“I would like the US Greenback to be a retailer of worth between the time I make it till I spend it, make investments it, pay my taxes with it, or give it away. It does that splendidly.” 1

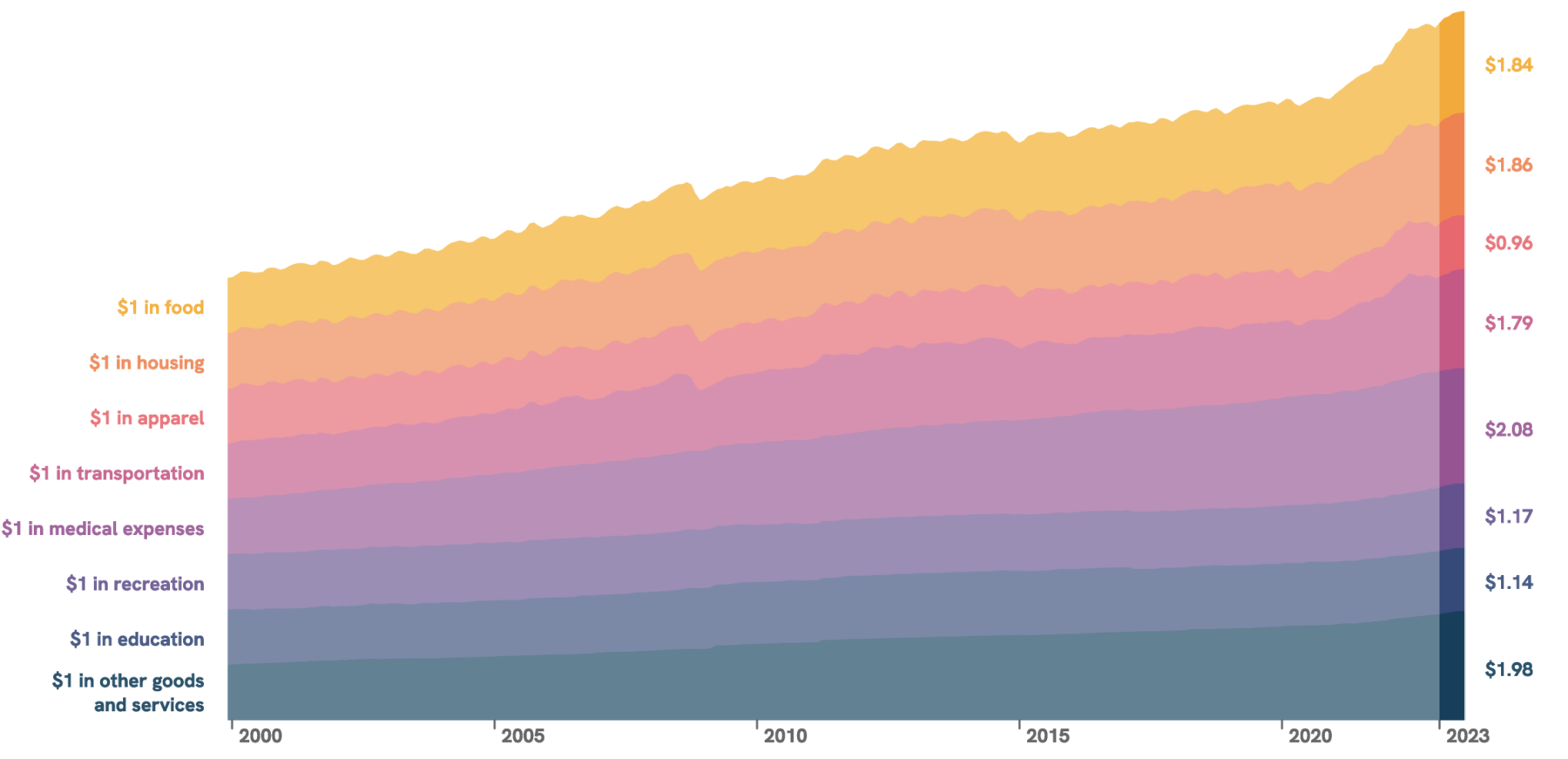

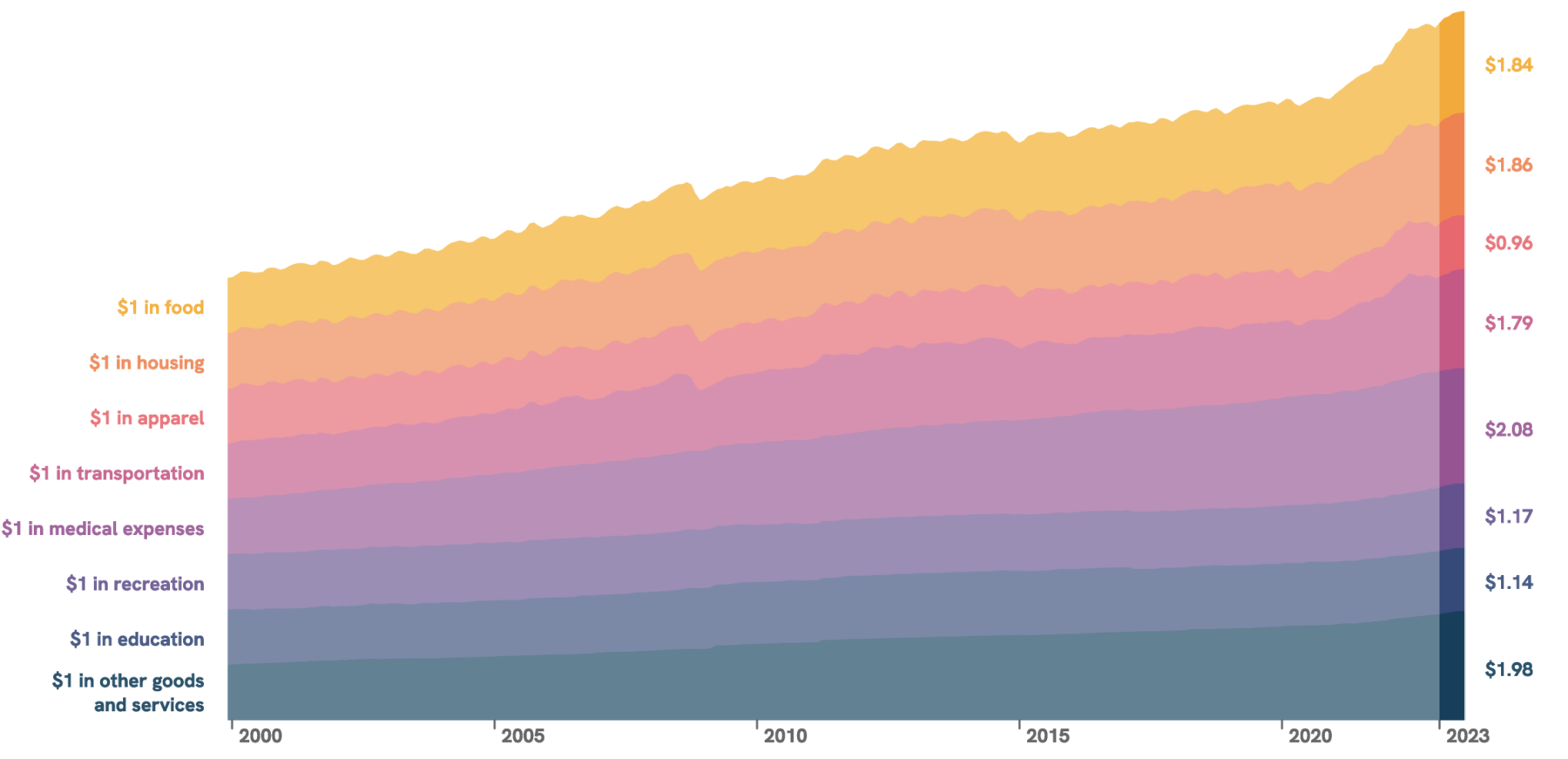

Right this moment, we’re going to have a look at a perennial (un)favourite #chartfail. To be extra exact, I wish to talk about the kind of chart that displays a elementary misunderstanding of the character of cash, foreign money, spending, investing, and taxes. I’ve talked about this previously, however I occurred throughout the chart above, and it serves as a reminder to revisit this subject in larger element.

You receives a commission in {dollars}. That compensation is in a foreign money that may be a broadly accepted medium of change.

For example, I work 40-60 hours per week; I receives a commission for my time and efforts. That comp will get deposited instantly into my checking account; that cash is obtainable for buying requirements (meals, housing, clothes, drugs, transportation, and many others.), discretionary spending (leisure, journey, and many others.), and for paying my taxes.

However that’s not all: I even have the chance to make investments these {dollars}: I can purchase a broad market index, patiently ready for it to understand; I can purchase bonds and benefit from the revenue they yield; I might buy actual property, which both provides me a spot to reside or lease out for revenue; I might additionally use that cash to begin or construct a enterprise.

In every of these 4 classes, the {dollars} I make investments will generate a return over time. And over the previous few centuries, these returns have drastically exceeded inflation. And that’s the important thing misunderstanding of charts just like the one above: It ignores the time worth of cash.

Whether or not it’s a couple of many years or a century, the maths works the identical.

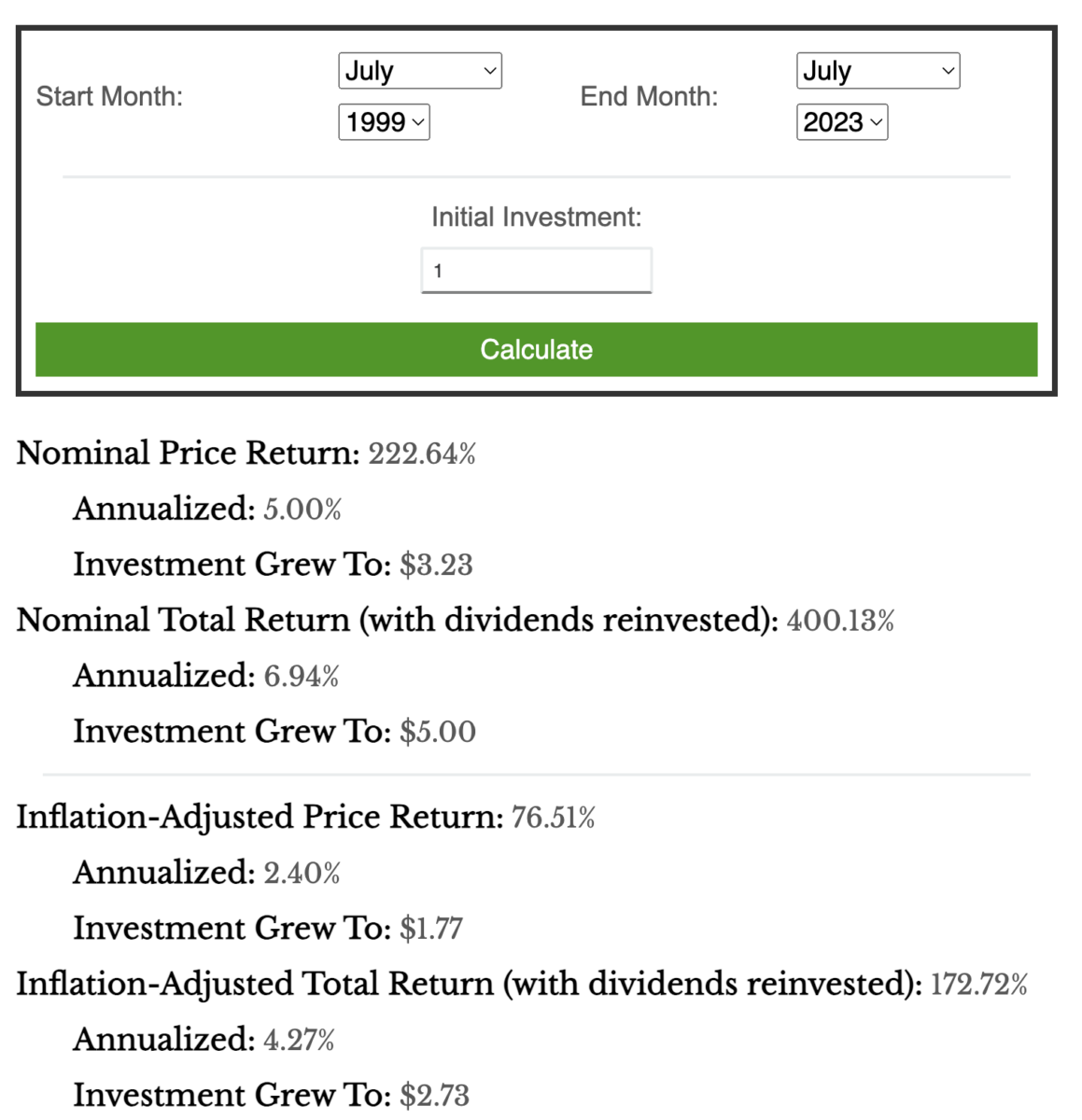

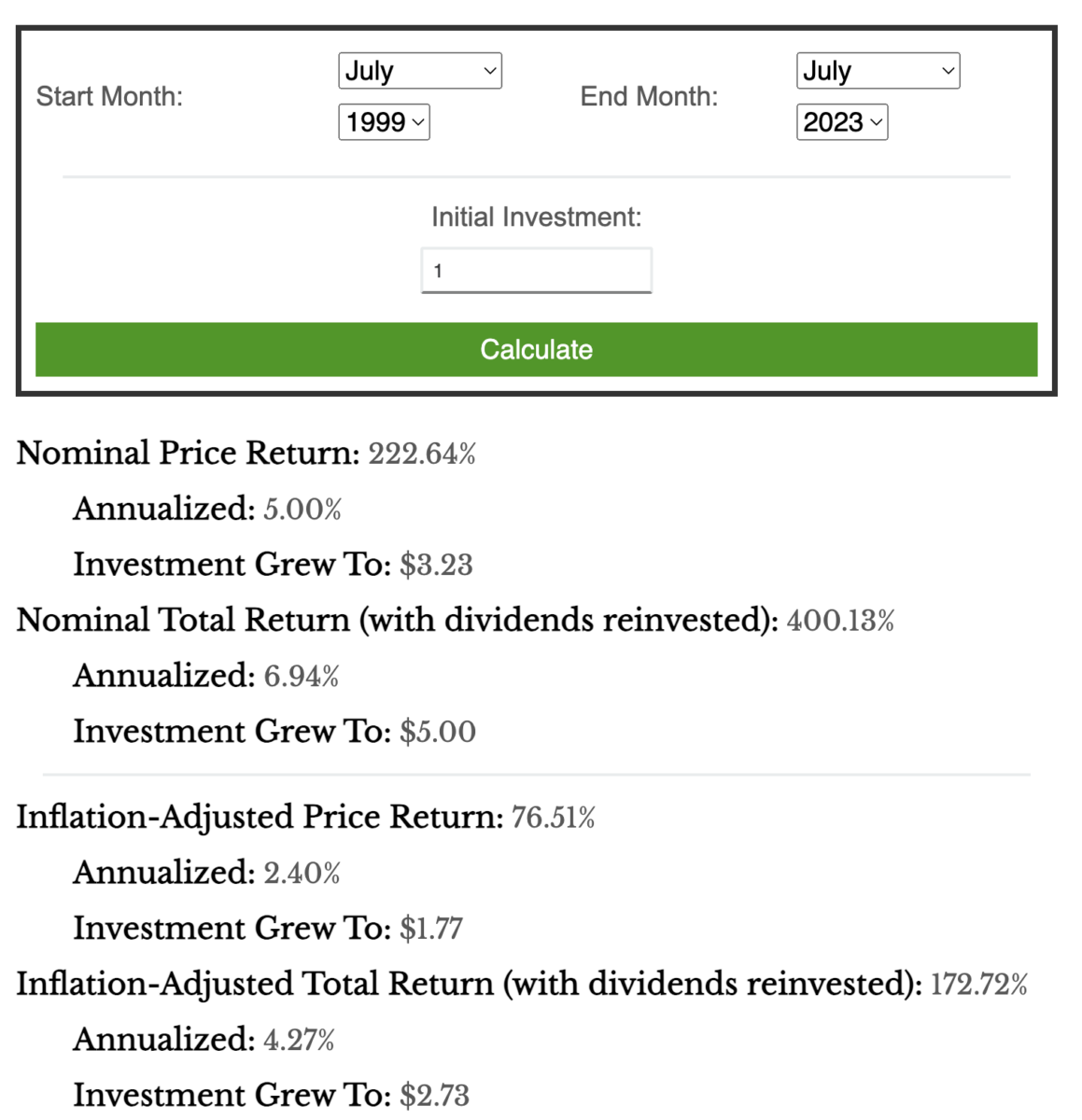

Again to our colourful chart at prime. Positive, it now takes $1.84 to purchase that greenback of 1999 meals. However had you set that right into a easy funding just like the S&P500 as a substitute of holding the {dollars}, it might have grown at an annual fee of 6.94% per 12 months and be price about $5 {dollars}.2 You might purchase these groceries and nonetheless have $3.16 left over.

Again to our colourful chart at prime. Positive, it now takes $1.84 to purchase that greenback of 1999 meals. However had you set that right into a easy funding just like the S&P500 as a substitute of holding the {dollars}, it might have grown at an annual fee of 6.94% per 12 months and be price about $5 {dollars}.2 You might purchase these groceries and nonetheless have $3.16 left over.

Hey, what a really completely different final result than suggesting a lack of buying energy — for those who perceive cash and math, you’ve got truly gained buying energy.

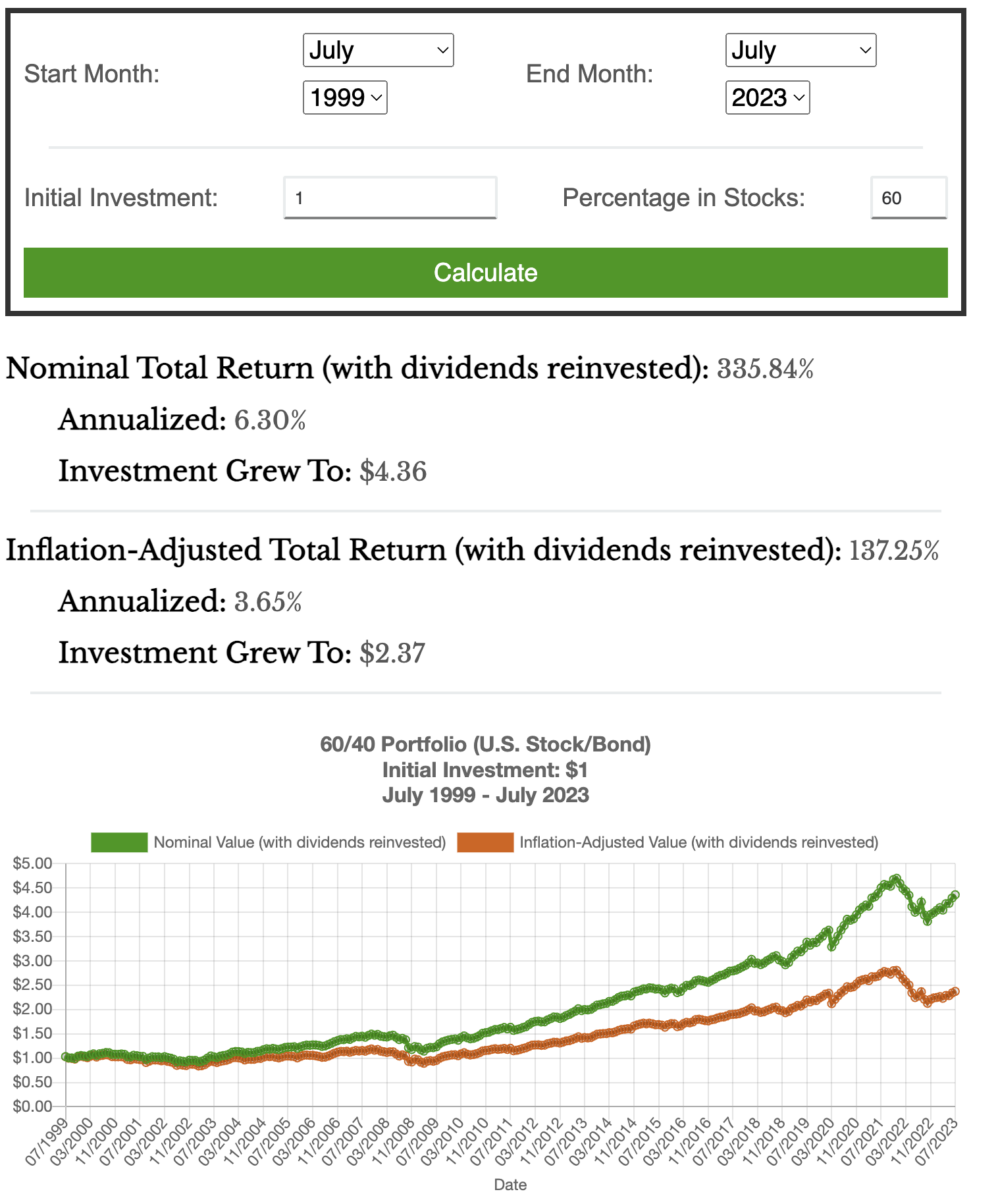

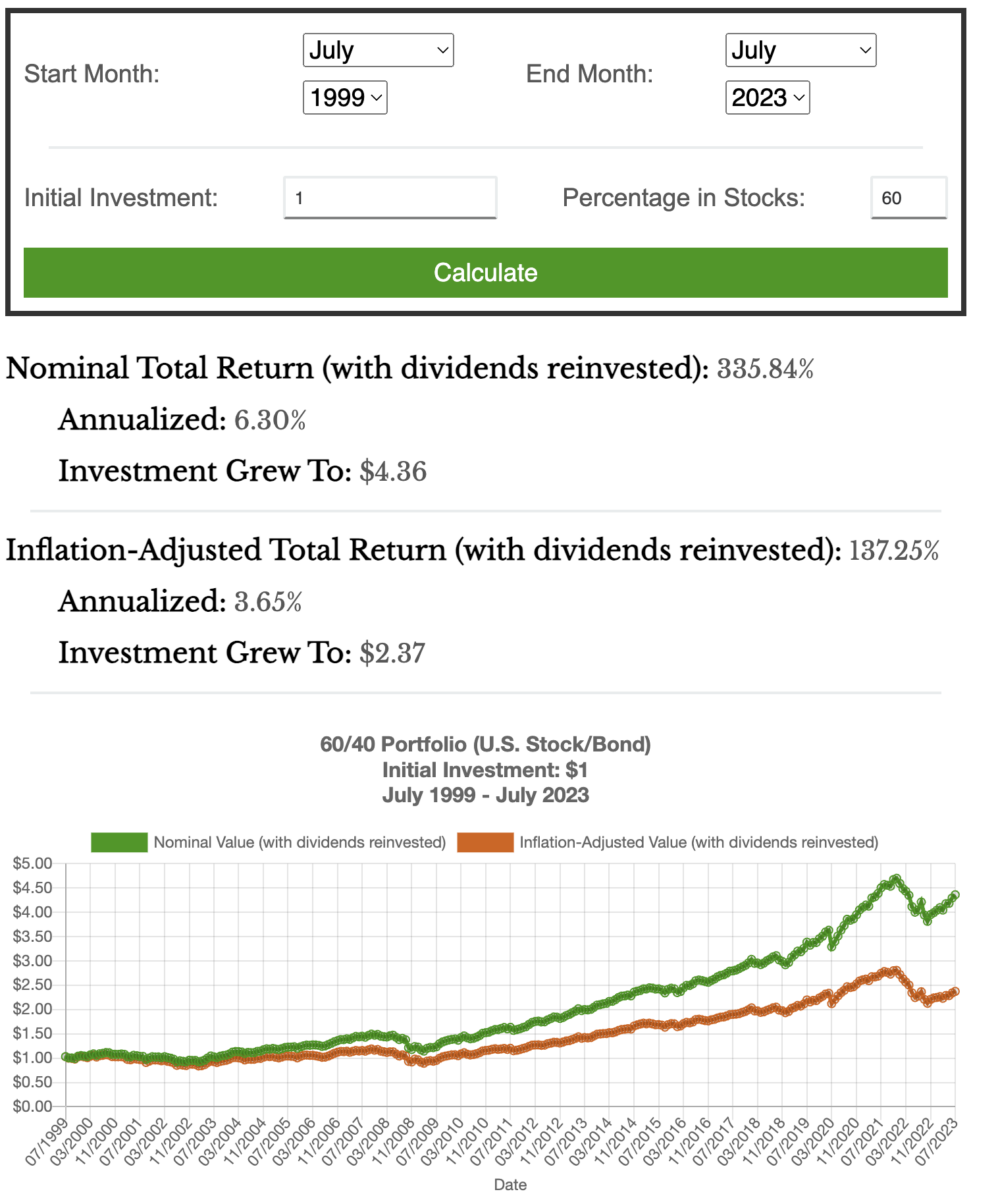

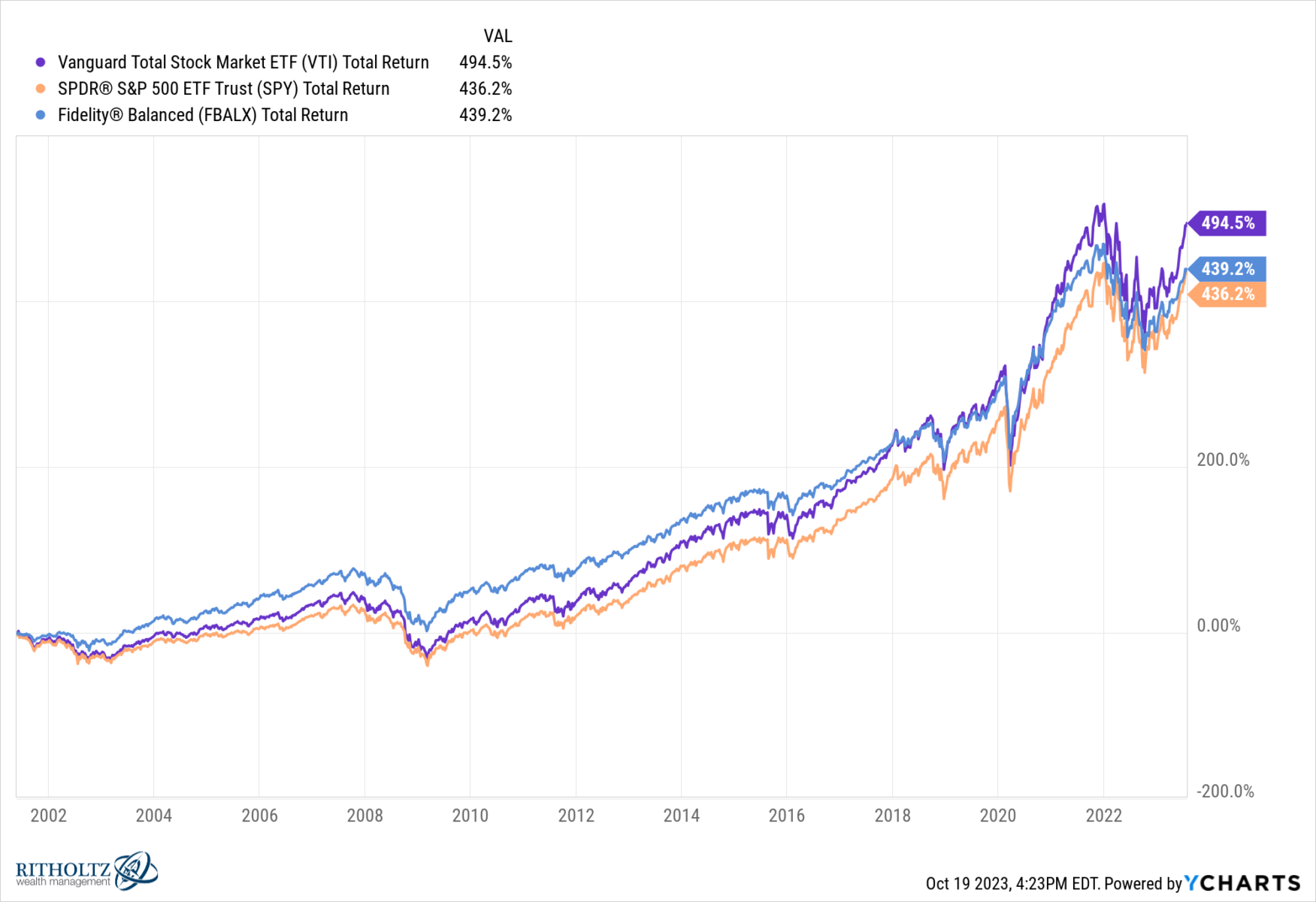

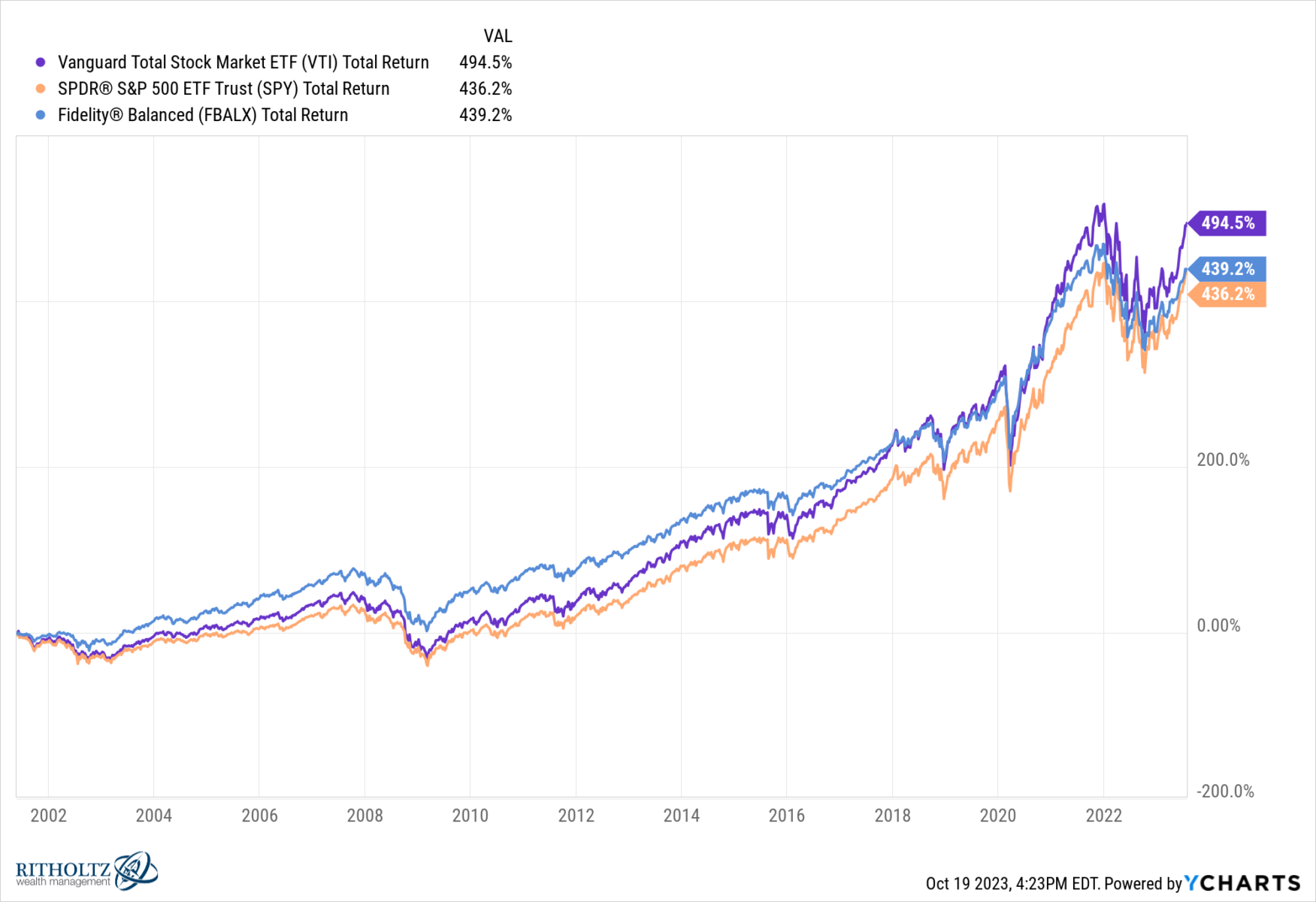

As an alternative of cherry-picking the S&P 500, what a couple of easy 60/40 portfolio (e.g., Constancy Balanced Fund, FBALX)? You’ll have completed barely worse, gaining about 6.7% per 12 months.3 And the Vanguard Complete Market (VTI) would have completed barely higher, garnering about 7.8% yearly over the identical interval.4

I all the time dislike these one-sided arguments – Come see how a lot the greenback has depreciated over a century! At finest, it’s denominator blindness; at worst, it’s purposefully deceptive, ignorant, or full-blown Russian propaganda. All I do know is these are crap charts that reveal little apart from their creator’s elementary misunderstanding of finance.

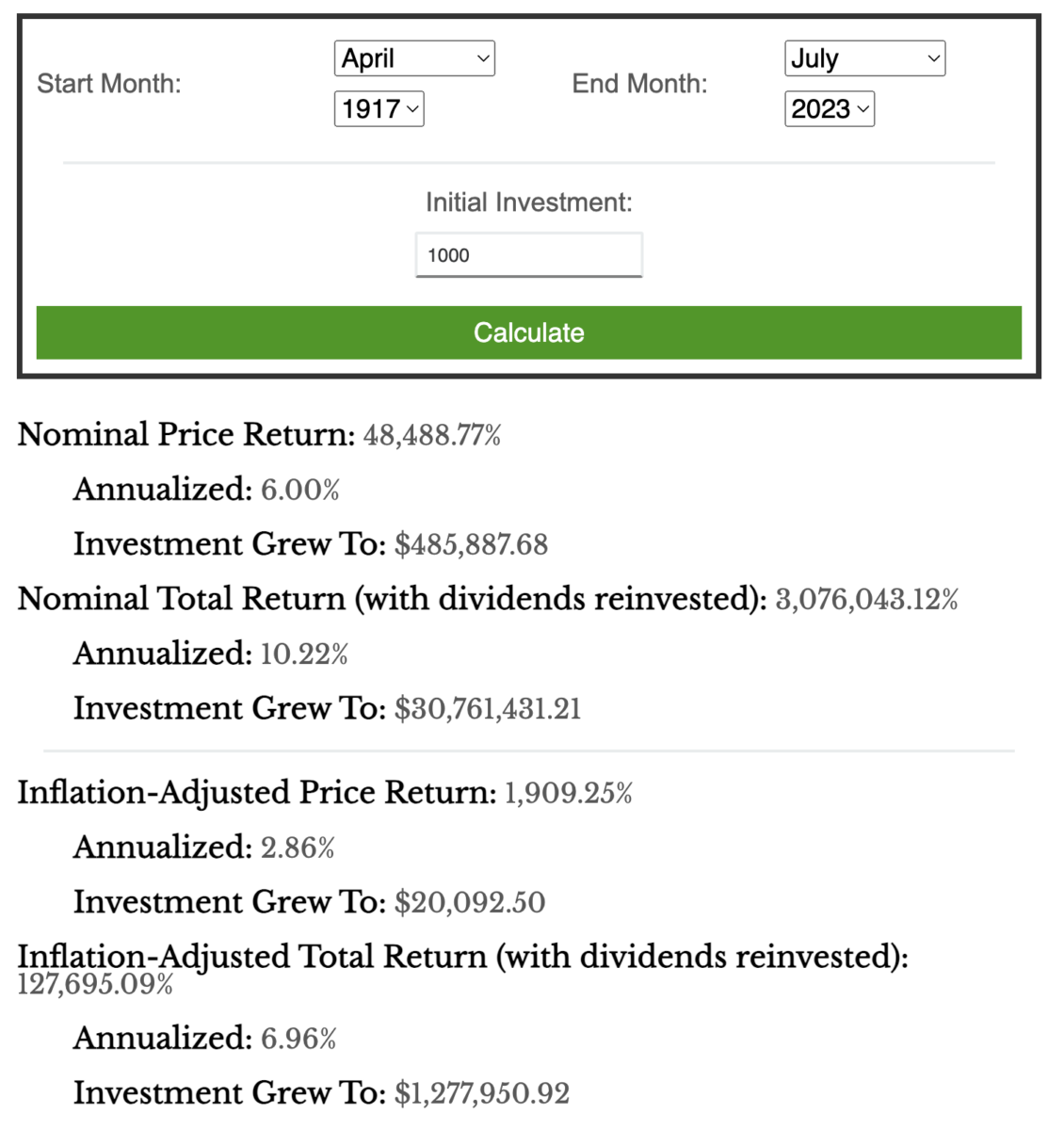

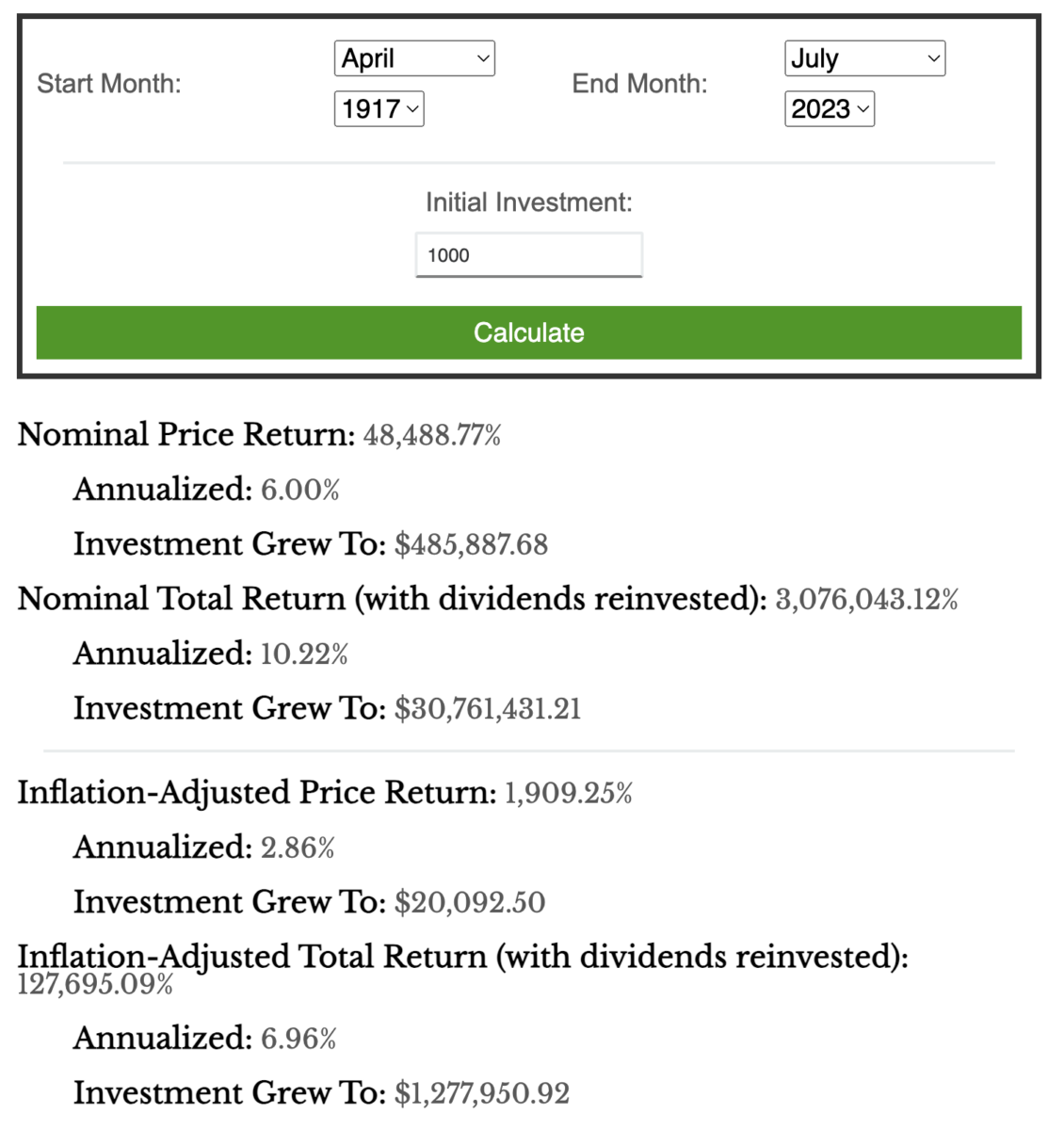

Let’s think about two individuals, every with $1,000 {dollars}, on the brink of go off to World Conflict I in April 1917. One decides to bury the money in mason jars within the yard, whereas the opposite units up an account invested out there (held in a belief in case they don’t return). Their descendants every take possession of those in July 2023. If it was your great-grandpappy who buried the money, sorry, it’s now price 96% lower than April 1917. But when it was your ancestor who put that $1,000 into equities over that very same interval, effectively congratulations. Since then, markets have returned about 10.22% a 12 months, and that small fortune grew to an unlimited one,5 now price over $30 million.6

Foreign money just like the U.S. Greenback is a medium of change, not a retailer of worth. As such, they’re by no means presupposed to be left hanging round for years or many years; burying them for hundreds of years is simply laughable.

{Dollars} are for spending and investing; they’re a medium of change, not a retailer of worth, and they don’t seem to be simply counting…

Supply:

How Far Does $1 From 1999 Go Right this moment?

by Shri Khalpada

PerThirtySix, August 14, 2023

__________

1. My Tweet from 10:33 AM · Oct 12, 2021

2. $1 within the S&P500 with dividends reinvested grew 6.94% annualized; over that 24-year interval it might have grown to $5.00; knowledge returns from Nick Maggiulli’s S&P 500 Historic Return Calculator [With Dividends]

3. $1 within the 60/40 portfolio with dividends reinvested grew at 6.30% annualized; over that 24-year interval it might have grown to $4.36 ; knowledge returns from Nick Maggiulli’s U.S. Inventory/Bond Historic Return Calculator.

4. $1 within the Vanguard Complete Inventory Market ETF (VTI) with dividends reinvested grew 7.87% annualized; over that 24-year interval, it might have grown to about $5.67.

5. $1,000 within the S&P500 with dividends reinvested would return 10.22% annualized, and from April 1917 to July 2023 can be price $30,761,431.21; knowledge returns from Nick Maggiulli’s S&P 500 Historic Return Calculator [With Dividends]

6. Returns over this lengthy a interval are exponential, and subsequently not very intuitive.

A enjoyable manner to consider that is through the rule of 72. At 10.2%, annual returns, your $1,000 will double each ~7 years. Ranging from 1917, meaning the cash has doubled 15 instances:

| Yr | Greenback Quantity |

| 1917 | $1,000 |

| 1924 | $2,000 |

| 1931 | $4,000 |

| 1938 | $8,000 |

| 1945 | $16,000 |

| 1952 | $32,000 |

| 1959 | $64,000 |

| 1966 | $128,000 |

| 1973 | $256,000 |

| 1980 | $512,000 |

| 1987 | $1,024,000 |

| 1994 | $2,048,000 |

| 2001 | $4,096,000 |

| 2008 | $8,192,000 |

| 2015 | $16,384,000 |

| 2022 | $32,768,000 |

Fairly unimaginable, huh?

Matching the above 1999 inflation chart:

S&P500 Returns, July 1999 to July 2023

60/40 Returns, July 1999 to July 2023