As soon as once more, coming out of guide responsibility for a fast few notes to share.

The mix of the market motion in July and yesterday’s presser made me have a look at a number of datapoints that I discover fascinating. I wish to share these 5 concepts that I consider are of a lot larger significance than many buyers notice:

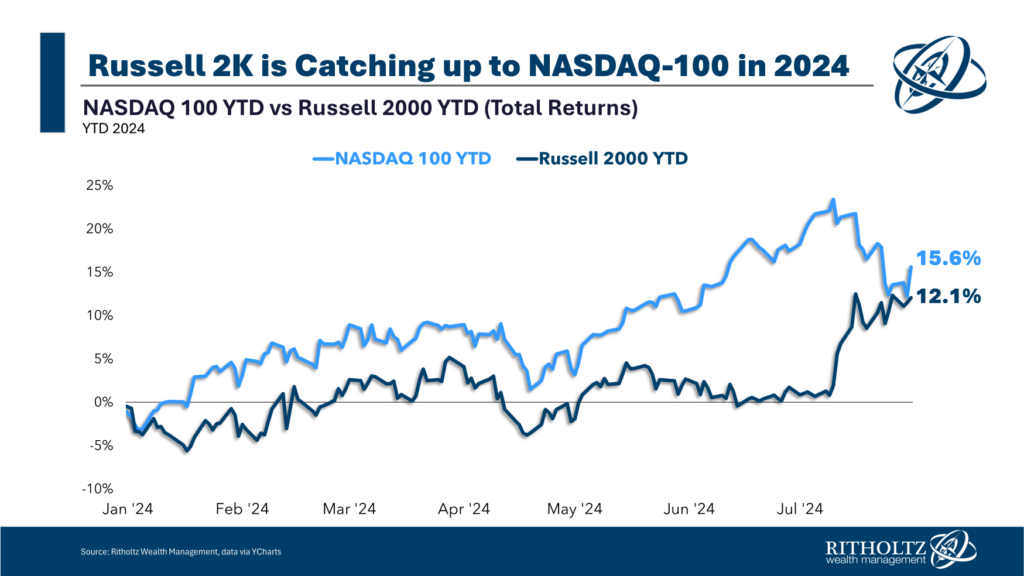

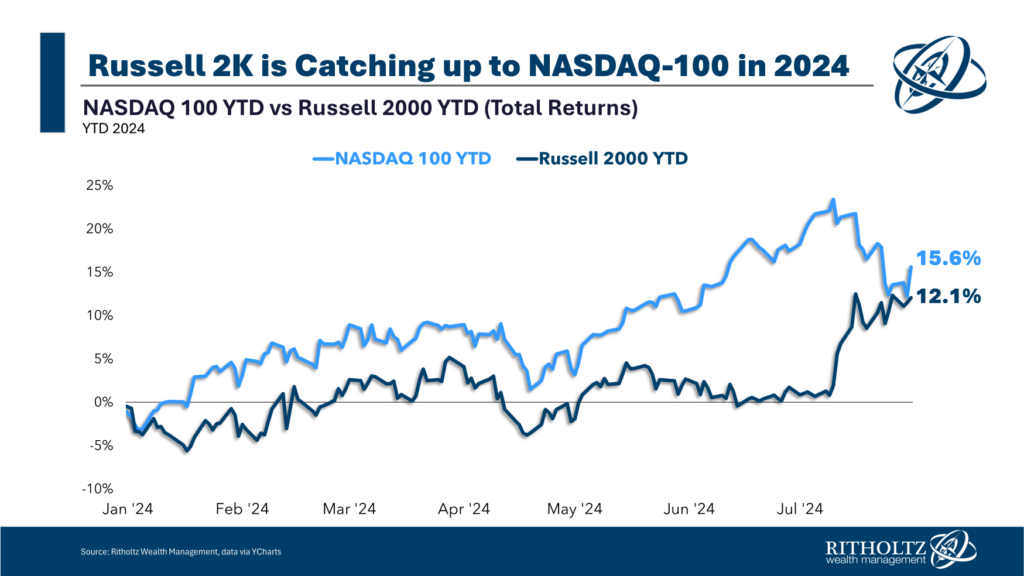

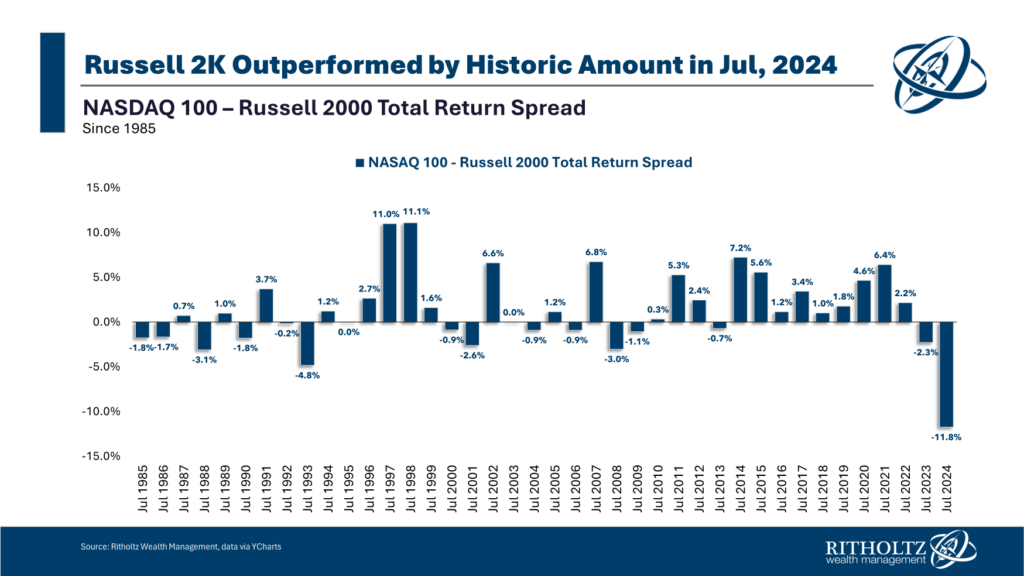

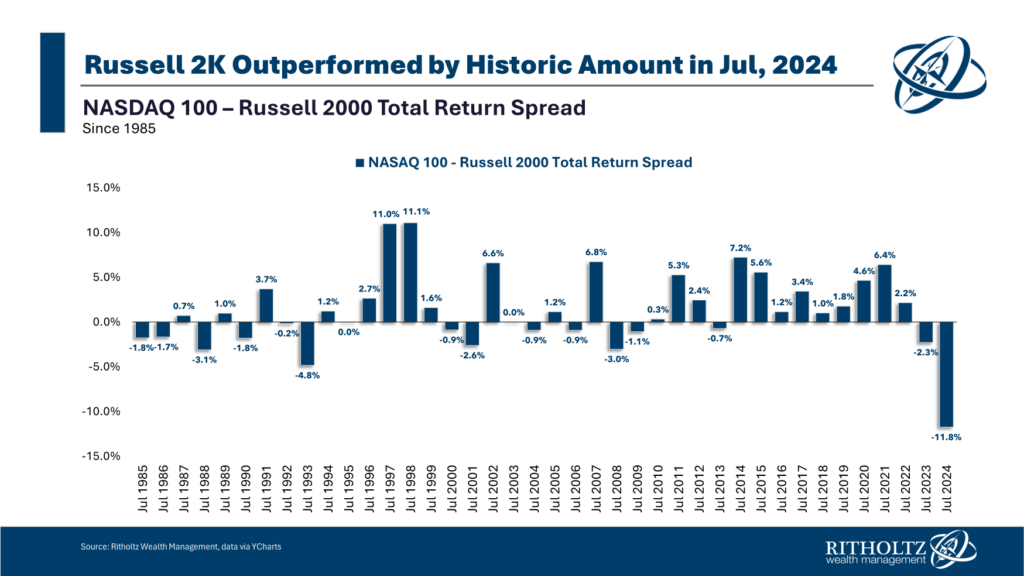

1. Small caps caught up with the Nasdaq 100 in July 2024: Take a look on the chart up prime. After one of many largest efficiency gaps in historical past, the Russell 2000 nearly caught as much as the Nasdaq 100. As of July 30th, the entire return of the Russell 200 was a mere ~1% behind the Nasdaq 100!

2. July was a traditional consolidation, however… On the one hand, July was a traditional consolidation and rotation away from the large cap winners broadening out to the remainder of the market is wholesome. The S&P 500 put up a +1.2% acquire (14.4% annualized); 9 out of 11 sectors climbed); solely tech and communication companies didn’t. S&P 500 had 364 shares optimistic within the month.

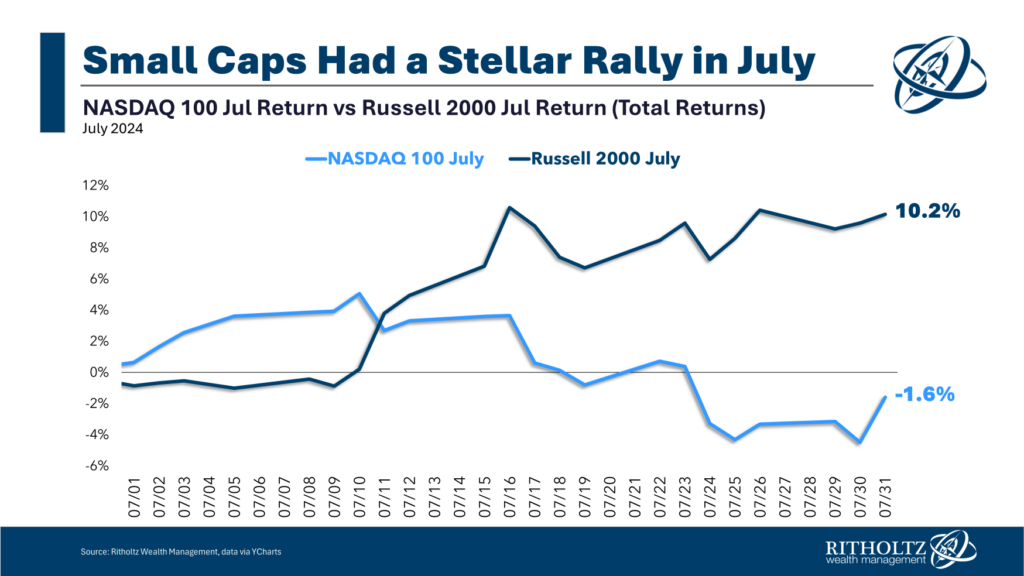

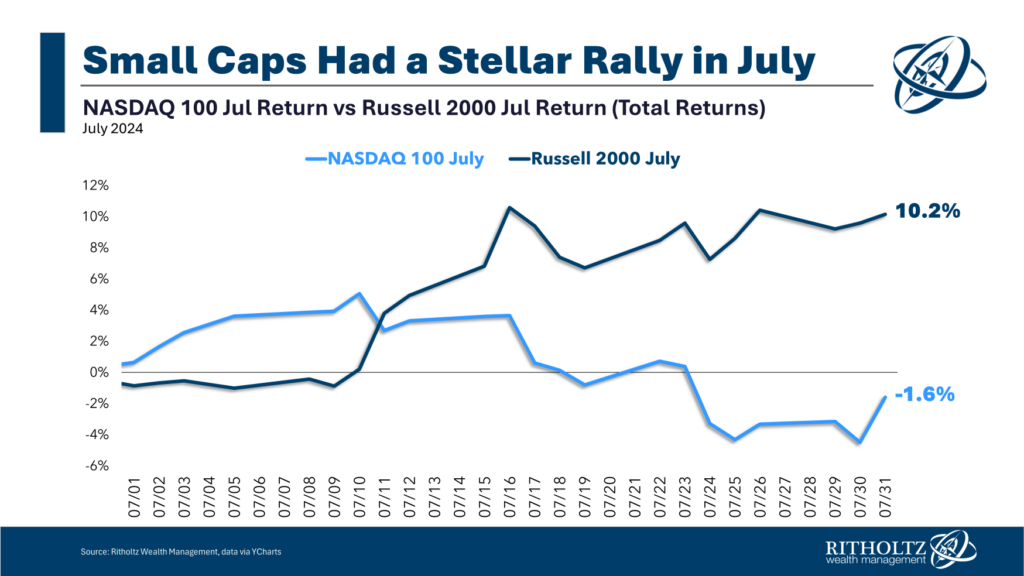

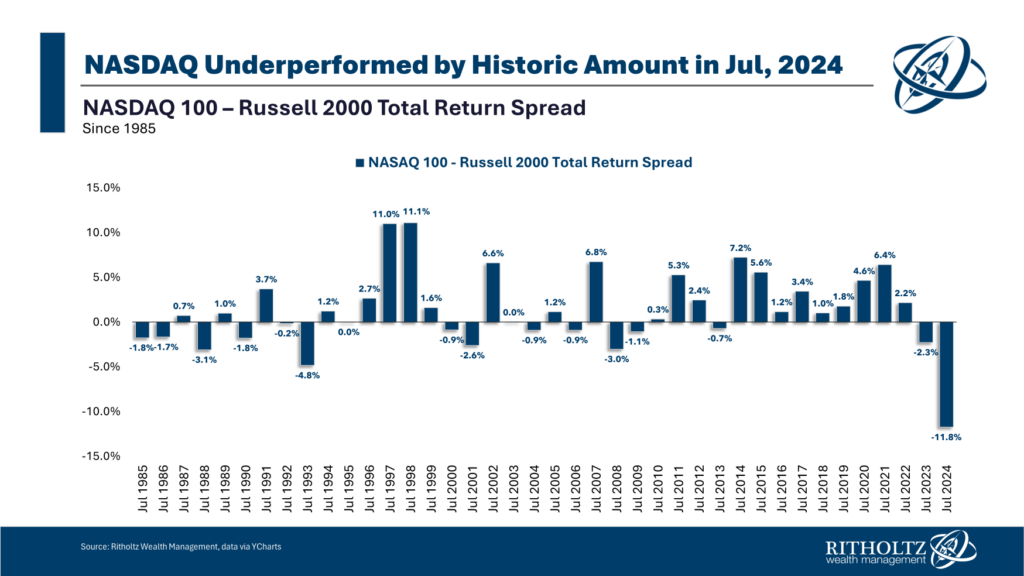

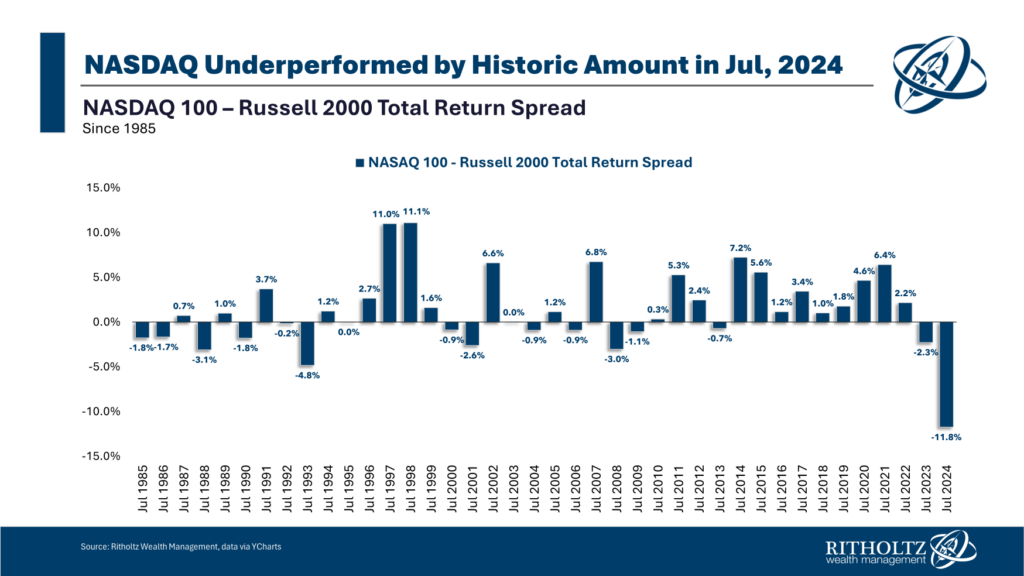

Nevertheless, the hole between the underperformance of the NASDAQ 100 versus the Russell 2000 by 11.8% in July is the very best ever:

Mentioned in a different way, Nasdaq underperformed by a historic quantity:

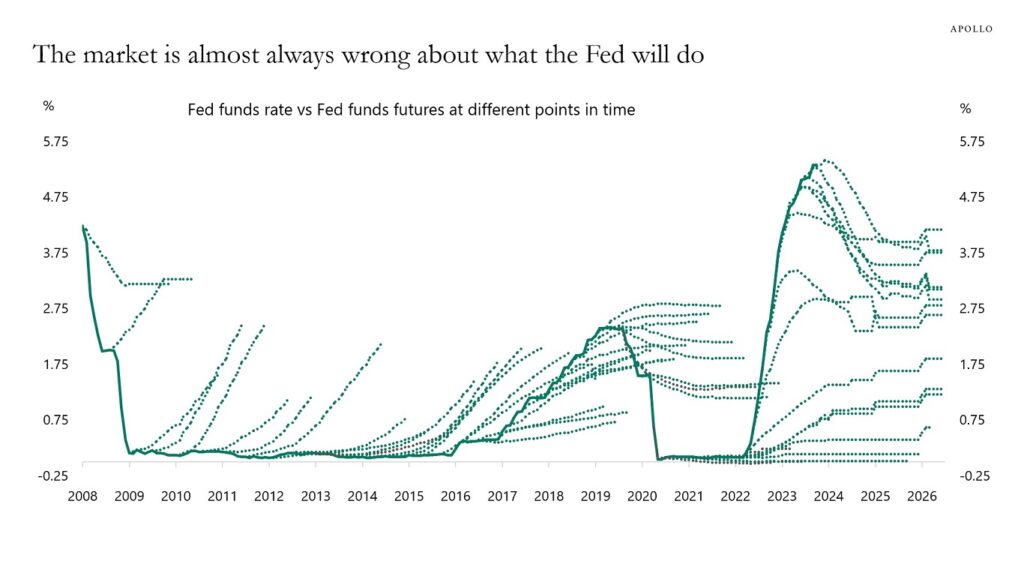

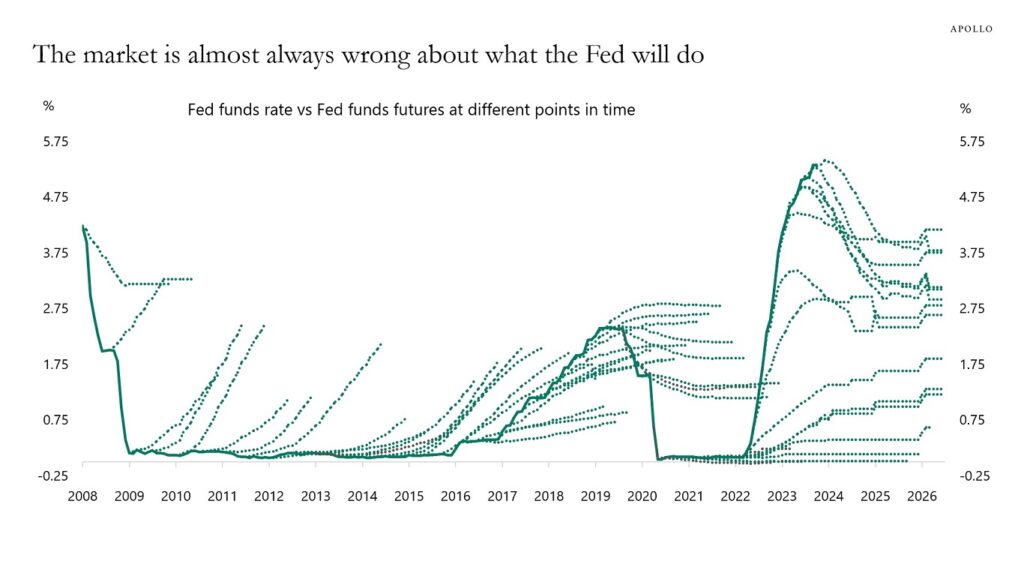

3. The market is nearly all the time improper about what the Fed will do subsequent: It might be onerous to acknowledge in real-time, however the market has been totally improper about what the FOMC was going to do subsequent (elevate or minimize charges) for the entire previous two and half many years. (For the report, September now appears to be like slightly probably).

Supply: Torsten Slok, Apollo

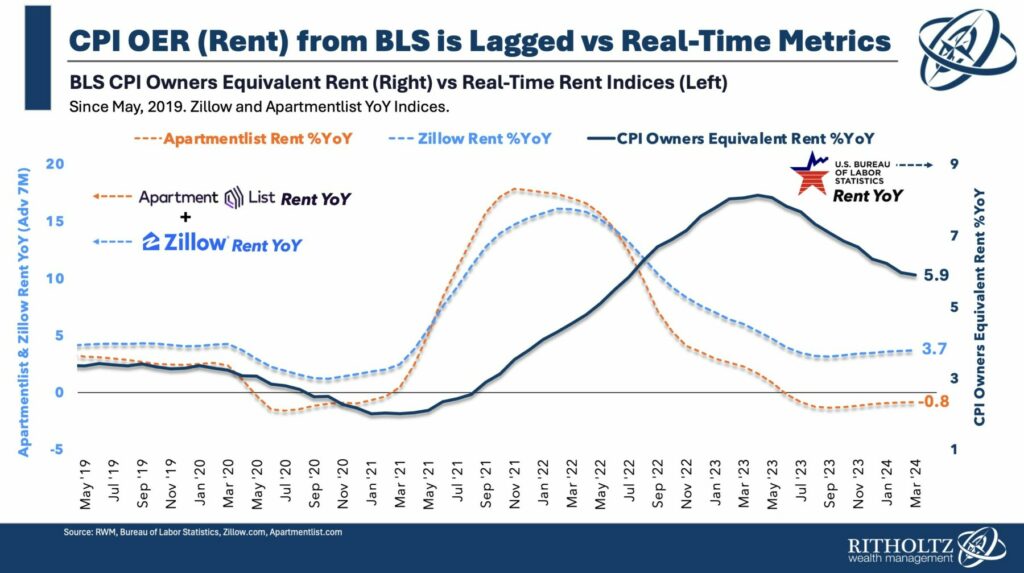

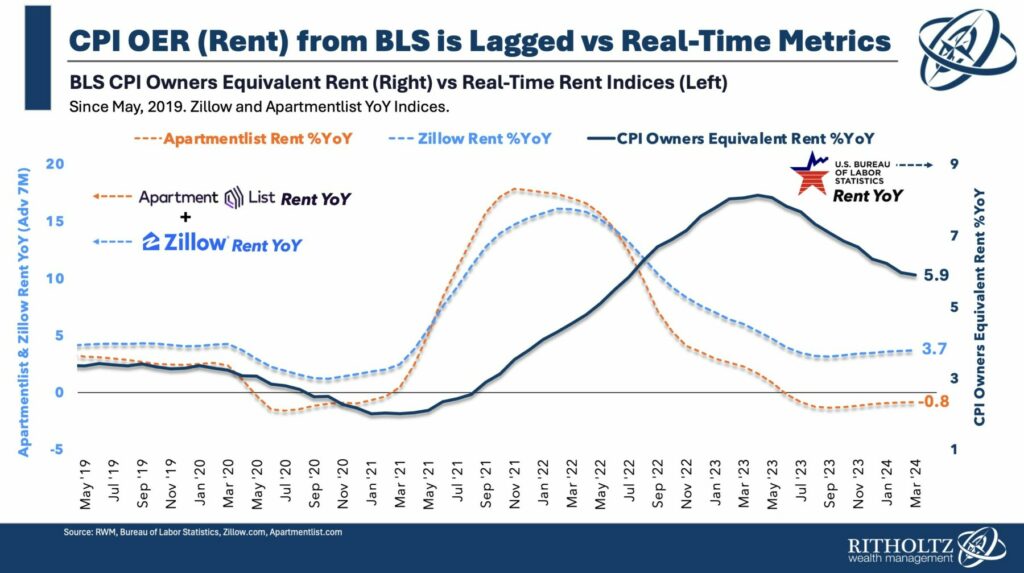

4. Reminder: Inflation peaked 2 YEARS AGO IN JUNE 2022

The Fed is ALWAYS late: Late to acknowledge inflation Spiking in 2021, the height in June 2022, the following collapse in 2023, and the underside in 1H 2024.

As I’ve been saying for over a yr, the FOMC ought to, have been slicing already – definitely Could or June or July. As of August 1st, they’re as soon as once more far behind the curve.

5. Political Regime Change?

I’m consistently reminding readers that who controls the White Home is (largely) irrelevant to market returns. Nevertheless, the error laden previous few months of media protection, polling, political wrangling and infinite hypothesis must be known as out for what it’s: Malpractice.

And in case you forgot, the political polls — in 2016, 2018, 2020, 2022 — have all been uniformly horrible. Individuals quoting these as if they’re prescient is malpractice of the very best order.

The handwringing over Biden was probably Peak-Trump, the celebration over Harris is probably going Trump-trough. The one wildcard I’m questioning about is whether or not the Russian prisoner swap is Putin dropping by the wayside. (I do not know however the timing is intriguing)

That’s all for now, see y’all in September for the primary fee minimize because the pandemic…

Beforehand:

Why Is the Fed At all times Late to the Celebration? (October 7, 2022)

Revisiting Peak Inflation (June 29, 2022)

Politics & Investing