Over at Alphaville, Robin Wigglesworth appears to be like at whether or not ‘Greedflation’ (aka price-gouging) meaningfully contributed to Eurozone inflation. Particularly, Financial institution of England analysis means that whereas they “discover no proof of an increase in total earnings within the UK” they did discover that “corporations within the oil, gasoline and mining sectors have bucked the pattern” with “some corporations… rather more worthwhile than others.”1

I used to be fairly skeptical about Greedflation initially; when i ranked the highest 15 sources of US inflation in mid-2022, “Company Revenue In search of” was on the backside, ranked 13 out of 15 inflation causes.

However as time went on, extra analysis and information turned out there. Slowly however certainly, we got here to be taught that extra corporations have been adapting to the pandemic period’s mixture of rabid demand and provide chain snarls with a selected strategy selecting “Worth over quantity.”

The primary particular person to determine this was Corbu’s Samuel Rines. (Twitter) He first started discussing the company choice for sustaining margin in 2022; over time, he noticed some corporations had pricing energy for each value AND quantity. Quickly after, “Worth over quantity” started to morph into “Worth AND Margin” (PAM).

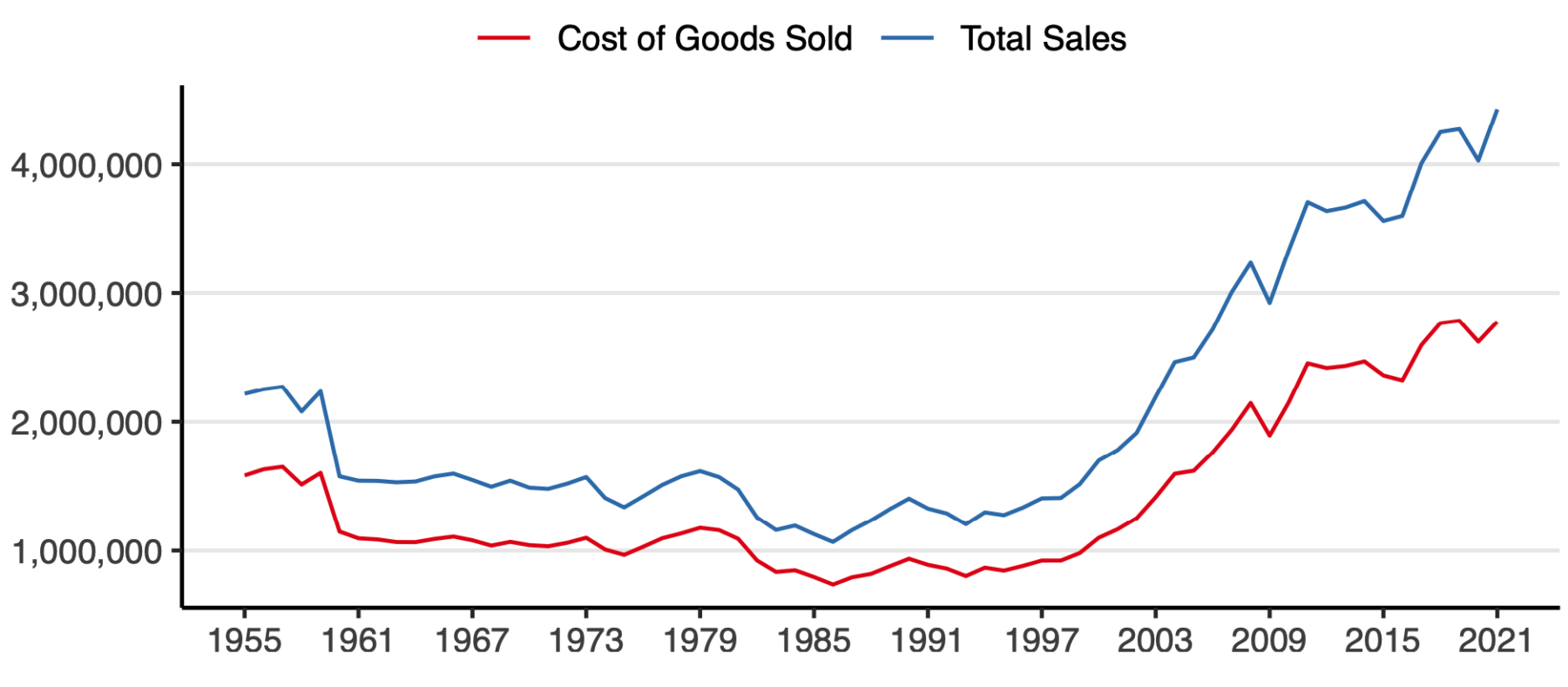

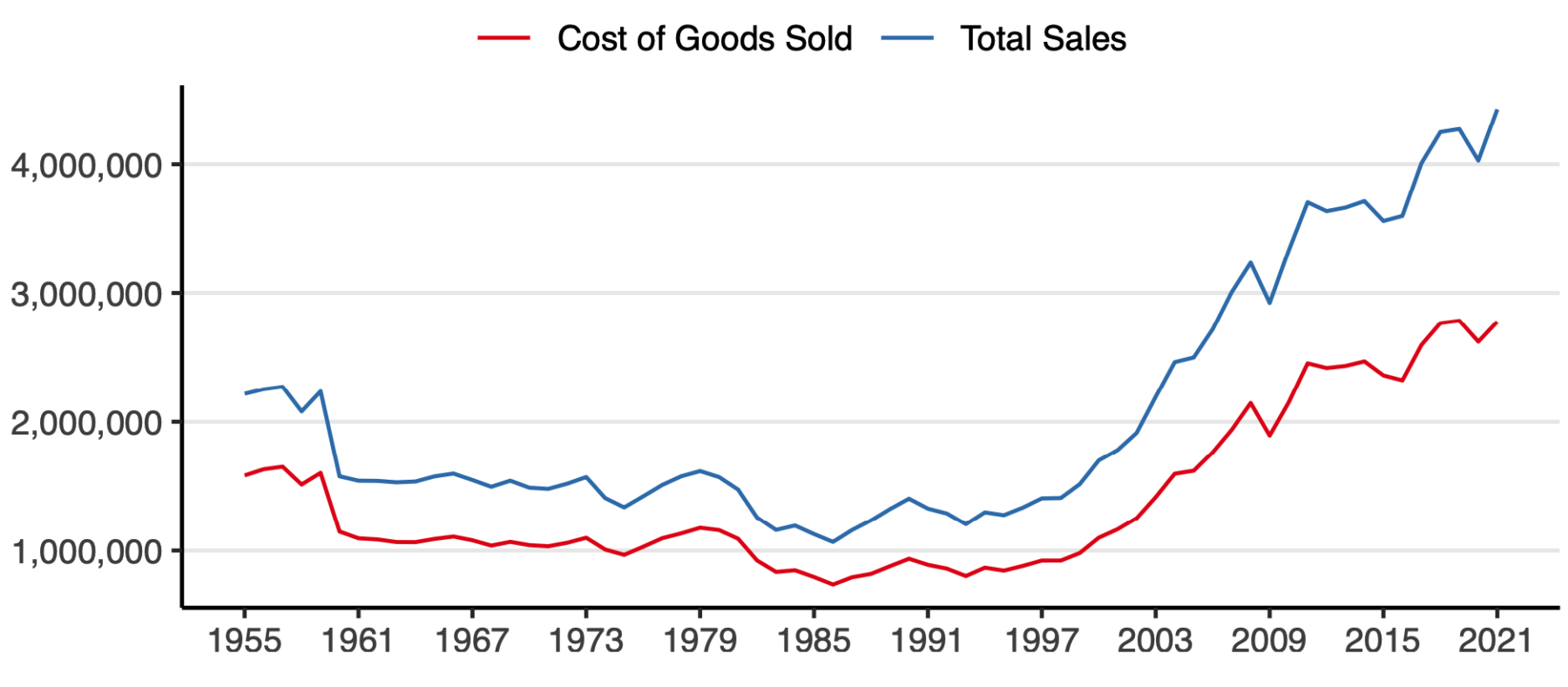

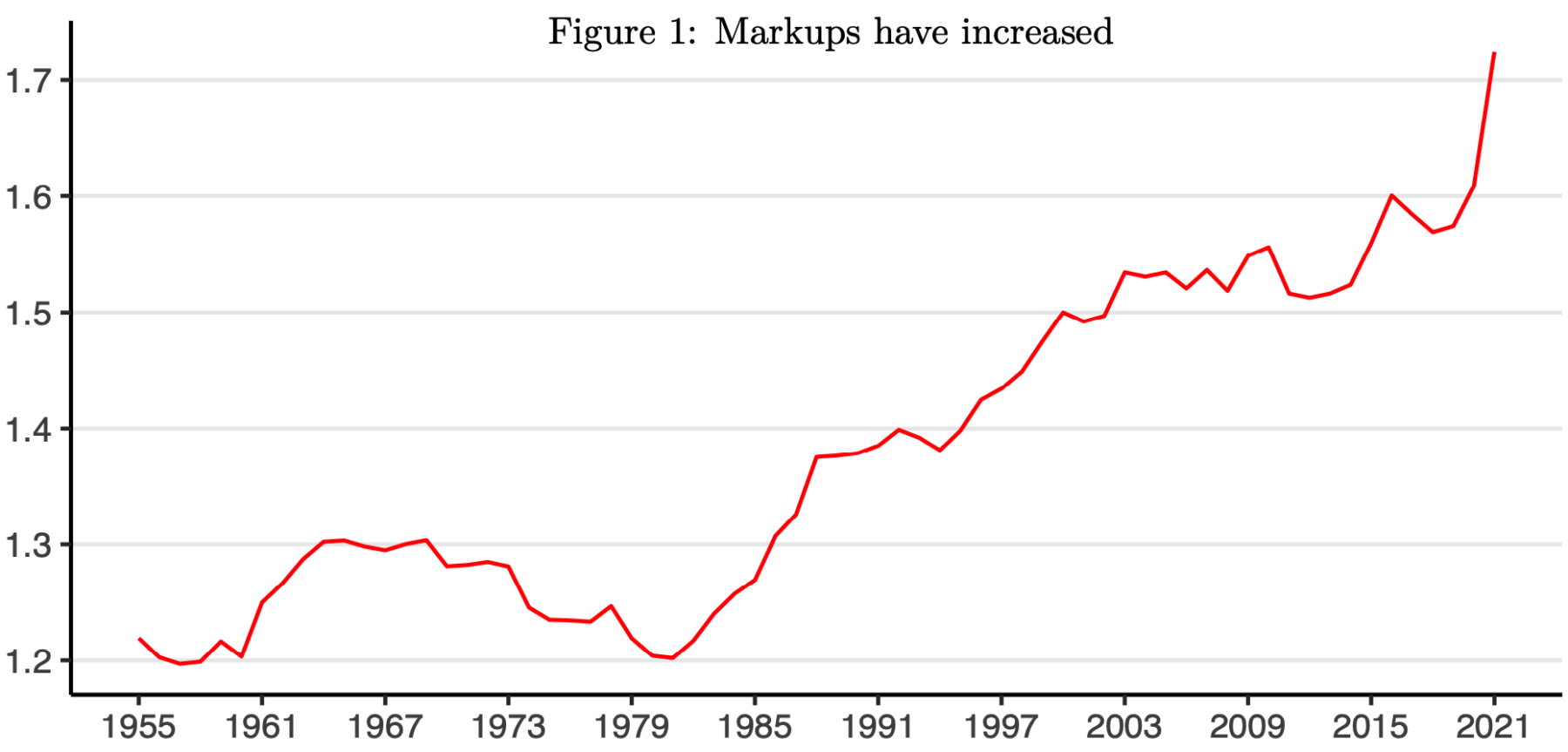

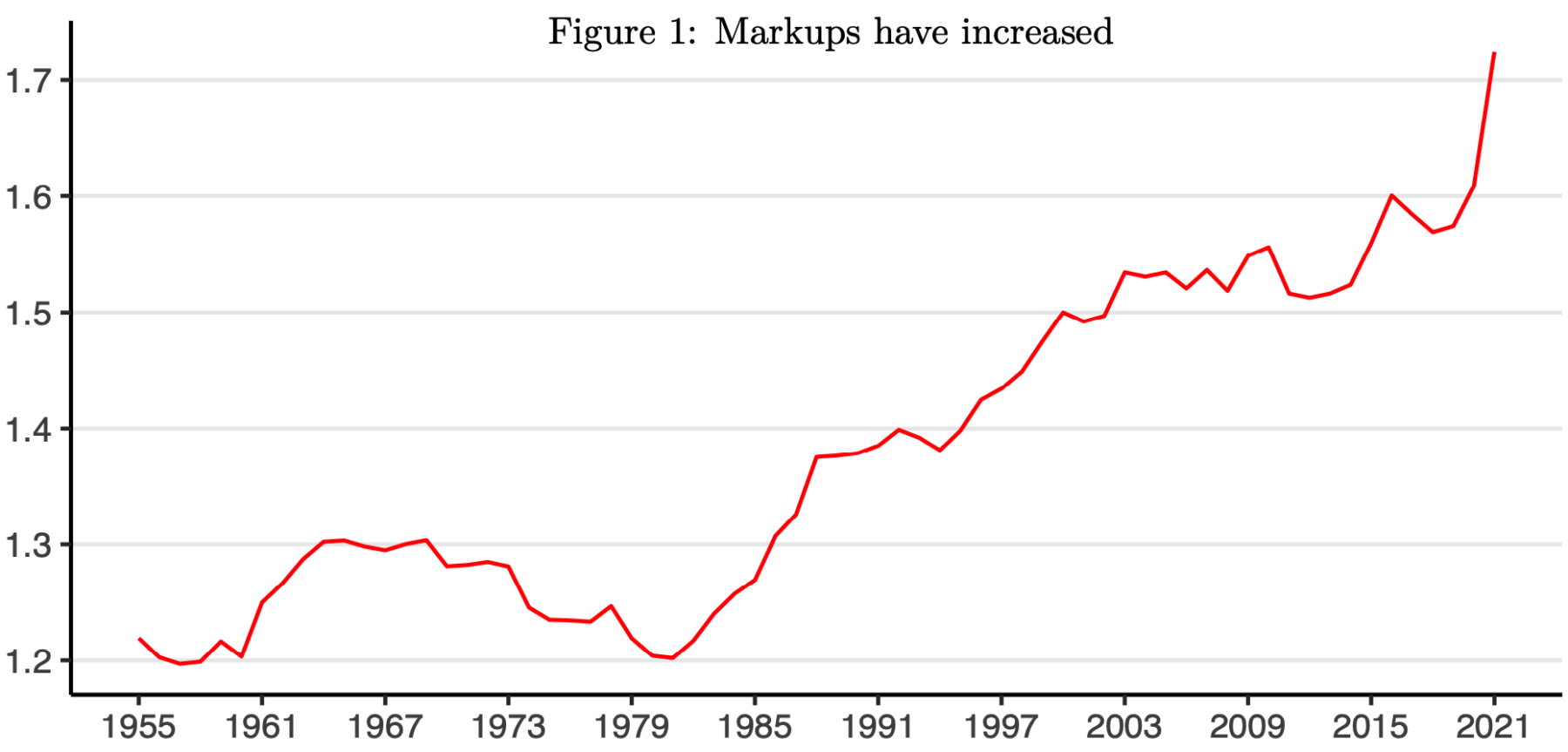

It’s the form of topic ripe for tutorial evaluation. Mike Konczal, director of the macroeconomic evaluation program on the Roosevelt Institute, wrote a report, Costs, earnings, and energy. (See charts above and beneath) The main focus was on annual internet revenue margins. It was about 5.5% within the 1960 to 1980 period. Within the ZIRP decade of ultra-low charges within the 2010s, it rose to six%. In 2021, it shot as much as 9.5%.

That’s an enormous, unexplained enhance:

Fortune coated Greedflation on July 11, 2022: “There’s a captivating debate enjoying out about markets, costs and inflation. Do corporations increase costs as a result of they need to, with a view to maintain tempo with inflation? Or, sensing a chance to notch greater earnings, do they make the most of an inflationary surroundings to boost costs, thereby fueling inflation?” (emphasis added)

There are different sources of value will increase, together with hyper-regulated localities, particularly in power and housing. In August 2022, Vox steered that should you have been mad about inflation it’s best to blame your native officers.

The drip of information made me marvel how a lot I underestimated greedflation initially. As shoppers, we frequently don’t (and can’t) see lots of the inputs into closing unit costs. Contemplate The Hidden Charges Of Ship Cargo:

“A cadre of ocean carriers are charging exorbitant, probably unlawful, charges on delivery containers caught due to congestion at ports. Sellers of furnishings, coconut water, even youngsters’ potties say the charges are inflating prices.”

As ballooning prices hit the wallets of American households, the worldwide ocean delivery business is having fun with its most worthwhile interval in latest historical past. Within the first quarter of 2022, the largest carriers’ working margins hit 57%, in line with one business analysis agency, after hovering within the single digits earlier than the pandemic.” (emphasis added)

Any business having fun with its most worthwhile interval in historical past will get my consideration.

My bias is that I used to be on Staff Transitory from the start. For certain, transitory took longer than anticipated, however as we discovered earlier this week, it asserted itself once more. However the danger of “stickier” inflation stays, pushed largely by company earnings, aka Rines’ PoV and PaM:

“In uncommon conditions—akin to an financial system’s reopening after a pandemic—widespread information that prices are rising permits companies to boost their costs understanding that their opponents will act in the identical method, in line with a paper by Isabella Weber, assistant professor of economics on the College of Massachusetts, Amherst, and her colleague, Evan Wasner.”

The “inform” about company earnings and greedflation got here after 2022 proved to be such a difficult yr within the markets. Regardless of 500+ BPS of fee will increase, a ~20% drop within the S&P500, and a 30+% drop within the Nasdaq 100, earnings have remained a lot better than anticipated:

“A comparability reveals how extraordinary our present inflationary misery really has been and nonetheless is. In contrast to throughout the 1970s, firms at this time wield adequate market energy to successfully defend their revenue mark-ups (and, by doing so, to comprehend greater earnings) throughout a time of inflationary stress that’s akin to that of the 1970s.”

Whilst inflation has come again down, the aftermath is that value will increase have held. Company margins and earnings could possibly be the rationale why value will increase will stick, at the same time as CPI falls again to regular. The speed of value will increase could have normalized, however the absolute value ranges at this time are a lot greater.

As Emily Stewart noticed, “What goes up could not come down. Like, ever.”

Let’s hope she is fallacious…

See additionally:

Greedflation’ revisited (FT, November 16, 2023)

Earnings in a time of inflation: what do firm accounts say within the UK and euro space?

Gabija Zemaityte and Danny Walker

Financial institution Underground, 16 November 2023

Banana Ships And The Hidden Charges Of Ship Cargo

GCaptain, July 3, 2022

Costs, Earnings, and Energy: An Evaluation of 2021 Agency-Degree Markups

Mike Konczal Niko Lusiani

Roosevelt Institute June 2022

Why Is Inflation So Sticky? It Might Be Company Earnings

Paul Hannon

WSJ, Might 2, 2023

Revenue Inflation Is Actual

By Servaas Storm

Institute for New Financial Considering June 15, 2023

The issue isn’t inflation. It’s costs.

by Emily Stewart

Vox, Nov 14, 2023

Beforehand:

Who Is to Blame for Inflation, 1-15 (June 28, 2022)

Has Inflation Peaked? (Might 26, 2022)

Transitory Is Taking Longer than Anticipated (February 10, 2022)

The Tide of Worth over Quantity (April 21, 2023)

__________

1. There are many similarities between the UK and the US, however loads of variations as properly. The experiences with company margin enlargement throughout a interval of inflation within the U.S. appear to have been markedly completely different than these within the UK.