What do the Nice Despair, the Nice Monetary Disaster, the Stagflationary 1970s, and the upcoming 10-years have in frequent?

In case you are a strategist at Goldman Sachs, then so much. At the very least in the event you do forecasts for market returns over the subsequent decade (lol), you might even see unbelievable similarities.

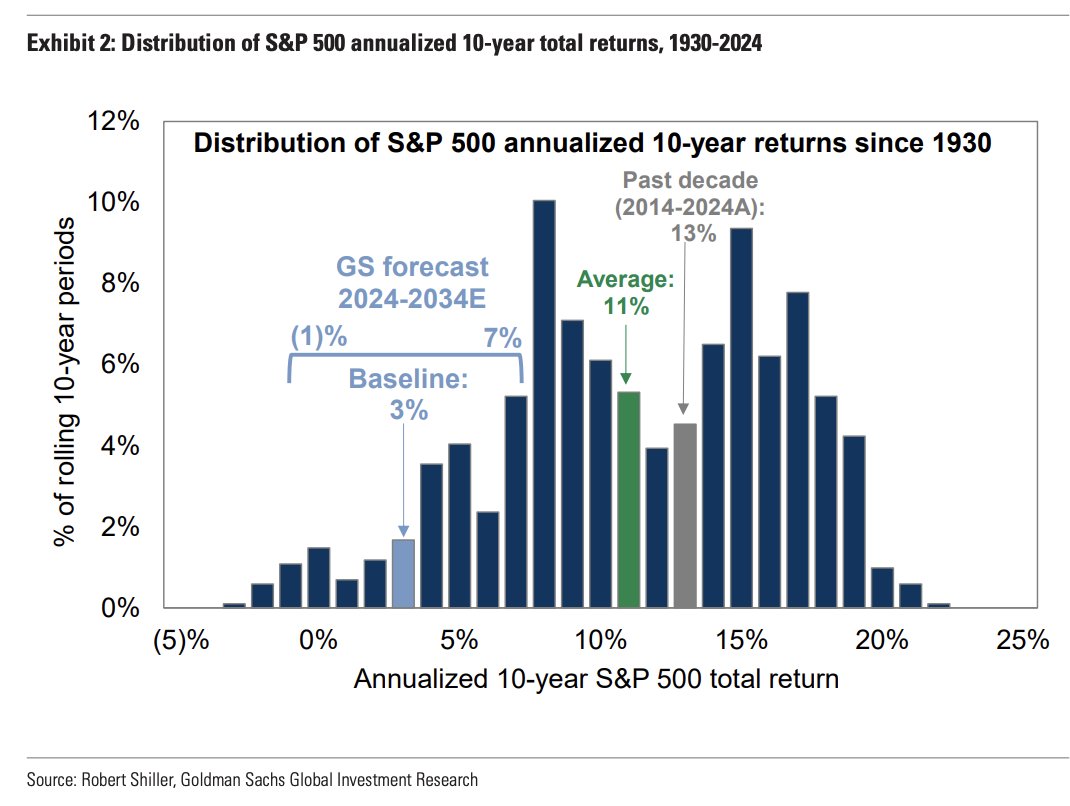

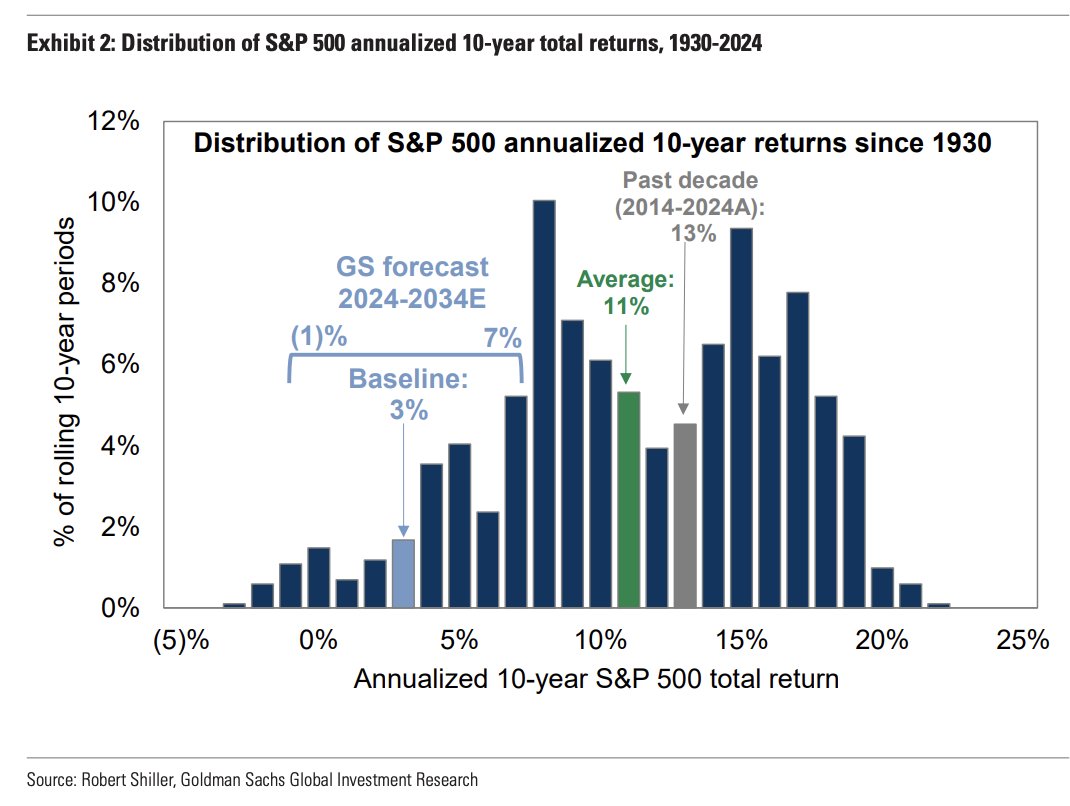

ICYMI: David Kostin and his staff of strategists see a 72% likelihood the S&P 500 underperforms Treasuries, and a 33% chance equities return lower than inflation. They count on ~3% a 12 months (or worse) yearly. “Traders needs to be ready for fairness returns in the course of the subsequent decade which might be in the direction of the decrease finish of their typical efficiency distribution relative to bonds and inflation.”

Likelihood Distribution of the subsequent decade in S&P 500 returns (in line with GS)

Supply: Goldman Sachs Funding Analysis

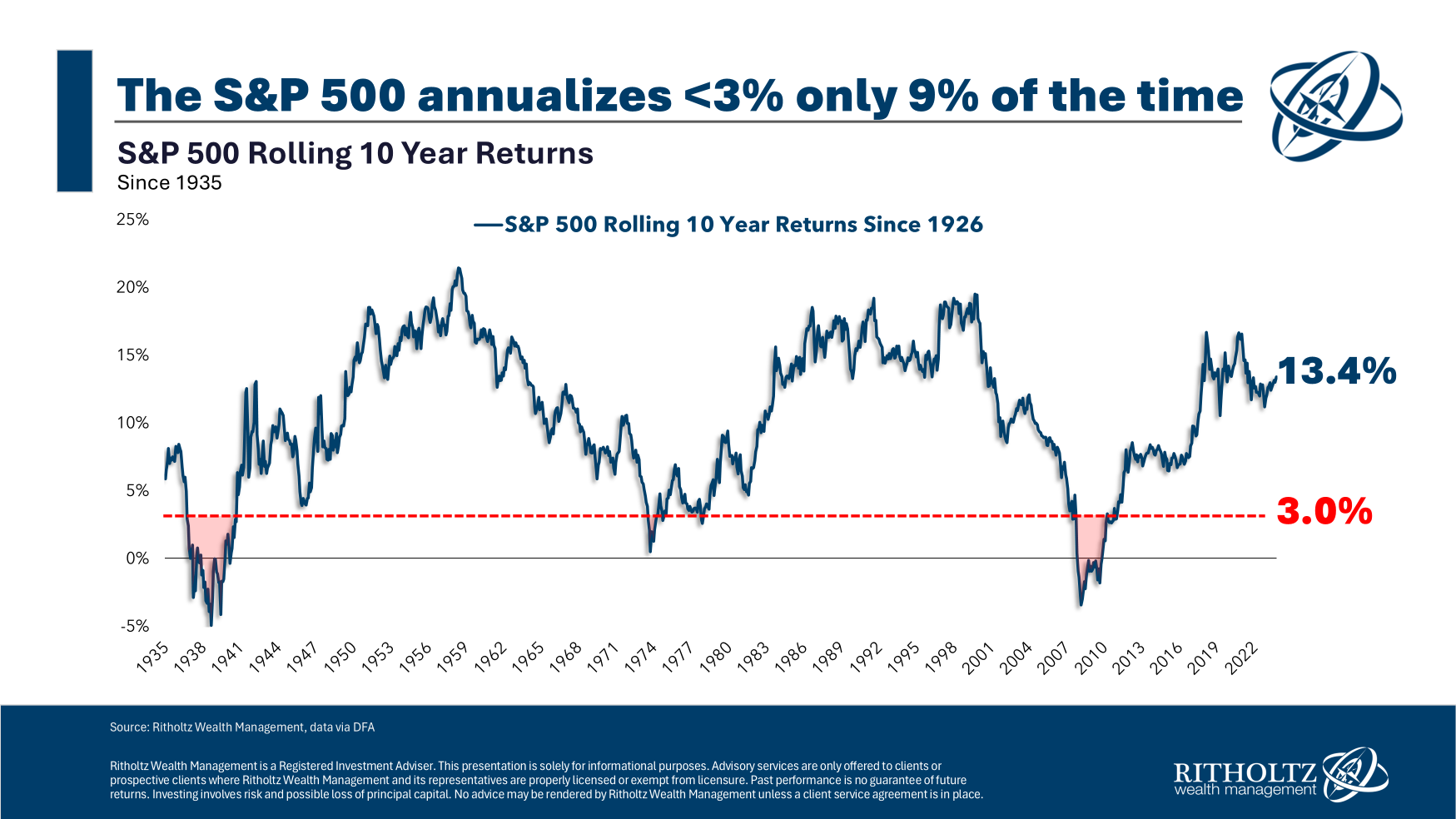

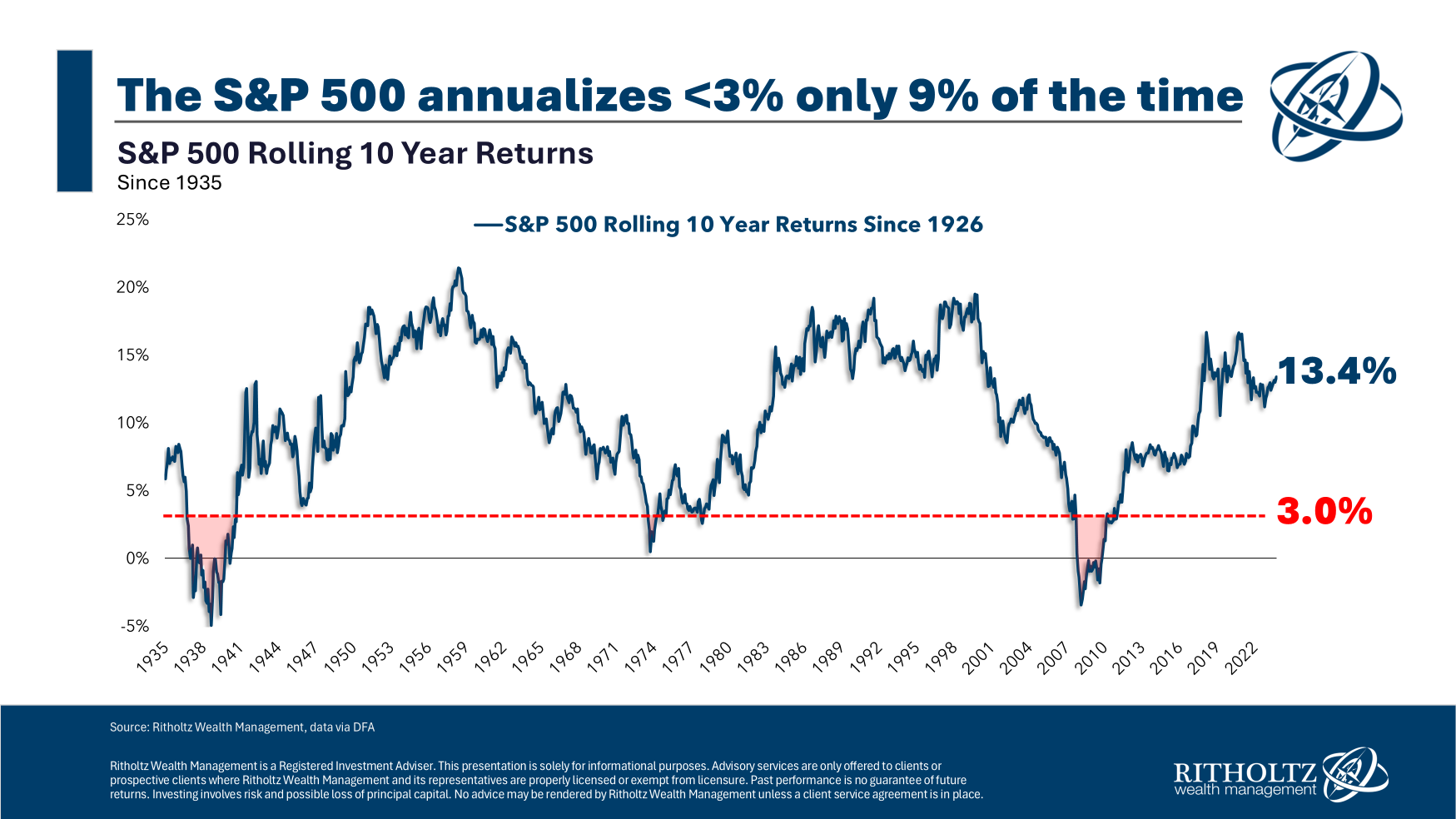

My colleague Ben Carlson buried the lede when he did an examination of all rolling 10-year durations going again to 1925. He discovered lower than 9% of these 10 12 months durations had returns of three% or much less. All of those decade-long durations befell in the course of the aforementioned eras of the GFC, the 1970s, or the Despair.

In different phrases, in the event you had been forecasting 10-year returns of three% yearly, you might be additionally forecasting an financial shitstorm of uncommon and historic proportions. At the very least, that has been the circumstance of all different decade-long durations the place market returns had been 3% yearly or 1% in actual phrases.

Forecasting one type of financial catastrophe or one other over the subsequent 10 years is just not a lot of a attain; you may be hard-pressed to think about any decade the place some financial calamity or one other didn’t befall the worldwide financial system. However that’s a really totally different dialogue than 3% yearly for 10 years.

This got here up yesterday yesterday at Jason Zweig’s e-book social gathering for the discharge of the third version of Ben Graham’s, The Clever Investor. The room was crammed with followers of Graham and Zweig, hosted by Josh Wolfe of Lux Capital. (its the 75th anniversary of the e-book’s preliminary launch.) There have been a handful of indexers within the room, nevertheless it was largely personal credit score and enterprise capital folks that I used to be chatting with

Through the Q&A, somebody introduced up the Goldman forecast. I used to be incredulous (and amused) that Enterprise Capitalists had been skeptical of the explosive potential for brand spanking new applied sciences to create better financial exercise, necessary, useful improvements, and naturally, additional market positive aspects.

I don’t know what the subsequent decade will deliver by way of S&P500 returns, however neither does anybody else. I do consider that the financial positive aspects we’re going to see in expertise justify greater market costs. I simply don’t understand how a lot greater; my sneaking suspicion is one % actual returns over the subsequent 10 years is manner too conservative.

***

In fact, you will discover different forecasts which might be friendlier to your portfolio, For instance, JP Morgan sees U.S. shares returning 7.8% yearly over the subsequent 20 years. That’s extra in step with historic averages.

However cherry-picking friendlier forecasts nonetheless depends on forecasts.

As a substitute, ask your self this easy query: In your whole experiences, how many individuals have made appropriate, outlier forecasts when looking 10 years? I’m not referring to extrapolating historic returns ahead — “Assume 8% whole return per 12 months on common” — however reasonably, right here is why markets ought to return X% versus the consensus of Y% for the subsequent ten consecutive 12-month durations. If we take a look at sufficient 10-year forecasts, somebody randomly will get it proper. However I can not recall anybody at a serious Wall Road Financial institution truly creating wealth forecasting markets a decade out.

We’re all higher off if we admit that guessing returns over the subsequent 10 or 20 years is a idiot’s errand. It’s actually no solution to handle your portfolio…

Beforehand:

Forecasting & Prediction Discussions

Sources:

3% Inventory Market Returns For the Subsequent Decade?

by Ben Carlson

A Wealth of Frequent Sense, October 22, 2024