Think about you had a tool that allowed you to look into the longer term. You enter a subject into this machine, requesting a selected quantitative measure, and at a selected future time. In different phrases, Worth and Date. The machine whirrs and spins, lights flash, bells ring, and out pops a chart displaying a spread of solutions and their possibilities.

You may think a machine like that will be price so much.

We even have and use a lot of such units; we take merchants’ bets and use them to evaluate the possibilities of future occurrences. The issue shouldn’t be how good or dangerous their monitor information are (they have an inclination towards mediocre); moderately it’s our failure to make use of these instruments correctly, per an inherently unknowable future at all times topic to new information and knowledge that adjustments these possibilities.

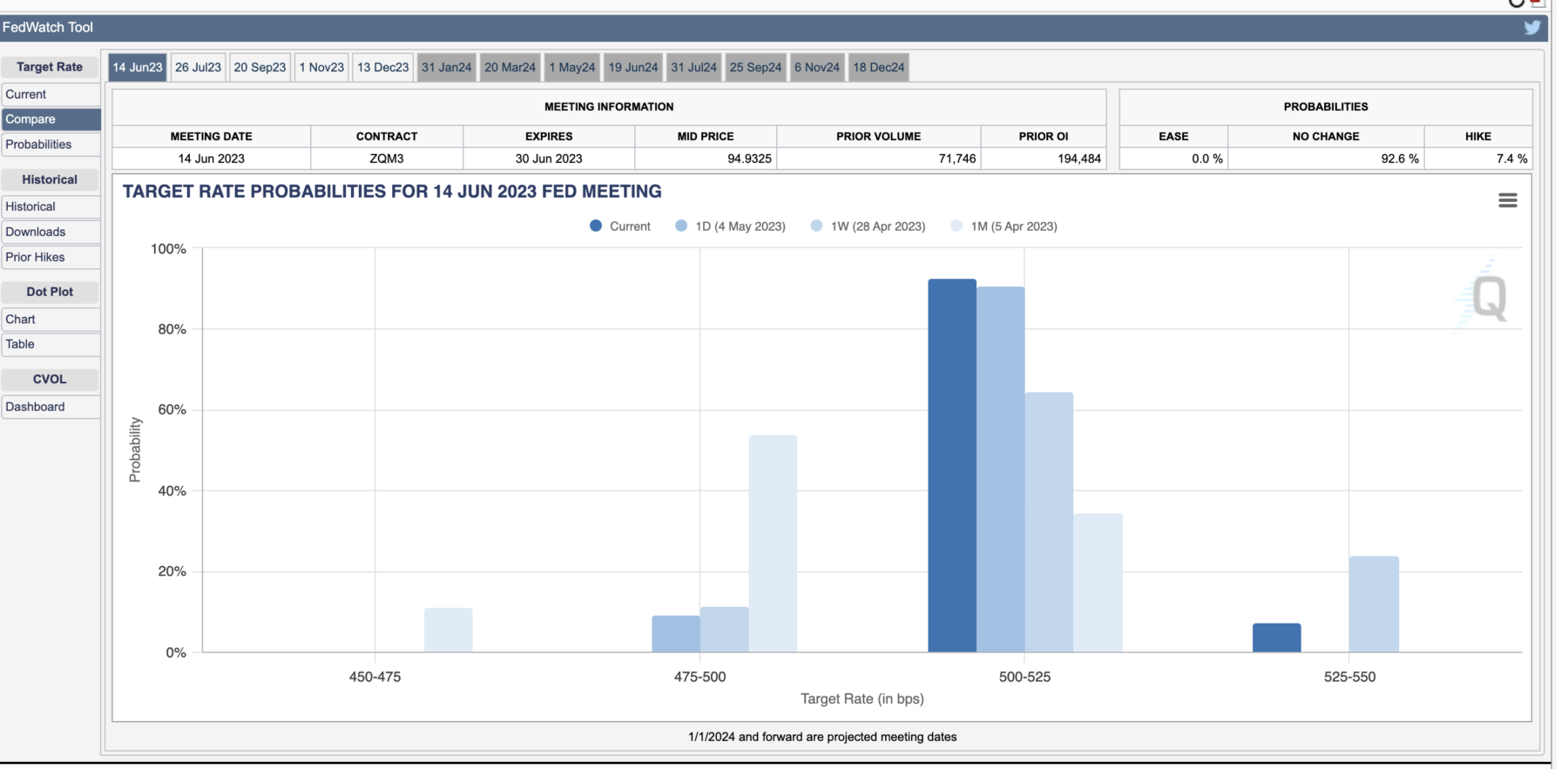

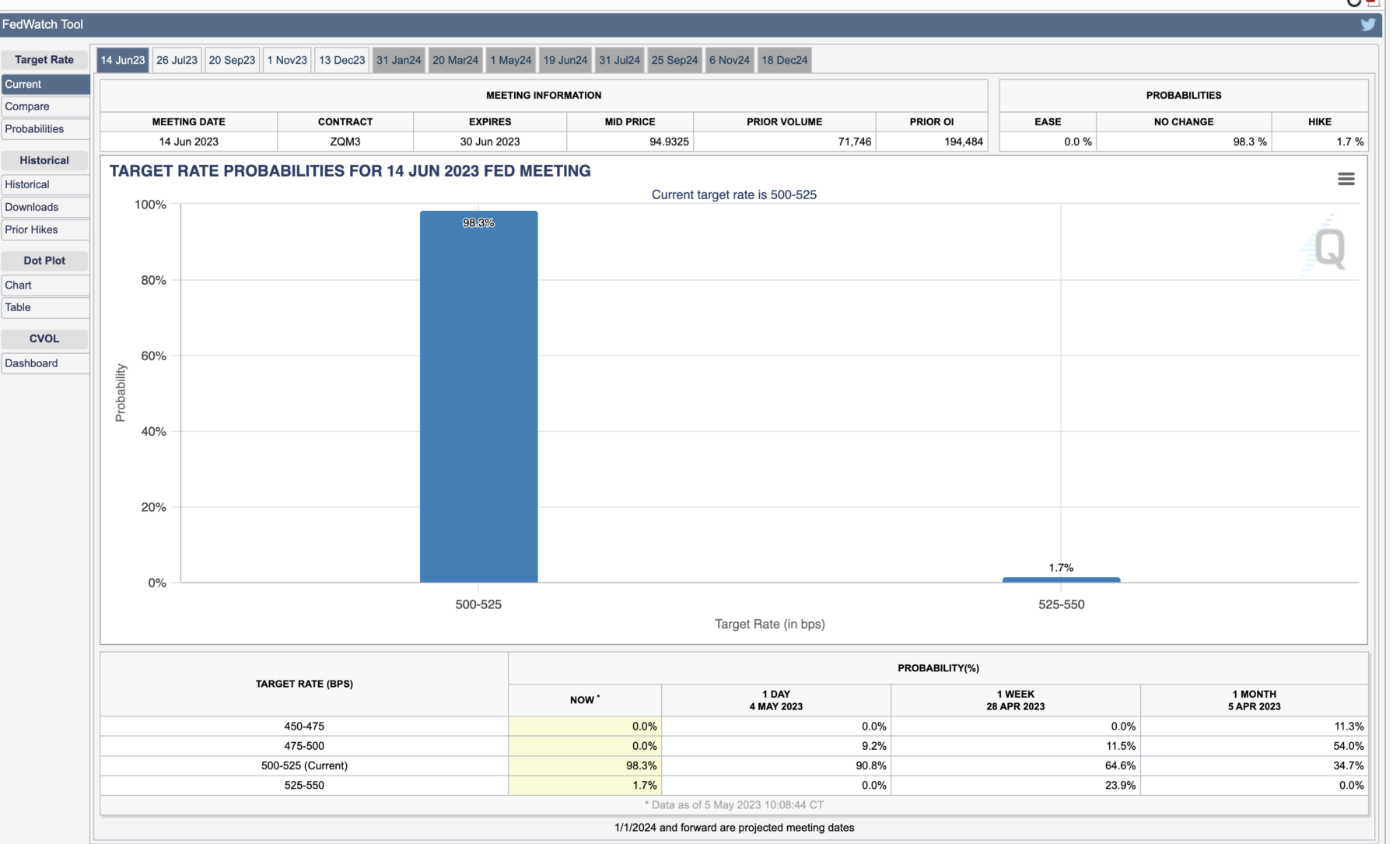

Contemplate simply the previous 48 hours of the CME FedWatch software. Yesterday (Might 4) it regarded like this the percentages of a pause have been over 98.9% with the chance of a price reduce on the June assembly within the low single-digits (2.0%):

CME Group FedWatch Device (Might 2023)

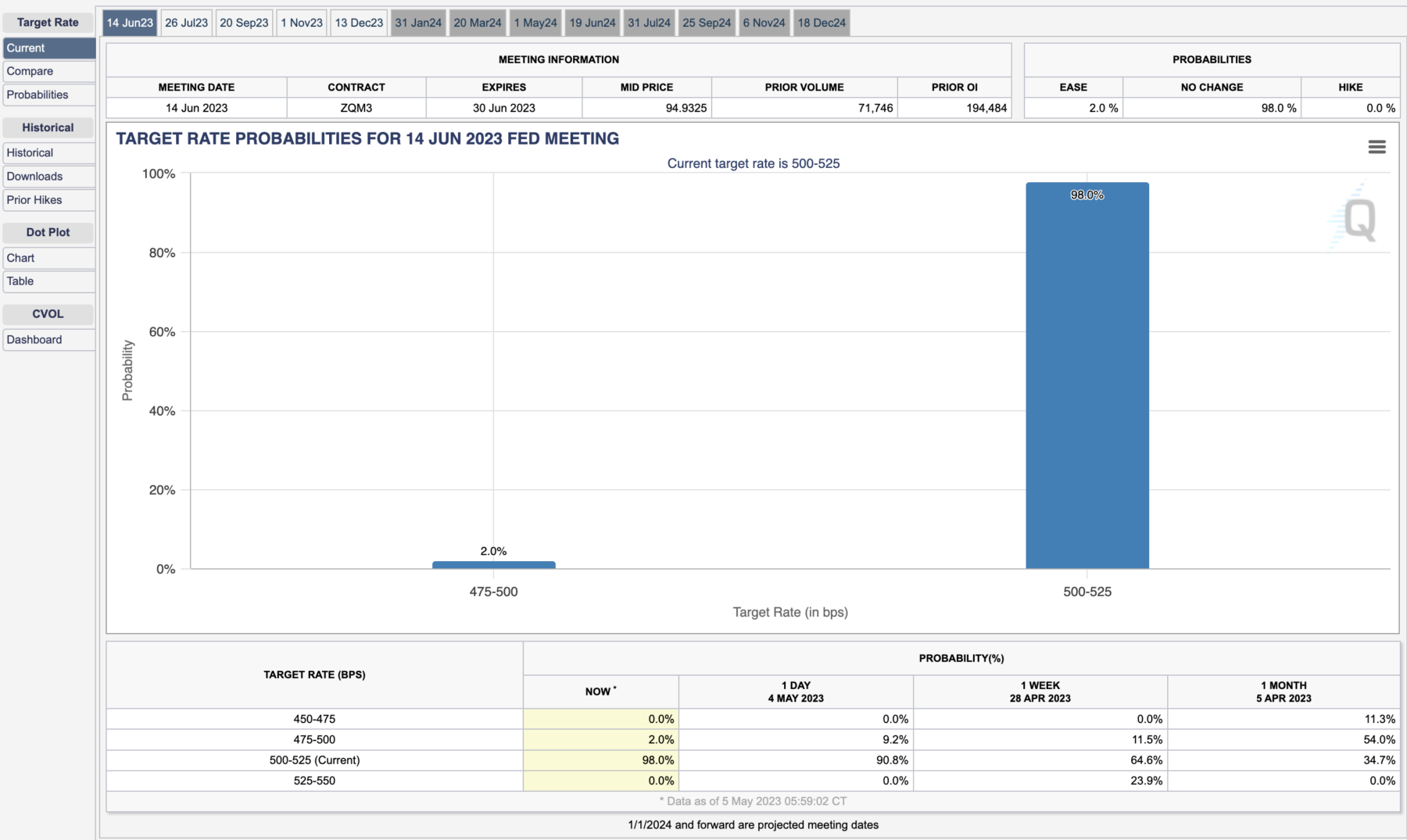

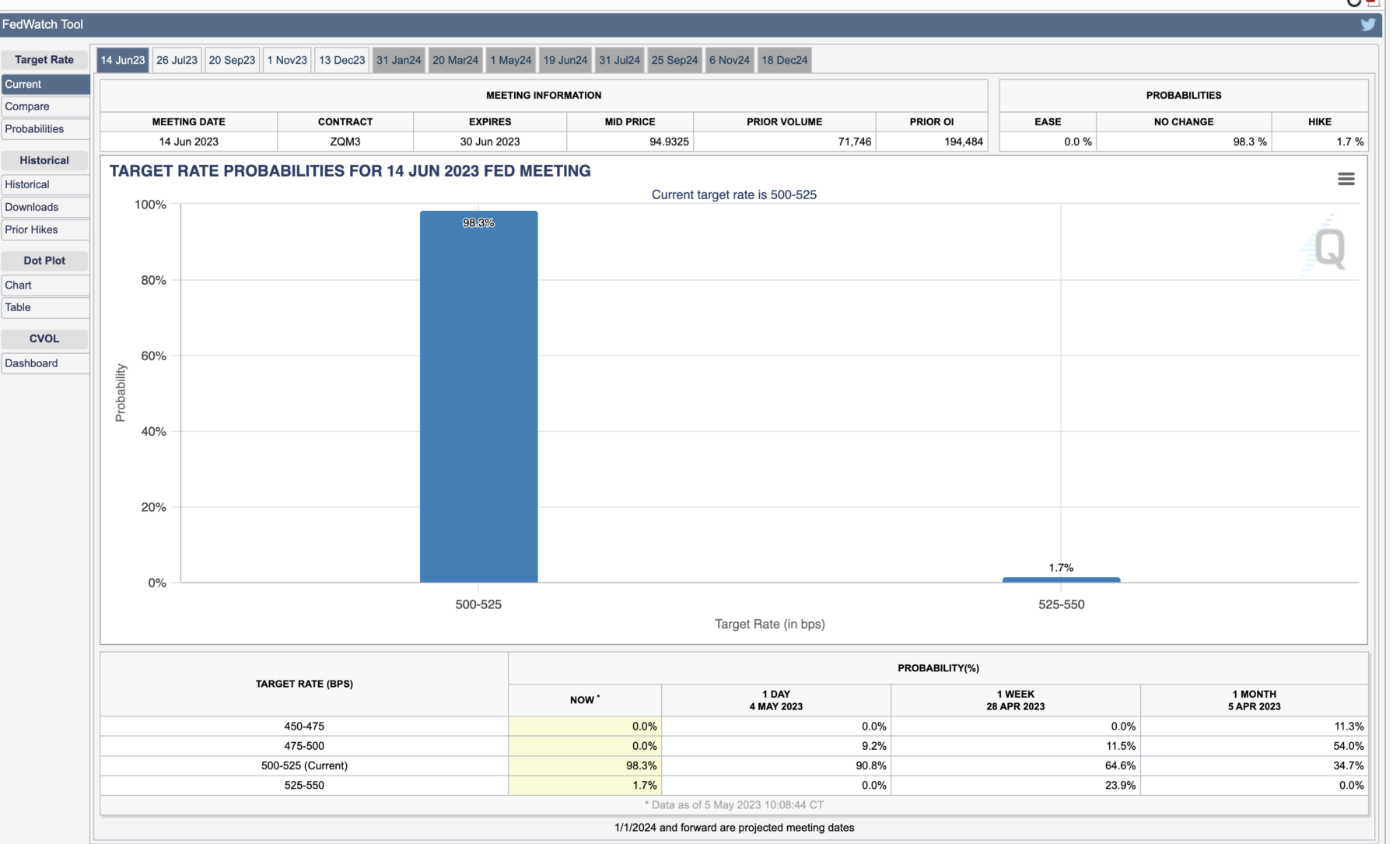

The subsequent day (at present, Might 5) a medium NFP of 253,000 on Might fifth exceeded consensus; this upended these possibilities barely by shifting the percentages of a price reduce to zero and making the percentages of a price hike on the June FOMC assembly a low single-digits chance (1.7%):

The software is working because it’s presupposed to, incorporating new information because it is available in. The chances nonetheless favor a pause, however the lean has shifted in a manner that I might recommend is a largely meaningless rounding error.

That sadly shouldn’t be the way it will get mentioned.

The issue lies not within the information however in ourselves. These information sequence at all times bounce round, confounding forecasters a lot of the time. Moderately than settle for the volatility of month-to-month financial datapoints — NFP, Shopper Spending, Manufacturing, Inflation, and so forth. — folks are inclined to get sucked into the trivia, permitting recency bias to have an effect on how they have a look at the world. From the attitude of an asset administration and monetary planning agency, the problem is getting folks to disregard the day-to-day noise in favor of eager about the place costs might be a decade therefore.

Contemplate the highest chart above; it reveals how the percentages of future price hikes or cuts have modified over every month. The chances change always as new data will get integrated. On condition that, you’d think about that traders would method these future expectations of price adjustments with a grain of salt. (I’ve lengthy been a fan of the idea of Robust Opinions, Weakly Held). As an alternative, there’s a tendency to place an excessive amount of weight onto the numbers themselves, encouraging quite a lot of adjustments and modifications to portfolios resulting from regardless of the newest information suggests.

It’s not simply that we are usually flawed, however moderately, we appear to not settle for the arithmetic behind the percentages of our personal errors. They’re exceedingly excessive, and we ignore that actuality at our personal peril.

It’s not simply that no one is aware of something, however moderately so few of us know that we all know little or no.

Investing is a humbling observe that requires the practitioner to not solely acknowledge their restricted understanding of the longer term however to behave in accordance with that small piece of knowledge. The temptation to reply to each financial shift each new information level every new change in possibilities is how folks find yourself chopping themselves up with small prices which are accruing into bigger ones.

“Don’t simply do one thing, sit there” continues to be sage recommendation for traders…

Beforehand:

No one Is aware of Nuthin’ (Might 5, 2016)

No one Is aware of Something, NFP version (June 5, 2020)

No one Is aware of Something, NYC Actual Property Version (June 10, 2022)

No one Is aware of Something, Kentucky Derby Version (Might 9, 2022)

Forecasting & Prediction Discussions