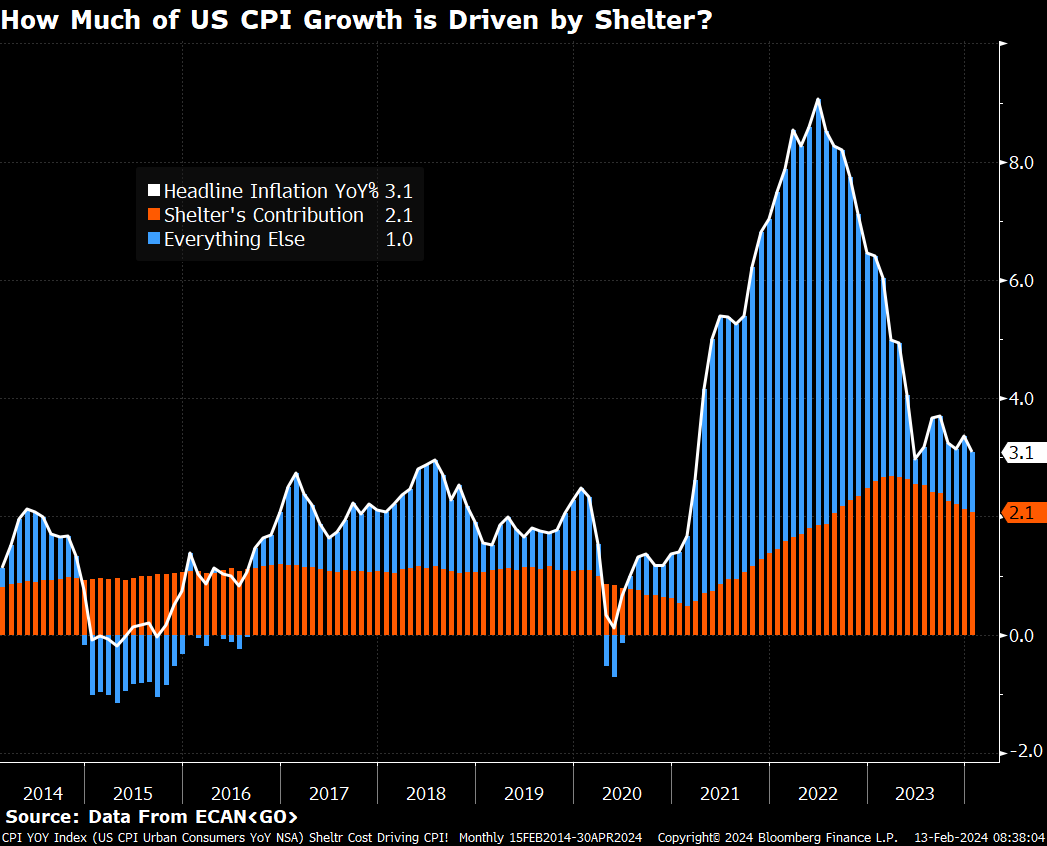

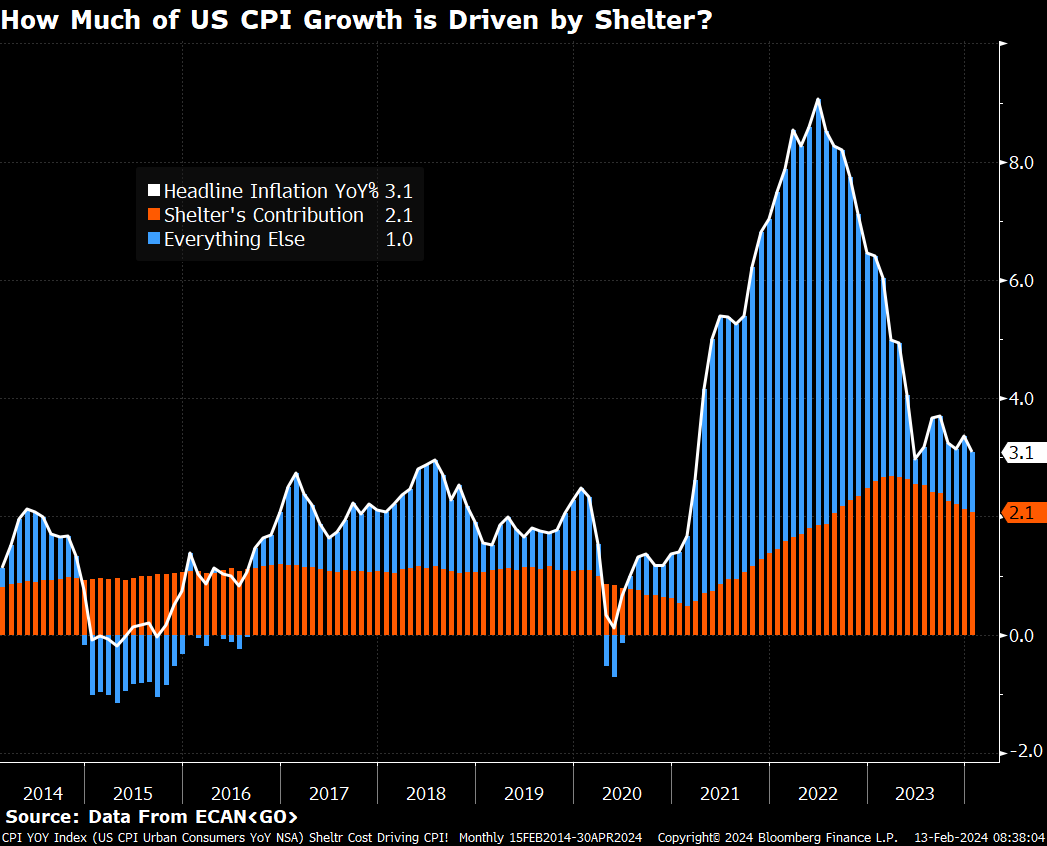

Final month, I discussed that CPI inflation measures had been based mostly on lagging BLS measures of House owners’ Equal Lease (OER).

BLS highlighted housing costs, headlining the CPI report as “CPI for all objects rose 0.3% in January; shelter up”

Because the chart above reveals, Shelter was 2/3rds of the rise in the latest. (Chart because of Michael McDonough).

Everyone knows OER lags real-world costs — I used to spitball this at 3-6 months. However this week’s podcast visitor, former NY Fed President Invoice Dudley, tells me the lag is nearer to 6-12 months. So BLS makes use of a measure of shelter for its inflation calculation that may truly lag behind precise costs by as a lot as a 12 months.

That places this week’s massive sell-off into correct perspective. It was a response to information that was both outdated or very outdated. It could not shock me to see that as folks determine this out, we claw again that sell-off over the subsequent few days or perhaps weeks.

The ever-present query: How a lot does the FOMC acknowledge how behind the curve this information is?

Beforehand:

CPI Improve is Based mostly on Unhealthy Shelter Knowledge (January 11, 2024)

How All people Miscalculated Housing Demand (July 29, 2021)