The September Federal Reserve assembly is behind us we nonetheless have November and December forward of us. Markets are nervous anticipating one other hike earlier than years over and two cuts in 2024. My recommendation: ignore these expectations as they’ve been wildly inaccurate over the previous few years; they’ve been largely inaccurate over the previous decade.

In terms of forecasting financial outcomes, the Fed is not any higher or worse than anyone else.

I do know of no higher authority to quote than Federal Reserve Chairman Jerome Powell, from his June 16, 2021 presser:

“The dots will not be a terrific forecaster of future price strikes. And that’s not as a result of—it’s simply because it’s so extremely unsure. There isn’t a nice forecaster of the longer term—so dots to be taken with a giant, large grain of salt.”

What makes the Fed just a little completely different is that they make these forecasts very publicly and keep an ongoing document of their historical past for posterity. They could be horrible financial forecasters however give them credit score for not burying these dangerous predictions like so many on Wall Avenue do. And please credit score Powell for admitting what so many different financial prognosticators fail to do: Personal up that they have no idea what’s going to occur sooner or later.

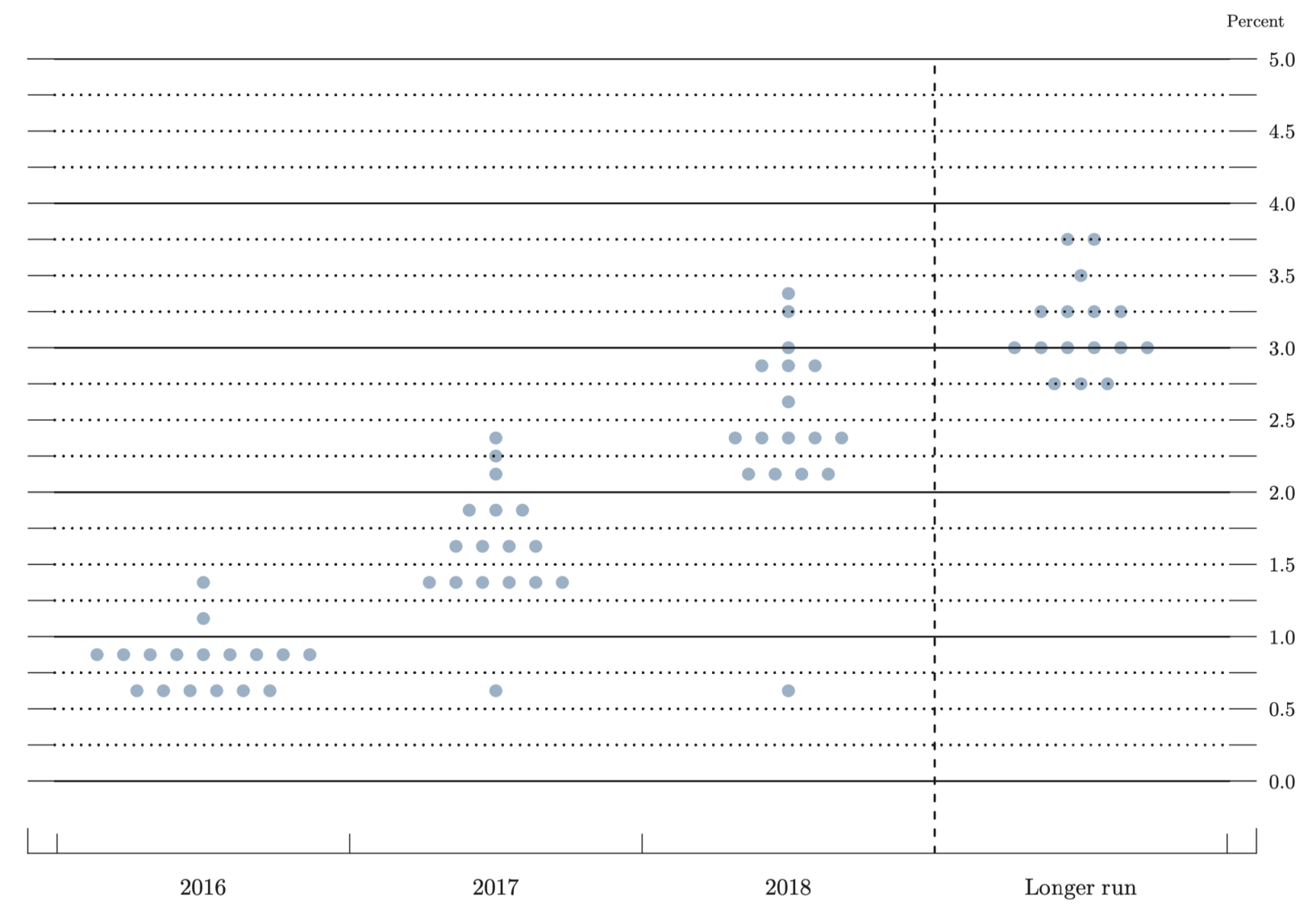

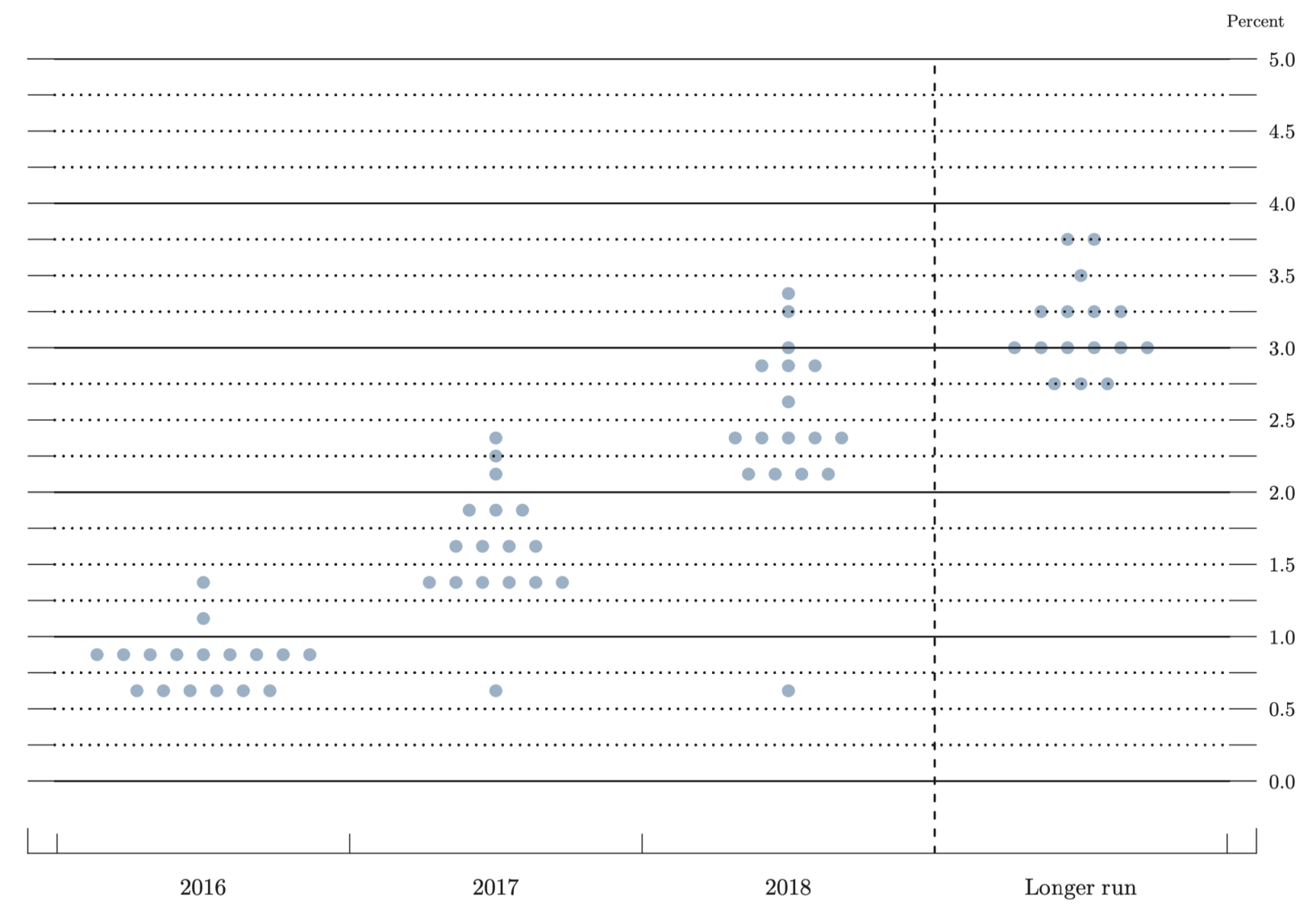

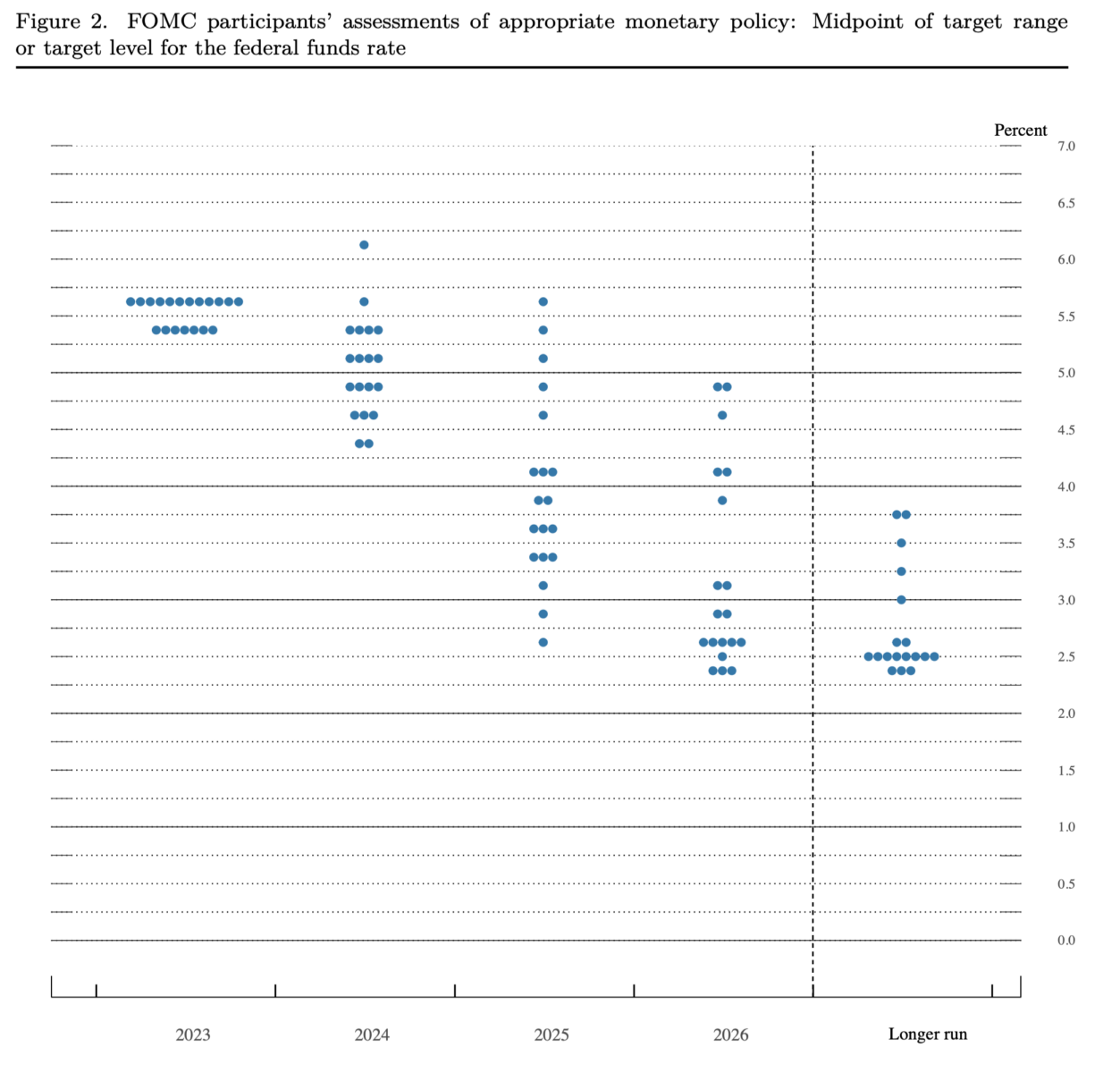

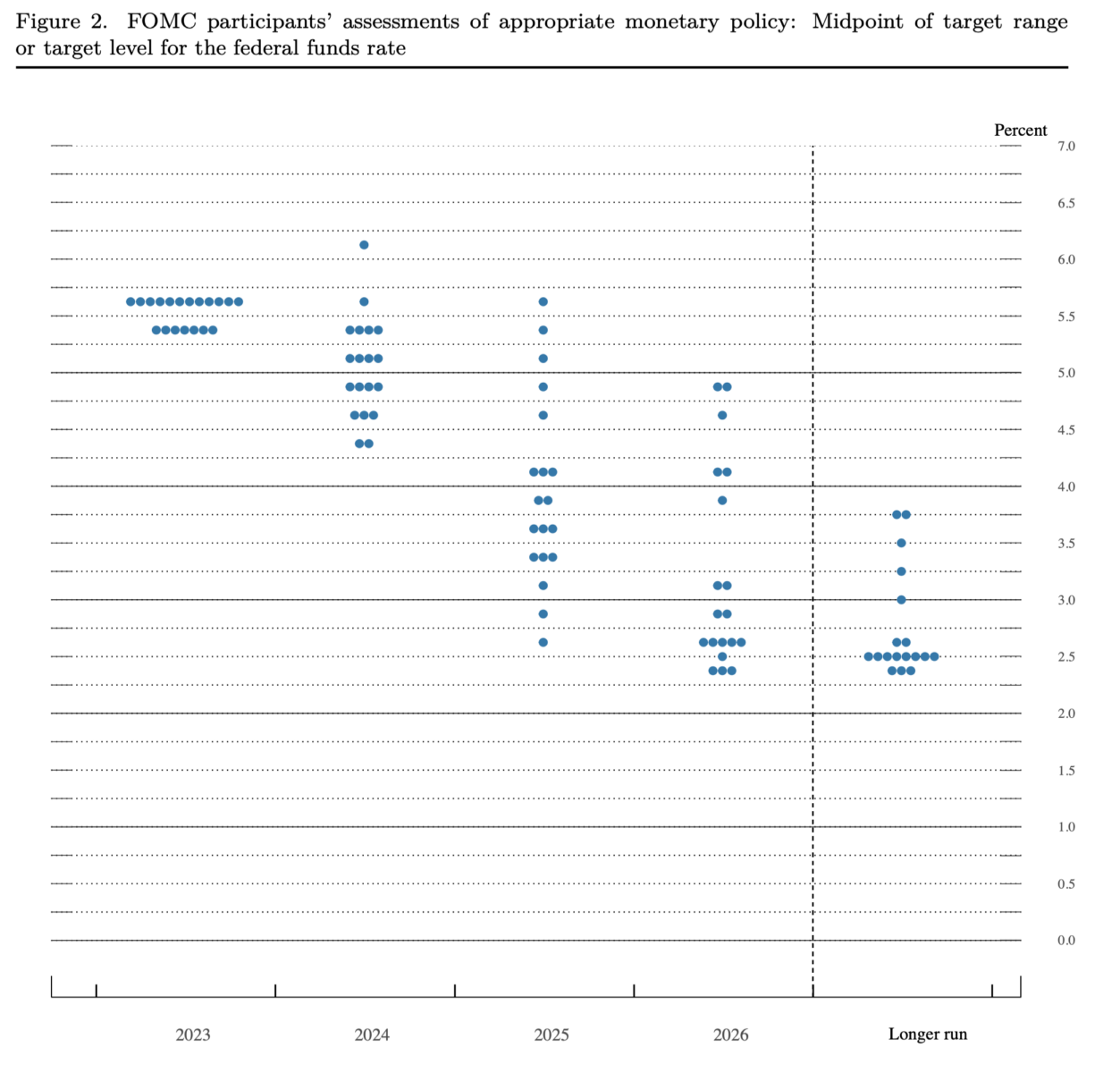

To wit: The Dot Plot.

Because the Chairman famous, the dot plot is solely a chart displaying every Federal Reserve member’s projection for the Fed funds price over the following few years. Every dot corresponds to a policymaker’s expectations of future rates of interest. Whereas they will not be official forecasts, they do present what particular person FOMC members are pondering. The substantial adjustments from one assembly to the following reveal simply how unstable financial knowledge may be, particularly in terms of CPI.

Go to the Fed’s web site, and seek for “Abstract of Financial Projections.” These are the quarterly summations that embody the dot plots inside them. Randomly seize a number of, and scroll to the 4th to eighth pages or so to seek out the dot plots. Then evaluate them to what truly occurred, by way of the FOMC’s goal federal funds price or vary, change (foundation factors) and degree.

The financial seriousness right here ought to stop you from pondering “Hilarity ensues.”

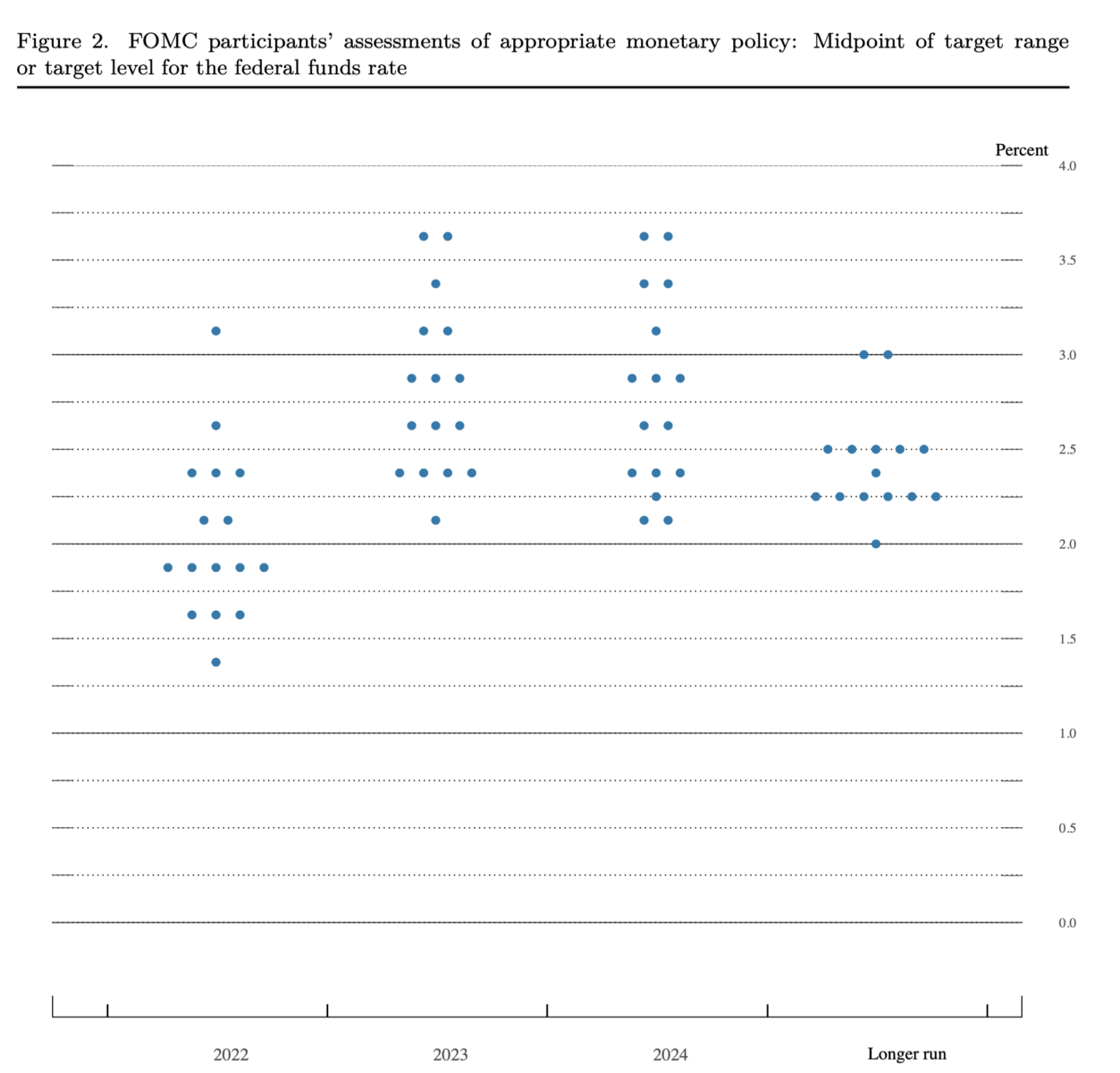

Listed below are the June 2016 dot plots:

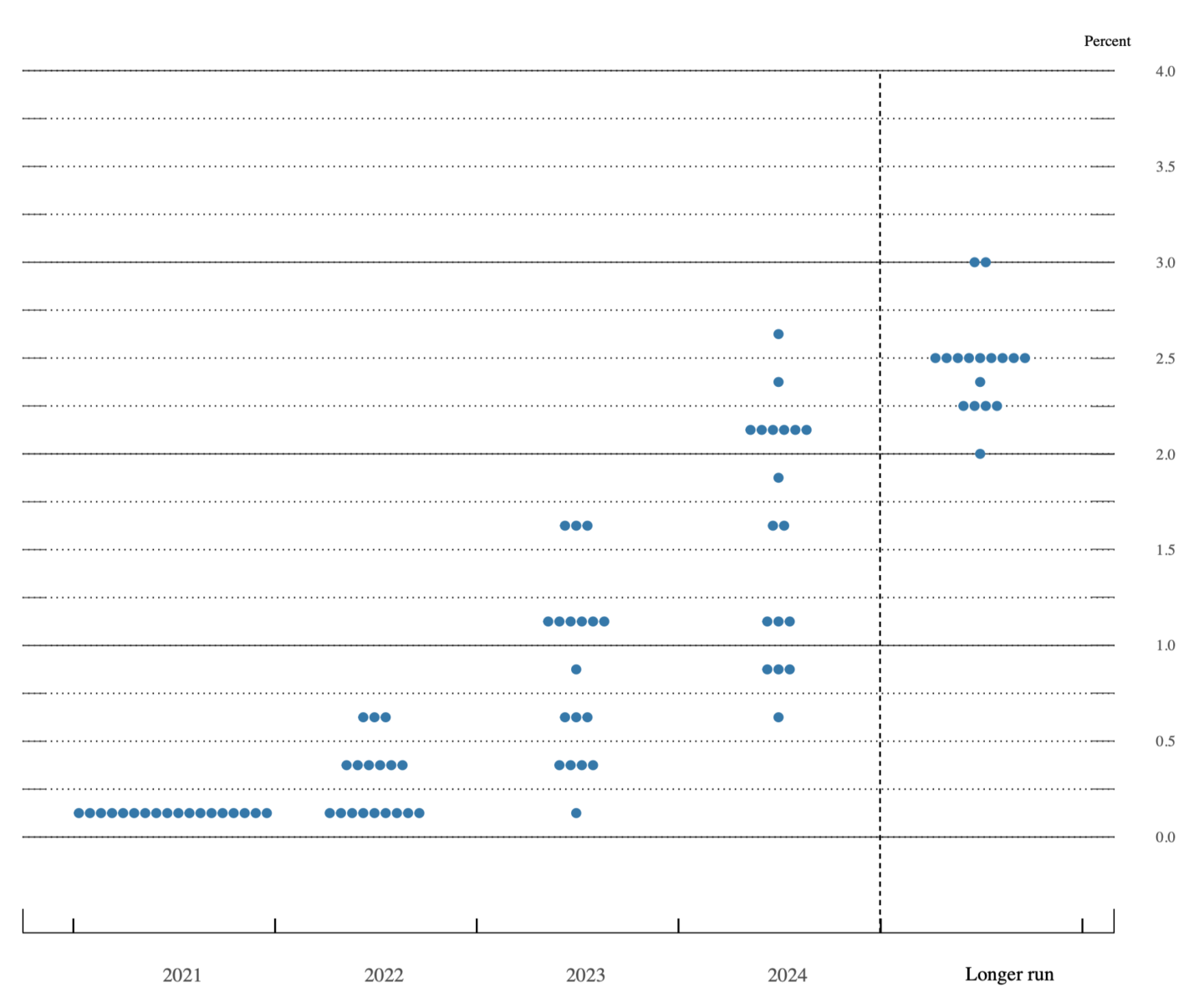

Quick ahead to September 2021, the place the Fed imagined 2023 fund charges to be round 1%:

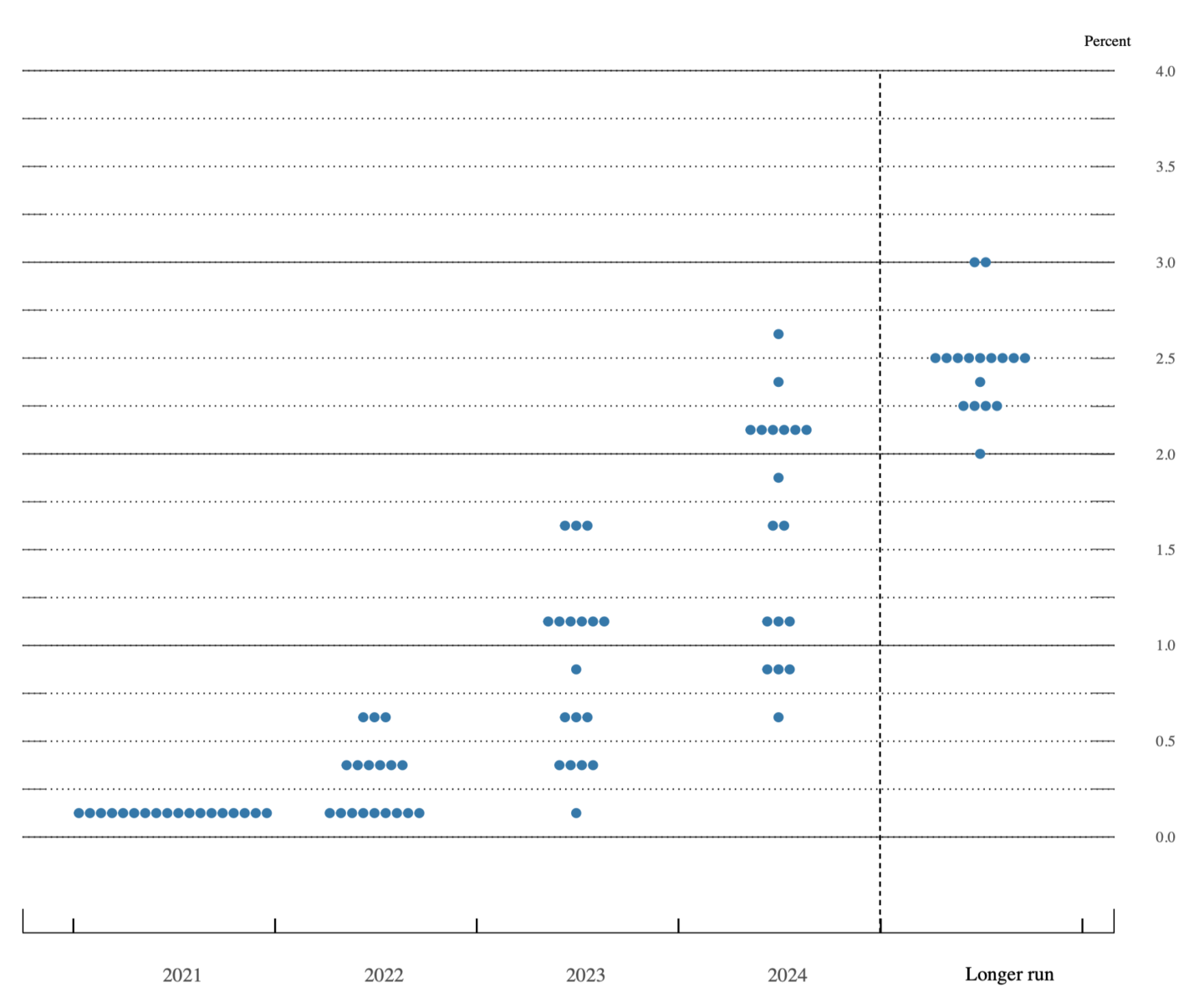

Now, March 2022 dots imagined a yr later we’d be about 3%:

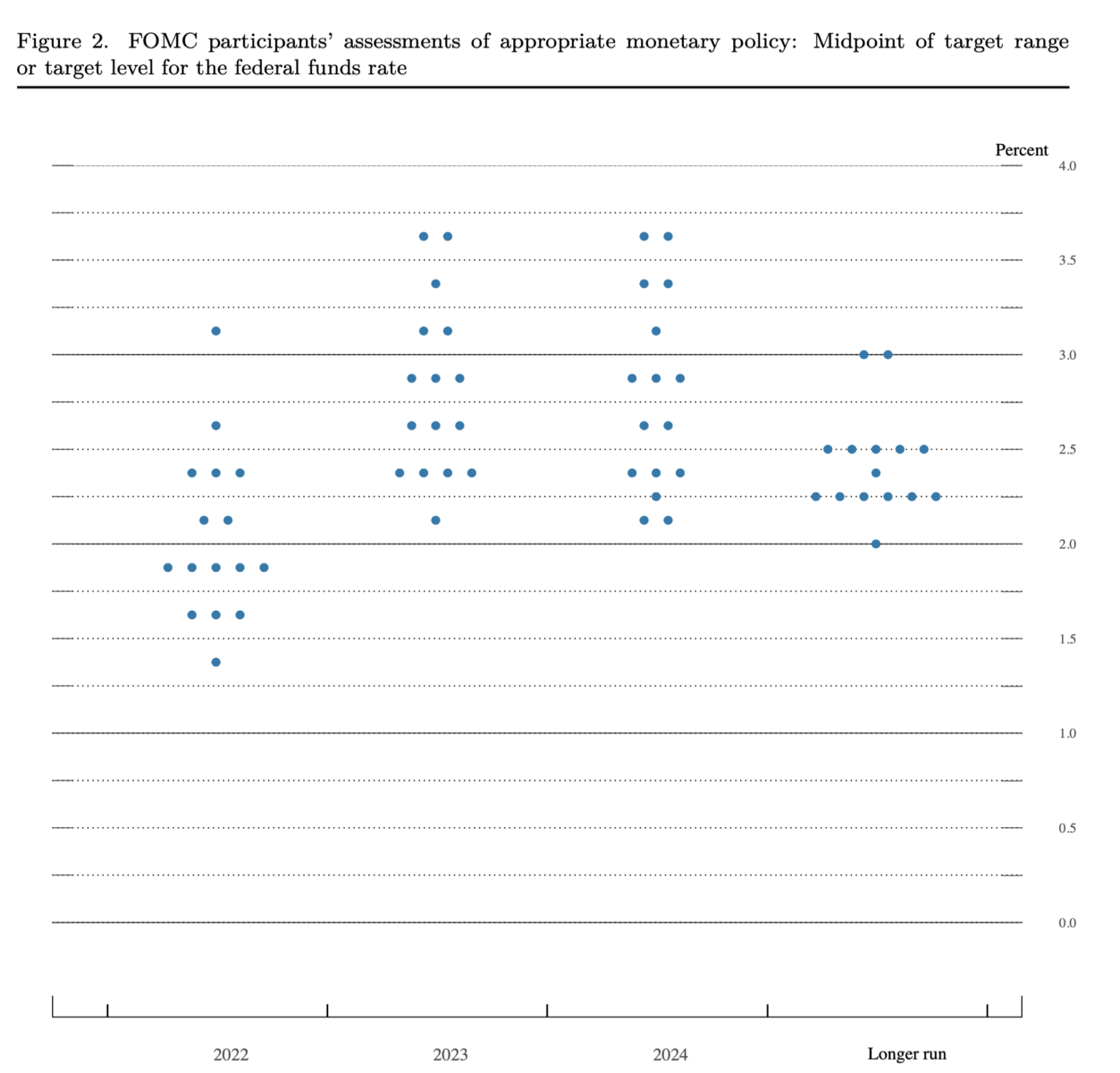

Final, the present September 2023 Dot Plot, which I suppose is reassuring(?) because the out years at the moment are trending downwards:

The dots are helpful to provide Fed watchers one thing to speak about, however for the remainder of us, it’s actually a humbling reminder that no one is aware of what the longer term holds. As a lot as folks criticize the Fed, I give them credit score for saying what they’re going to do after which doing it. And once more, kudos to them for admitting they will’t see the longer term.

Now if we will simply get them to know the current, possibly we’ll be OK…

Replace: 1:32 pm

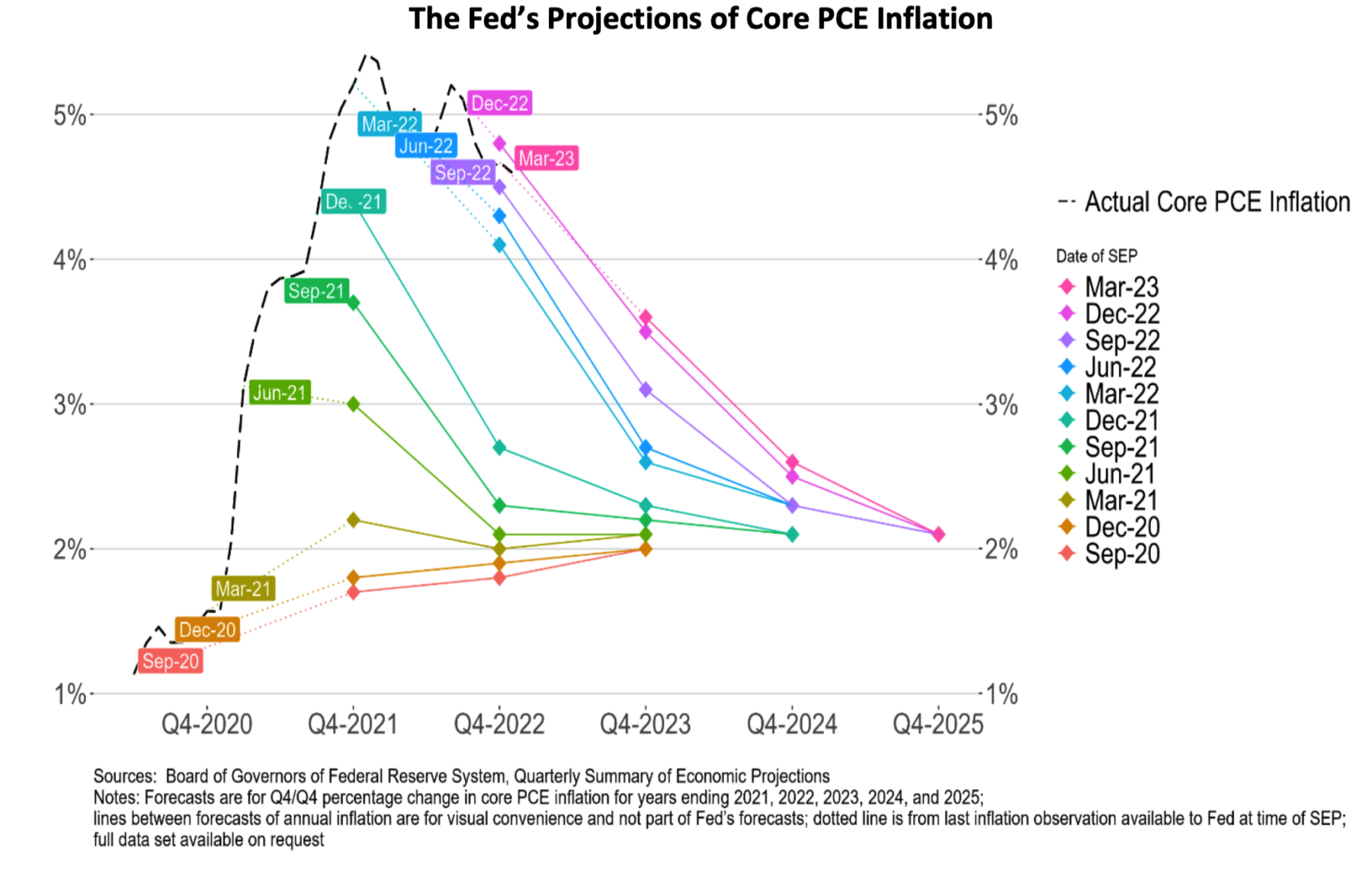

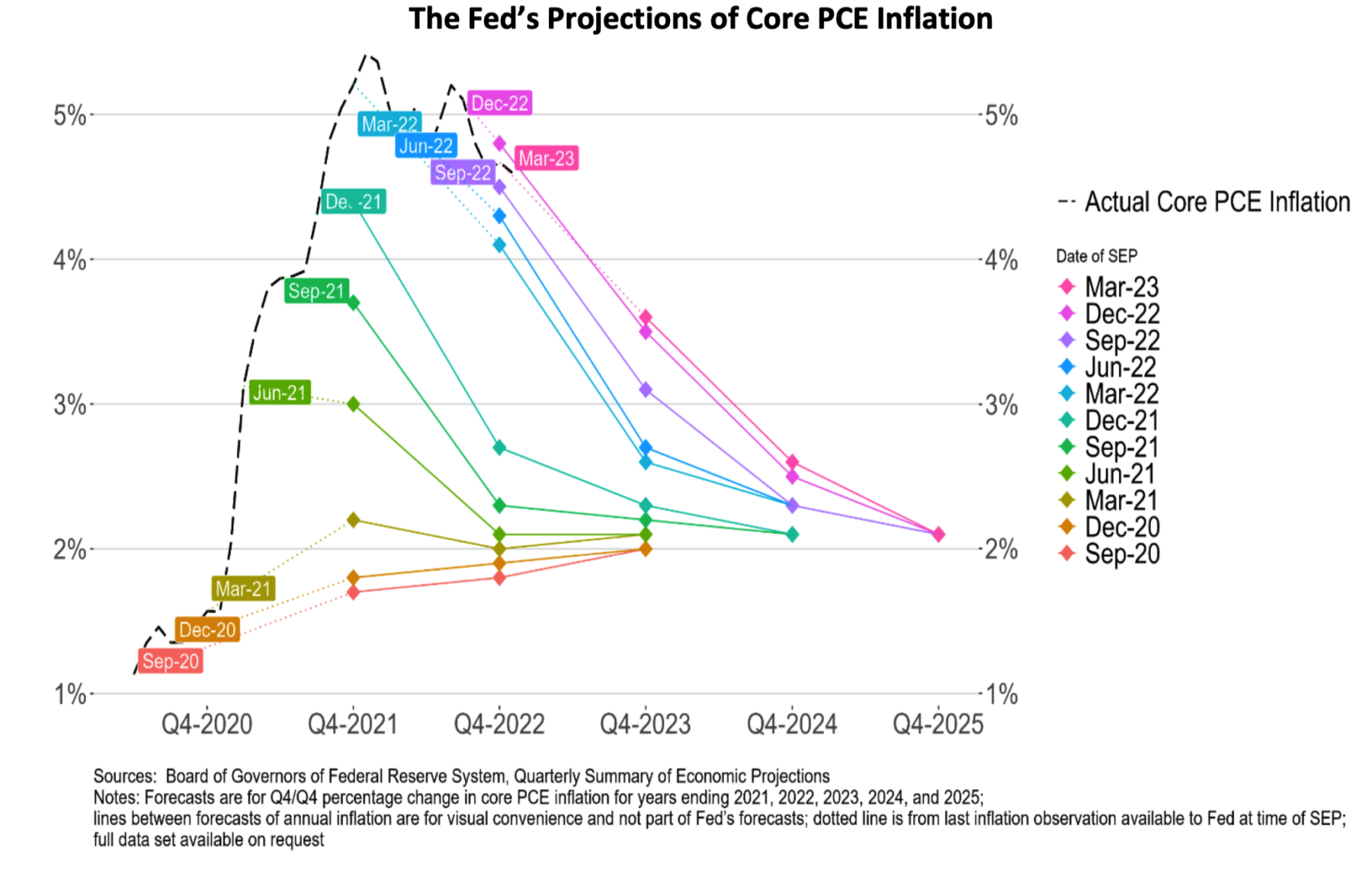

My pal Rosie shares the next data from his 2022 dialogue of the primary FOMC improve:

“Evidently, I’m skeptical of the Fed’s forecasts, regardless that traders deal with them (and the dot-plots) as gospel. Take a look at the accuracy of the Fed’s forecasts (a complete of 110 data-points again to 2012)”

- Fed funds price: correct 37% of the time

- Core inflation: correct 29% of the time

- Unemployment price: correct 24% of the time

- Actual GDP development: correct 17% of the time

-David Rosenberg

Beforehand:

5 Methods the Fed’s Deflation Playbook May Be Improved (Businessweek, August 18, 2023)

Why Is the Fed All the time Late to the Social gathering? (October 7, 2022)

Who Is to Blame for Inflation, 1-15 (June 28, 2022)

No person Is aware of Something (Assortment)

See additionally:

Powell’s Taper Tightrope May Be Sophisticated by Fed ‘Dots’ (WSJ, Sept. 21, 2021)

The Federal Reserve’s newest dot plot, defined (BankRate September 20, 2023)

The Fed and its Dots lavish portrait (James Lavish, Dec 18 2022)

The Fed ‘Dots’ Put Monetary Markets In A Tizzy (Forbes 6/19/21)