“A new product that gives buyers full draw back safety: Traders within the $7.5 trillion ETF universe can now put cash behind the Innovator Fairness Outlined Safety ETF, which started buying and selling below the ticker TJUL on Tuesday. The providing comes from Innovator Capital Administration, which launched the primary so-called buffer ETFs, additionally typically known as defined-outcome funds, in 2018.” –Bloomberg

Let’s get this out of the best way: I dislike any product that exchanges a portion of your potential good points in trade for draw back safety.

Let’s talk about why.

At first, merchandise like these are wholly pointless. Not less than, in case you are a wise investor who does the appropriate issues: Arrange a monetary plan, handle your individual habits, interact in long-term pondering, and keep away from reacting to the infinite every day noise that markets + media generate.

Second, comply with Charlie Munger’s recommendation and invert the gross sales pitch: 70% of the upside (you surrender 16.62% per yr for two years) with not one of the draw back sounds engaging – except you concentrate on what you might be actually giving up and getting in trade.

Would you settle for a commerce the place for ~32% of the upside, you might be free of having to handle your individual habits? That sounds fairly costly for one thing that ought to price you a) nothing if you happen to do it your self, or 2) 50-100 bps if you happen to work with an advisor.

That feels like a horrible deal to me.

Third, whenever you personal a broad index of equities, the upside compounds over the long term whereas the drawdowns are momentary. Giving up everlasting good points to keep away from impermanent drops looks as if an terrible trade.

My apparent bias is that my advisory agency expenses shoppers to create monetary plans and handle their belongings. However simply do the maths: Would you like to surrender 67 foundation factors (RWM’s dollar-weighted common price is ~0.67%) or would you like to surrender 30% of your good points PLUS pay an annual 0.79% price for the TJUL ETF? It’s the advisor’s job to stop shoppers from participating within the sort of dangerous funding habits that drawdowns usually trigger; I can’t see how buying and selling that for >30% of the upside makes any sense.

Innovator, the agency behind TJUL, manages “greater than 50 buffer funds which have collectively drawn over $12 billion in belongings since 2018. . . Among the many largest automobiles are the Innovator S&P 500 Energy Buffer ETF (PAPR), totaling about $687 million in belongings, and the Innovator S&P 500 Energy Buffer ETF (PJUL), which has roughly $834 million in belongings.”

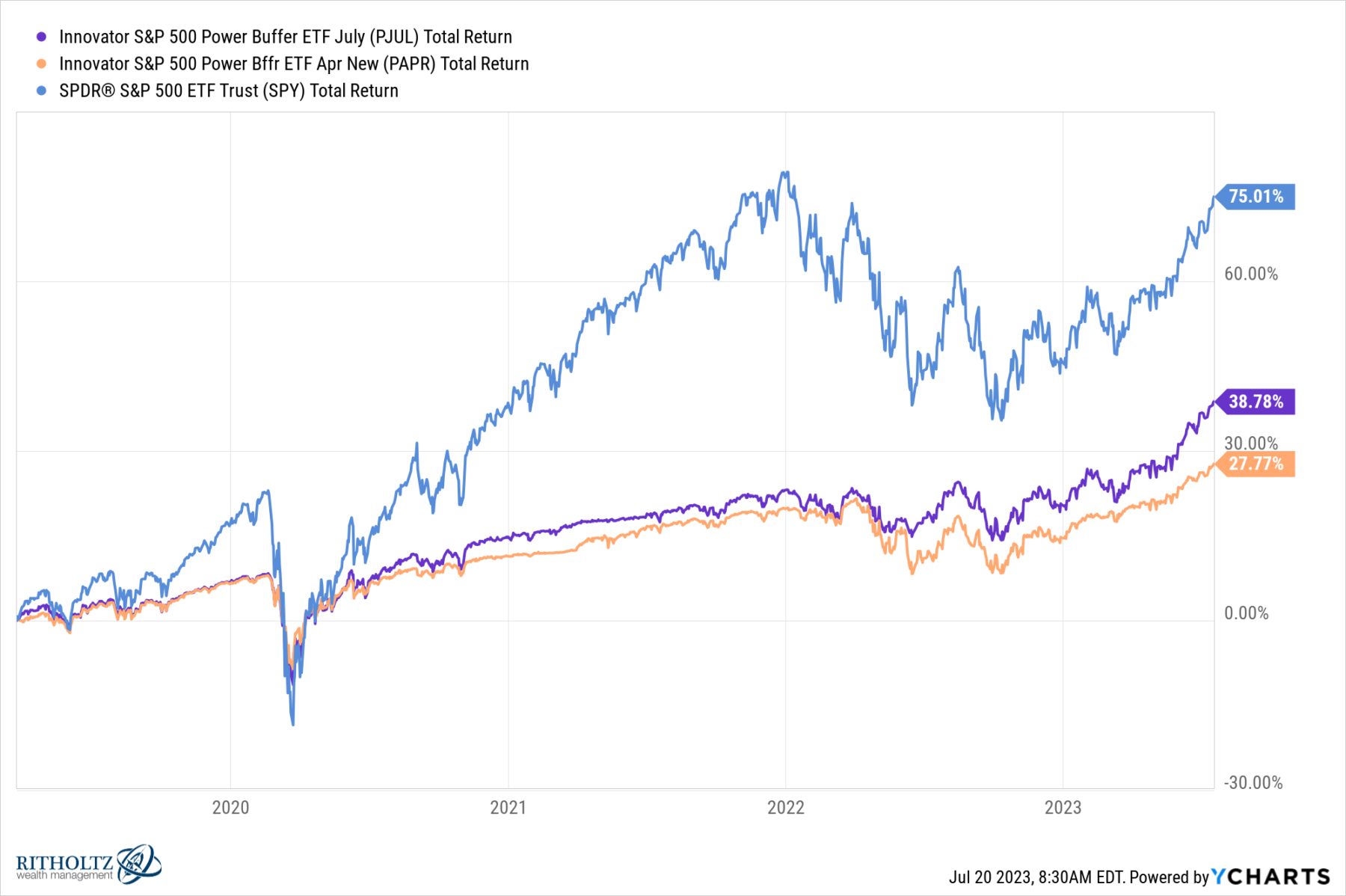

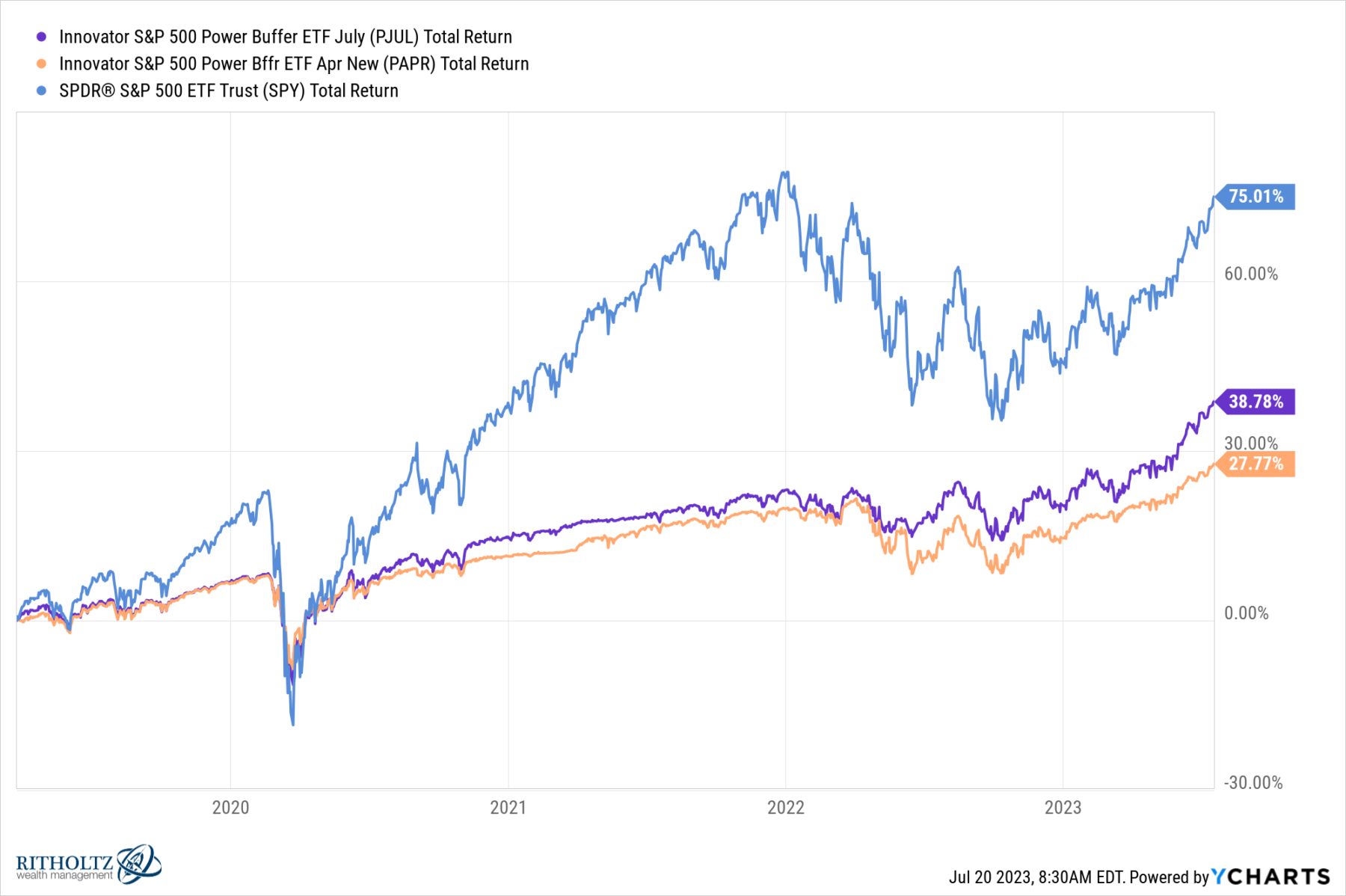

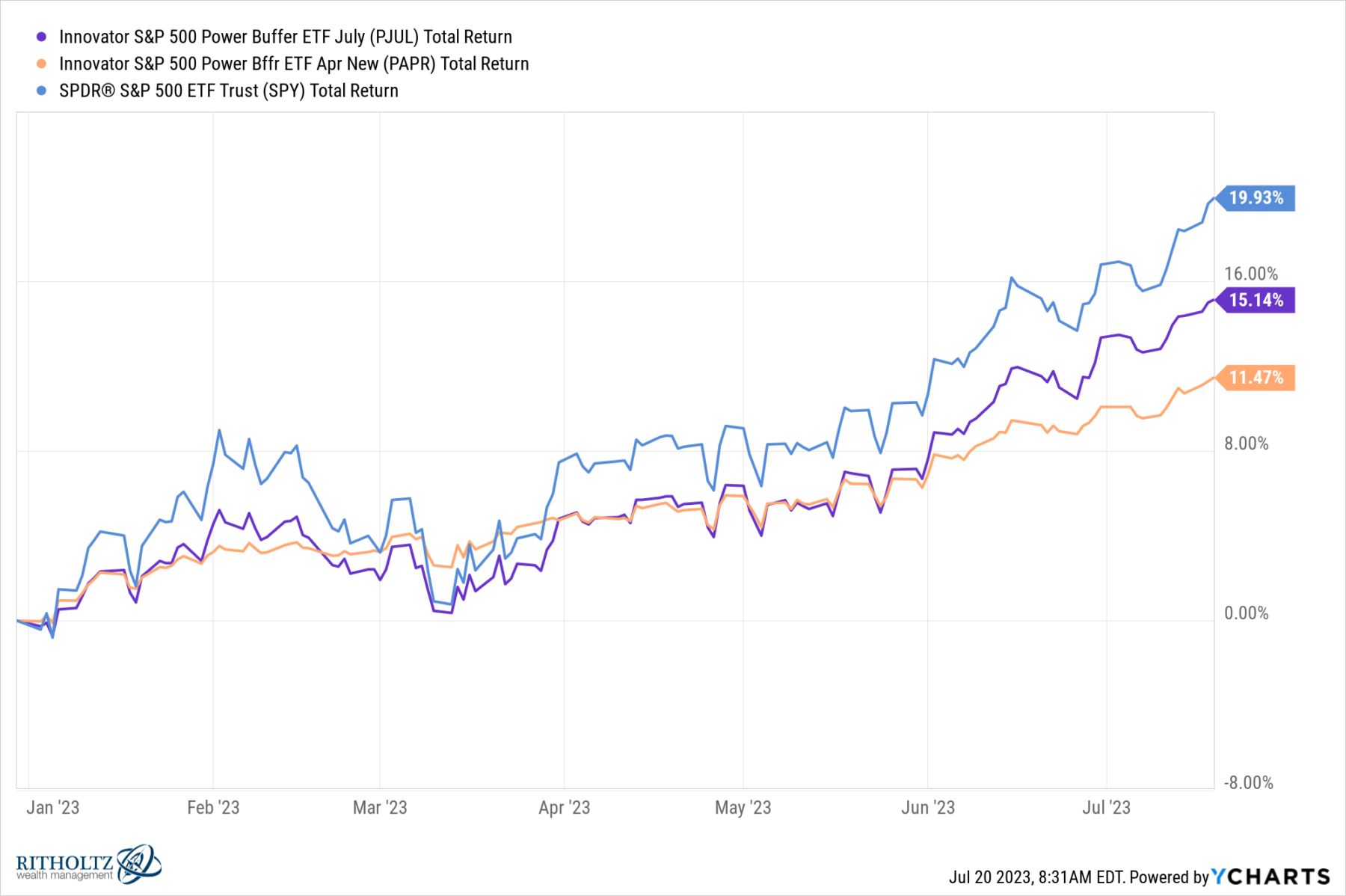

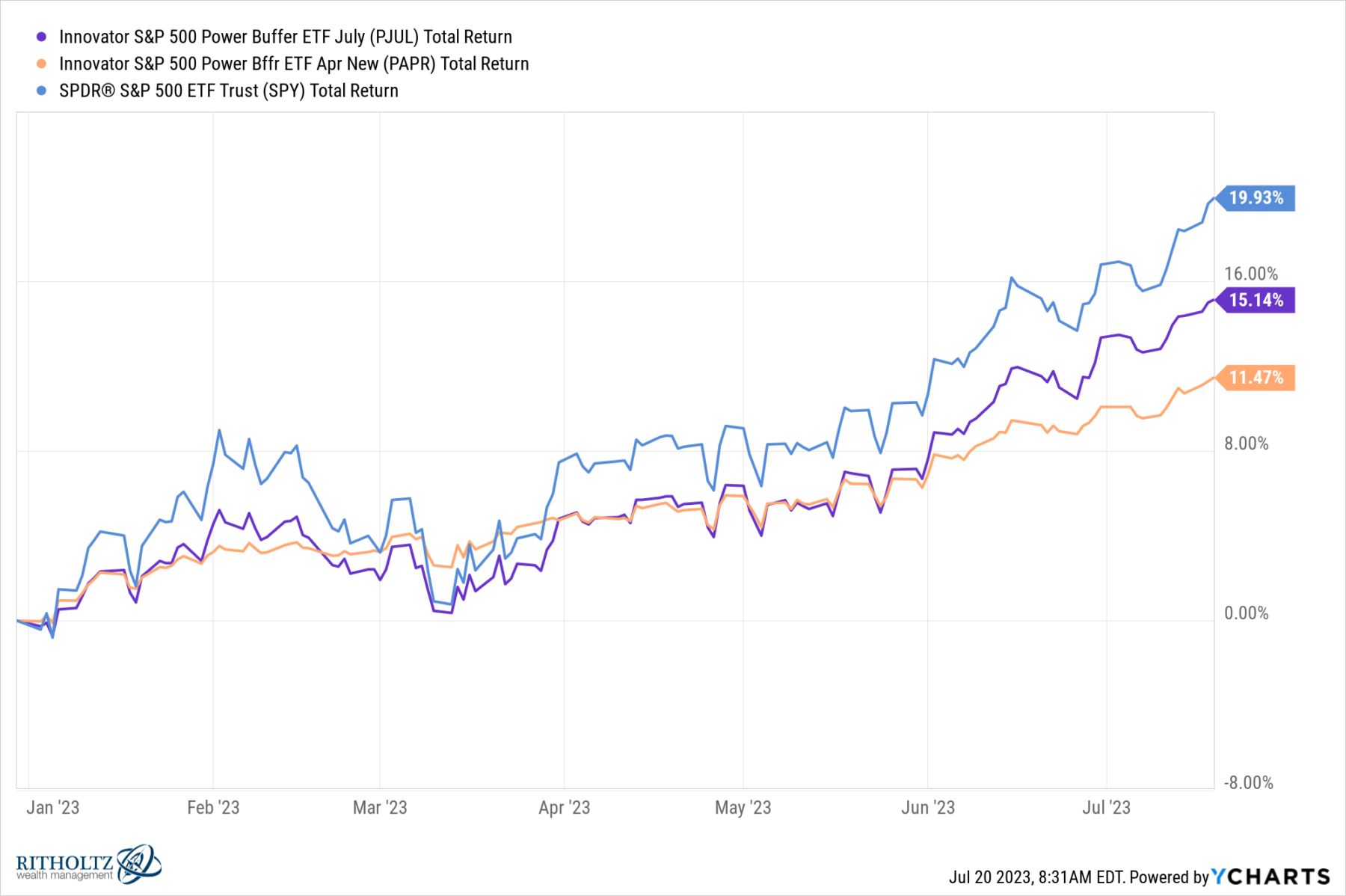

These funds have a beginning upside cap of 14.28% versus TJUL’s 16.62%; the chart above reveals how they’ve executed yr so far: Up 11.5% and 15.1% respectively this yr, versus 19.9% for SPY. Since inception (March 2019), they’re up 27.8% and 38.8% respectively, versus 75% for the SPY S&P 500 ETF over the identical interval. (Chart after the soar).

The efficiency numbers reveal this can be a horrible trade-off for the common retail investor.

See additionally:

Innovator TJUL

Innovator PAPR

Innovator PJUL

Supply:

Wall Avenue Will get New ETF Providing 100% Draw back Safety

By Vildana Hajric, and Emily Graffeo

Bloomberg, July 18, 2023

PJUL, PAPR, SPY March 25 2019 to July 10, 2023 (yesterday’s market shut)