No, “almost half” of $94.5 billion in retail stock losses in 2021 was not “attributable to organized retail crime.”

That line is simply one other in a protracted sequence of falsehoods put forth by the skilled bullshitters on the Nationwide Retail Federation.

Right here’s Reuters:

“The primary lobbying group for U.S. retailers retracted its declare that “organized retail crime” accounted for almost half of all stock losses in 2021 after discovering that incorrect information was used for its evaluation.”

I’ve been calling out their nonsense for almost twenty years and was able to retire my Black Friday debunking of their annual Thanksgiving silliness. I tracked the annual retail gross sales forecast as a twofold train: Keep away from forecasts, as they’re largely improper, and have a tendency to lose buyers’ cash. And second, be cautious of what self-interested commerce teams say about their business; they’re lobbyists and cheerleaders, not seekers of reality.1

However since a spokesperson for the NRF admitted they needed to take away content material from its report on organized retail crime (report from April 2023, produced with employed gun K2 Integrity), I’ve begun to rethink that.

After six months of relentless propaganda on crime, the NRF needed to edit the declare that “almost half” of stock losses had been organized crime.

It’s not.

The precise quantity? About 5%, or 1/10 as a lot.

The straightforward math drawback appears to have been exascerbated by Capital One, which handled ALL SHRINKAGE as retail theft. As Retail Dive reported, the statistic comes from a Capital One Buying report on retail theft, which treats the NRF’s complete shrink quantity as theft, then extrapolated the numbers by state.2

You’ll be able to rely on C-Suite executives at publicly traded firms to leap on each development to excuse poor firm efficiency. Early this yr, Walgreens finance chief James Kehoe admitted as a lot: “Possibly we cried an excessive amount of final yr” about merchandise losses. Prior to now, firms have referenced COVID-19, crypto, inflation, conflict, and even AI exhibits in quarterly calls as a part of their “contextualizing” income and revenue patterns.

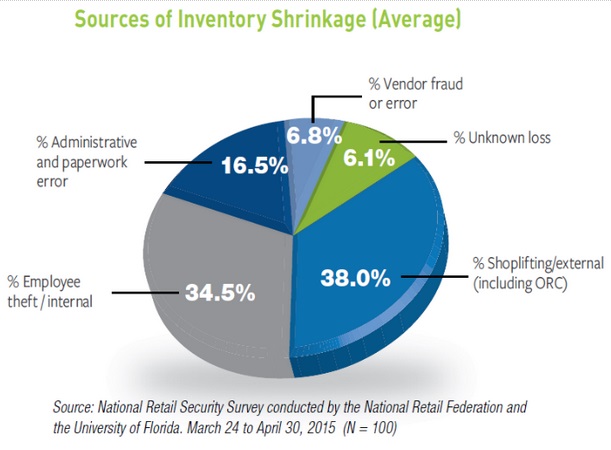

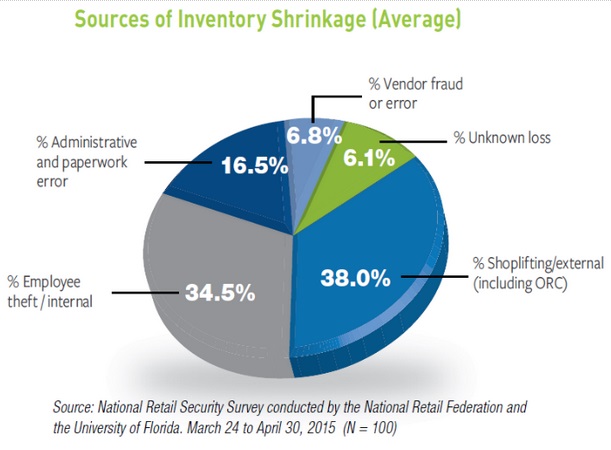

There are a lot of sources of “Shrinkage” of stock, and whereas there may be some debate as to the biggest sources, they give the impression of being one thing like this:

Worker theft: It’s the primary supply of shrinkage. (My expertise: it’s usually uinderreported by firms). Issues “fall off” the truck, Staff steal merchandise, or resell it and preserve the money. This prices retailers anyplace between $15-20 billion yearly within the US.

Shoplifting: $10-15 billion per yr. Whether or not its merely strolling out with items, doing smash & grabs or in any other case dishonest self-checkouts, it’s the second largest supply of retail theft, and a pernicious problem to all retailers.

Return fraud: Returning stolen merchandise is a variation of shoplifting; notice it typically (ceaselessly?) entails cooperative staff.

Credit score Card Fraud: Has been an enormous supply of losses; a few of it’s borne by banks, and greater than slightly of it impacts shoppers, who usually are unaware of it.

Vendor Fraud: Mild shipments and different types of stock shrink earlier than items even arrive at retailers or their warehouses account for $2-Four billion in losses

Administrative errors: Generally these are reputable errors in ordering,. Logistics, and stock monitoring.

Operational loss, or unintentional loss: Any firm that buys, ships, warehouses and shows hundreds of thousands of products a yr goes to often break, injury or misplace them. Its regular, and a part of any retail enterprise.

Accounting Fraud: Not each retailer is Loopy Eddies, cooking the books, however quite a lot of shops have been identified to get inventive with their stock administration.

The declare that organized retail crime accounted for “almost half” of stock losses was false, but it surely’s additionally an indictment of recent media. All too usually, the reality issues a lot lower than meme manufacturing and clickbait.

Who has time to truly fact-check information when one thing this juicy comes alongside? That it was clearly false and based mostly on outdated lobbyists’ experiences by no means appeared to lift any crimson flags.3

The LA Instances referred to as out how foolish a number of the claims had been in late 2021:

“It’s straightforward to get consideration for sensational claims, nonetheless, notably once they come from official sources. Rachel Michelin, president of the California Retailers Assn., advised the San Jose Mercury Information that in San Francisco and Oakland alone, companies lose $3.6 billion to organized retail crime every year.

That might imply retail gangs steal almost 25% of complete gross sales in San Francisco and Oakland mixed, which amounted to round $15.5 billion in 2019, in keeping with the state company that tracks gross sales tax.

Can that be proper? In a phrase: no.”

And in keeping with NRF information itself, from its annual Retail Safety Survey, shrink attributed to exterior theft, together with organized retail crime, has largely remained the identical since 2015. On-line dasher just lately reported that “The common retail shrinkage charge has hovered round 1.4% for over a decade.” In 2022, Retail’s shrink charge rose to 1.6% from 1.4% of gross sales in 2021, in keeping with the NRF’s annual retail safety survey; 1.6% was the place the reported shrink charge was in 2019 and 2020 additionally:

Supply: Retail Dive

A large media scare was created by those that couldn’t be bothered to test the information, however forth by a careless, biased commerce group with a historical past of nice exaggeration or outright mendacity, to cheerlead the pursuits of its personal business.

Traders ought to look askance at information and claims from business spokespeople and commerce teams. All of them have agendas, none of which embrace the well-being of your portfolios…

Supply:

Retailers have against the law drawback. It’s within the numbers.

The problem is complicated and infrequently clouded by imprecise information. Generally from the business itself.

Retail Dive, Nov. 29, 2023

See additionally:

US retail lobbyists retract key declare on ‘organized’ retail crime

By Katherine Masters

Reuters, December 5, 2023

‘Possibly we cried an excessive amount of’ over shoplifting, Walgreens govt says

By Nathaniel Meyersohn

CNN January 7, 2023

Retailers say thefts are at disaster stage. The numbers say in any other case

By Sam Dean

LA Instances, December 15, 2021

Companies preserve complaining about shoplifting, however wage theft is an even bigger crime

Michael Hiltzik

LA Instances, August 30, 2023

Retail Group Retracts Startling Declare About ‘Organized’ Shoplifting

By Eduardo Medina

NY Instances, December. 8, 2023

Organized journalistic crime

JUDD LEGUM AND TESNIM ZEKERIA

Widespread.information, Dec 11, 2023

Beforehand:

Black Friday Survey #Fails

__________

1: See additionally, The Nationwide Affiliation of Realtors.

2. We had a Capital One bank card ~20 years in the past however canceled it once they refused to decrease charges from 18% in 2007 to what they had been always promoting on TV. (They had been very disagreeable to take care of). I’m not remotely shocked that fundamental arithmetic is difficult for this firm.

3. Extra Reuters:

In response to NRF spokesperson Danielle Inman, the declare that organized crime accounted for almost half of all stock losses was based mostly on two-year-old testimony from Ben Dugan, former president of the advocacy group Coalition of Regulation Enforcement and Retail. In 2021, he advised a U.S. Senate committee that organized retail crime accounted for $45 billion in annual losses for retailers, in keeping with estimates by the coalition.

The inclusion of the declare in NRF’s report was “taken instantly from Ben’s testimony” and “was an inference made by the K2 analyst linking the outcomes of the NRF survey from 2021 and Ben Dugan’s assertion made that very same yr,” Inman mentioned.