How far behind the curve is the FOMC?

I’m within the final month of guide depart however I felt compelled to come out at what appears like a seminal second within the financial/market cycle to debate how we received right here and what the approaching price cuts may imply going ahead.

Fast caveat: The world is at all times extra complicated and nuanced than we see within the media or academia; there are hundreds of thousands of little unknown particulars and our penchant for narrative fallacy results in clear and compelling storylines that usually lack verisimilitude.

Let’s begin at 30,000 ft earlier than zooming in on the small print. Following the monetary disaster, ZIPR/QE despatched charges to 0%, fiscal stimulus was largely non-existent,1 and so the 2010s post-GFC restoration decade was characterised by weak job creation, poor wage positive aspects, tender shopper spending and modest GDP. Inflation was non-existent, and CASH was king.

Traditionally, that is what post-financial crises are likely to seem like – apart from these durations the place governments apply the fiscal stimulus lesson we discovered from Lord Keynes to jump-start an financial enlargement.

The pandemic led to plenty of provide points, however like a lot else on the earth, the roots of those points stretched again years or many years:

-Over-building of single-family houses within the 2000s led to an underbuilding of single-family houses type 2007-2021; an affordable estimate is the USA wants 2-Four million single-family houses, particularly modestly priced starter houses.

-“Simply in Time” supply squeezed just a few extra pennies in income per share (not insubstantial) however the fee was a fragility that led to huge shortages in crucial objects, most particularly healthcare.2

-Labor Shortages hint again to 9/11, when the Bush Administration modified the principles of who can keep in the USA after getting a university diploma. That was adopted by decreased authorized immigration, an uptick in incapacity, COVID-19 deaths, and early retirement. An affordable estimate is the USA wants 2-Four million extra employees to workers our labor pressure and cut back wage pressures totally.

The delay in restarting the manufacture of semiconductors, which pushed up costs in new and used automobiles; it grew to become a big component of the preliminary spherical of value will increase.

Final, I’ve to say Greedflation.3 I used to be skeptical when the time period first got here into use, naively believing that corporations solely raised costs when compelled to, lest they lose the long-term good will of shoppers.

My views have since developed.

The time period is outlined as corporations profiting from the final mayhem surrounding an inflation surge to boost costs excess of their enter prices have gone up. It isn’t value gouging per se, however a extra common “Hey, all people else is elevating costs, why not us too?” If firm administration is there to (arguably) maximize income, properly then, value over quantity is what many corporations did to nice impact.

Earnings raced to all-time highs, serving to to propel the inventory market to ATH, because it climbed the wall of fear and power perma-bears and disbelievers.

~~~

Into this complicated mess, a once-in-century pandemic comes alongside.

Just a few weeks earlier than this occurred, in DC, Congress received itself tied into knots over renaming just a few faculties /libraries (this didn’t occur). Then the NBA shut down dwell video games, and a cascade of closures adopted all through the broader economic system.

The nation together with a lot of the world shuts down.

Concern ranges spiked. The shortcoming to move even essentially the most primary of laws was overcome by panic, and Congress handed the biggest fiscal stimulus as a share of GDP since World Struggle Two within the CARE Act (I).

Most observers have been sanguine, however full credit score to Wharton Professor of Finance on the Faculty of the College of Pennsylvania Jeremy Siegel. He presciently noticed {that a} fiscal stimulus that big would result in an enormous, albeit transitory surge in inflation.

And he was proper.

With individuals WFH and the service economic system partly, briefly closed, customers shifted to items consumption. Our 60/40 economic system grew to become a 40/60 one. Give individuals caught at residence massive stimulus checks, and the end result will probably be a large demand for items that sends costs screaming larger each time.4

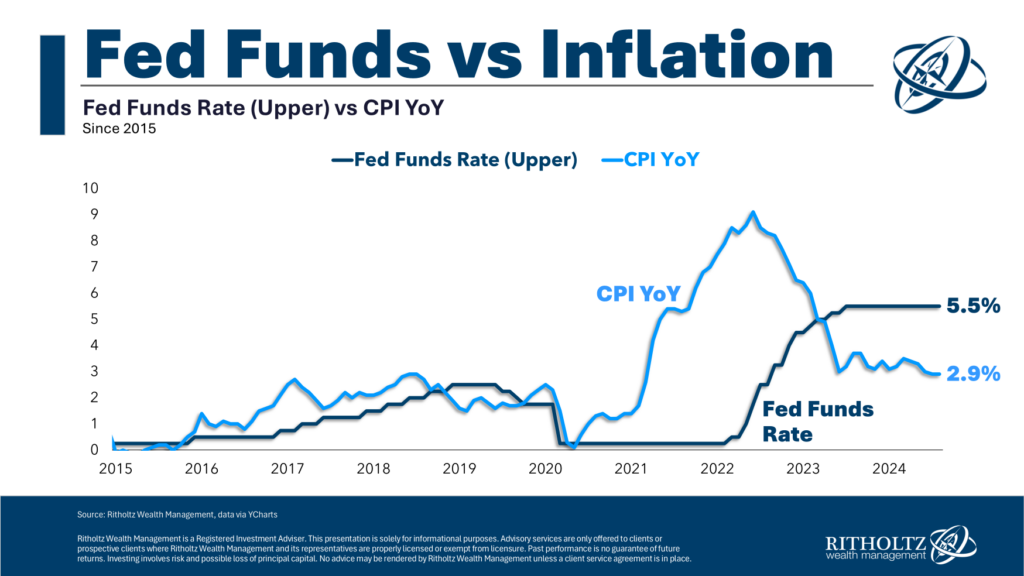

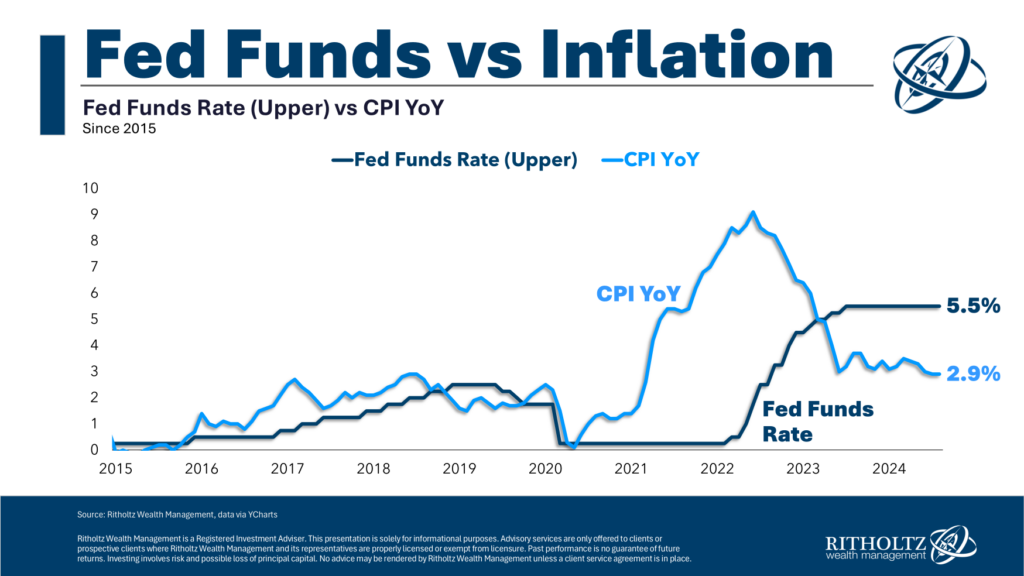

Inflation handed via the Federal Reserve’s 2% goal in March of 2021; by December ‘21, CPI was over 7%. It might peak in June of 2022 at 9%. It got here again down virtually as shortly because it went up.

By June of 2023, it was apparent to any observer who understood how the BLS fashions labored that inflation had been defeated. CPI fell to about 3%, however that measure was considerably elevated, because it included plenty of lagged information about housing and leases.

The Fed is massive stolid establishment, conservative in nature. They transfer slowly. Their incentive construction is asymmetrical: They’re much extra involved with “Not Being Flawed” than they’re in “Being Proper.”

That complexity isn’t fairly as contradictory as it could sound.

Think about the opportunity of price cuts in June 2023 (as I used to be advocating for on the time). Had they reduce too quickly, and inflation reignited, they give the impression of being silly. If it was not too quickly, all they might have achieved was: Offering credit score reduction for the complete backside 50% of customers; making extra housing provide out there; stimulating CapEx spending; encouraging extra hiring; conserving the financial enlargement going.

However right here is the factor: They might have gotten exactly zero credit score for that end result. It was a modest danger with no upside to them.

So as a substitute, they performed it secure. They waited till it was past apparent that inflation was dormant and the economic system was cooling.

We will debate whether or not the FOMC ought to have begun easing charges June 2023 (maybe a smidgen early) or September 2025 (manifestly late).

Regardless, price cuts are coming. They’re seemingly totally baked into inventory costs, which suggests one other concern of Jerome Powell – not permitting the AI frenzy to show right into a full-on bubble. That may be a dialog for an additional day.

Take pleasure in the remainder of your summer season!

Beforehand:

Why the FED Ought to Be Already Slicing (Might 2, 2024)

CPI Improve is Primarily based on Dangerous Shelter Information (January 11, 2024)

The Fed is Completed* (November 1, 2023)

Who Is to Blame for Inflation, 1-15 (June 28, 2022)

Inflation Comes Down Regardless of the Fed (January 12, 2023)

Why Is the Fed At all times Late to the Occasion? (October 7, 2022)

The Publish Lock-Down Economic system (November 9, 2023)

How All people Miscalculated Housing Demand (July 29, 2021)

_________

1. On the time, I blamed the shortage of strong fiscal motion on “partisan sabotage,“ however that was broadly pooh-poohed from each the Left and Proper. CARES Acts 1 & 2 (beneath Trump) and three (Underneath Biden) have solely served to substantiate that prior remark that we all know what the right playbook seems to be like; when we don’t put that into impact, it’s sometimes for all of the flawed ideological and political causes.

2. It is a nationwide safety difficulty, and I assist the Federal Authorities mandating a 90-180-day provide of these crucial to the nation’s well being and well-being. If all corporations MUST have a 3-month provide of widgets, then it shouldn’t have an effect on the inventory costs aside from who compiles a provide most effectively. And massive penalties for stockpiling low-cost overseas-made rubbish that received’t work when wanted.

3. And its cousin Shrinkflation.

4. By the tip of 2021, vaccines had turn out to be broadly out there and the start of the tip of the pandemic was in sight. What got here subsequent was the summer season of revenge journey, extra providers spending, and a sluggish return to if not regular, then shut.