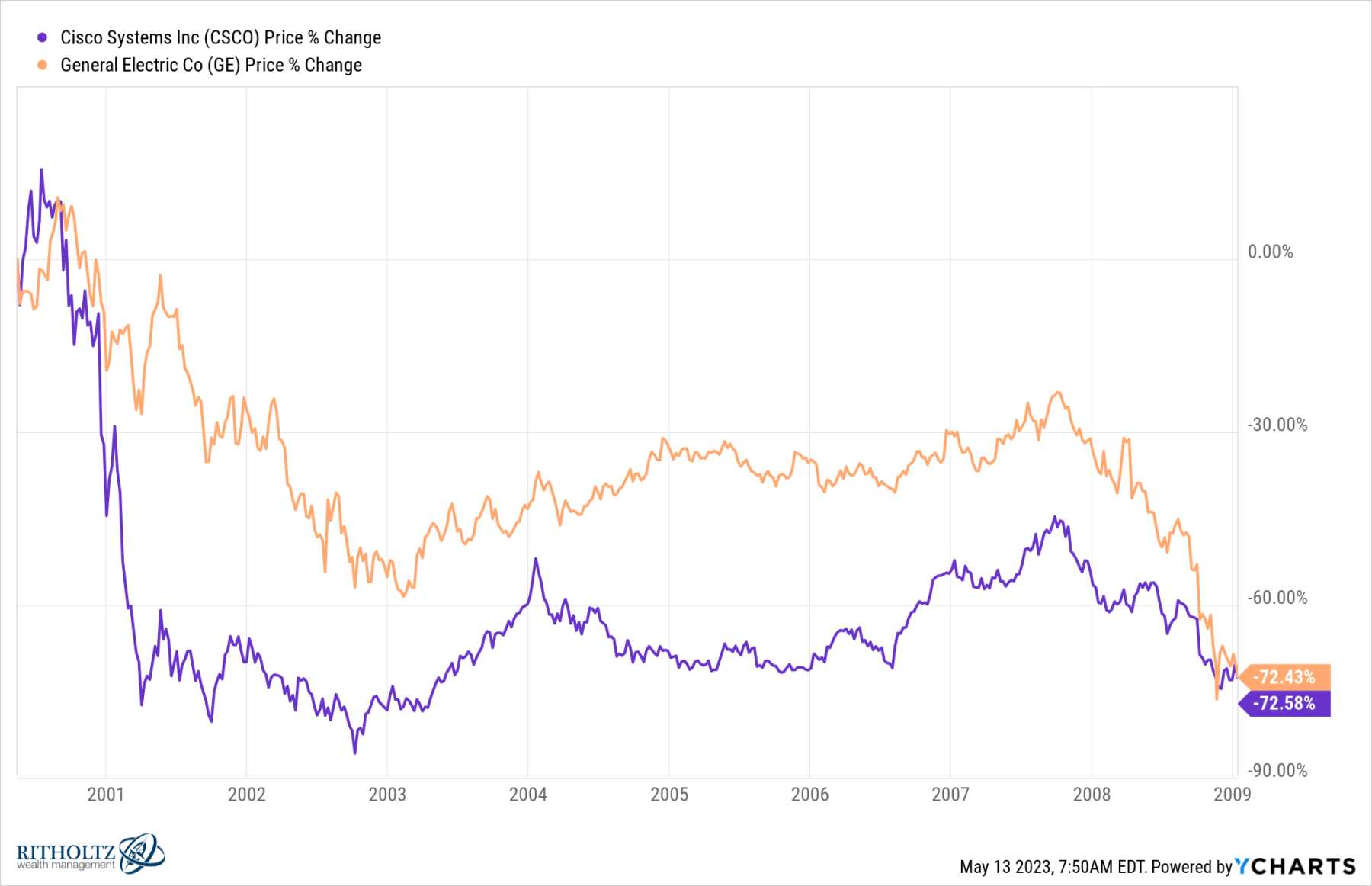

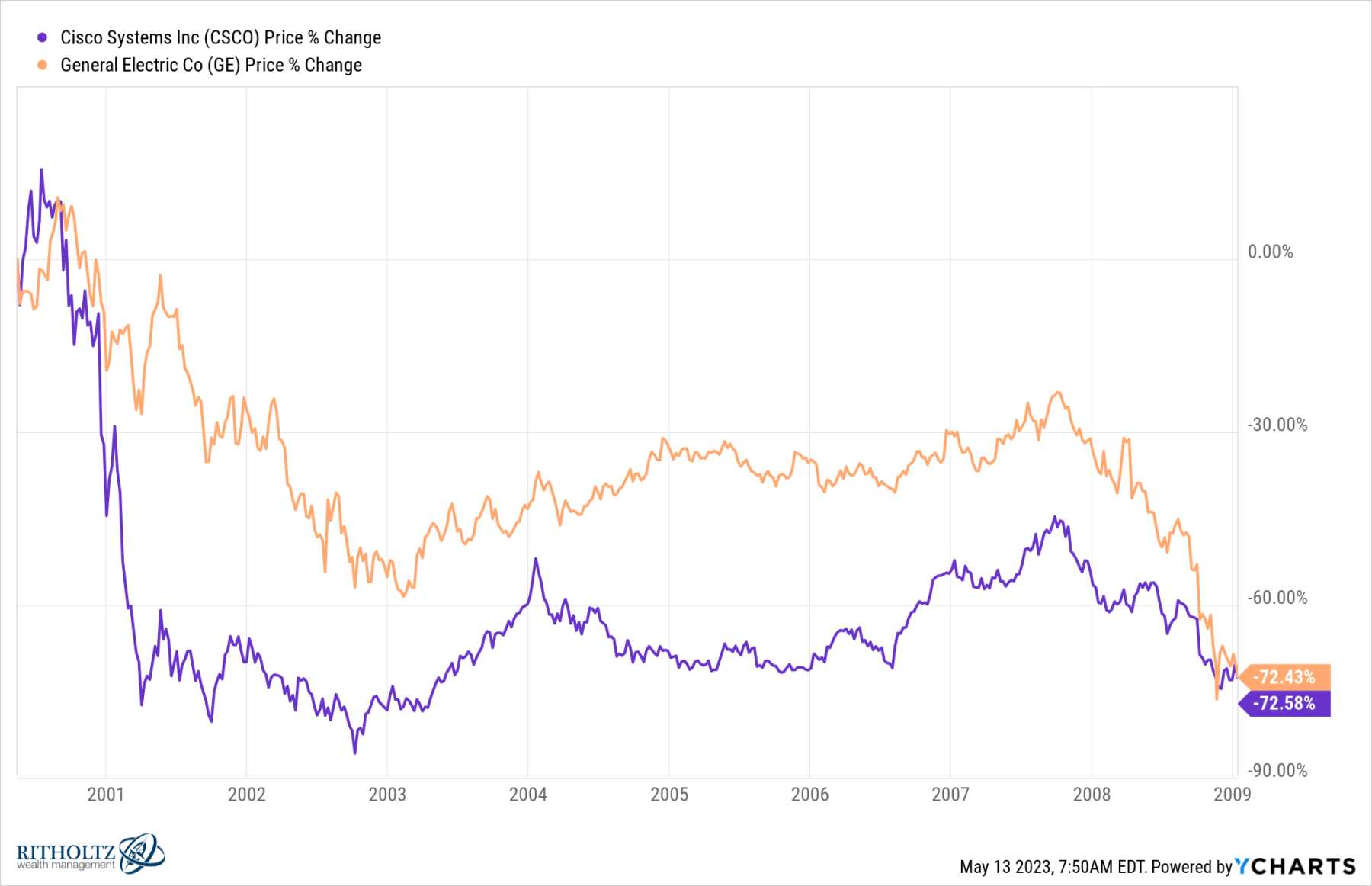

…however even GE beat CSCO over the subsequent decade, by way of January 2009. Selecting CSCO over GE was additionally a nasty decide:

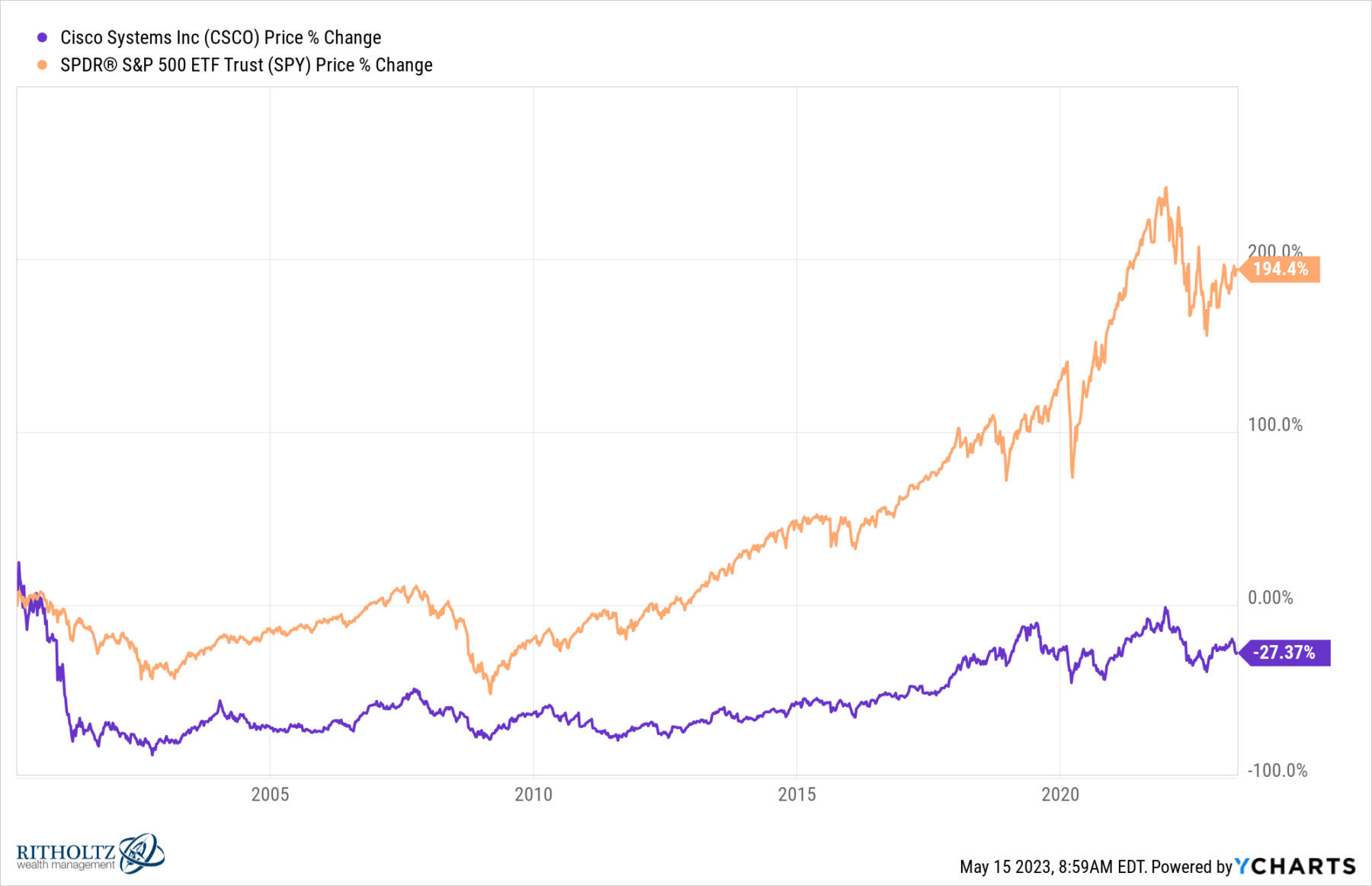

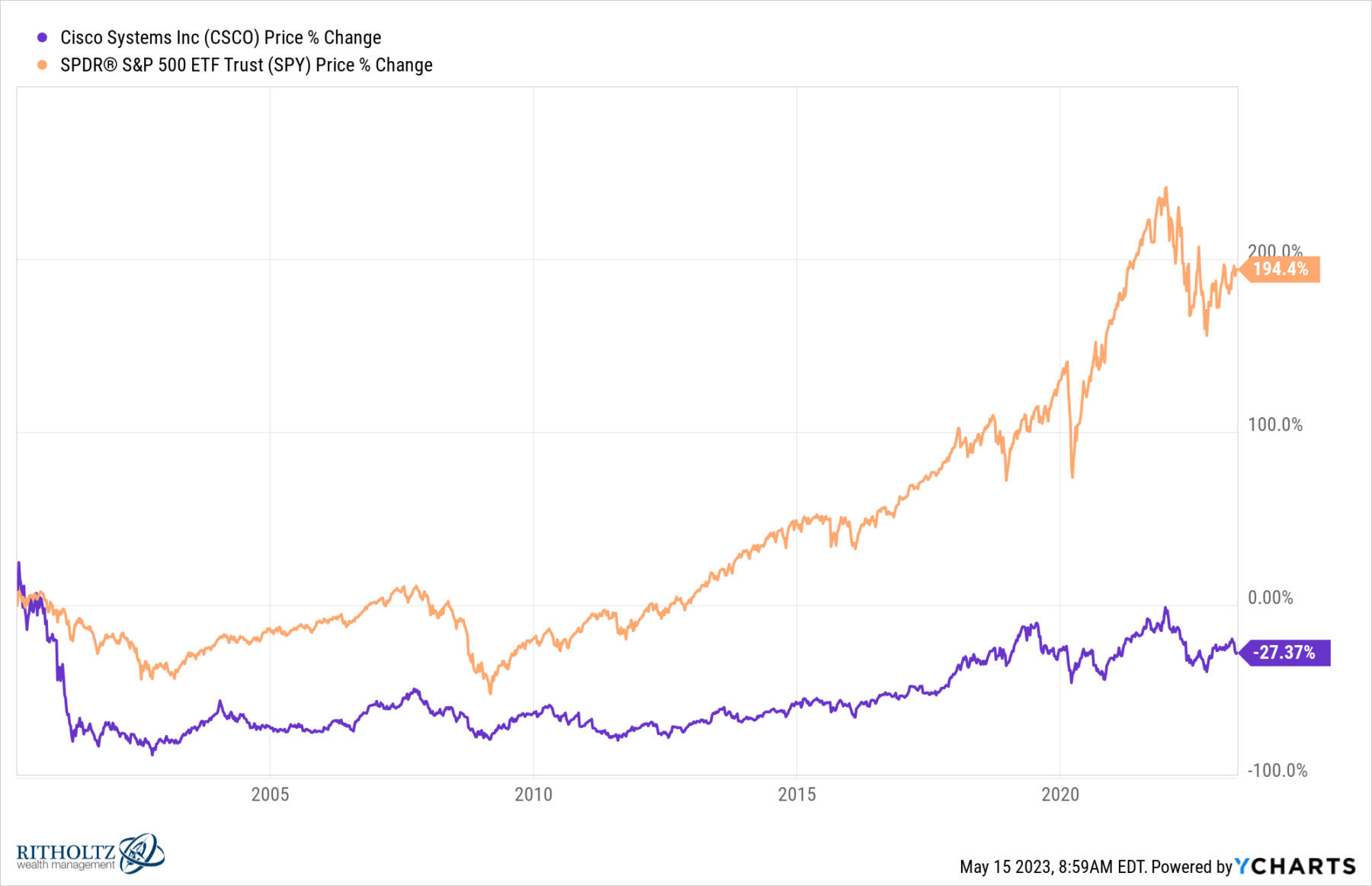

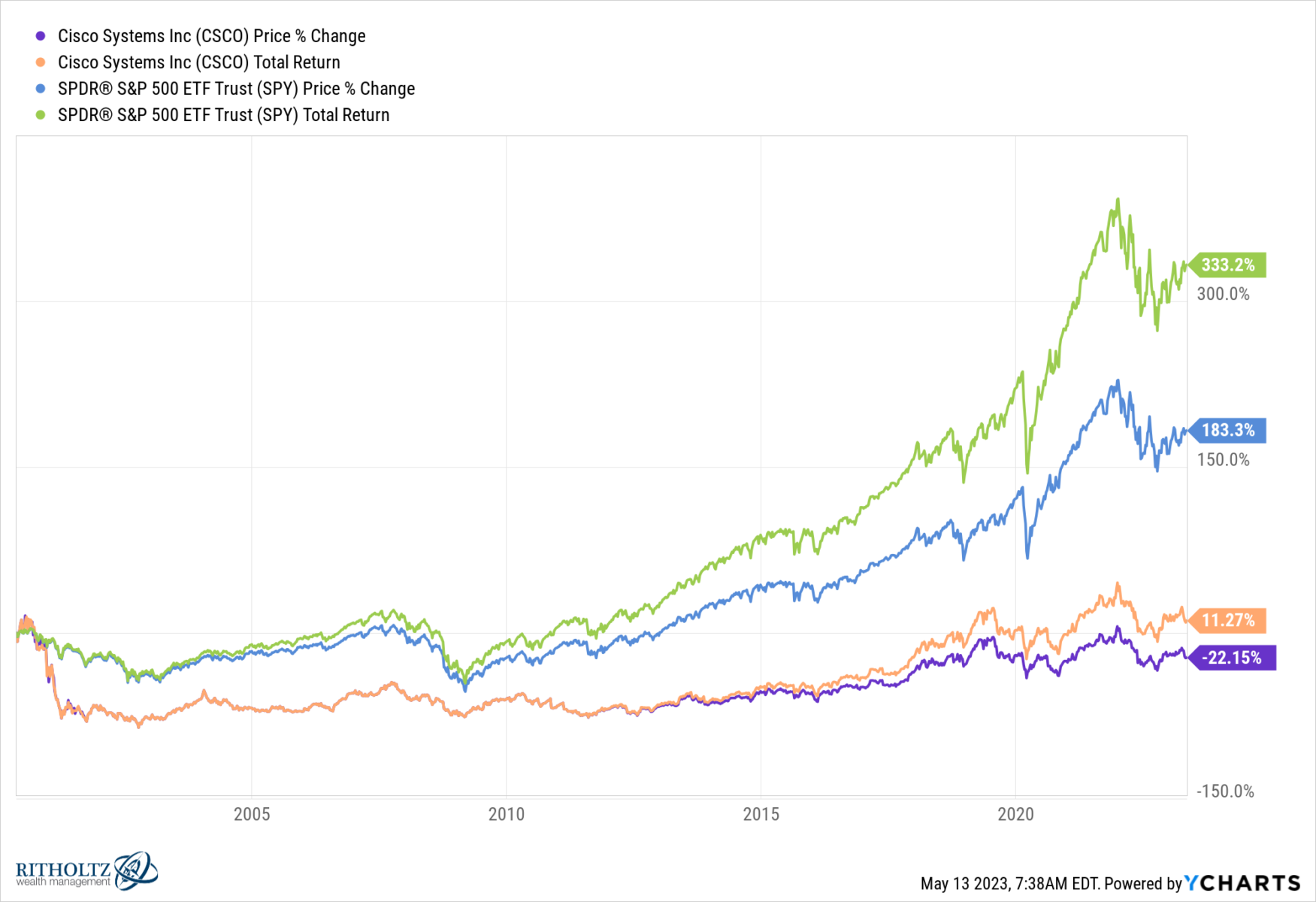

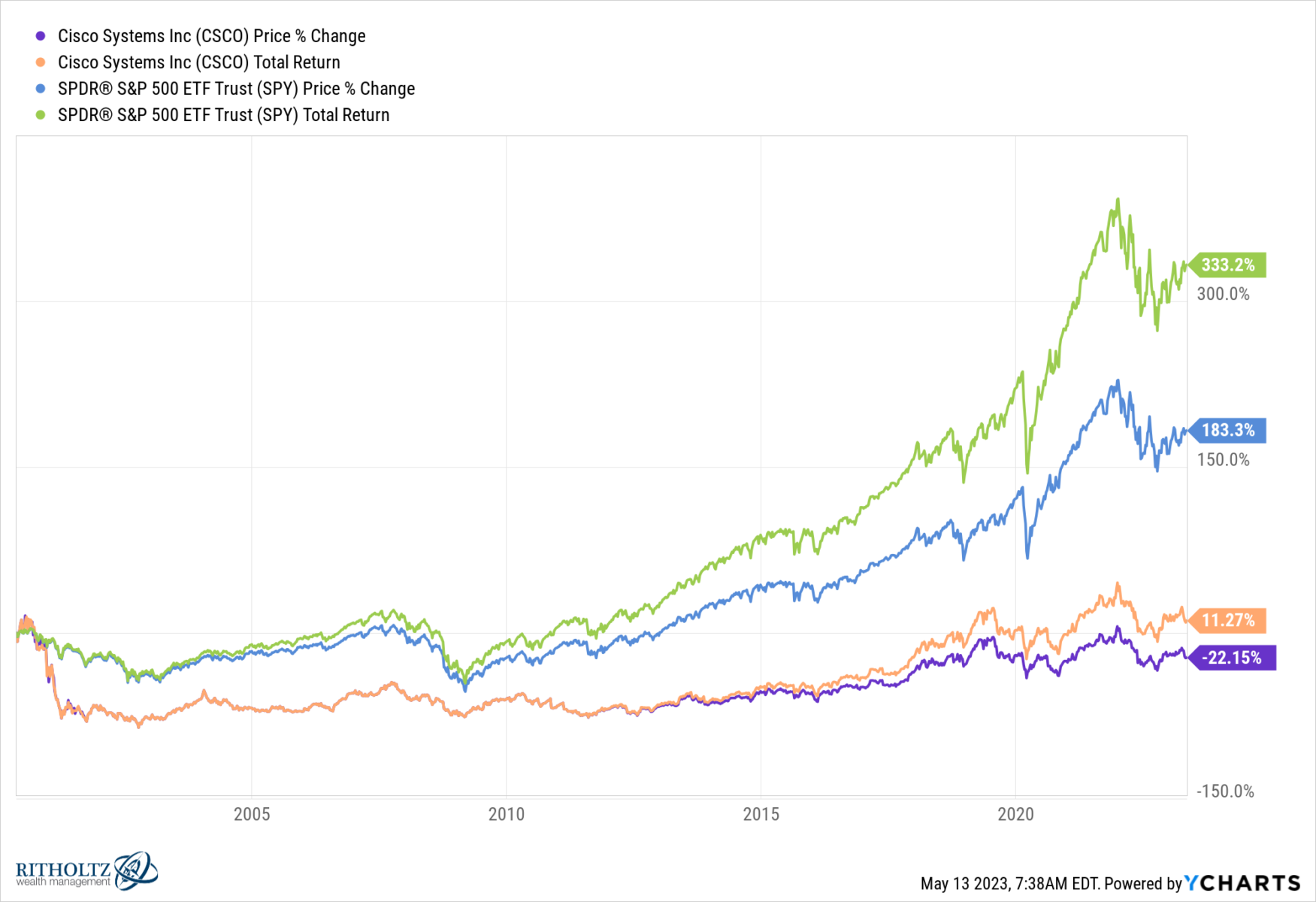

How did the “Irrespective of how you narrow it, you’ve bought to personal Cisco” inventory decide do towards a easy benchmark?1 Decide your poison: The S&P500 is up 194.4% since that cowl story, whereas CSCO stays 27.4% decrease,2 a spot. of 221.8%.

CSCO versus S&P500

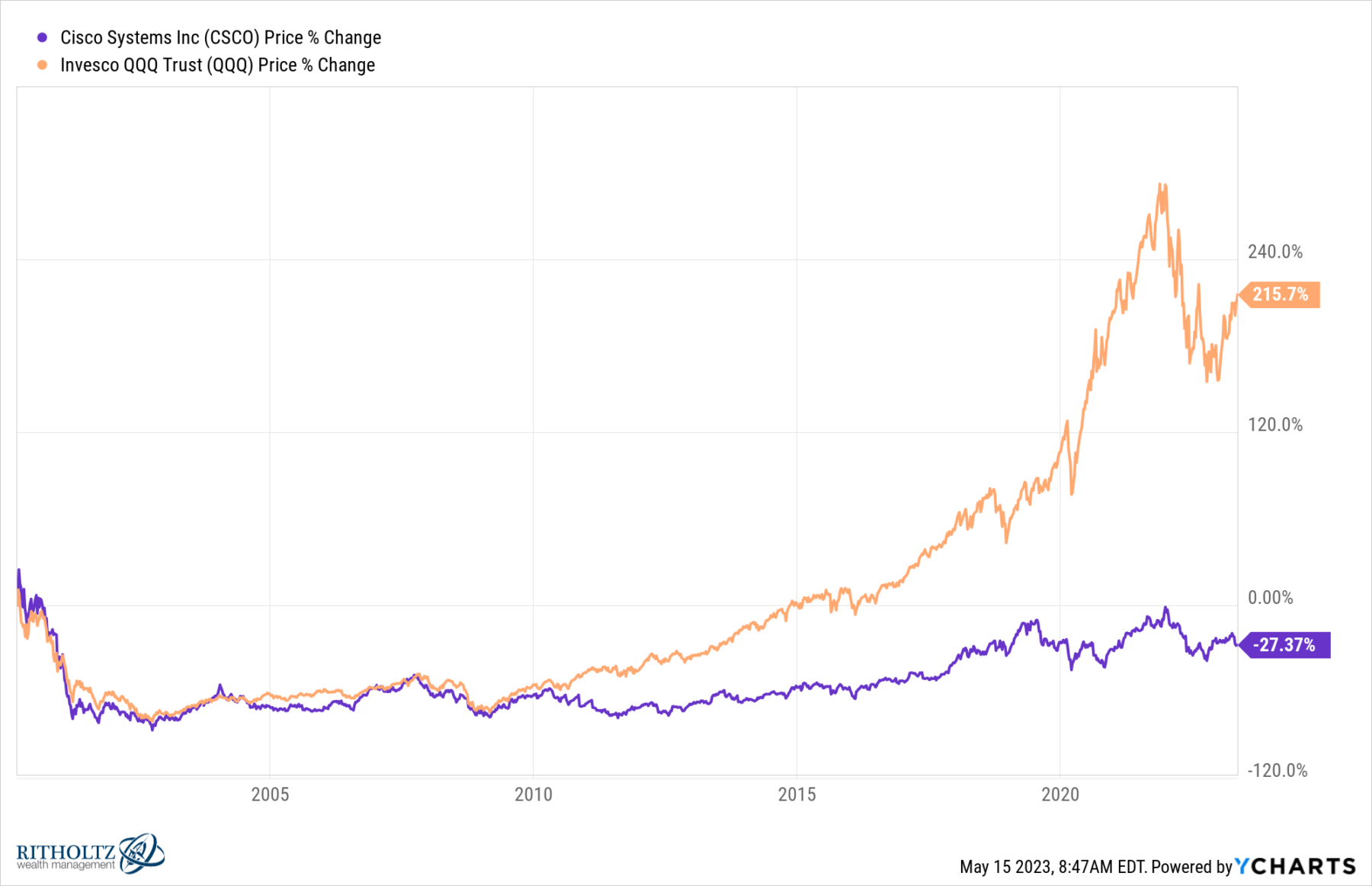

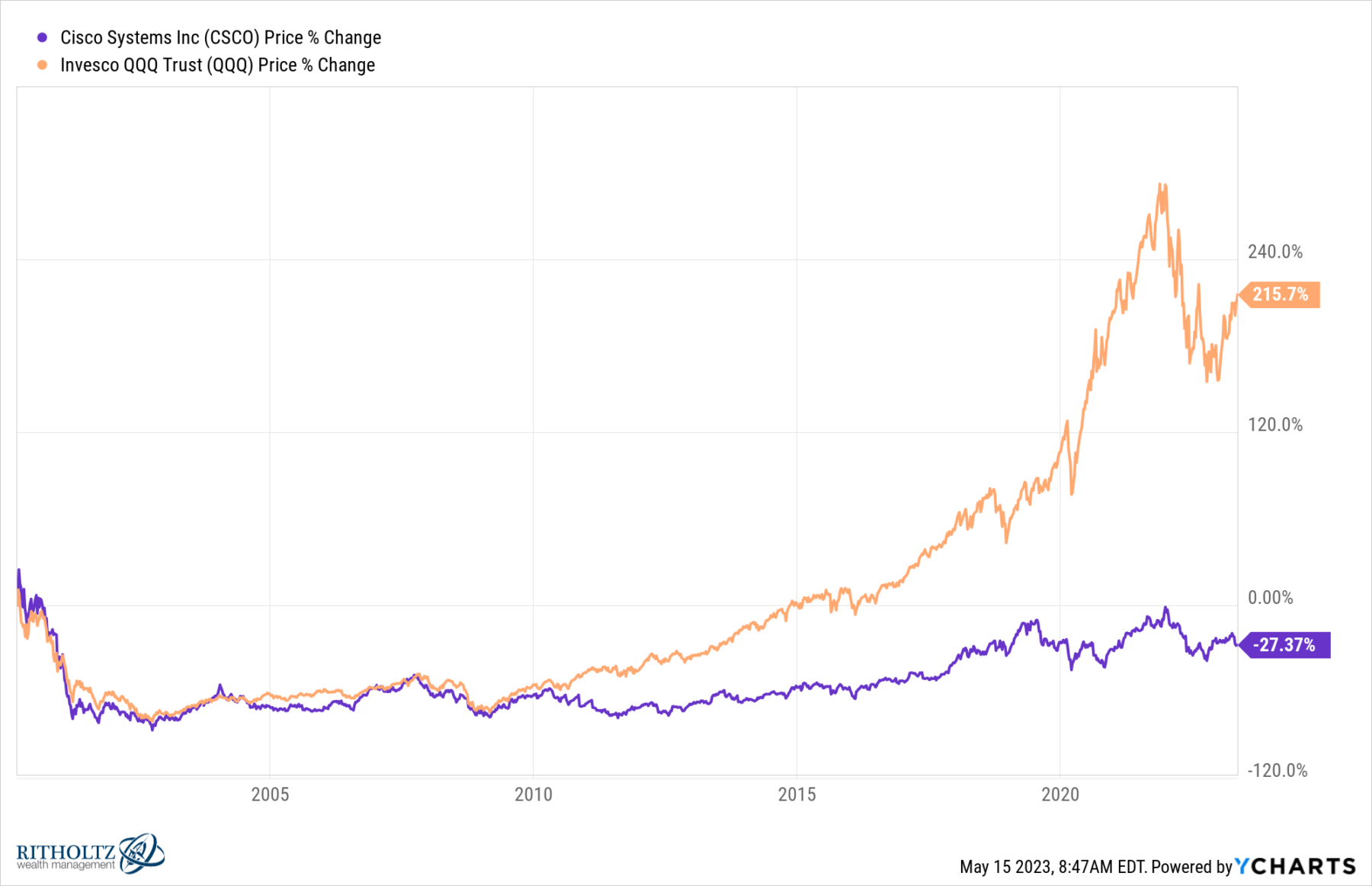

The Nasdaq 100 (QQQ) is up much more than the SPY’s 194.4% — it gained 215.7%, which is much more outstanding when you think about the drag of its as soon as largest inventory — Cisco — will need to have had on the index’ returns.

And at the moment? CSCO stays 32.7% beneath its highs (March 27) round when this cowl got here out 23 years in the past…

A stark reminder: In relation to inventory selecting and predicting the longer term, no one is aware of something.

Supply:

There’s One thing About Cisco

By Andy Serwer, Irene Gashurov, Angela Key

FORTUNE Journal, Might 15, 2000

Mirror (password: CSCO)

Beforehand:

Can Anybody Catch Nokia? (October 26, 2022)

Regularly, Then Out of the blue (October 1, 2021).

Why the Apple Retailer Will Fail (Might 20, 2021)

No one Is aware of Nuthin’ (Might 5, 2016)

How Information Seems When Its Previous (October 29, 2021)

Predictions and Forecasts

__________

1. Passive indexing existed in 2000, nevertheless it was nowhere close to as broadly adopted then as it’s at the moment.

2. Its much more amusing displaying whole returns

CSCO since IPO (%)

CSCO since IPO ($)