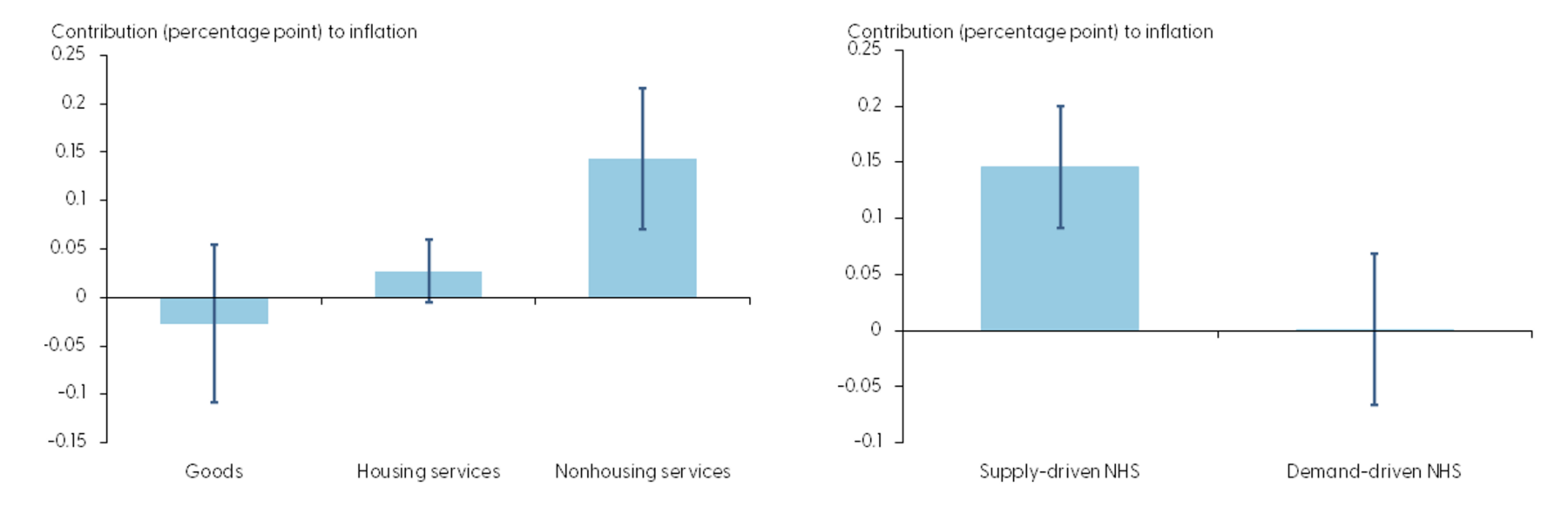

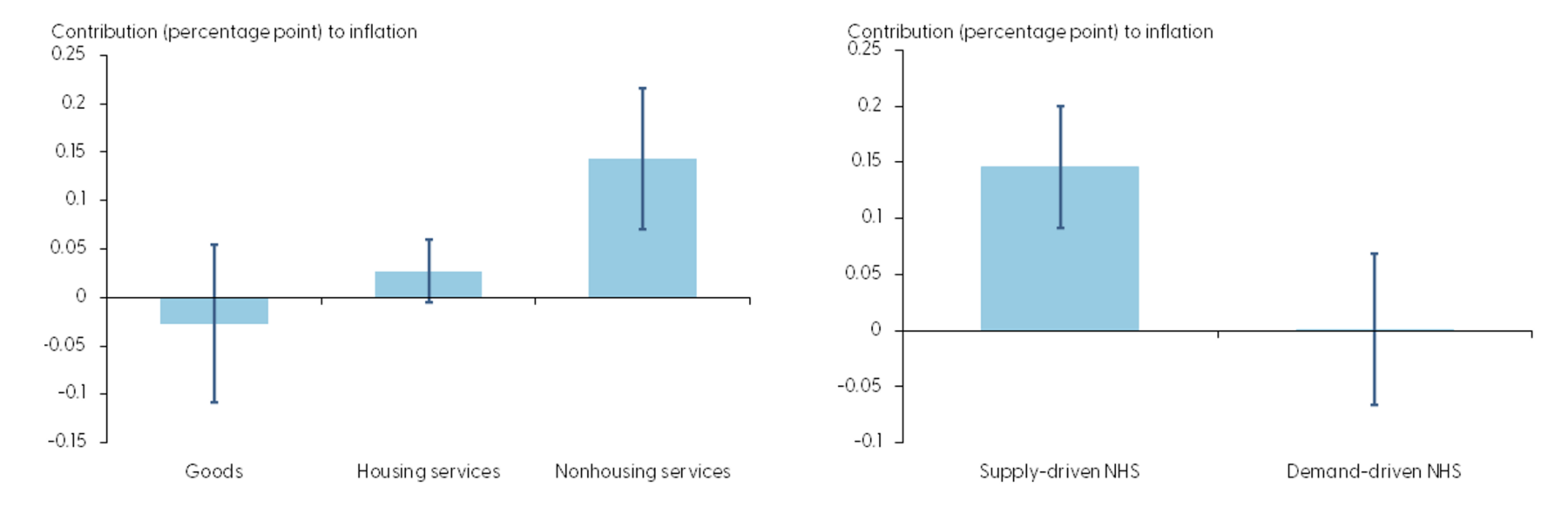

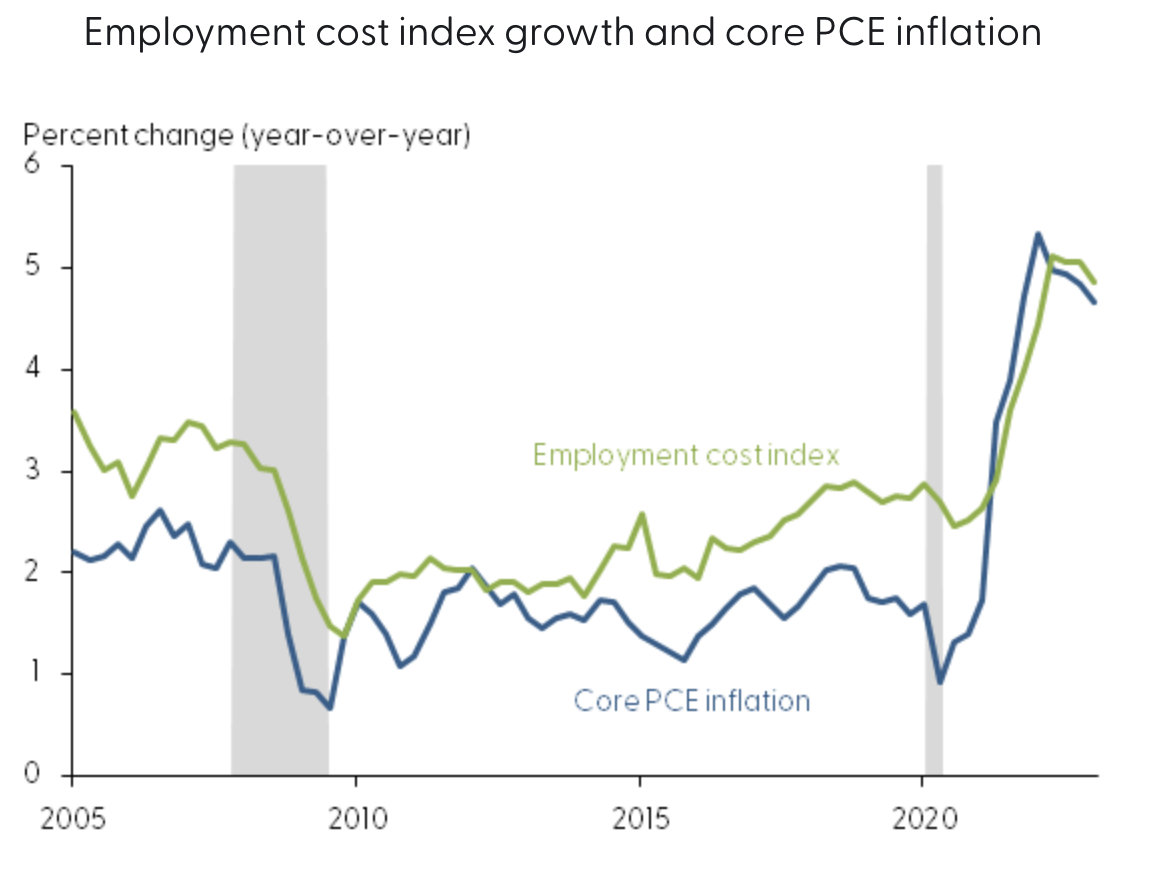

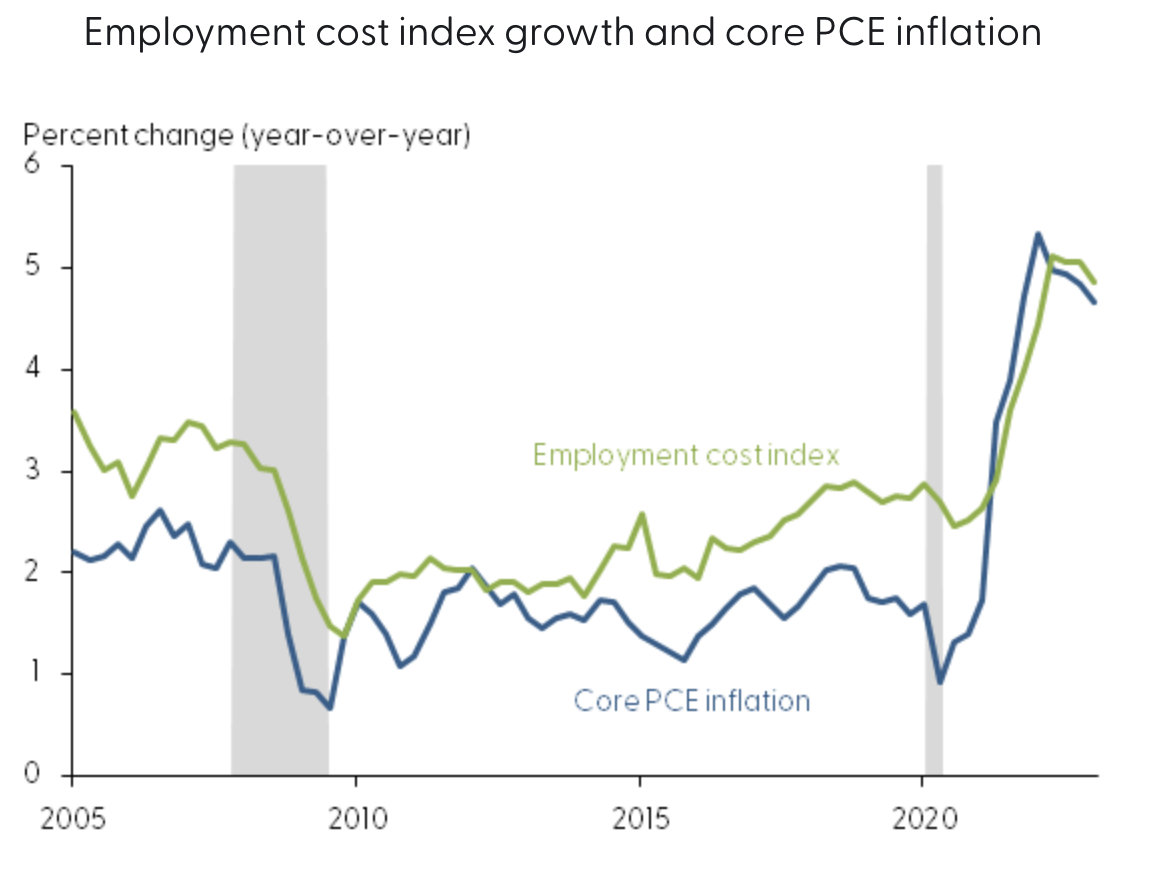

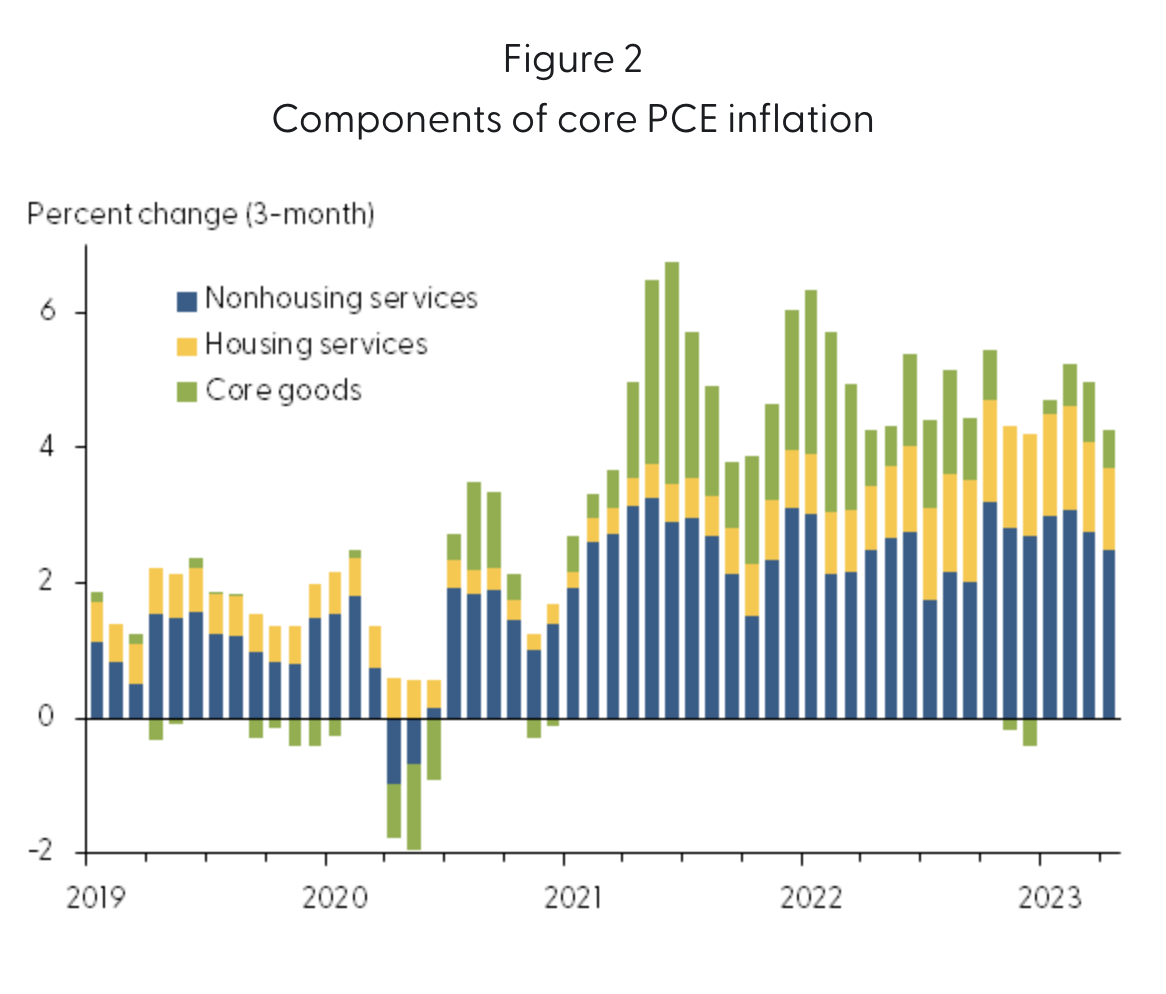

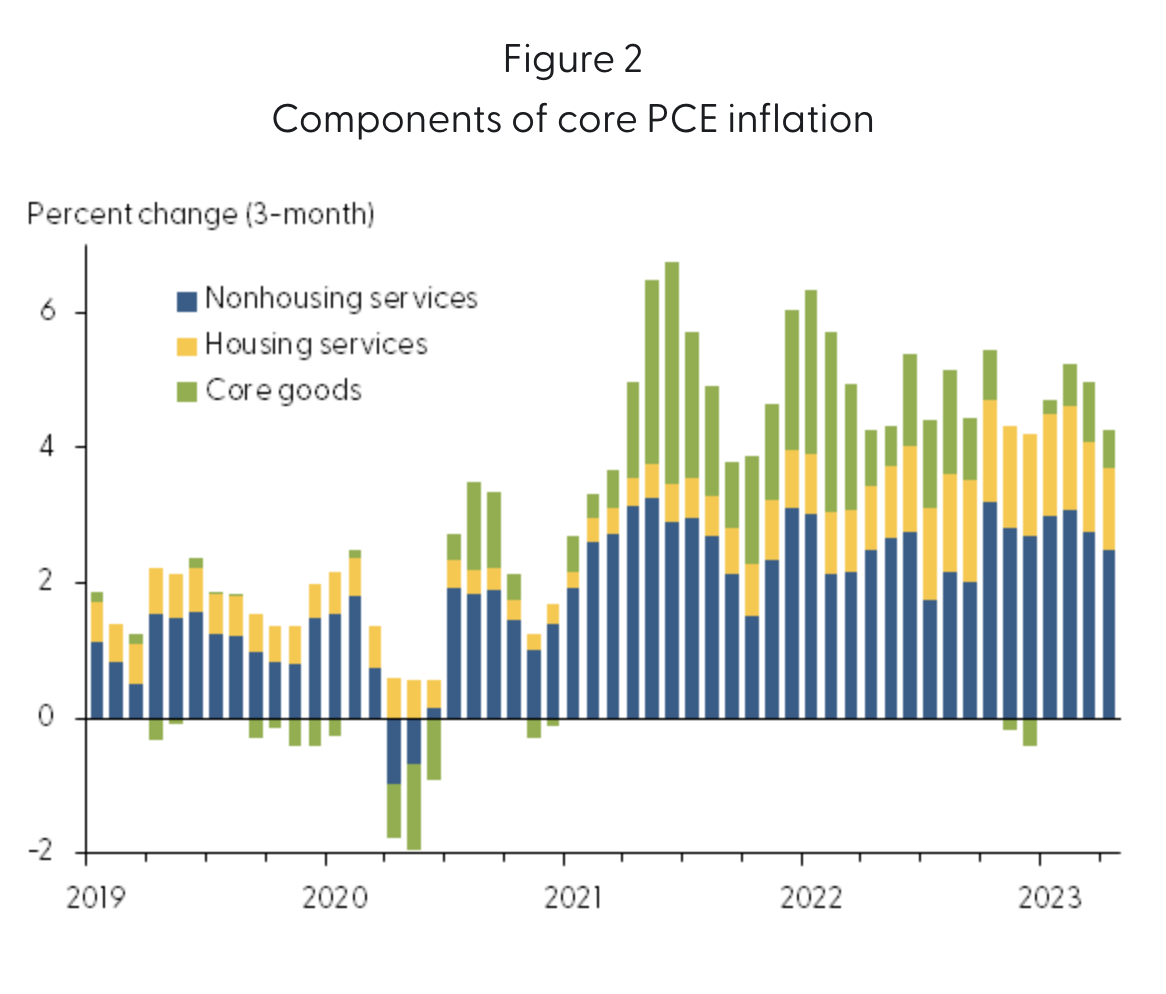

“Tight labor markets have raised considerations concerning the position of labor prices in persistently excessive inflation readings. Evaluation exhibits that increased labor prices are handed alongside to clients within the type of increased nonhousing providers costs, nevertheless the impact on total inflation may be very small. Labor-cost development has no significant impact on items or housing providers inflation. General, labor-cost development is liable for solely about 0.1 share level of latest core PCE inflation.” (emphasis added)

Fascinating analysis from the San Francisco Federal Reserve Financial institution, pondering the impression of wage good points on inflation.

Counterintuitively, they discovered that rising wages have a minimal impression on inflation. How little? The research discovered {that a} “1% level improve in labor prices causes solely a 0.15% rise in core PCE inflation” over 4 years – a rise of lower than 0.04% yearly.

There are a number of components that designate this: First is productiveness and effectivity good points; rising productiveness is a big a part of the explanation why service-sector earnings have been increasing over the previous few a long time. Second, In lots of providers companies wages are however one element of many who have an effect on producer costs. Final, there are occasions when corporations would moderately retain market share, and infrequently enable increased wages to eat into margins.

I’d add a caveat concerning the distinctive impression of the pandemic: The shift to items over providers throughout the lockdowns – an infinite 20% surge – together with the large fiscal stimulus of the three CARES Acts was additionally a driver of upper costs. Add to the combination shortages brought on by damaged provide chains. The sudden inflow of money to households mixed with plenty of pent-up demand created an inflation spike.

That is necessary as a result of Federal Reserve Chairman Jerome Powell – incorrectly in my and others’ views – has said his considerations over rising wages as a driver of inflation. The Fed Chair said it “could also be a very powerful class for understanding the long run evolution of core inflation. As a result of wages make up the biggest price in delivering these providers, the labor market holds the important thing to understanding inflation on this class.”

The concentrate on rising wages has led to some coverage choices which have had all kinds of unintended penalties. Maybe that’s why so few Fed economists boast about stagnant wages over the previous 3decades contributing to deflation.

Regardless, credit score Adam Hale Shapiro, a senior economist within the Financial Analysis Division of the Federal Reserve Financial institution of San Francisco, for calling out that his boss is mistaken about this concern…

Supply:

How A lot Do Labor Prices Drive Inflation? (PDF)

Adam Hale Shapiro

FRBSF Financial Letter, Could 30, 2023

See additionally:

Peter Coy: The Minimal Wage Is Fairly Minimal (March 31, 2023)

Beforehand:

Generational Reset of Minimal Wage (November 30, 2021)

Chopping Unemployment Advantages Does Not Enhance Employment (September 1, 2021)

Elvis (Your Waiter) Has Left the Constructing (July 9, 2021)

America’s Company Welfare Queens (BloombergNovember 13, 2013)

Wages in America

Inflation