A couple of days in the past I gave a brief discuss on the topic. I used to be partly impressed by a bit of remark made at a seminar, roughly “after all everyone knows that if costs are sticky, larger nominal charges elevate larger actual charges, that lowers combination demand and lowers inflation.” Possibly we “know” that, but it surely’s not as readily current in our fashions as we predict. This additionally crystallizes some work within the ongoing “Expectations and the neutrality of rates of interest” mission.

The equations are the totally commonplace new-Keynesian mannequin. The final equation tracks the evolution of the actual worth of the debt, which is normally within the footnotes of that mannequin.

OK, prime proper, the usual end result. There’s a constructive however short-term shock to the financial coverage rule, u. Rates of interest go up after which slowly revert. Inflation goes down. Hooray. (Output additionally goes down, because the Phillips Curve insists.)

The subsequent graph ought to offer you pause on simply the way you interpreted the primary one. What if the rate of interest goes up persistently? Inflation rises, all of the sudden and utterly matching the rise in rate of interest! But costs are fairly sticky — ok = 0.1 right here. Right here I drove the persistence all the best way to 1, however that is not essential. With any persistence above 0.75, larger rates of interest give rise to larger inflation.

What is going on on? Costs are sticky, however inflation shouldn’t be sticky. Within the Calvo mannequin just a few corporations can change worth in any immediate, however they modify by a big quantity, so the speed of inflation can soar up immediately simply because it does. I feel numerous instinct needs inflation to be sticky, in order that inflation can slowly choose up after a shock. That is the way it appears to work on the planet, however sticky costs don’t ship that end result. Therefore, the actual rate of interest would not change in any respect in response to this persistent rise in nominal rates of interest. Now perhaps inflation is sticky, prices apply to the spinoff not the extent, however completely not one of the immense literature on worth stickiness considers that risk or how on the planet it may be true, no less than so far as I do know. Let me know if I am incorrect. At a minimal, I hope I’ve began to undermine your religion that all of us have straightforward textbook fashions during which larger rates of interest reliably decrease inflation.

(Sure, the shock is destructive. Have a look at the Taylor rule. This occurs lots in these fashions, another excuse you may fear. The shock can go in a special route from observed rates of interest.)

Panel Three lowers the persistence of the shock to a cleverly chosen 0.75. Now (with sigma=1, kappa=0.1, phi= 1.2), inflation now strikes with no change in rate of interest in any respect. The Fed merely publicizes the shock and inflation jumps all by itself. I name this “equilibrium choice coverage” or “open mouth coverage.” You’ll be able to regard this as a characteristic or a bug. If you happen to consider this mannequin, the Fed can transfer inflation simply by making speeches! You’ll be able to regard this as highly effective “ahead steerage.” Or you’ll be able to regard it as nuts. In any case, in case you thought that the Fed’s mechanism for decreasing inflation is to lift nominal rates of interest, inflation is sticky, actual charges rise, output falls and inflation falls, effectively right here is one other case during which the usual mannequin says one thing else fully.

Panel four is after all my important passion horse nowadays. I tee up the query in Panel 1 with the pink line. In that panel, the nominal curiosity are is larger than the anticipated inflation charge. The actual rate of interest is constructive. The prices of servicing the debt have risen. That is a critical impact these days. With 100% debt/GDP every 1% larger actual charge is 1% of GDP extra deficit, $250 billion {dollars} per yr. Someone has to pay that eventually. This “financial coverage” comes with a fiscal tightening. You may see that within the footnotes of fine new-Keynesian fashions: lump sum taxes come alongside to pay larger curiosity prices on the debt.

Now think about Jay Powell comes knocking to Congress in the midst of a knock-down drag-out struggle over spending and the debt restrict, and says “oh, we’ll elevate charges four proportion factors. We want you to lift taxes or minimize spending by $1 trillion to pay these additional curiosity prices on the debt.” Amusing may be the well mannered reply.

So, within the final graph, I ask, what occurs if the Fed raises rates of interest and monetary coverage refuses to lift taxes or minimize spending? Within the new-Keynesian mannequin there’s not a 1-1 mapping between the shock (u) course of and rates of interest. Many various u produce the identical i. So, I ask the mannequin, “select a u course of that produces precisely the identical rate of interest as within the prime left panel, however wants no extra fiscal surpluses.” Declines in curiosity prices of the debt (inflation above rates of interest) and devaluation of debt by interval 1 inflation should match rises in curiosity prices on the debt (inflation beneath rates of interest). The underside proper panel offers the reply to this query.

Evaluation: Similar rate of interest, no fiscal assist? Inflation rises. On this very commonplace new-Keynesian mannequin, larger rates of interest with out a concurrent fiscal tightening elevate inflation, instantly and persistently.

Followers will know of the long-term debt extension that solves this drawback, and I’ve plugged that answer earlier than (see the “Expectations” paper above).

The purpose immediately: The assertion that we’ve straightforward easy effectively understood textbook fashions, that seize the usual instinct — larger nominal charges with sticky costs imply larger actual charges, these decrease output and decrease inflation — is solely not true. The usual mannequin behaves very in another way than you assume it does. It is superb how after 30 years of enjoying with these easy equations, verbal instinct and the equations stay up to now aside.

The final two bullet factors emphasize two different points of the instinct vs mannequin separation. Discover that even within the prime left graph, larger rates of interest (and decrease output) include rising inflation. At greatest the upper charge causes a sudden soar down in inflation — costs, not inflation, are sticky even within the prime left graph — however then inflation steadily rises. Not even within the prime left graph do larger charges ship future inflation decrease than present inflation. Widespread instinct goes the opposite method.

In all this theorizing, the Phillips Curve strikes me because the weak hyperlink. The Fed and customary instinct make the Phillips Curve causal: larger charges trigger decrease output trigger decrease inflation. The unique Phillips Curve was only a correlation, and Lucas 1972 considered causality the opposite method: larger inflation fools individuals quickly to producing extra.

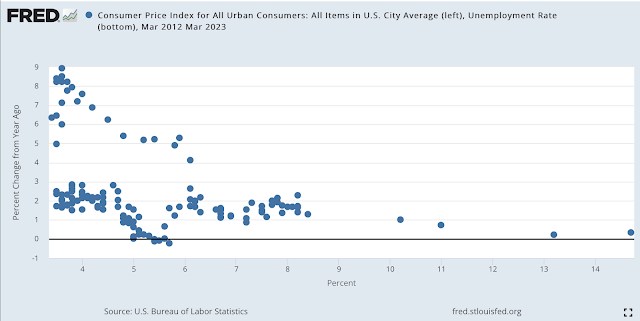

Right here is the Phillips curve (unemployment x axis, inflation y axis) from 2012 by means of final month. The dots on the decrease department are the pre-covid curve, “flat” as widespread knowledge proclaimed. Inflation was nonetheless 2% with unemployment 3.5% on the eve of the pandemic. The higher department is the newer expertise.

I feel this plot makes some sense of the Fed’s colossal failure to see inflation coming, or to understand it as soon as the dragon was contained in the outer wall and respiration fireplace on the interior gate. If you happen to consider in a Phillips Curve, causal from unemployment (or “labor market situations”) to inflation, and also you final noticed 3.5% unemployment with 2% inflation in February 2021, the 6% unemployment of March 2021 goes to make you completely ignore any inflation blips that come alongside. Certainly, till we get effectively previous 3.5% unemployment once more, there’s nothing to fret about. Effectively, that was incorrect. The curve “shifted” if there’s a curve in any respect.

However what to place as a substitute? Good query.