I’ve a vivid recollection of the interval following the Nice Monetary Disaster: I spent March to September of 2008 writing Bailout Nation and the post-Lehman collapse revising and updating the manuscript. The primary two months of ‘09 had been spent modifying, and off I went on a well-deserved trip in late February.

Once I lastly got here up for air, markets had been minimize in half (peak to trough down 56%) and each sentiment indicator I tracked was essentially the most excessive they’ve been in my skilled lifetime. “Cowl your shorts and go lengthy” was not a tough name.

What was tough was the following onslaught of nonbelievers – these bears who after the market bottomed in March 2009 and started shifting larger, refused to imagine what they had been seeing. The remainder of ‘09 noticed a fierce rally of 63% within the S&P500 from the March 6th lows; the total calendar 12 months gained +23.5%.1

In 2010, markets gained 12.8%.

When 2011 noticed a flat S&P 500,2 the destructive narratives took on a larger urgency.

However that complete 31-month transfer was stuffed with angst and narratives of disbelief. If you weren’t actively buying and selling or investing again then, chances are you’ll recall these storylines that dominated the media:

1. That is nothing greater than a Lifeless Cat Bounce, which is able to rapidly run out of steam because the bear market reasserts itself;

2. We aren’t merely taking a look at inflation however hyperinflation because of these FOMC insurance policies;

3. Equities by no means bought again all the way down to single digit PE ratios which is how we all know this can be a horrible entry to shares.

4. The Fed’s many credit score amenities has distorted {the marketplace}, however that may solely carry us to this point and the underside will drop out any day;

5. ZIRP/QE are types of monetary repression that finally will fail resulting in the subsequent crash;

6. 2008-09 was simply the primary leg down much like 1929; the actual injury will come within the 1932 crash (circa ~2011-12).

There have been many extra narratives, however these above are sufficient to show the purpose. Suffice it to say that not one of the scary tales promising recessions, crises, recessions, disasters, or worse ever got here to be.

Then got here 2012, up 13.4%; 2013 was the 12 months that the S&P 500 broke out to highs above the pre-GFC peak, signifying a brand new bull market.3 The markets gained +29.6% on the 12 months.

A decade later, COVID-19 and an aggressive, belated price mountaineering cycle modified the investing regime.

~~~

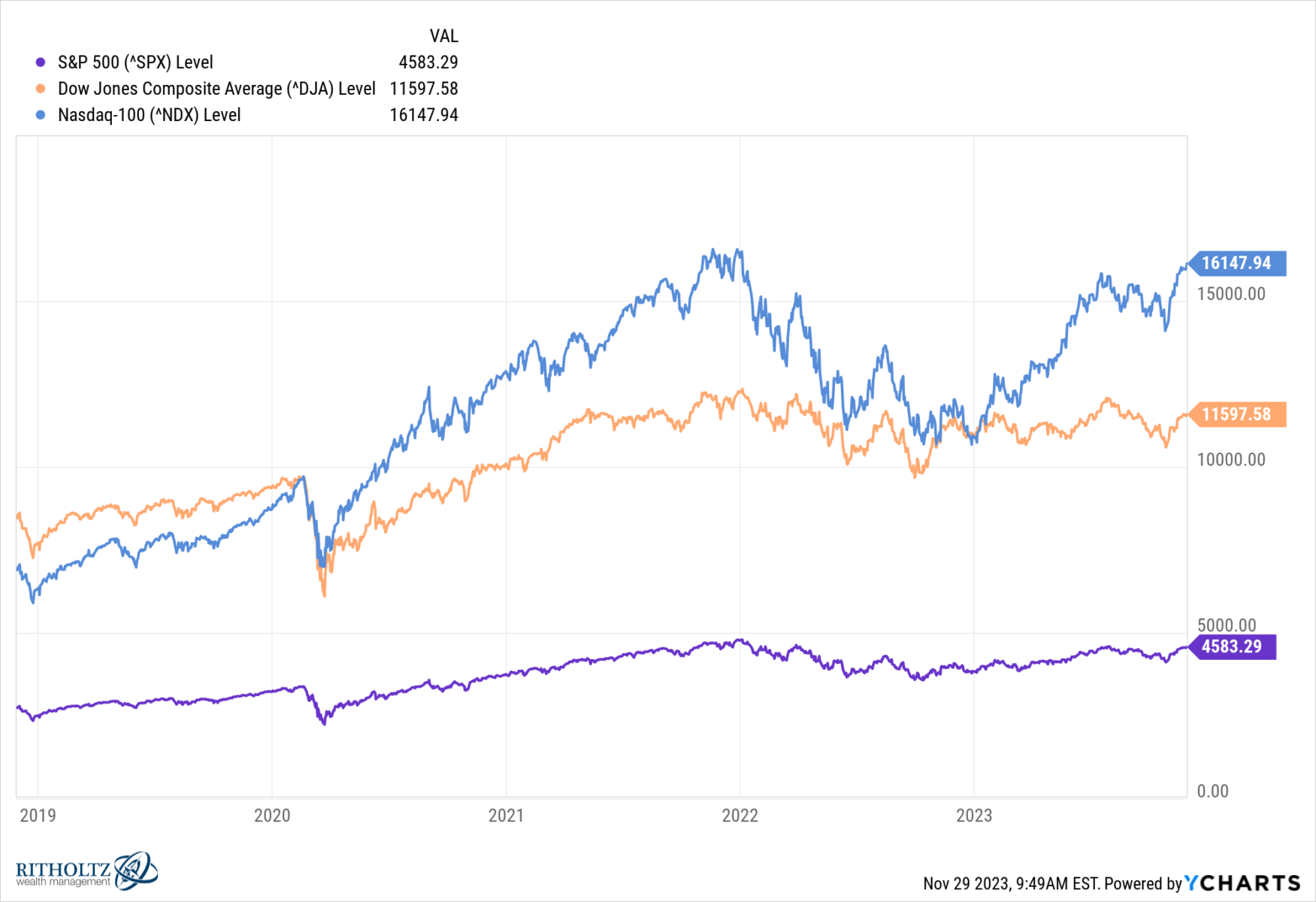

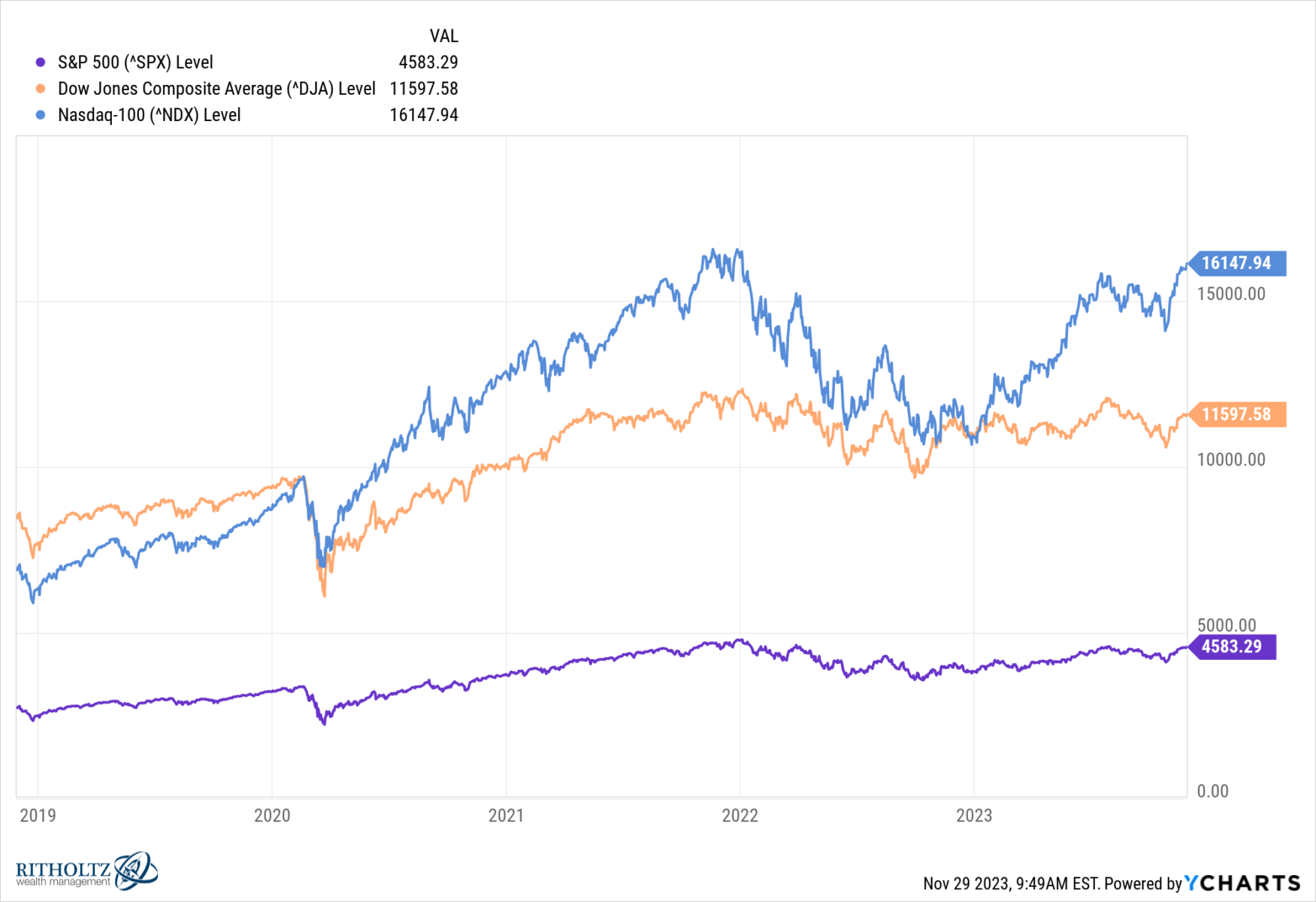

One can not assist however discover an analogous set of circumstances right now, 41 months after markers made their pandemic lows on March 26, 2020. We sit a couple of share factors away from the pre-pandemic highs (see chart above). Sentiment is destructive, disbelief is rampant, and that is essentially the most hated rally because the transfer off of the 2009 lows.4 Three years later, pundits had been asking the identical query: How hated is that this rally?

JC Parets of All-Star Charts factors out that “The inventory market is having a historic 12 months. The S&P500 is up over 20% to this point, with top-of-the-line months of the 12 months nonetheless forward. The Dow Jones Industrial Common is simply 2% from new all-time highs.” He provides the Nasdaq has completed even higher, up 46% for 2023 with a month left within the 12 months, and the VIX is pushing 4-year lows all the way down to 12.

Right this moment, we have now Russia and Hamas beginning sizzling wars in Ukraine and Israel; 2010s had Brexit and the specter of the European Union collapse.5

In fact, no two rallies or bull markets are ever an identical: Shares ain’t precisely low-cost, charges have trended larger (not decrease) and the Russell 2000 can not get out of its personal method.

However the two eras increase comparable questions for merchants: Are you too bullish, or not bullish sufficient…?

Beforehand:

The Most Hated Rally in Wall Road Historical past (October 8, 2009)

How Hated Is This Rally? (September 10, 2012)

Spherical Journey: Classes From the 2022 Bear Market (August 1, 2023)

Understanding Investing Regime Change (October 25, 2023)

Bull & Bear Markets

See additionally:

Buyers are nonetheless unhappy

JC Parets

All Star Charts, November 28, 2023

__________

1. That’s worth solely; the 2009 complete return with dividends was +26.5%.

2. 2011 complete return was +2.1%

3.Technicians and others usually don’t rely the restoration rally off of the lows as a part of the brand new bull market; somewhat they’re merely getting again to interrupt even. For this reason the 1982-2000 rally shouldn’t be dated to the lows in 1973…

4. I first used that phrase on October 8, 2009, and it took off.

5. The home political local weather post-January sixth and the rise of authoritarianism/popularism is totally different than the post-GFC period…