Physics has been in search of a grand “Unified Subject Principle” that may clarify all the pieces within the universe. I typically surprise if we can not discover a related overarching idea about all unhealthy decision-making. The closest I’ve discovered as that single level of failure is the Dunning Kruger impact.

Recall final week, we have been discussing enthusiastic about the impression of retiring Child Boomers on the fairness markets and of rising charges on housing. Rereading that this morning, I spotted I buried a very powerful a part of the dialogue:

“Each questions are an enchanting reveal of how a standard understanding of complicated topics barely scratches the floor of the wealthy complexities that lay beneath. All too usually, the superficial narrative fails to seize the fact beneath.”

The dialogue was actually about how preliminary appearances might be deceptive on account of complexity we could not even pay attention to; the housing query about charges — that are clearly necessary — led us to acknowledge they’re removed from the only real driver of the residential actual property market. Certainly, many different issues might be much more necessary.

Our personal lack of depth in a selected skillset is why we miss that complicated actuality. Our tendency as a species in direction of overconfidence can mix with just a little bit of data; finally, this results in basic misunderstandings.

Can this one-two punch clarify why it’s so straightforward to get a lot fallacious within the capital markets so usually?

Let’s take into account one other query, this one on U.S. fairness valuations:

“Child-boomers’ large move of 401Ok plan contributions helped to drive equities greater; now that ~70 million Boomers are retiring, when do demographics flip this from an enormous optimistic to a web drag?”

The demographic query touches on an enormous concern: $6 trillion {dollars} in 650,000 (401ok) retirement plans held by 10s of tens of millions of Individuals. The preliminary assumption is the retiring boomers matter an amazing deal, however a deeper dive into the construction of fairness possession means that it most likely doesn’t.

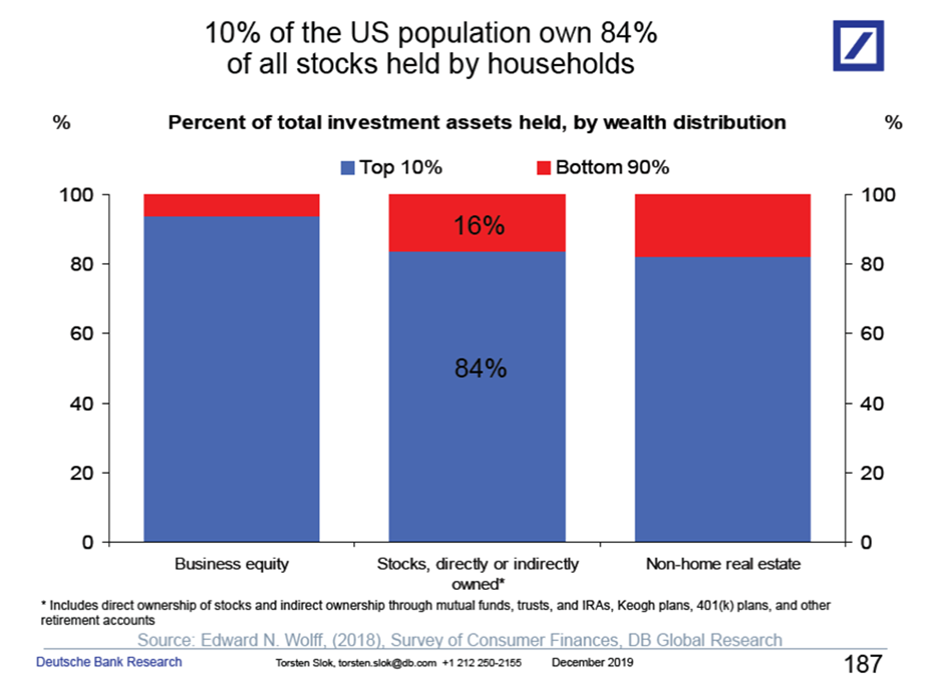

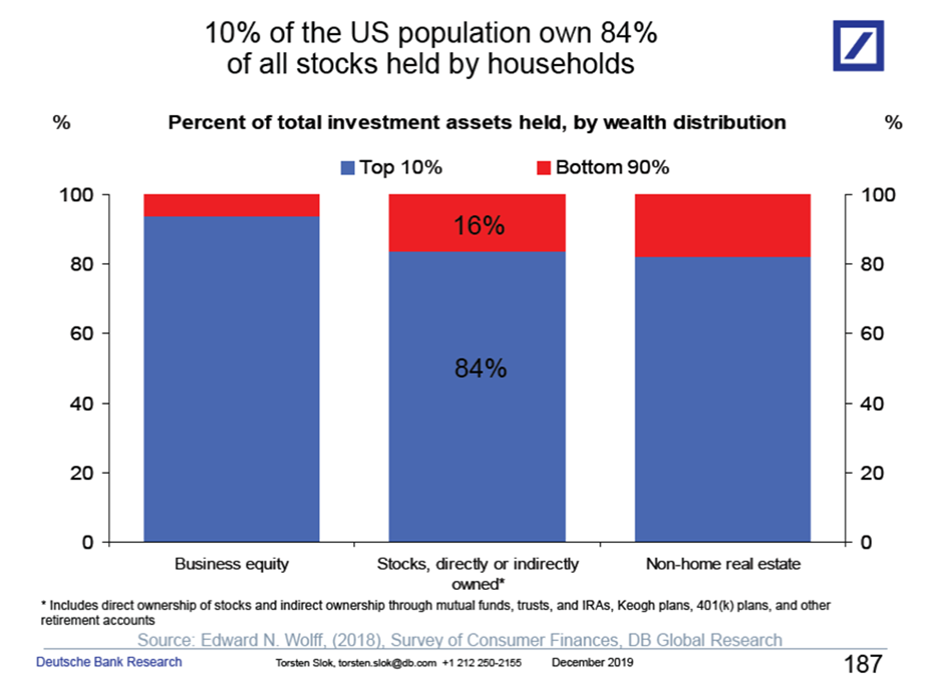

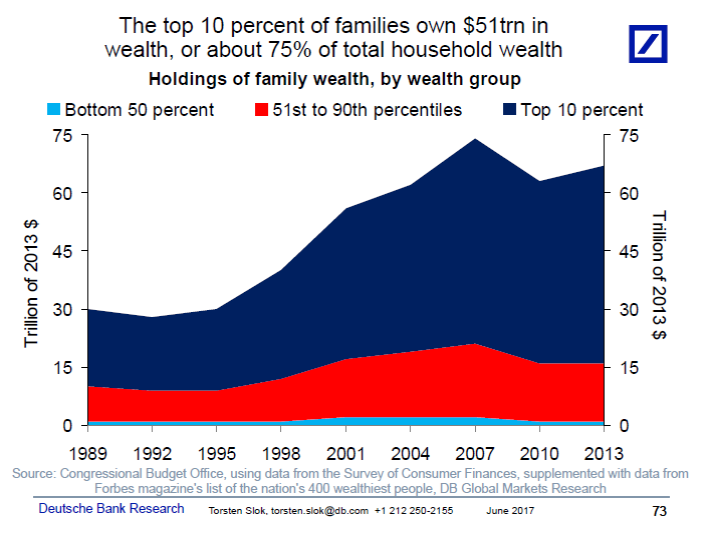

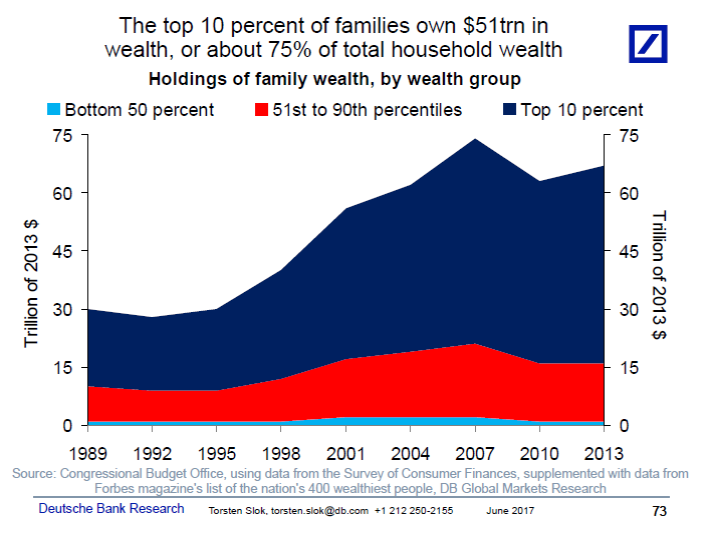

I think most of us have a distorted viewpoint of the common investor versus the full capital out there. Because the charts beneath present, the overwhelming majority of equities are held by the highest 1% and 10%. This demographic cohort is just not a vendor on account of retirement – the tax bills could be too nice. As a substitute, a complete strategy to managing generational wealth switch, philanthropy, items, trusts, and so on. happens.

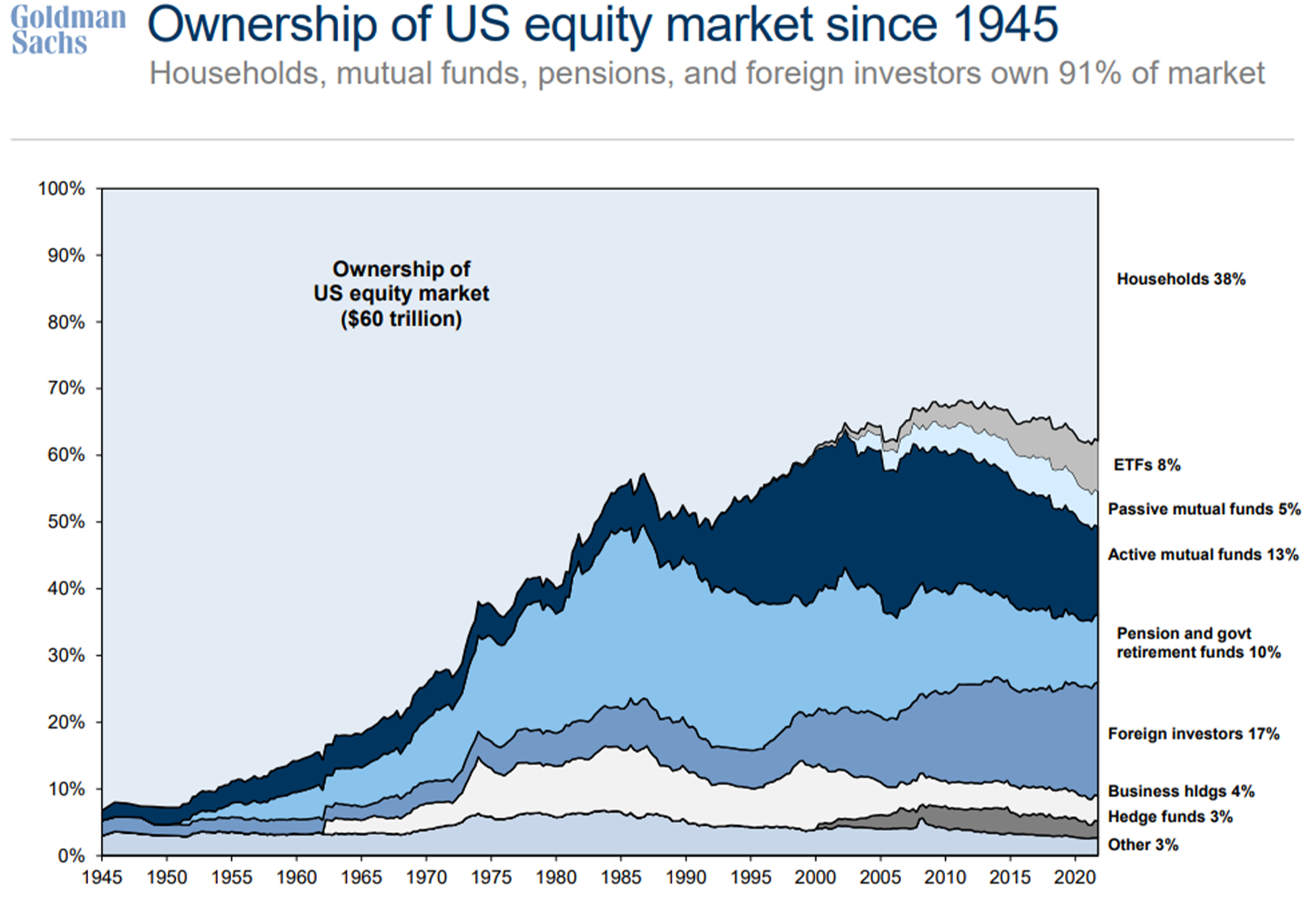

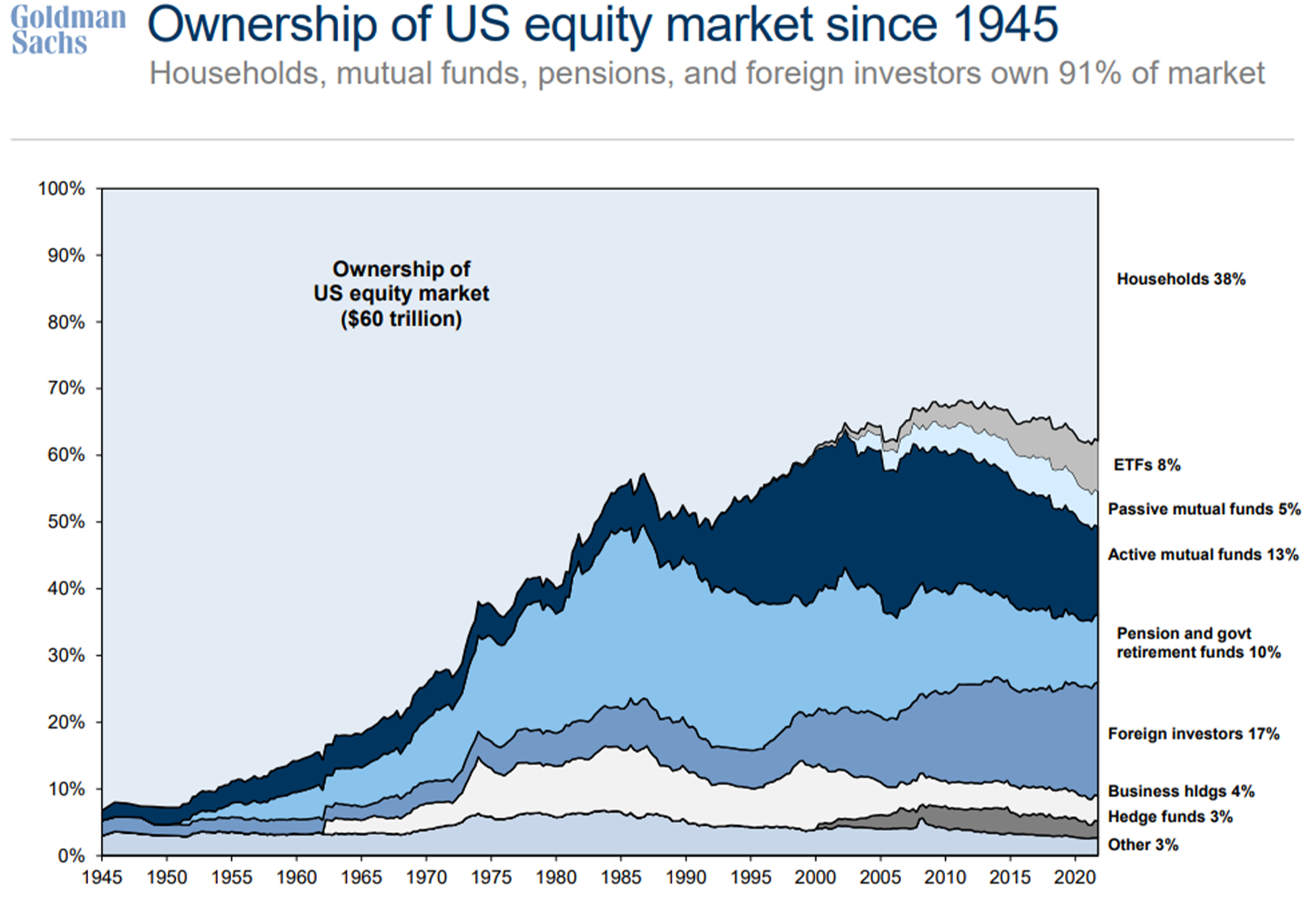

Including a layer of complexity, at one cut-off date, all of those shares have been owned immediately by people as particular firm inventory. As Ben identified through his favourite chart at high, possession of U.S. fairness market since 1945 has shifted dramatically to completely different funding automobiles. U.S. households as soon as owned 95% of all shares individually in brokerage accounts; right this moment, possession is is through ETFs, mutual funds, pensions, hedge funds, overseas traders, and so on.

Property taxes are why appreciated fairness is transferred this manner. These eventualities don’t often contain a a lot inventory promoting. However as we now have seen, most individuals have little concept about precisely how high heavy fairness possession is. The market is far larger, extra professionalized, and institutionalized.

~~~

A number of years in the past, a pal got here out with a implausible concept for an Index and ETF; even higher, he managed to snag an incredible inventory image. (I’m purposefully omitting the specifics and the names of the fund managers, sponsors, banks, and so on.) It had an ESG twist, and so was a possible match for foundations, endowments, household workplaces, and so on. He put collectively an amazing board of advisors, a intelligent concept for adjusting the index, it was all so sensible. The index even outperformed it’s S&P500 benchmark all 5 years working. Nevertheless it discovered little choose up regardless of the new sector it was in. Right here we’re 5 years later, and whereas the concept + ticker are nonetheless nice, the fund shut down on account of lack of curiosity.

I requested my buddy if he had any curiosity in promoting the stub (property embody title, mental property, board, ticker image, and so on.) for pennies on the greenback. I like the concept, and picture how straightforward it might be to show it into a large success, a $ billion greenback ETF.

Earlier than placing any time or capital in danger, I wished to debate it with an knowledgeable. In my circles, no one is aware of extra concerning the ETF trade than Dave Nadig. We regarded on the concept and who the potential ETF/index patrons is likely to be. We kicked round how the goal demographic makes these choices, how they examine which field, who they seek the advice of with, what different events advise the decision-makers. Final, we thought of why different like-minded funds equally failed to draw a lot capital. The important thing conclusion was this was regardless of the attractive concept and inventory ticker and nice efficiency, it was solely a so-so investing automobile, unlikely to draw a lot capital.

Therefore, I used to be saved a whole lot of time and work and headache and capital, all as a result of I had some small consciousness of my very own astonishing ignorance. I don’t often consider humility as my sturdy swimsuit, however I’d chalk this one as much as a mixture of concern, worry and recognition of my lack of competency on this house.

I take into account {that a} large win…

~~~

Some individuals have urged that figuring out about cognitive biases doesn’t assist in the battle towards them. I by no means need to be on the other facet of an mental argument with Danny Kahneman; nevertheless, I’m hopeful that if we take into consideration issues much less by way of what we do know, and extra by way of what we would not know, maybe we will make higher choices.

Beforehand:

What If EVERYTHING Is Narrative? (June 21, 2021)

What If All the things is Survivorship Bias? (aka The Hidden World of Failure) (October 23, 2020)

Inventory Possession:

Distribution of Family Wealth within the U.S. since 1989 (March 10, 2020)

Inventory Possession within the USA (January 14, 2020)

Wealth Distribution Evaluation (July 18, 2019)

Composition of Wealth Differs: Center Class to the High 1% (June 5, 2019)

Wealth Distribution in America (April 11, 2019)

US Wealth Distribution, Inventory Possession Version (June 30, 2017)