Earlier than yesterday’s FOMC assembly, I reiterated my view from July 2023 that this climbing cycle was – or no less than must be – over.

The Narrative bias driving commentary at the moment is that this sudden bullishness is the market sussing out the final hike. However this after-the-fact story doesn’t resonate as fact with me, because it appears extra just like the 10% market correction of October 2023 has ended. Future discounting mechanisms anticipate market motion; if they’re reacting to them, effectively that’s not precisely a mechanism discounting the longer term, is it?

It is a complicated time for buyers; somewhat than repeat the clichés, let’s attempt to make some sense of all of the cross-currents.

Federal Reserve: There isn’t a such factor as a “Hawkish Pause.”

That is a kind of phrases that basically annoys me. It brings to thoughts Ralph Waldo Emerson’s perception: “What you do speaks so loudly I can’t hear what you’re saying.”

The FOMC is both elevating, not altering, or reducing charges, PERIOD. All the chatter, speeches, transcripts, press releases, and so forth. are for individuals who want to spend their time sifting by means of the tea leaves for hints as to what’s coming subsequent. My choice: take a look at what the Fed’s open market committee’s actions are.

To me, “Hawkish Pause” sounds lots like a George Carlin bit on “Pleasant Hearth.”

Secular Bull Market: US shares are within the 5-6th inning of a bull market.

The Pandemic crash and rally was a 34% reset and a continuation of the bull that formally started in March 2013.

BAML’s Chief Fairness Technician Stephen Suttmeier likens the 2020 crash to the fashionable model of the 1987 crash: A considerable crash that happened 7 years into the beginning of a brand new bull. Historic comparisons indicate this market might have one other 3-7 years to go.

Money in No Longer Trash: TINA (as we famous final yr) is formally over.

525 foundation factors of hikes later, bonds are very engaging and fixed-income buyers are incomes a good return on their cash. If you’re in a prime tax bracket and have residency in a high-tax state with robust credit score high quality – assume Ohio, New York, Massachusetts, California, Connecticut, and so forth. – you have to be taking a look at Munis right here. Relying on the specifics a 4.5-5% muni yield is the taxable equal of 8-10%.

These of you searching for earnings may think about placing recent cash to work constructing a bespoke muni portfolio, or shopping for the suitable muni fund in your circumstances. (we are happy to help).

Regime Change: The shift from financial to fiscal stimulus.

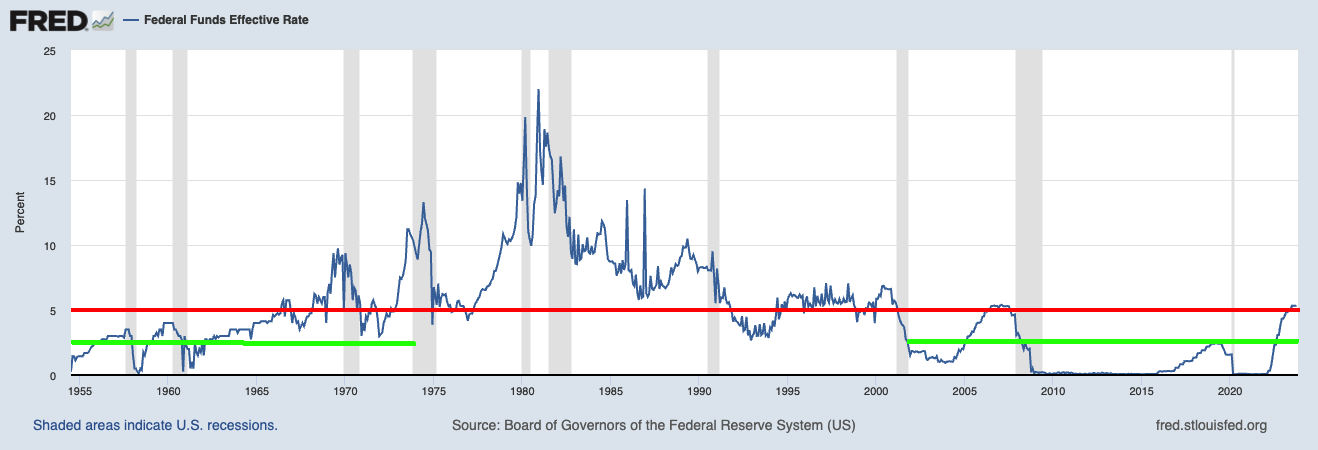

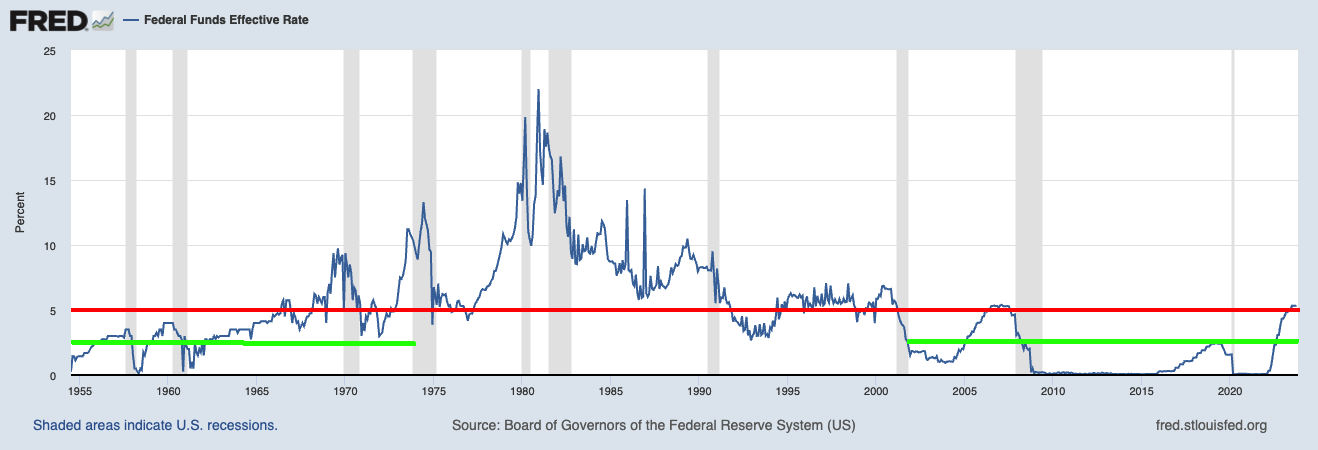

The period of ultralow charges – that’s something below 2% — has ended. Whereas I anticipate to see charges average later in 2024 or 25, it’s a low chance wager they return to zero.

The ramifications of this are vital: Bonds are actually a competitor to equities; normalized charges may see this rally broaden out from Mega caps to Mid and Giant Caps; the tip of ZIRP might impression company earnings; increased charges ultimately will harm shopper spending and CapEx. Observe that these charges are regular for the post-war interval however a bit excessive for the fashionable period.

~~~

Given all the above, I might recommend you 1) preserve a diversified portfolio of equities; 2) decrease your return expectations for these equities; 3) look to diversify globally as effectively; 4) revisit your bond portfolios; 5) think about Munis for tax free yield.

YMMV.

Beforehand:

Money Is No Longer Trash (October 27, 2023)

Understanding Investing Regime Change (October 25, 2023)

Farewell, TINA (September 28, 2022)

Secular vs. Cyclical Markets (Might 16, 2022)

Finish of the Secular Bull? Not So Quick (April 3, 2020)

Is the Secular Bear Market Coming to an Finish? (February 4, 2013)

Trying on the Very Very Lengthy Time period (November 6, 2003)

Bull & Bear Markets