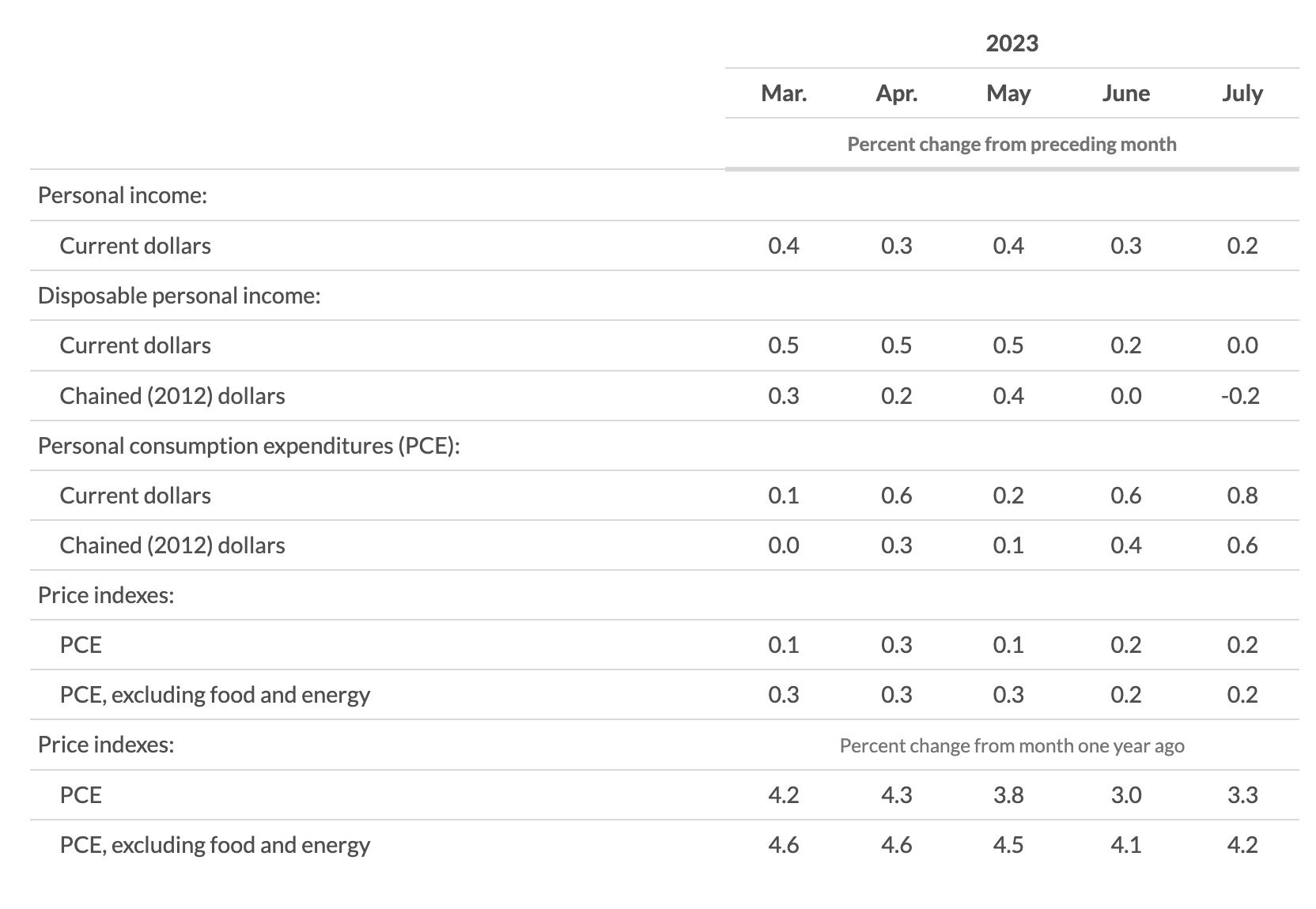

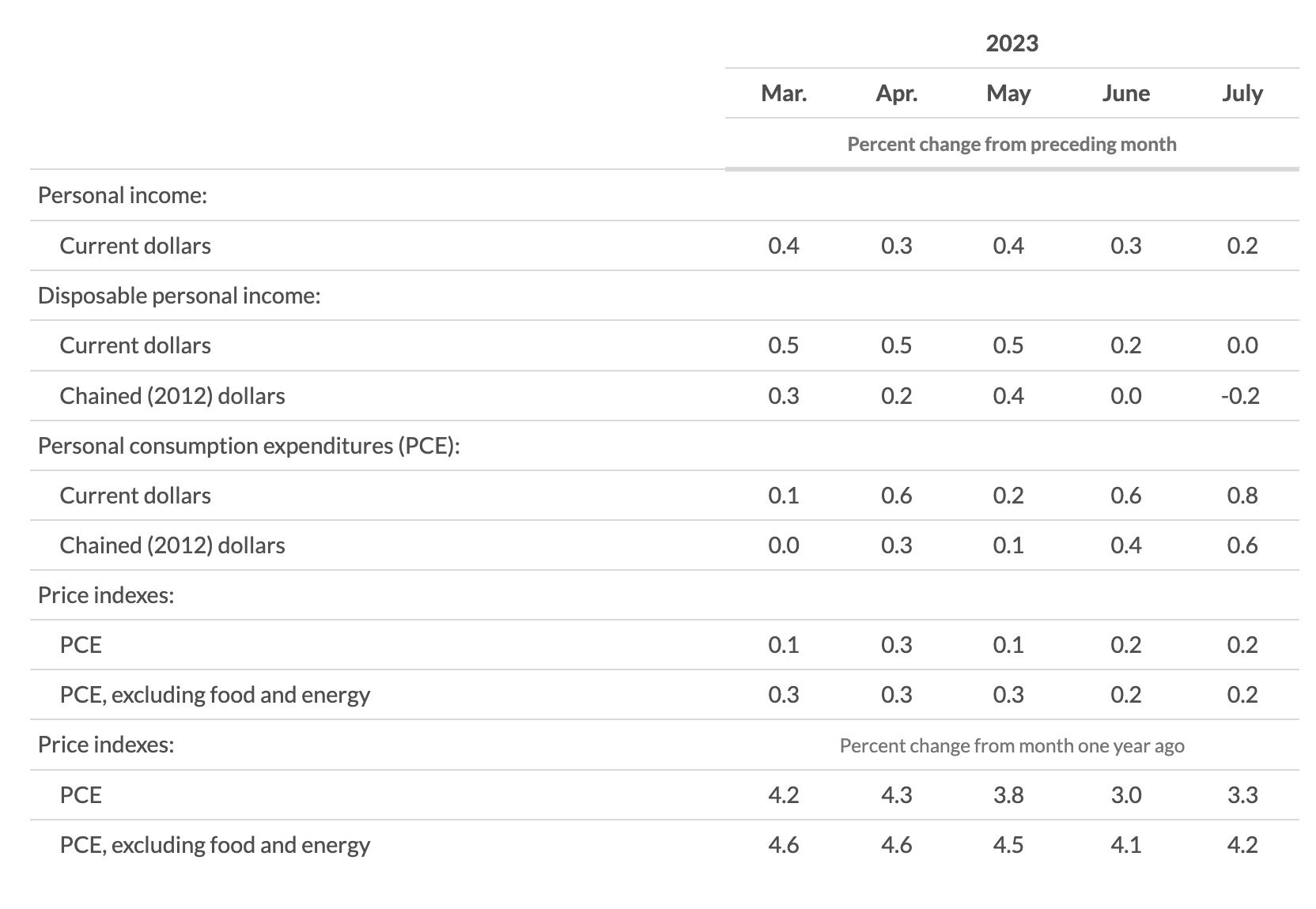

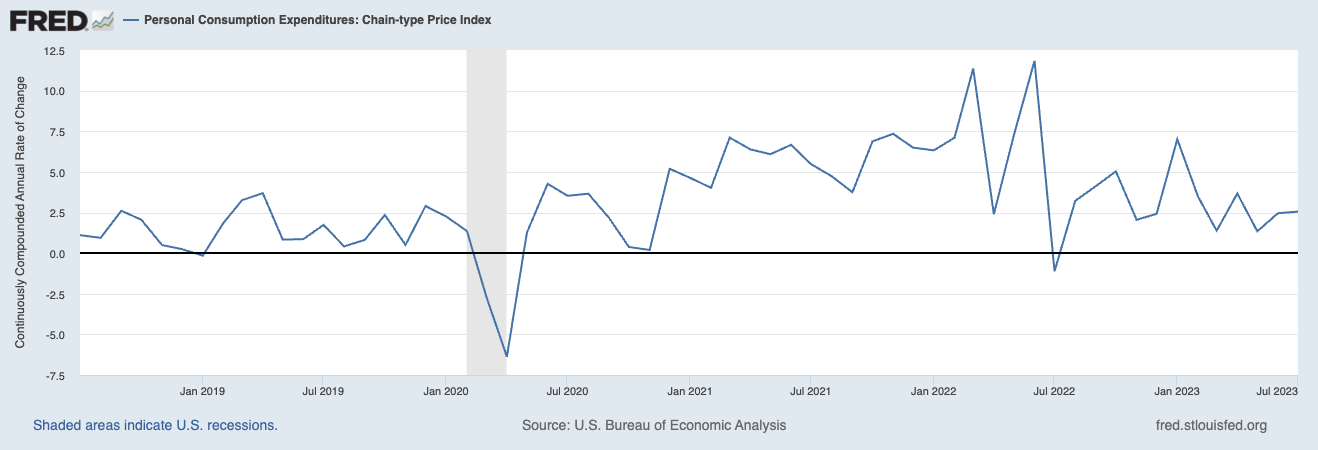

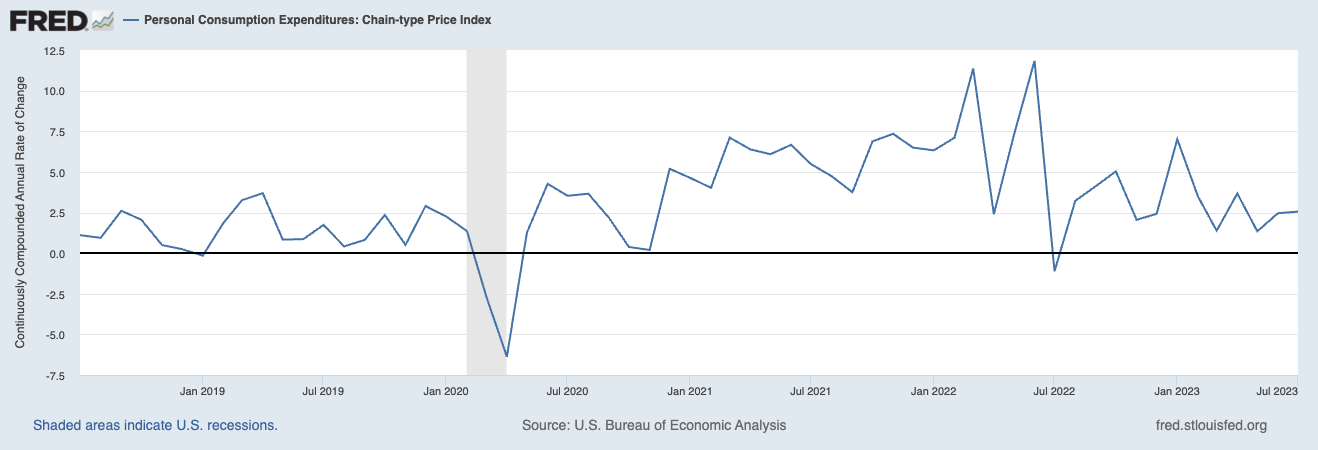

The Fed’s favored inflation report was a 2.1% annualized (Three months by way of July) and three.3% year-over-year.

Right here is BEA:

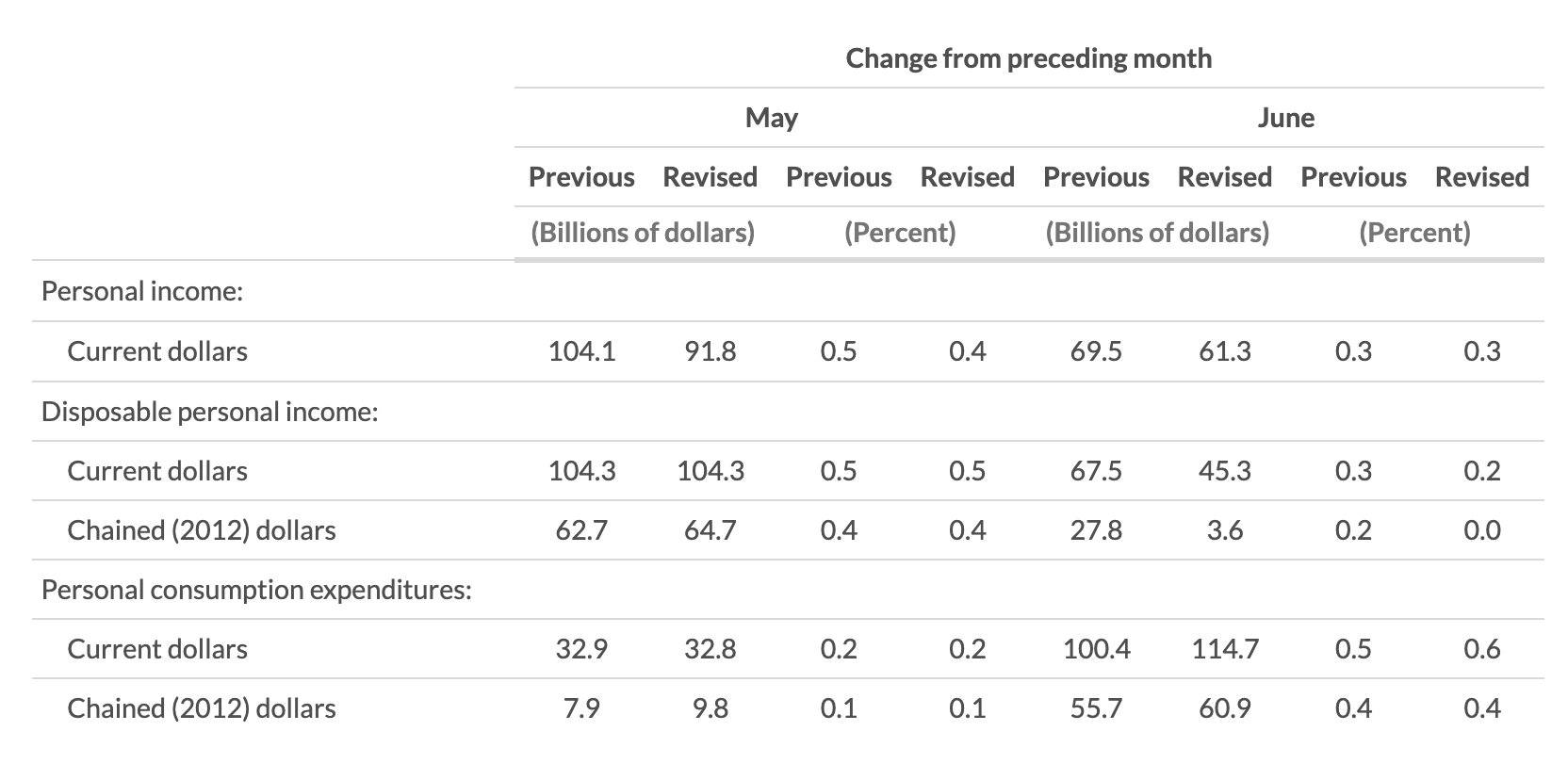

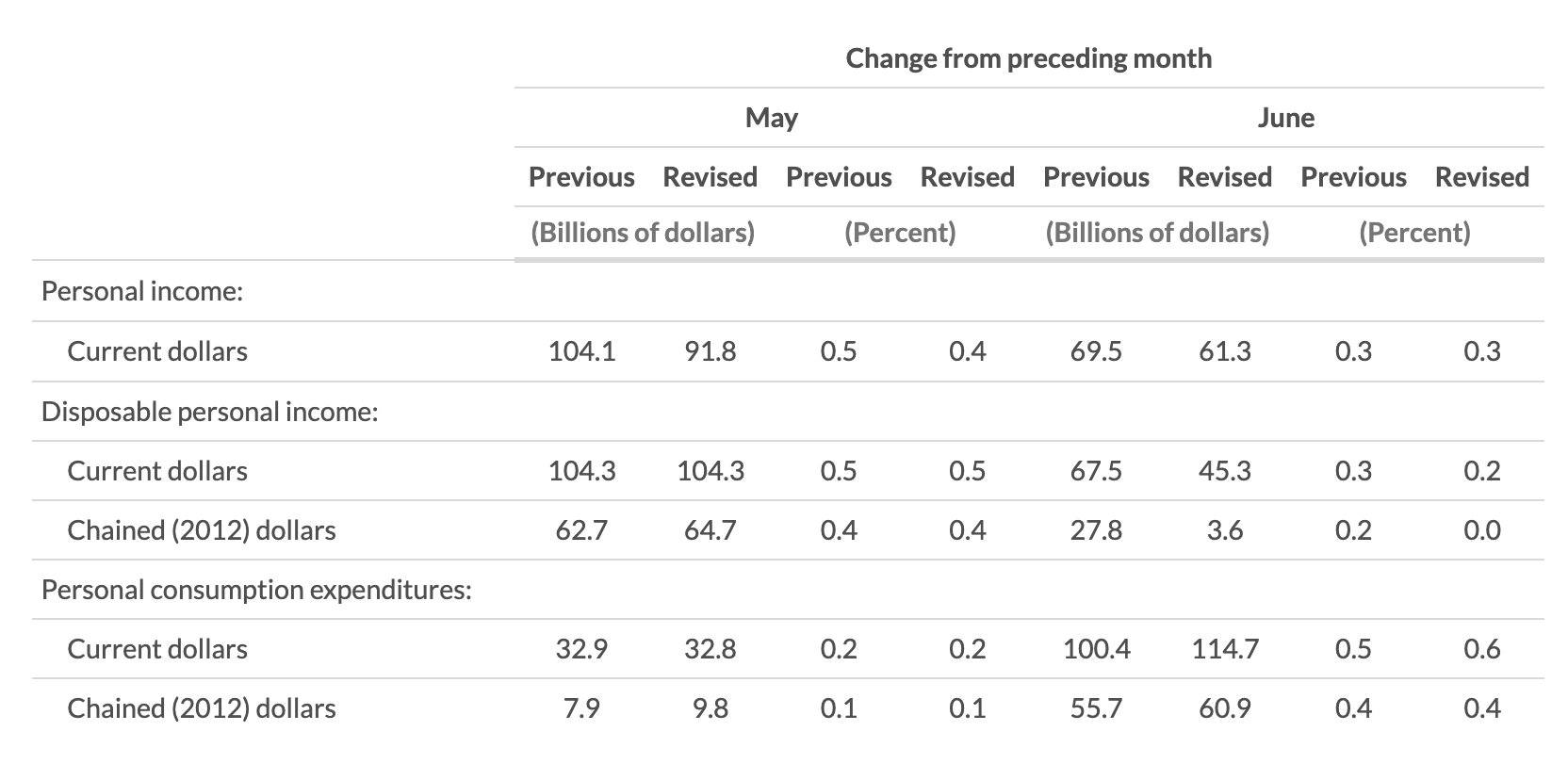

Private revenue elevated $45.Zero billion (0.2 % at a month-to-month charge) in July, in response to estimates launched right now by the Bureau of Financial Evaluation (desk Three and desk 5). Disposable private revenue (DPI), private revenue much less private present taxes, elevated $7.Three billion (lower than 0.1 %) and private consumption expenditures (PCE) elevated $144.6 billion (0.eight %).

The PCE worth index elevated 0.2 %. Excluding meals and power, the PCE worth index elevated 0.2 % (desk 9). Actual DPI decreased 0.2 % in July and actual PCE elevated 0.6 %; items elevated 0.9 % and companies elevated 0.four % (tables 5 and seven).

I really feel like a damaged document right here, however 0.2%? PUH-leeze, the FOMC is finished.

Supply:

Private Revenue and Outlays (BEA, July 2023)

Beforehand:

5 Methods the Fed’s Deflation Playbook May Be Improved (Businessweek, August 18, 2023)

2% Inflation Goal is Foolish (July 26, 2023)

A Dozen Contrarian Ideas About Inflation (July 13, 2023)

Inflation Expectations Are Ineffective (Could 17, 2023)

Inflation

Some charts that make it seem like I do know what I’m speaking about…