This morning, the WSJ reported that “Customers anticipate to see 4.1% inflation a 12 months from now, the bottom such studying in two years and down sharply from its latest peak of 6.8%.”

There are some who imagine that is excellent news, however as we identified in Might, it’s a meaningless, lagging survey. In actual fact, it could be even worse than that, as a result of it seems that some on the Federal Reserve really imagine the Fed’s personal survey of shoppers comprises info. As we’ve got beforehand proven (repeatedly), it doesn’t.

At the very least, it doesn’t include invaluable info offering perception into future inflation ranges. What it does reveal is that the Federal Reserve isn’t present with the newest analysis on 1) What drives inflation; 2) The fallibility of surveys and polling information; 3) An up to date understanding of behavioral economics and the way human decision-making works.

Final we famous, Sentiment Surveys are typically ineffective; their most precious moments happen at extremes, that are sometimes seen in hindsight. Folks haven’t any potential to forecast issues like what inflation will likely be like 1, 3, or 5 years therefore. They will (arguably) extrapolate out present CPI a number of months or quarters, however even that is likely to be too beneficiant. And whereas individuals’s expectations can issue into inflation, it’s however one component out of many, and one that’s simply modified.

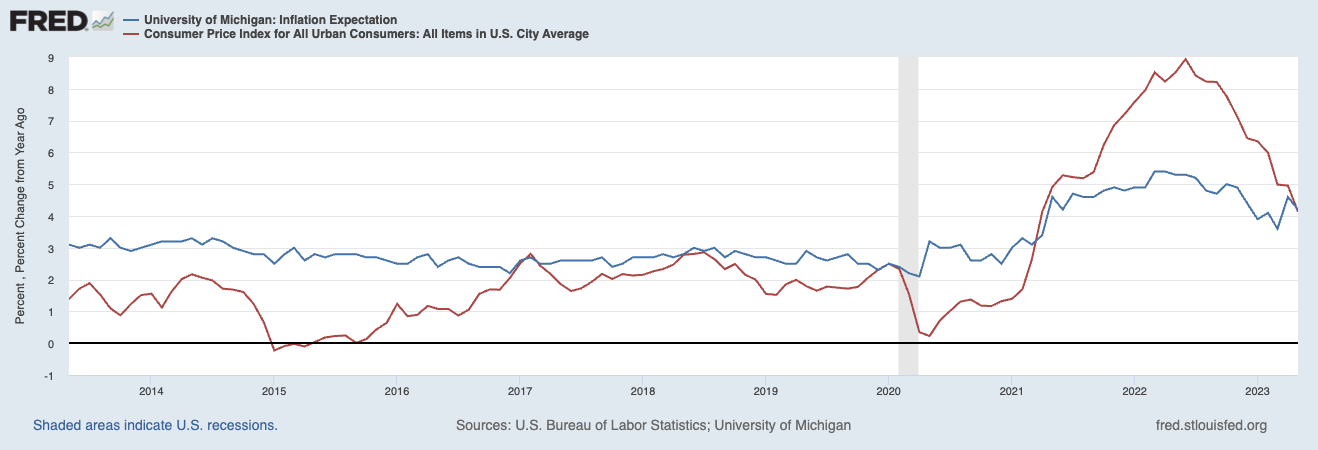

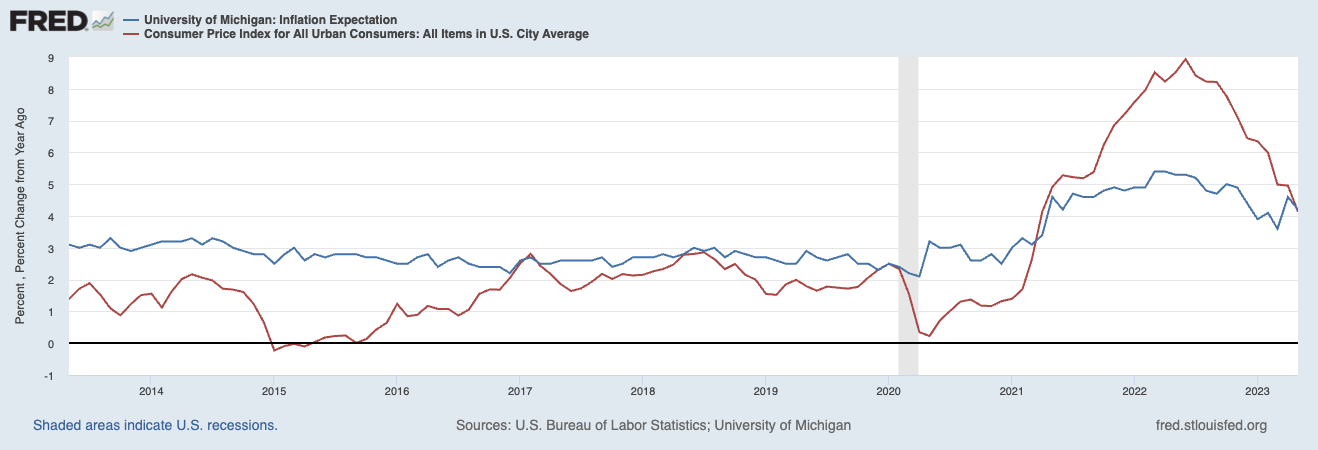

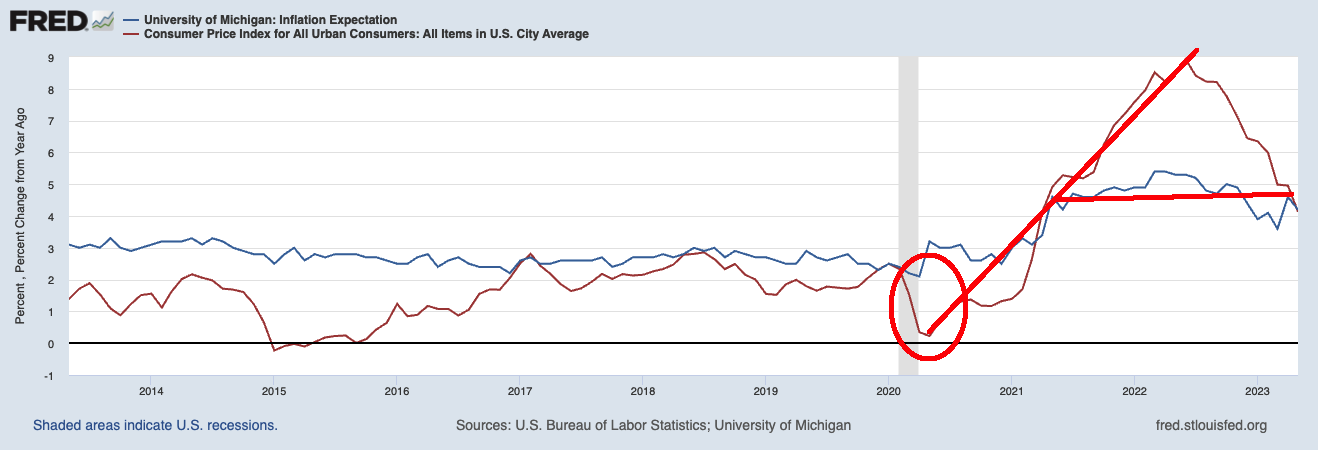

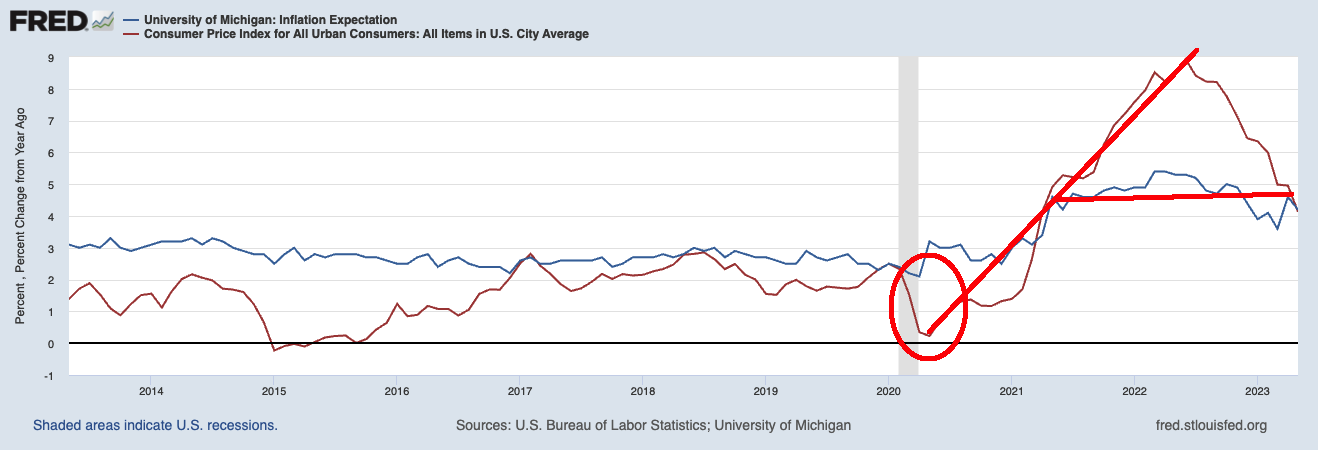

Because the FRED chart beneath exhibits, shoppers have been fairly sanguine about inflation initially of its enormous run-up in 2021; they have been panicked about inflation on the peak, simply because it was starting its collapse. In the event you purchased Inflation Futures based mostly on Shopper expectations, you’d rapidly go broke.

To say it is a helpful measure reveals an irrational attachment to an outdated normal. As Brookings defined, this traces again to the late 1960s work by Nobel laureates Edmund Phelps and Milton Friedman. They targeted on inflation expectations because of the ties between inflation and unemployment. Persistently excessive inflation within the 1970s grew to become unanchored, as long-running inflation led to greater wage calls for. The phenomenon of the wage-price spiral endured within the 1970s and 80s.

It appears to nonetheless be persisting amongst sure economists, who’ve ignored what occurred post-pandemic/post-fiscal stimulus: Regardless of CPI spiking greater, unemployment continued to fall.

Contemplate what occurred for the reason that 1970s: Globalization elevated, automation grew to become widespread, and productiveness elevated dramatically. I believe these components are a part of the rationale why inflation and unemployment have decoupled. The opposite half is that the financial system is simply so totally different at the moment than it was 50 years in the past, that utilizing a 1970s analog is a recipe for failure.

Your complete idea of the Environment friendly Market Speculation (which received a Nobel prize for Eugene Fama) was that what individuals say about something is way much less invaluable than what they do, particularly with their hard-earned {dollars}. Whether or not they make investments it available in the market or purchase inflated shopper items is itself a supply of invaluable info; actually a lot better than asking them what they thought inflation is likely to be someday within the distant future.

Individuals who ought to know higher pay method an excessive amount of consideration to Inflation Expectations. The charts above present that they shouldn’t…

Beforehand:

Inflation Expectations Are Ineffective (Might 17, 2023)

Transitory Is Taking Longer than Anticipated (February 10, 2022)

No one Is aware of Nuthin’ (Might 5, 2016)

How Information Appears to be like When Its Outdated (October 29, 2021)

Predictions and Forecasts

No one Is aware of Something

Supply:

Good Information for the Fed: Buyers See Decrease Inflation on the Horizon

By Christian Robles

WSJ, July 3, 2023