At the moment, Jerome Powell is making the opening remarks on the 24th Jacques Polak Annual Analysis Convention in DC. I’ll be on Bloomberg Radio from 3:00 pm-6:00 pm, and it’s the primary subject we’ll handle.

I needed to assemble just a few ideas and up to date discussions collectively in preparation for that. These are what’s driving my ideas on Jerome Powell & Co and the dangers future FOMC motion presents.

1. The post-lockdown economic system is returning to regular.

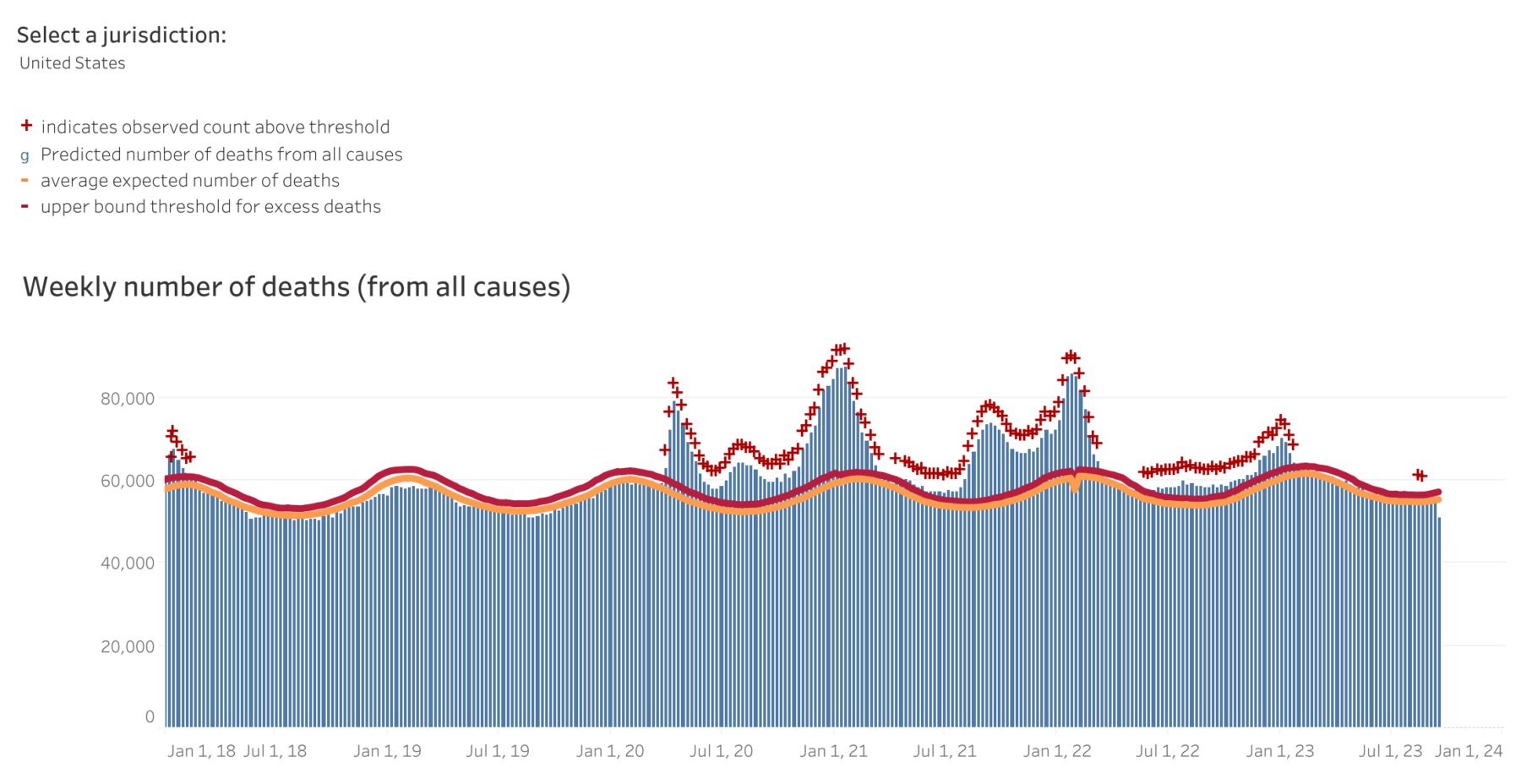

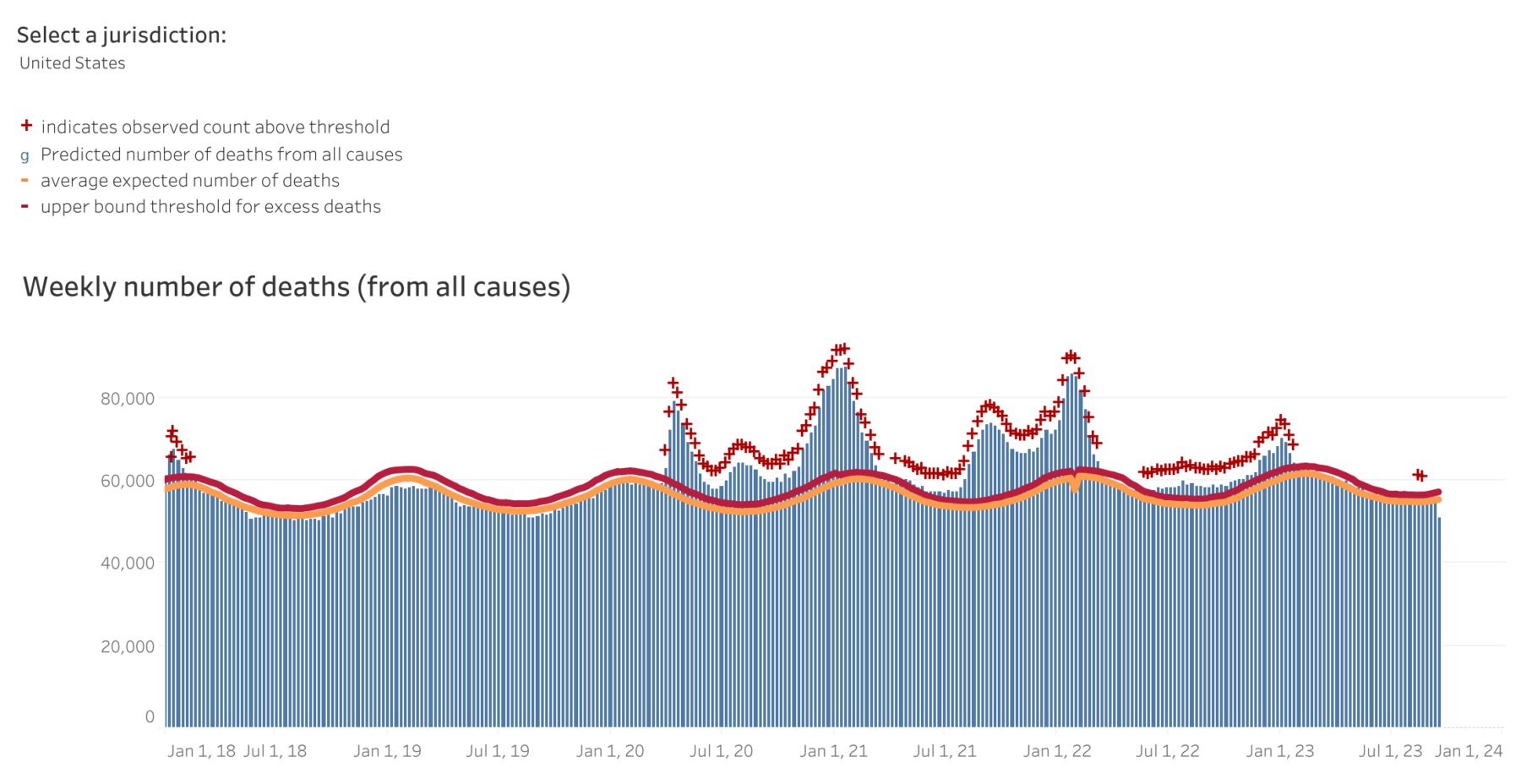

The chart up high exhibits the influence of Covid-19 on extra deaths in America. Squint and you may see the financial influence of the early surge of deaths in 2020, which slowed throughout lockdowns (and summer time); the 2nd wave within the Fall of 2020 into Winter; the third surge within the Summer time of 2020 (Omicron variant) which ebbed then peaked in January 2022; then the Fall/Winter surge in 2022-23.

Then we re-opened in earnest.

The inflation surge actually started within the Spring of 2021: Everybody got here out of their lockdowns, armed with CARES Act money of their financial institution accounts, bored out of their minds and able to get together. First, it was Items from Automobiles to Homes to anything they may purchase; then, it was Providers, together with leisure and (particularly) journey.

However provide chains unraveled and other people bought vaxxed & boosted. Finally, after all of the pent-up demand brought on by 18 months of cabin fever broke, issues started to normalize. We’re principally there, however some points nonetheless stay.

2. Shortages stay a giant supply of persistent inflation.

We wildly underbuilt single-family properties for about 15 years; Semiconductors are nonetheless not accessible in portions wanted to hit pre-pandemic ranges of latest automotive gross sales of 16-17 million yearly; There’s a enormous scarcity of laborers as folks have upskilled and moved on to raised gigs. As evidenced by the profitable strike resolutions in labor’s favor, the steadiness of energy has shifted ion the labor markets.

I don’t see how larger charges generally or larger for longer will clear up these issues.

3. The Fed is finished elevating charges.

It was apparent to me the Fed was executed (or ought to have been) elevating charges in Could. I insisted they had been executed earlier than the latest assembly (November 1st). There are various causes for this, however probably the most =essential ones are:

a) They’re making housing a lot worse;

b) Charges got here down regardless of — not as a result of — of the Fed;

c) Inflation peaked final June and has continued to subside since.

The chart above explains a lot of what occurred.

4. The Fed’s fashions are previous and damaged.

I don’t have an issue with utilizing econometric fashions — the difficulty is that each one fashions are restricted, incomplete, and sometimes misguided depictions of actuality. You neglect that at nice peril.

I used to be aghast to listen to Minneapolis Fed president Neel Kashkari say “It’s not that our fashions are improper, it’s the darkish matter.” This displays a failure to know the constraints of fashions generally and the problems with your individual fashions particularly. Plainly I have to constantly go to George E. P. Field‘s quote “All fashions are improper, however some are helpful.”

Who’re you gonna imagine, your fashions or your individual mendacity eyes?

~~~

The danger as we speak is that the FOMC will tip us into an pointless recession, and ship the unemployment charge over 5%.1 There are few issues extra irritating than self-inflicted, avoidable errors.

Beforehand:

The Fed is Completed* (November 1, 2023)

Inflation Comes Down Regardless of the Fed (January 12, 2023)

For Decrease Inflation, Cease Elevating Charges (January 18, 2023)

Why Aren’t There Sufficient Staff? (December 9, 2022)

How the Fed Causes (Mannequin) Inflation (October 25, 2022)

How Everyone Miscalculated Housing Demand (July 29, 2021)

Who Is to Blame for Inflation, 1-15 (June 28, 2022)

Federal Reserve

__________

1. It may additionally give us a second time period of President Trump, assuming Chris Christie is improper and he stays out of jail. But it surely’s not too troublesome to see both consequence…