Take a look at these latest headlines concerning the basic 60/40 funding technique1:

The 60-40 Funding Technique Is Again After Tanking Final 12 months

BlackRock Ditches 60/40 Portfolio in New Regime of Excessive Inflation

Why a 60/40 Portfolio Is No Longer Good Sufficient

The 60-40 portfolio is again

Sorry, however all of those headlines completely miss the purpose. No, the 60/40 mixture of shares and bonds will not be useless; No, this isn’t the primary time we had a regime of excessive inflation, transitory or in any other case.

The 60/40 will not be “again” as a result of it by no means left.

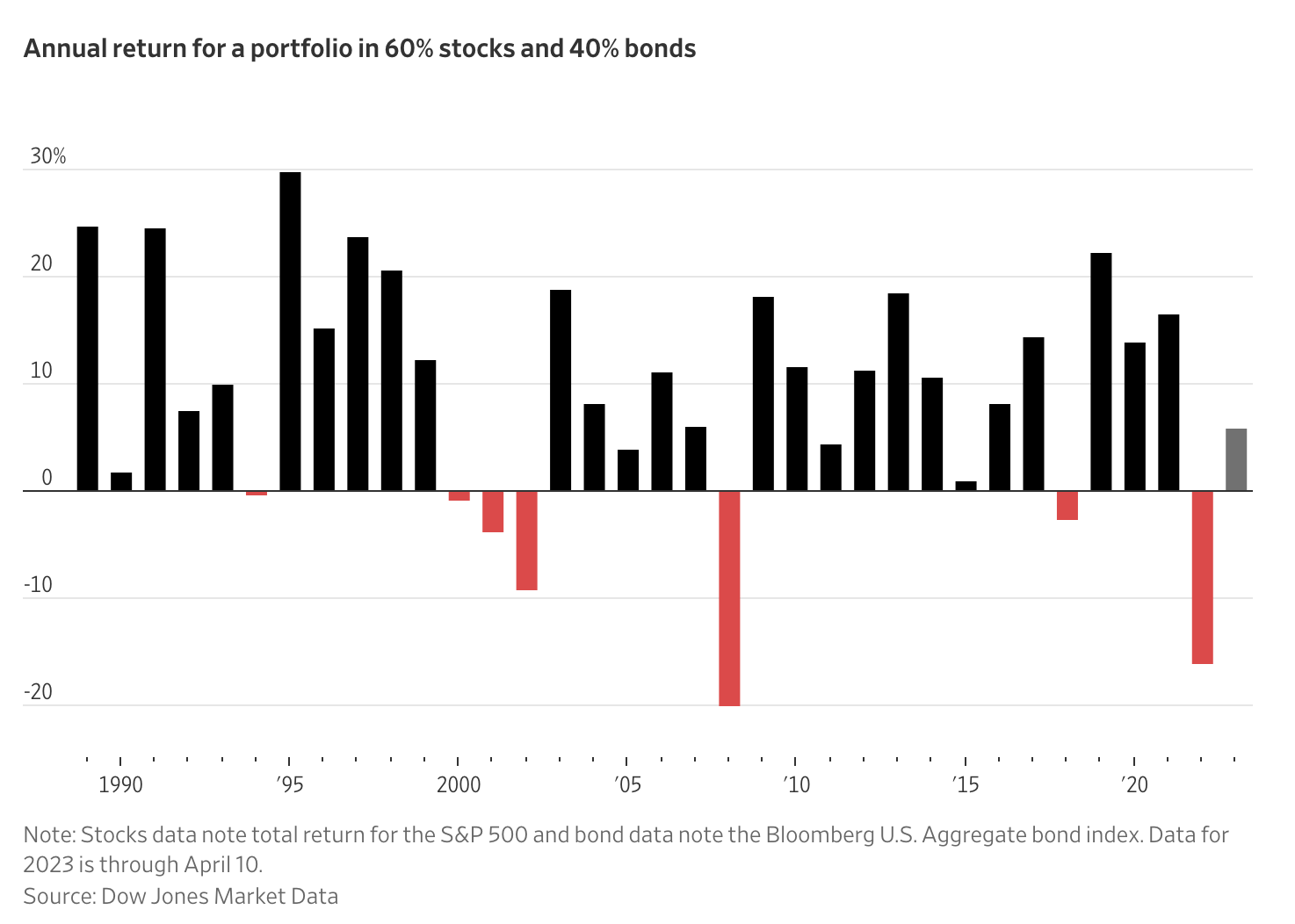

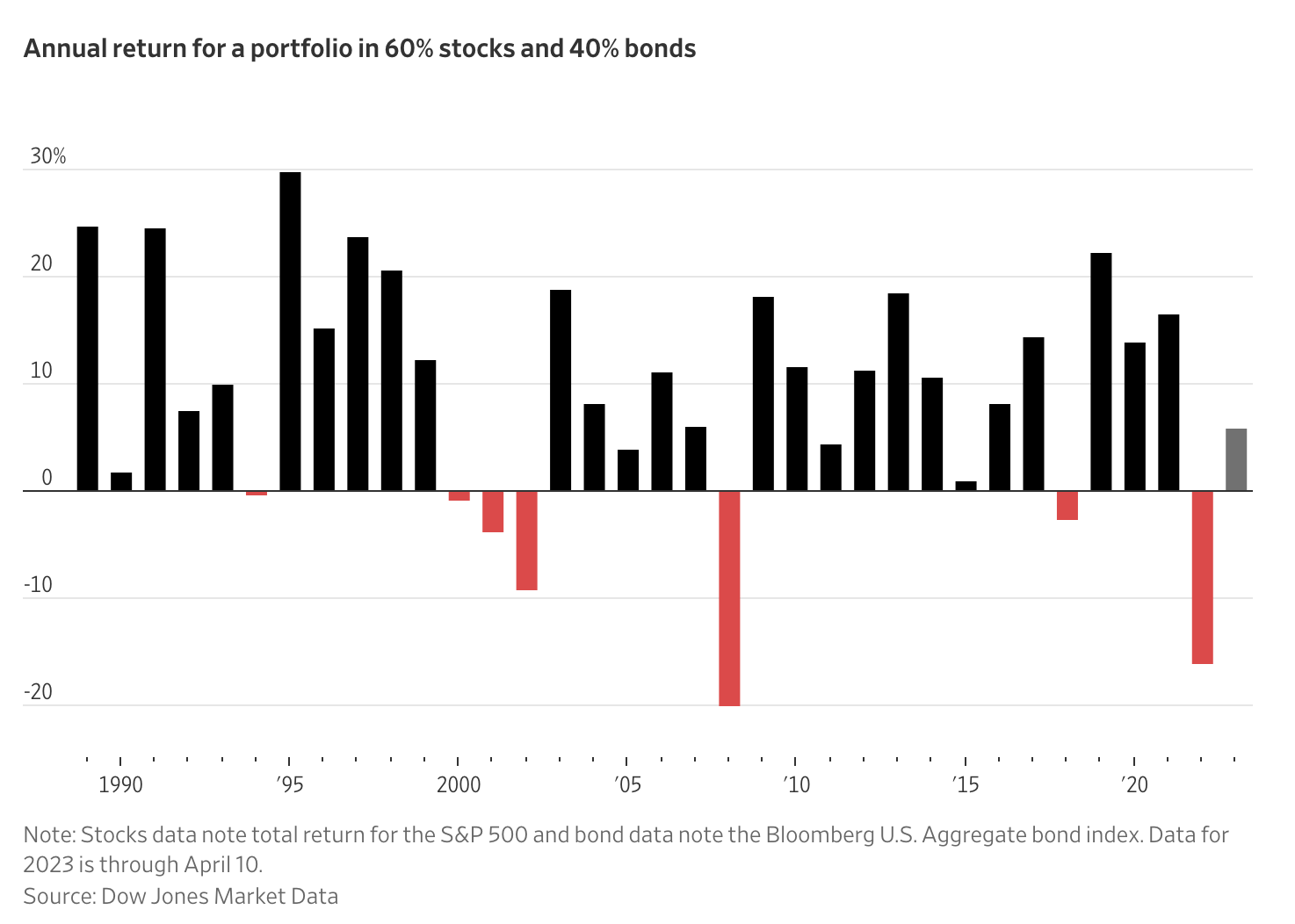

Regardless of the headline, the Wall Road Journal chart (above) reveals 2022 because the exception that proves the purpose: Prior selloffs — 2000-03 and 2008-09 — had been all fairness pushed. That you must return to 1981 to seek out one other 12 months when each shares and bonds had been down double digits in the identical 12 months. These years are pretty ugly for funding portfolios.

And that’s precisely the purpose: One outlier 12 months each four a long time or so makes for a reasonably dependable funding technique. The educational proof that this form of investing outperforms all others over an extended sufficient timeline is overwhelming.

I discover Vanguard’s take to be extra according to my very own: Improved outlook for the 60/40 portfolio. Which means, with charges nearing the terminal worth, bonds now generate first rate yield in addition to present ballast towards the volatility of the fairness portion of your portfolios.

I’ve learn countless screeds the previous few years as to the return of the energetic investor and why passive is unquestionably going to fail this cycle. It’s superb how a lot enthusiasm will get generated when virtually half of energetic managers outperform for 1 / 4 or two…

See additionally:

What Beat the S&P 500 Over the Previous Three A long time? Doing Nothing. (Morningstar, April 17, 2023)

__________

1, The caveat being 60/40 displays a reasonably reasonable threat tolerance, and better fairness allocations (e.g., 70/30) could be acceptable for individuals with increased threat tolerances and/or longer funding horizons.